Authored by:

Robert Koenigsberger, Managing Partner & Chief Investment Officer

Mohamed A. El-Erian, Chair

Petar Atanasov, Director & Co-Head of Sovereign Research

Kathryn Exum, Director & Co-Head of Sovereign Research

January 9, 2024

Decoding the Global Macro Environment: A Top-Down Perspective and the Related Implications for Emerging Markets Heading into 1Q 2024

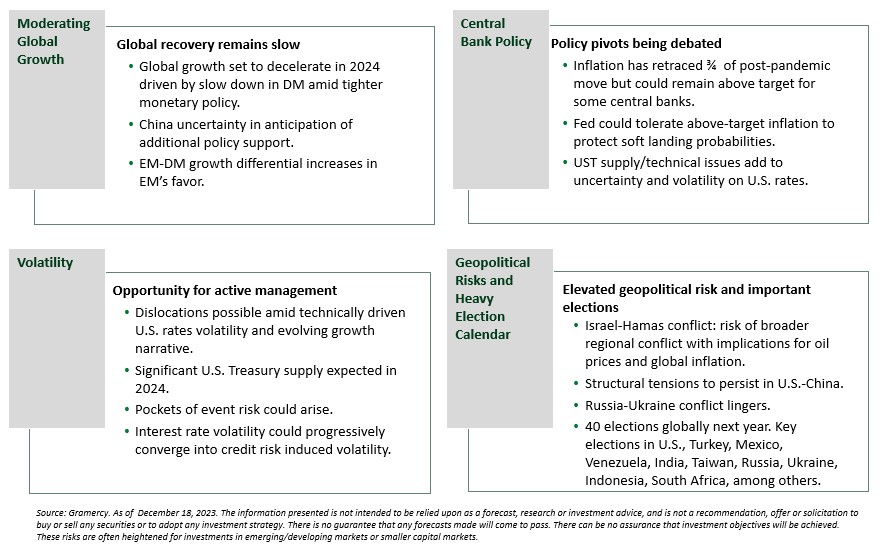

Top-Down Observations

Having navigated synchronized phases for monetary policy in systemically important advanced countries, the emerging market asset class enters 2024 looking at competing liquidity paradigms that will require them to maintain the sound economic management that has served them well in recent years. This need is accentuated by uncertainties about the robustness of global growth. Absent a significant shift in asset class flows, this is an environment that will result in significant performance dispersion, among both companies and sectors.

After dealing with the headwind of one of the most compressed hiking cycles in decades by the Federal Reserve and the European Central Bank, emerging markets breathed a huge sigh of relief when it became clear that these influential central banks had reached “peak rates.” This relief was significantly amplified by markets rushing to price in large rate cuts in 2024 – a possibility where the Fed has kept an open door, but the ECB is more reluctant.

There is no doubt that the net impact of all this for emerging economies is a more accommodating global liquidity environment, lower funding costs, and less pressure on their exchange rates. Importantly, it comes at a time when global growth is expected to be more restrained as the exceptional U.S. performance in 2023, both in absolute and relative terms, moderates.

The tug-of-war between more supportive financial conditions and less accommodating growth will place a premium on responsive domestic policies, something that quite a few emerging economies did well on in the last few years. It is also likely to increase the pressure for greater dispersion in both economic and financial outcomes within the asset class.

Flows are likely to play an important role in shaping this tug-of-war. Intriguingly, emerging markets have not experienced anywhere near the inflows of investible funds that other asset classes have. Instead, outflows have persisted into year end.

This is particularly surprising given that, on average, emerging markets have higher credit quality, less leverage, and more attractive spreads. The extent to which outflows turn into inflows will be an important factor in determining whether attractive risk/return opportunities at the individual sovereign and corporate level become part of a significant uplift for the asset class as a whole.

Themes Influencing Investment Decisions in 1Q 2024

Global growth to moderate amid tighter financial conditions and cautious Chinese stimulus

Global growth finished 2023 at around 3.0% YoY and is projected to decelerate slightly in 2024 as tight financial conditions and fiscal consolidation take a toll on economic activity. However, developed market “DM” economies and China are expected to drive the slowdown, while emerging market “EM” growth appears set to remain resilient. The important EM versus DM growth differential is in positive territory thanks to the normalization of EM fundamentals to pre-pandemic levels and stable growth trajectories in many major EM economies. Against this backdrop, regional and country divergence among EM credits is a theme that we expect to carry forward into 2024 and influence differentiation in investment decisions and outcomes. Our base case envisions a soft landing in the U.S., supported by Fed rhetoric that seems likely to turn progressively more dovish, provided U.S. inflation continues to moderate while demand side activity and wage growth continue to moderate.

As far as global growth is concerned, markets will remain focused on whether the Chinese authorities will signal an increased willingness to provide more sizable policy support to the economy as it transitions from “post-COVID” recovery to finding new structural drivers of economic growth over the medium-term. We remain of the view shared in the last Outlook that an all-in “bazooka” approach is unlikely amid Beijing’s strategic objective of reducing leverage in the economy and increased economic stability. We expect moderate GDP growth next year wrapped around the 5% reference level, which is likely to be satisfactory to policymakers as the focus increasingly shifts to the “quality of growth” rather than its scale. Nevertheless, ad-hoc and/or targeted measures to support specific strategic sectors of the economy (i.e., property sector) remain likely, in our view.

As usual in recent years, geopolitical developments and specifically the evolution of the U.S.-China relationship will remain a key watch point for markets as we enter the new year. There has been a diplomatic thawing between the two economic and military superpowers in recent months, including the first face-to-face meeting in a year between Presidents Biden and Xi, who agreed to open a presidential hotline and resume military-to-military communications, among other measures. However, better recent dynamics in the defining global economic relationship could be challenged early in the first quarter as Taiwan faces pivotal elections for president and parliament on January 13th. Outside of the Taiwan issue, we expect that Beijing will continue to leverage opportunities to enhance its global clout on international relations and its position as a leader of the “global South” on the main topics of global significance.

Central banks dovish pivots likely to gain momentum as inflation converges to targets

Christmas came early for markets in mid-December when the Federal Reserve gave a clear signal that the time for unwinding the post-pandemic monetary policy tightening is likely coming in 2024 amid an improving inflation outlook and better odds of engineering a soft landing for the U.S. economy. This backdrop is without a doubt supportive for markets, and we expect EM assets across the board to benefit from stronger investor sentiment carrying forward into 1Q 2024.

This being said, we are cognizant of the fact that following the Fed’s dovish pivot in mid-December investors quickly priced in six cuts next year versus the Fed’s projected three. In addition, futures markets have fully priced in a first rate cut in March, with around 20% probability of a cut as early as January. Clearly, markets have run ahead of the FOMC and to the extent Chair Powell and his colleagues felt the need to dial back some of the dovishness in 1Q, there is a risk, albeit not a base case, that market optimism could be somewhat tampered. In one direction or the other, the divergence that has opened up between Fed projections and market expectations about the pace of policy easing in 2024 will likely have to be resolved in this quarter.

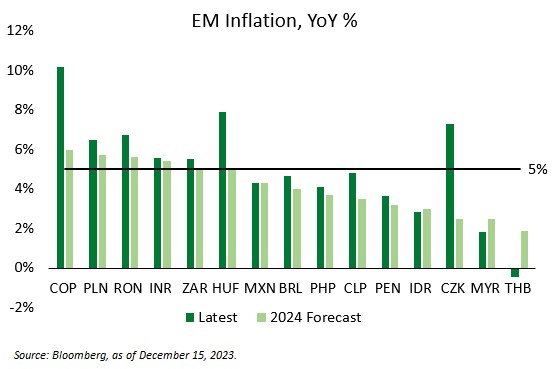

As for EM, the moderation in inflation dynamics observed in 2023 seems set to gain further momentum in the new year as supply side dynamics continue to normalize after the pandemic shock of 2020-21. For most major emerging markets, year-on-year headline inflation is projected to decelerate further in 2024. In many economies, the level is expected to be close to or well below 5% (see Exhibit 1), which marks a strong convergence with medium-term target ranges for many EM central banks. We expect that markets will respond to the ongoing EM disinflation trend with improved sentiment toward local currency assets. Furthermore, amid a markedly more benign macro backdrop dominated by a “dovish Fed pivot” narrative replacing the previous “higher for longer” regime, many EM central banks should be able to carry on with growth-supporting monetary policy easing cycles and continue to unwind the significant tightening delivered over the last couple of years.

Exhibit 1: EM inflation set to continue to decrease in 2024 and start converging to targets

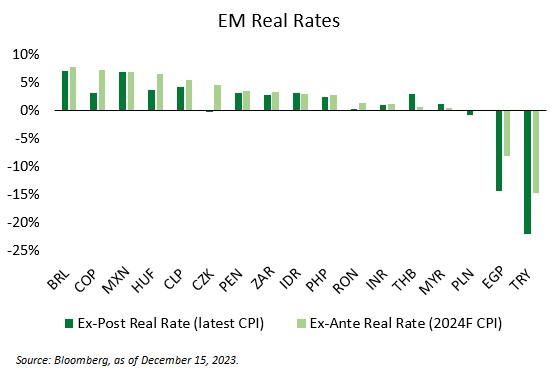

In an environment of declining inflation, the real carry investors get in EM local assets appears set to improve even as EM central banks cut rates. This provides a bullish FX and rates anchor at the start of the new year, especially if the weaker USD/peak Fed hawkishness narrative holds. For most of 2023, only a handful of Latin American economies offered investors attractive real interest rates. Looking forward to next quarter and the rest of 2024, wesee that most EM jurisdictions with actively traded local currency curves have transitioned to a positive real

Exhibit 2: Higher forward looking real rates in EM as inflation comes down

rate environment, both on current and forward-looking inflation basis (see Exhibit 2). For the first time in years, there are almost no major emerging market economies with negative real rates on a forward looking basis (using projected 2024 headline inflation) and a handful of local curves would now offer real rates in the 6-7% territory. All else being equal, we expect this setup to support the attractiveness of EM assets in general and local currency assets in particular.

Geopolitical and political risks abound

As we turn the page to 2024, none of the raging global conflicts appear close to a potential resolution. The war in Ukraine has seeded the global spotlight to the unfolding military conflict between Israel and Hamas, but remains a major source of risk and, as in 1Q 2023, is prone to intensification of hostilities when the weather conditions improve toward the end of the quarter. Distracted by the conflict in the Middle East and domestic political priorities ahead of an election year, the U.S. authorities, Ukraine’s main provider of financial and military aid, appear unable and/or unwilling to sustain the level of their support. Despite formally inviting Ukraine to begin accession talks with the EU, a process that may take decades, European leaders are also struggling to find the required consensus to approve significant financial help for Kyiv. These factors could embolden the Kremlin for more forceful actions and paint a less optimistic outlook for Ukraine’s war effort and economy, in our view.

Meanwhile, at the time of writing, the humanitarian situation in Gaza is appearing to become increasingly catastrophic under Israel’s relentless military onslaught. While rhetoric by the Biden Administration has shifted to be more critical of the Netanyahu Government’s actions, underlying U.S. financial and military support for Israel remains unwavering. This signals to us that the conflict is likely to continue in the coming months, despite growing indignation among the global community at the humanitarian cost. As such, an escalation of the conflict to the broader region remains a major risk that markets will need to monitor during 1Q24. The potential for more direct involvement in the conflict by some of Israel’s Arab neighbors such as Lebanon/Hezbollah or by Iran could carry major implications for global commodity prices and inflation dynamics and although not a base case, should not be ignored.

Beyond the major global conflict hotspots, market participants will need to factor in an exceptionally heavy electoral calendar across EM and DM in 2024. Countries with more than 60% of global nominal GDP combined face some type of election next year. At the very start of the first quarter, markets will already face Taiwan’s presidential and parliament elections on January 13th. Depending on the outcome and rhetoric around this election, the recently improved management of the U.S.-China diplomatic relationship could face renewed challenges. Other notable national elections in 1Q include El Salvador (presidential and legislative) on February 4th, Indonesia (presidential and legislative) on February 14th, Senegal (legislative) on February 25th and Russia (presidential) on March 17th. Türkiye will hold local elections in March that carry exceptionally high market relevance as President Erdogan strives to recapture the Istanbul and Ankara municipalities that he lost to the opposition in 2019.

As usual, EM election dynamics have huge repercussions for economic policy and market performance of EM assets. 2024 promises to be particularly interesting and full of investment opportunities. Starting from the first quarter, the ongoing normalization of economic policy management in Türkiye under MinFin Simsek and CBT Governor Erkan hinges on Erdogan’s political success in the upcoming local elections in March. A political win for the President will likely validate Simsek and Erkan’s market-friendly pivot on economic policy, which in our view should provide another boost to Turkish assets, especially on the local currency side. Another pivotal EM election in 2024 will take place later in the year in Venezuela, but the domestic political dynamics in the run-up to the vote will be a focus of EM investor attention throughout the year. Continued re-integration of Venezuela in the international community, further U.S. sanctions relief, and ultimately a sovereign debt restructuring hinge on the Maduro regime’s willingness to ensure minimally acceptable election standards that could allow external/independent observers to endorse the results. The fate of opposition leader and early polls frontrunner Maria Corina Machado will also be a decisive factor. Although Argentina’s elections already happened in late 2023, the macroeconomic adjustment “shock therapy” embarked upon by President Milei’s Administration will be another major topic attracting EM investor focus as the new year progresses.

Investment Strategy Review and Outlook

Multi-Asset Strategy

Despite the challenges present in 2023, our Multi-Asset strategy was able to perform well. These challenges included the impact of higher interest rates (including bank failures), the continued war in Ukraine and the conflict between Israel and Hamas. The drivers of performance were both top-down asset allocation decisions and bottom-up security selection/structured transactions. In particular, our decision to embrace high yield, opportunistic credit and special situations over investment grade served us well. The portfolio also benefited from our allocation to private credit/asset-backed lending. Additionally, we embraced volatility by “planning the trade and trading the plan” on our entries and exits.

We continue to believe there are high expected returns in EM credit driven by both dislocation recovery and the “Powell Pivot” that markets cheered in late 2023. However, given the uncertainties that remain, volatility is a top-down macro theme where we continue to have high confidence due to “unusual uncertainty” and bouts of illiquidity in the marketplace.

Our objective to capture the embedded returns in the dislocation recovery remains, but to do so in a fashion whereby we participate in a material amount of the upside but continue to limit the correlation to a challenging/draw-down market. We look to do so through our barbell, which is anchored in high yielding asset backed lending and high conviction EMD. On the other side of the barbell, we continue to lean-in on opportunistic and special situations only when they present themselves as asymmetric opportunities. We expect to continue the migration from high yield to investment grade and increase duration and exposure to selective local markets.

Lastly, if markets over-shoot to the upside, we will look to re-load hedges on EMB and SPY to mitigate any big moves to the downside. Combined, this gives us confidence that we can capture the high expected returns but do so without making any non-recoverable mistakes.

Please see the Multi-Asset Strategy video for more information about the team and their process.

Capital Solutions

As we reached the end of the year, we faced a more constructive environment in public markets. Investors are pricing in the end of the tightening cycle in DM and the beginning of the easing phase in 2024.

As is usually seen when the level of capital markets activity is slowly starting to pick up, it starts mostly in DM and with the large sovereign and investment grade names in EM, leaving a large group of corporates still without access to public markets. In this context, our EM private credit strategy continues to prosper, positioning the product as an essential tool for the capital structures of these companies, either in scenarios of refinancing, CAPEX expansion, or business plan acceleration – for those that are starting to consider a risk-on approach for their business plan. We continue to benefit from these market dynamics. We are deploying new loans to larger corporates and regional companies, including the largest companies in Latin America. In previous years, these companies would not have considered our highly structured and collateralized facilities but rather relied on unsecured public bond capital market access. It is also important to mention, from a monetization perspective, as we see more constructive markets, some of our large borrowers that were considering a take-out strategy for repayment from capital markets or M&A on event-driven situations, are starting to prepare and plan accordingly for 2024. In a sense, this uncertain market with spurs of bullishness and bearishness, allows us to actively manage our portfolio, focusing on deploying to the better credits when the market closes and on the other side achieving monetization of portfolio assets as companies can execute their exit plans.

Even in this more stable environment, EM market windows are still challenging, so larger corporates value our speed and certainty of execution and are willing to pay the additional cost to access mid to long-term capital. Our funding is viewed as a resilient source to be used as a bridge to better market access. We continue to see the trend of how more corporates accept more restrictive facilities for long-term capital based on their view of still volatile market conditions for the next 18 to 24 months.

We continue advancing the execution of a number of loans to corporates with over $100 million in EBITDA, highlighting the competitive advantage of private credit in the current cycle. As a result, we have been able to further diversify within our target jurisdictions to cater to a wider universe of companies, including entities with over $1 billion in market cap. The most notable consequence has been the increase in credit quality throughout our portfolio, while maintaining attractive mid-teen returns with enhanced collateral packages.

During the fourth quarter, we deployed six senior secured loans, amounting to $100 million, in a combination of new deals, upsizes to existing loans and platform loans. The loans were directed towards the agribusiness, O&G, TMT, food & beverage, and financial sectors and diversified across Brazil, Mexico, Paraguay, Costa Rica and Africa. Additionally, we have $100 million already committed and in the process of being funded.

At the close of the fourth quarter, we had $250 million in the advanced due diligence stage. This is critical to our strategy as we want to maintain our deployment capacity during the first half of 1Q-2024, when the level of activity tends to decrease in some of our key markets in Latin America. Furthermore, based on our ability to deploy larger ticket sizes and our clear market-leading position in EM, especially Latin American private credit, we have a robust pipeline of over $1 billion across deals in advanced and early-stage conversations. The pipeline is comprised of both our established platforms as well as single transactions, allowing our team to diversify the portfolio by investing in different industries and countries including sectors such as Peru and Colombia healthcare, financial institutions and FinTech’s in Colombia and Mexico, Agribusiness in Brazil, O&G services in Peru, Mexico and Dominican Republic and real estate in Mexico and Chile.

Please see the Capital Solutions Strategy video for more information about the team and their process.

Emerging Markets Debt

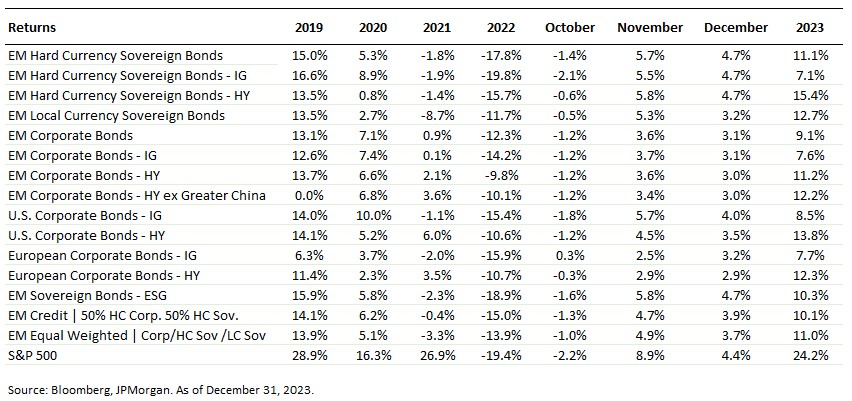

While 2023 ended on a high note, with a surprisingly dovish turn in Fed rhetoric stoking positive global risk sentiment into the new year, 2023 was a year marked by significant volatility and investor angst. Mixed macroeconomic data throughout the year whipsawed the U.S. Treasury market and, in turn, investors who found it difficult to have much conviction in any one investment theme throughout the year. The positive surprise of U.S. exceptionalism and the implications for credit strength were dampened by the resulting uncertainty to disinflation prospects, rates outlook and refinancing risks. The right call during the year, in both developed and emerging markets credit, was to “hide out” in high yield where you could clip big coupons from companies benefiting from better-than-expected growth, and not worry as much about interest rate risk given the lower duration profile of this segment. To that point, the high yield segment of emerging market hard currency sovereigns and corporates, as measured by the JPM EMBI Global Diversified HY Index (EMBIGD HY) and the JPM CEMBI Broad Diversified HY Index (CEMBI BD HY), returned 15.4% and 11.2%, respectively, in 2023. This compares to the investment grade segments which returned only 7.1% and 7.6%, respectively, during the year. Interestingly, emerging markets local currency sovereigns also performed exceptionally well this year despite a backdrop of increasing U.S. rates. This performance was largely due to the fact that many emerging market economies reacted more swiftly to global inflationary pressures than their developed market counterparts, and started hiking rates earlier, thus putting them in a position to start cutting rates first in 2023. It is interesting to note that emerging markets debt posted these returns in another year of significant outflows for the asset class ($32 billion of outflows). The performance of emerging markets debt in 2023, despite all its challenges, speaks to the resilience and maturation of the asset class over the last several decades and proves that emerging markets debt deserves a seat at the table when it comes to strategic asset allocation decisions.

In 2024, we are confident that inflation can continue its downward trend towards 2%, giving the Fed room to start cutting rates during the first half of year. A key question for markets, however, will be whether the Fed has been able to orchestrate a soft landing in the U.S. or whether the U.S. will fall into a more severe recession where the elevated interest rate environment of the last couple years finally catches up to the economy. This is an important question because in a soft landing scenario, both investment grade and high yield assets can perform well, while in a hard landing scenario, high yield assets may come under more pressure as sentiment towards riskier assets sours. At this stage, we believe that there is a higher probability of a soft landing versus a hard landing, especially as it seems that the Fed, more confident in its inflation figures, is going to focus more squarely on sticking the landing. Nonetheless, it may be too soon to tell on the fundamental front for the U.S. economy and the reality is that high yield had a great year in 2023, making valuations look a bit more stretched, especially in the event of a hard landing. At the same time, significant price destruction occurred within the investment grade bucket on the back of U.S. rates volatility in 2023. While some of this has been repaired by the rally in November and December of 2023, significant convexity, and thus upside, remains in the investment grade segment of emerging markets debt. As such, we believe that a rotation out of lower quality high yield credit into investment grade credit with convexity and better quality high yield credit in emerging markets is warranted and will provide the best risk adjusted returns in 2024. These segments should also be the first beneficiaries of inflows into the asset class once they resume, which we believe will be in 2024 given the brighter interest rate environment on the horizon.

Global Market Index Returns

Please see the Emerging Markets Debt Strategy video for more information about the team and their process.

Special Situations

In Special Situations, we have been focused on a variety of uncorrelated alpha opportunities. This has included our funding of later stage litigation finance related to “diesel-gate” and the cases against BHP due to the environmental damage caused by the Samarco dam failure in 2015. Often times, we have been able to structure these investments with insurance to provide asymmetric expected outcomes.

We are also focused on the thawing of relations between Venezuela and the United States and the investment opportunities that have presented themselves as a result. Lastly, with all the excitement vis-à-vis the change of government/regime in Argentina, we are exiting some investments and initiating others.

The Financial Times published an article discussing Gramercy’s loan to support certain environmental lawsuits.

Conclusion

With a new year, there will certainly be new opportunities and challenges. The markets cheered the Powell Pivot but now interest rate risk is giving way to recession fears and credit risk. We remain attracted by the dislocation recovery that is underway and the asset backed carry embedded in both public and private markets. Equally important, we are excited about the opportunistic and special situations opportunities that are present in the markets today. That being said, the battle between liquidity and growth will remain. As a result, we expect continued volatility will allow for tactical positioning of capital driven by our top-down and bottom-up perspectives on the asset class. Resilience, optionality, and agility, “ROA,” are the path toward capturing our target returns but without making any non-recoverable mistakes. In doing so, we will continue to respect and embrace the volatility in the markets by “planning the trade and trading the plan.”

Thank You!

Over the past 25 years, Gramercy has been dedicated to delivering upon our mission to positively impact the well-being of our clients, portfolio investments, and our team-members. Gramercy’s commitment to excellence has been reflected in its numerous accolades over the years. These achievements are a testament to the integrity, hard work and dedication of the firm’s talented team of professionals.

As we reflect on the past 25 years, we are reminded of the challenges that Gramercy has faced and overcome, including: Russian Debt Crisis a.k.a. Vodka, Brazilian Crisis a.k.a. Caparihna, Argentina Crisis a.k.a. Tango (and a few more thereafter), the September 11th terrorist attacks, the Global Financial Crisis, the European Debt Crisis, Brexit, the COVID-19 pandemic/lockdown, and the Russian Invasion of Ukraine.

Not many firms, particularly investment managers in emerging markets, can say they have navigated all of those challenging events. Through it all, the team has remained steadfast in its commitment and our aspiration of delivering strong risk-adjusted returns to our clients supported by a transparent and robust institutional platform. Looking ahead, we are excited to see what the future holds for Gramercy and our clients.

We have a quarter-century under our belts, but we remain aspirational for the performance and growth that is embedded in our DNA. We are celebrating 25 years, but we have the infectious energy and intensity of an exciting start-up. With our strong track record, our dedicated team, and our innovative approach, we are confident that the firm will continue to thrive and make a positive contribution to our constituents in the years to come.

Thank you to our valued clients, trusted business partners and dedicated team-members. We thank you for the past 25 years and we look forward to the next 25 and beyond.

Our 25th Anniversary Celebration video includes highlights from our time together as we commemorated the event and planned for the years to come.

About Gramercy

Gramercy is a global emerging markets investment manager based in Greenwich, Connecticut with offices in London, Buenos Aires, Miami, West Palm Beach and Mexico City, and dedicated lending platforms in Mexico, Turkey, Peru, Pan-Africa, Brazil, and Colombia. The firm, founded in 1998, seeks to provide investors with a better approach to emerging markets, delivering attractive risk-adjusted returns supported by a transparent and robust institutional platform. Gramercy offers alternative and long-only strategies across emerging markets asset classes including multi-asset, private credit, public credit, and special situations. Gramercy’s mission is to positively impact the well-being of our clients, portfolio investments and team members. Gramercy is a Registered Investment Adviser with the SEC and a Signatory of the Principles for Responsible Investment (PRI), a Signatory to the Net Zero Asset Managers initiative and a Supporter of TCFD. Gramercy Ltd, an affiliate, is registered with the FCA.

Contact Information:

Gramercy Funds Management LLC

20 Dayton Ave

Greenwich, CT 06830

Phone: +1 203 552 1900

www.gramercy.com

Joe Griffin

Managing Director, Business Development

+1 203 552 1927

[email protected]

Investor Relations

[email protected]

This document is for informational purposes only, is not intended for public use or distribution and is for the sole use of the recipient. The information set forth herein and any opinions herein do not constitute an endorsement, implied or otherwise, of any securities, nor does it constitute an endorsement with respect to any investment area or vehicle. It is not intended as an offer or solicitation for the purchase or sale of any financial instruments or any investment interest in any fund or as an official confirmation of any transaction. Opinions, estimates and projections in this report constitute the current judgement of Gramercy as of the date of this report and are subject to change without notice. All market prices, data and other information, are not warranted as to completeness or accuracy and are subject to change without notice at the sole and absolute discretion of the Investment Manager. Gramercy has no obligation to update, modify or amend this report or otherwise notify a reader hereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Certain statements made in this presentation are forward-looking and are subject to risks and uncertainties. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account information currently available to us. Actual results could differ materially from the forward-looking statements made in this presentation. When we use the words “believe,” “expect,” “anticipate,” “plan,” “will,” “intend” or other similar expressions, we are identifying forward-looking statements. These statements are based on information available to Gramercy as of the date hereof; and Gramercy’s actual results or actions could differ materially from those stated or implied, due to risks and uncertainties associated with its business. Unless otherwise stated, all representations in this presentation are Gramercy’s beliefs based on sector knowledge and/or research. Past performance is not necessarily indicative of future results. Any reference to net returns reflect the deduction of management fees, carried interest, unconsummated transaction fees, professional fees, organizational fees and interest. Such fees and expenses will reduce returns to investors and in the aggregate, may be substantial. References to any indices are for informational and general comparative purposes only. There are significant differences between such indices and an investment program of Gramercy. A Gramercy Fund may not invest in all or necessarily any significant portion of the securities, industries, or strategies or represented by such indices. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. This presentation is strictly confidential and may not be reproduced or redistributed, in whole or in part, in any form or by any means. © 2024 Gramercy Funds Management LLC. All rights reserved.