Authored by:

Robert Koenigsberger, Managing Partner & Chief Investment Officer

Mohamed A. El-Erian, Chair

Petar Atanasov, Director & Co-Head of Sovereign Research

Kathryn Exum, Director & Co-Head of Sovereign Research

April 3, 2024

Decoding the Global Macro Environment: A Top-Down Perspective and the Related Implications for Emerging Markets Heading into 2Q 2024

Top-Down Observations

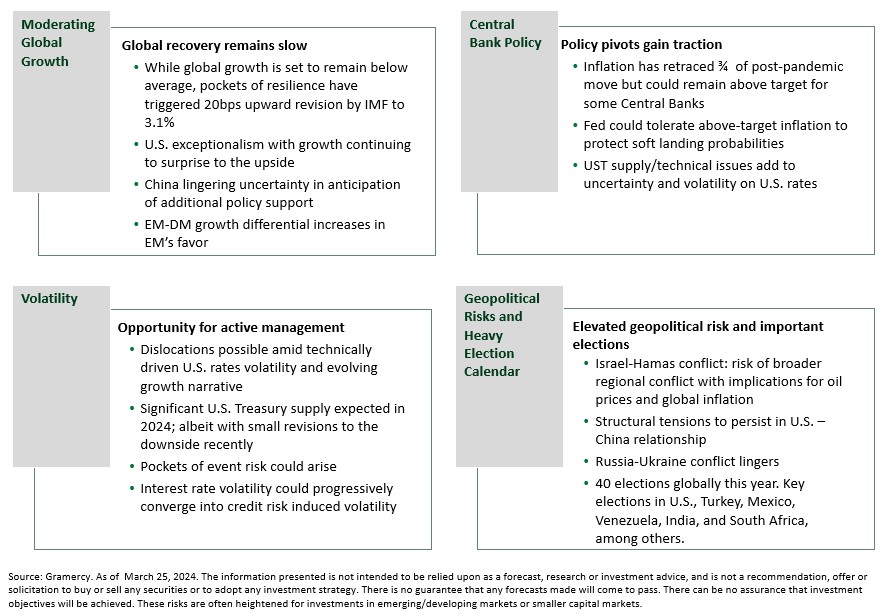

Themes Influencing Investment Decisions Entering 2Q 2024

The evidence of a challenging “last mile” in the advanced countries’ battle against inflation, and the backup in government yields that came with that, did not dent the impressive asset price rally that started last October. Neither did news that Germany, Japan, and the UK had fallen into recession, the tragic prolongation of deadly wars, or the heavy election calendar.

Japanese, European, and U.S. stocks set record highs as the rally broadened from a handful of tech-related names. Risk spreads on U.S. corporate bonds narrowed to levels not seen for three years. Emerging market assets attracted bigger crossover, and some dedicated investor flows after a prolonged period of outflows.

Three factors were particularly influential in reinforcing the asset price rally. Together, they impressively repressed volatility and reminded investors, once again, that markets are neither the economy nor are they geopolitics.

First, U.S. economic exceptionalism continued with solid growth, low unemployment, and solid job creation. This more than offset worries about growth fragilities elsewhere in the world, including in China and Europe.

Second, the U.S. Federal Reserve decided to bypass three consecutively hotter-than-expected inflation prints, with Chair Powell asserting that “nothing had changed” in the favorable inflation story. Meanwhile, in Japan, the Central Bank embarked in a notably dovish manner in the long-awaited normalization of interest rates and exit from yield curve control.

Third, from a bottom-up and sectoral perspective, the secular promise of Generative AI-induced productivity gains remained well anchored.

As long as these three factors persist, markets will be supported in continuing to look through global economic uncertainties, more stubborn than expected inflation, domestic political fluidity, and geopolitical tragedies. With that may come investor exuberance that would widen the search for yields and returns, with hitherto lagging asset classes more likely to gain greater investors’ interest.

The hope is that a successful soft landing of the advanced economies will provide for stronger fundamental support for high valuations. We see this as constituting the belly of the curve of potential outcomes, with a probability of around 60 percent. The distributions tails consist of a 20 percent probability of technological advances resulting in significantly earlier generalized productivity gains and 20 percent of a substantial slowdown on the back of a large political/geopolitical shock or a big policy mistake.

Pockets of strength persist despite still below average global growth

Following the 40 basis point (bps) upgrade in global growth to 3.1% in 2023, the year began with moderate resilience, particularly in the U.S., which led the IMF to revise up its 2024 world growth forecast by 30bps to 3.1%. Composite PMIs in the U.S., EU, and China all improved, with the EU remaining in contractionary territory. The EM-DM differential remains favorable although it decelerated slightly in 1Q on faster paced DM growth relative to EM. Our base case for a soft landing in the U.S. remains well anchored in this context with a lower likelihood for a hard landing. As noted by the IMF World Economic Outlook in January, risks to the outlook appear balanced. On the upside, continued disinflation and normalization of monetary conditions combined with productivity gains could drive higher growth while on the downside, deepening of geopolitical conflicts, inflation resurgence or China weakness could pull down activity.

In China, the National People’s Congress meetings held in early March delivered an anticipated growth target of “around 5%” with incremental fiscal stimulus largely in the form of central and local government special bond issuance. We believe the economic measures and guidance put forth thus far are likely adequate to reach a growth target of around 4.5% and are not indicative of a “bazooka” style approach to more aggressively restore confidence. We expect additional small rate adjustments and further use of the Pledged Supplementary Lending tool, which should support growth as needed later in the year. Lastly, the recent increase in opacity and centralization of decision-making leaves room for policy surprises. On this, we would watch for any expansion of government home-buying that could more meaningfully alter supply and demand dynamics and restore confidence.

Central banks’ policy pivots appear set to gain traction

The end of the first quarter was characterized by prevailing dovish signals by the systemic global central banks. This translated into buoyant sentiment in markets, which should carry forward into the second quarter as investors anticipate the beginning of monetary policy easing in DM. The Swiss National Bank (SNB) reinforced the sentiment by unexpectedly delivering a 25bps rate cut at the end of March, becoming the first major DM central bank to ease policy in this cycle. The SNB pointed to inflation having converged to below its 2% target since June 2023 and revised its inflation projections sharply lower to 1.4% YoY for this year. In addition, the Bank of England (BoE) seemed to also shift in a more dovish direction in its last 1Q meeting, as for the first time since September 2021 there were no votes in favor of a rate hike and the hawkish Monetary Policy Committee members dropped guidance for hikes going forward.

The U.S. Federal Reserve (Fed) also contributed to the overall dovish bias at the end of the quarter as it kept its benchmark interest rate unchanged but signaled that it expects to ease monetary policy by a cumulative 75bps in 2024. The accompanying statement emphasized the common disclaimer that the FOMC needs to gain “greater confidence that inflation is moving sustainably toward two percent” before delivering the first rate cut. However, Chair Powell suggested during his press briefing after the decision that it would be appropriate to begin easing policy back towards a more neutral level “at some point this year”, reinforcing consensus market expectations that now price a first Fed cut in June.

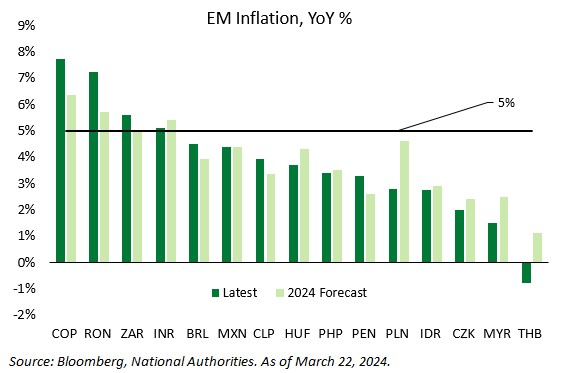

Across EM, double digit inflation now seems to be firmly in the rear-view mirror for most major economies and the convergence toward central bank targets that we highlighted in our last reports continues (see Exhibit 1). This has contributed to current and forward-looking real interest rates in EM that stand at a structurally different level compared to the recent past, providing an important fundamental anchor for EM’s external accounts as well as select local currency debt stories. Amid a relatively dovish backdrop in DM and potentially softer USD in the coming months, we expect EM central banks to be able to maintain and, in some cases, even accelerate their own policy easing cycles, supporting economic activity and diffusing political pressures in their economies. Against this backdrop, we expect carry in select local EM credits to remain attractive in 2Q, which, combined with relative FX stability, should deliver attractive total returns for investors and catalyze stronger financial inflows toward EM economies.

Exhibit 1: Convergence of inflation to targets in EM continues:

Geopolitics and political event risk remain in focus for 2Q

As we enter the second quarter, the two major conflicts in Ukraine and Gaza drag on with no resolution on the horizon. After being re-elected for a new six-year term with a record level of support, Russian President Putin might feel emboldened to escalate his rhetoric and actions vis-a-vis Ukraine. Meanwhile, as former President Trump prepares for another run for the White House, an increasing number of stakeholders in the international community will likely start to incorporate into their scenarios diminished U.S. financial and military help for Ukraine going forward.

Meanwhile, the humanitarian catastrophe in Gaza continues to worsen with no tangible prospects for a near-term ceasefire, despite efforts by global and regional stakeholders to encourage the Israeli war cabinet and Hamas toward the negotiation table. While the hostilities persist and the toll on Gaza’s population continues to increase, escalation of the conflict to the broader region remains a risk that markets will continue to monitor during 2Q24.

The Taiwanese presidential outcome of a Democratic Progressive Party victory has thus far been a benign market event with President-elect William Lai’s initial remarks avoiding redlines for Beijing. The narrow victory over KMT and TPP and lack of majority in parliament provide a check and balance, supporting the status quo. Lai is set to take office on May 20th where tensions could begin to resurface. Lai will have to further elaborate on his cross-strait policy. We see room for a flare-up of unprecedented military exercises from Beijing, but they should remain short of any near-term conflict. Beyond 2Q, nervousness over U.S.-China tensions and Taiwan policy may resurface as the U.S. electoral campaign and polls heat-up into November.

Key EM elections in the second quarter include South Africa on May 29th and Mexico on June 2nd where general policy continuity is expected with some room for volatility, particularly in the case of South Africa. While not our base case, African National Congress support which dips below 45% could complicate coalition formation and increase policy risk. In Mexico, Claudia Sheinbaum of the ruling Morena party remains comfortably ahead in polls with over 60% support; Xochitl Galvez has just over 30% support. The first debate will be held on April 7th. A key focus for the markets in the aftermath of the election will be the composition of Congress, fiscal policy and Sheinbaum’s willingness and ability to scale back electoral spending. Headline risk from the U.S. electoral campaign could also drive moderate volatility.

Also in the second quarter, the largest and logistically most complex election in history will take place in India, the world’s most populous democracy. Close to 1 billion eligible voters will be able to cast their ballots in the general elections over the span of 44 days between April 19th and June 1st, with a new government expected to be sworn in by mid-June. Polls suggest that Prime Minister Narendra Modi is in a commanding position to win a third term in office as he seeks a decisive mandate for enacting aggressive economic reforms that markets are likely to welcome.

In Venezuela, the U.S. will need to decide whether to extend its oil and gas General Liscense 44 on April 18th ahead of Venezuela’s Presidential Election which is set for July 28th. While the state of elections are unlikely to be free and fair, international observation and participation of opposition candidates combined with domestic incentives in the U.S. support extension. While the lifting of oil sanctions has been highly beneficial financially for Venezuela’s embattled economy and the regime, the government’s actions in recent months have repeatedly demonstrated that retaining power at any cost is clearly being prioritized by Maduro over ensuring the continuation of sanctions relief beyond the end-April review period set by the U.S. Department of State. Looking ahead, we believe the key question from a market perspective will be whether the U.S. and Venezuela will be able to find some sort of workable formula for diplomatic rapprochement after the July elections, if they are assessed by the international community as meeting at least a minimal legitimacy threshold.

Investment Strategy Review and Outlook

Multi-Asset Strategy

Despite the interest rate challenges present in 1Q, we were able to embrace the volatility and perform well on both an absolute and relative basis. The drivers of performance were both top-down asset allocation decisions and bottom-up/structured transactions. In our high conviction performing credit, the combination of high yield and investment grade worked to our satisfaction. Meanwhile the “special sauce” of capital solutions/asset backed lending contributed as expected. Lastly, opportunistic credits such as Argentina, Pakistan and Ecuador proved to be truly opportunistic.

Looking forward, the interrupted “Powel Pivot”, seems to be back on track. As interest rate cuts ensue, we expect a search for yield to include flows to EMD. Those flows combined with clean technicals should provide for an acceleration of the dislocation recovery that paused this past quarter.

Our objective to capture the embedded returns in the dislocation recovery remains, but to do so in a fashion whereby we participate in a material amount of the upside but continue to limit the correlation to a challenging/draw-down market. We look to do so through our barbell, which is anchored in high yielding asset backed lending and high conviction EMD. On the other side of the barbell, we continue to lean-in on opportunistic and special situations only when they present themselves as asymmetric opportunities. We expect to continue the migration from high yield to investment grade and increase duration and exposure to selective local markets.

Lastly, if markets over-shoot to the upside, we will look to re-load hedges on EMB and SPY to mitigate any big moves to the downside. Combined, this gives us confidence that we can capture the high expected returns but do so without making any non-recoverable mistakes.

Please see the Multi-Asset Strategy video for more information about the team and their process.

Capital Solutions

The volatility observed in the global markets persisted through the first quarter, leading to significant fluctuations in the U.S. Treasury market. This instability has resulted in periods of uncertainty, providing emerging market companies with limited opportunities to access public markets—a trend that was present in 2023 and is anticipated to continue in the current year. During these brief windows, access to the public markets was predominantly available to large investment grade issuers, with only a few high-yield issuers managing to break through. The total number of EM corporate primary issuances during 1Q was $88bn. This is split as $71 billion from investment grade issuers and $17 billion from HY issuers. The 1Q 2024 figure is up 22% from 1Q 2023 ($72bn) but down from 2022, 2021 and 2020.

This environment of high interest rates and constrained access to public markets has further boosted demand for our private credit strategy. We have seen an uptick in larger companies opting to incorporate our highly secured structures into their financing strategies. Evidence of this is seen in our structured trade transaction of $50 million to a company with a $6 billion market cap in Turkey. Additionally, the existing volatility, which is not necessarily indicative of a bear market, has opened valuable short-term access windows. These have been particularly positive for our event-driven transactions, allowing us to achieve highly attractive monetizations, including the full monetization of our acquisition financing for the purchase of Nike’s Chilean business through a private strategic process and repayment of a substantial portion of our exposure for the financing of a Mexican healthcare platform via an IPO repayment.

Moreover, the high-rate environment has highlighted the uncorrelated nature of our private credit strategy in comparison with our developed market peers. While high yield companies in the U.S. are struggling with their maturity walls in the new rate environment, often to unsustainable levels, our borrowers have exhibited more consistency.

Our deployment has remained robust, on the back of the aforementioned tailwinds. During the first quarter, we deployed ten senior secured loans, amounting to $212 million, in a combination of new deals, upsizes to existing loans and platform loans. The loans were directed towards the agribusiness, O&G, real estate, power generation, manufacturing and financial sectors and diversified across Brazil, Mexico, Colombia, Dominican Republic, Turkey and Africa. Additionally, we have over $100 million already committed and in the process of being funded.

At the close of the first quarter, we had a pipeline of $150 million in the advanced due diligence stage and almost $1 billion in early stage deals. The pipeline is comprised of both our established platforms as well as single transactions, allowing our team to diversify the portfolio by investing in different industries and countries including sectors such as Peru and Colombia healthcare, financial institutions and fintech’s in Mexico and Brazil, agribusiness in Brazil, mining in Peru and Mexico, O&G in Africa and Mexico, and real estate in Mexico and Costa Rica.

Please see the Capital Solutions Strategy video for more information about the team and their process.

Emerging Markets Debt

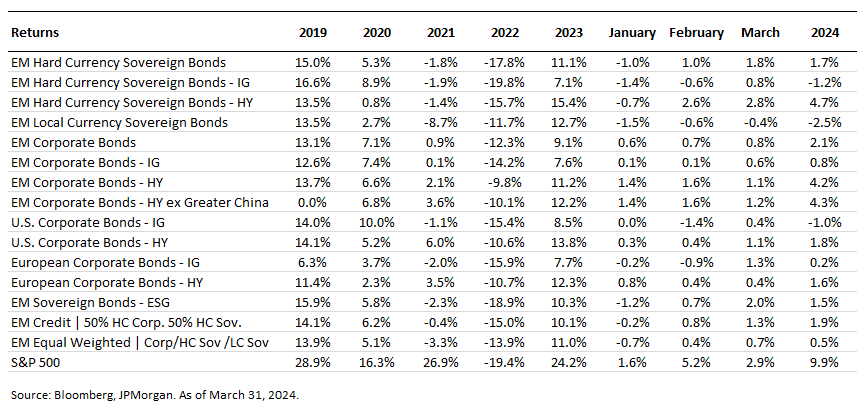

The first quarter of 2024 was marked by the return of interest rate volatility as the ‘no landing’ scenario regained market attention. Widening in the U.S. Treasury market began early in January as Fed speakers pushed back on the early timing and extent of Fed rate cuts that the market had priced in after the December pivot and gained traction with stronger-than-expected U.S. GDP growth of 3.3% and strong global PMIs published in January, where U.S. services and manufacturing rose to seven-month and fifteen-month highs, respectively. Then, February kicked off with a U.S. employment report that was double consensus expectations and was followed by a higher-than-expected CPI reading. These two data points cemented the idea of the ‘no landing’ scenario for the market until the end of March, when the Fed sent a surprisingly dovish message signaling 75bps of rate cuts for 2024, despite an upward revision to year-end 2024 core PCE inflation from 2.4% to 2.6%. In this context, the 10-yr U.S. Treasury widened 28bps during the quarter to 4.21%.

Unsurprisingly, the no landing scenario was positive for risk assets during the quarter. This was true within EM as well, where EM HY (both sovereign and corporate) outperformed EM IG assets. Performance of local currency sovereigns (-1.9%) during the quarter was negatively impacted by a stronger U.S. dollar as Treasury rates widened.

We continue to believe that the no landing scenario is part of the journey for 2024 but that the soft landing scenario is the ultimate destination. In this context, we still have high conviction that the Fed will be able and willing to start its rate cutting cycle during the second half of the year. As such, we believe portfolios should reflect a barbell approach. On one hand, EM high yield assets, both sovereign and corporates, that are attractive from an all-in yield perspective. On the other hand, EM investment grade assets, primarily corporate, that remain attractive from a relative value basis versus developed markets and continue to have attractive convexity for when the Fed starts cutting. In the short-term, as data is likely to continue to point towards a no landing scenario, which is a tailwind for higher beta assets, we think the barbell should be weighted more towards high yield assets.

Please see the Emerging Markets Debt Strategy video for more information about the team and their process.

Special Situations

The Special Situations team continues to focus on the successful management and monetization of our existing portfolio of legal assets in emerging markets, including in Brazil, Mexico, Peru, Argentina, Venezuela, and developed markets, including the United States and the United Kingdom. We are also seeing attractive opportunities in secondary transactions involving legal assets. We often seek to structure these investments with insurance to protect against the downside.

Finally, we are seeing interesting opportunities in real estate development in underpenetrated markets in the United States, Europe, and Latin America.

Conclusion

This past quarter witnessed a fair amount uncertainty and volatility due to the data dependency of the Fed and the delayed “Powel Pivot”. Markets now seem poised to return to the yield seeking behavior that proved to be a bit premature late last year. We remain attracted by the dislocation recovery that should resume and the asset backed carry embedded in both public and private markets. Equally important, we are excited about the opportunistic and special situations opportunities that are present in the markets today. That being said, the battle between liquidity, growth and sticky inflation will remain. As a result, we expect continued volatility will allow for tactical positioning of capital driven by our top-down and bottom-up perspectives on the asset class. Resilience, optionality, and agility, “ROA,” are the path toward capturing our target returns but without making any non-recoverable mistakes. In doing so, we will continue to respect and embrace the volatility in the markets by “planning the trade and trading the plan.”

On February 1st, Gramercy hosted a virtual roundtable discussion. First, Scott Slayton, Partner, Chief Strategist at Capital Creek Partners moderated a fireside chat between Mohamed A. El-Erian, Chair and Robert Koenigsberger, Managing Partner and Chief Investment Officer. Next, Timothy Reick, Chief Executive Officer at HRC Group moderated a discussion between Gramercy’s Investment Strategy leaders.

About Gramercy

Gramercy is a global emerging markets investment manager based in Greenwich, Connecticut with offices in London, Buenos Aires, Miami, West Palm Beach and Mexico City, and dedicated lending platforms in Mexico, Turkey, Peru, Pan-Africa, Brazil, and Colombia. The firm, founded in 1998, seeks to provide investors with a better approach to emerging markets, delivering attractive risk-adjusted returns supported by a transparent and robust institutional platform. Gramercy offers alternative and long-only strategies across emerging markets asset classes including multi-asset, private credit, public credit, and special situations. Gramercy’s mission is to positively impact the well-being of our clients, portfolio investments and team members. Gramercy is a Registered Investment Adviser with the SEC and a Signatory of the Principles for Responsible Investment (PRI), a Signatory to the Net Zero Asset Managers initiative and a Supporter of TCFD. Gramercy Ltd, an affiliate, is registered with the FCA.

Contact Information:

Gramercy Funds Management LLC

20 Dayton Ave

Greenwich, CT 06830

Phone: +1 203 552 1900

www.gramercy.com

Joe Griffin

Managing Director, Business Development

+1 203 552 1927

[email protected]

Investor Relations

[email protected]

This document is for informational purposes only, is not intended for public use or distribution and is for the sole use of the recipient. The information set forth herein and any opinions herein do not constitute an endorsement, implied or otherwise, of any securities, nor does it constitute an endorsement with respect to any investment area or vehicle. It is not intended as an offer or solicitation for the purchase or sale of any financial instruments or any investment interest in any fund or as an official confirmation of any transaction. Opinions, estimates and projections in this report constitute the current judgement of Gramercy as of the date of this report and are subject to change without notice. All market prices, data and other information, are not warranted as to completeness or accuracy and are subject to change without notice at the sole and absolute discretion of the Investment Manager. Gramercy has no obligation to update, modify or amend this report or otherwise notify a reader hereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Certain statements made in this presentation are forward-looking and are subject to risks and uncertainties. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account information currently available to us. Actual results could differ materially from the forward-looking statements made in this presentation. When we use the words “believe,” “expect,” “anticipate,” “plan,” “will,” “intend” or other similar expressions, we are identifying forward-looking statements. These statements are based on information available to Gramercy as of the date hereof; and Gramercy’s actual results or actions could differ materially from those stated or implied, due to risks and uncertainties associated with its business. Unless otherwise stated, all representations in this presentation are Gramercy’s beliefs based on sector knowledge and/or research. Past performance is not necessarily indicative of future results. Any reference to net returns reflect the deduction of management fees, carried interest, unconsummated transaction fees, professional fees, organizational fees and interest. Such fees and expenses will reduce returns to investors and in the aggregate, may be substantial. References to any indices are for informational and general comparative purposes only. There are significant differences between such indices and an investment program of Gramercy. A Gramercy Fund may not invest in all or necessarily any significant portion of the securities, industries, or strategies or represented by such indices. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. This presentation is strictly confidential and may not be reproduced or redistributed, in whole or in part, in any form or by any means. © 2024 Gramercy Funds Management LLC. All rights reserved.