Authored by:

Robert Koenigsberger, Managing Partner & Chief Investment Officer

Mohamed El-Erian, Chair

Petar Atanasov, Director & Co-Head of Sovereign Research

Kathryn Exum, Director & Co-Head of Sovereign Research

July 12, 2023

Decoding the Global Macro Environment: A Top-Down Perspective and the Related Implications for Emerging Markets Heading into 3Q 2023

Top-Down Observations

In the second quarter of the year, global investors were reminded of the old adage that “the economy is not the market and the market is not the economy.”

Persistent inflation prompted central banks in advanced countries to raise policy interest rates and indicate their intention to maintain these higher rates for longer, despite indications of a global economic slowdown. This slowing was particularly visible in Europe and China. The U.S. economy continued to surprise to the upside on the back of an impressively robust labor market.

Despite the more fragile economic context overall, risk markets marched higher in the second quarter. Initially, the leg up was driven by a highly concentrated set of names that were either riding a big secular wave, such as AI and ML, or seen as “all weather,” such as big tech.

As the quarter proceeded, the resulting eye-popping dispersion in asset values gradually gave way to a broader rally, pulling more investment funds into markets. By contrast, government bond markets signaled caution about the future. Yield curves inverted further, with the U.S. 2s-10s ending the quarter at minus 100 basis points, a level not seen for a very long time.

We expect two tug-of-wars to continue to play out in the second half of this year. First, the stability offered by a handful of still-resilient economies versus the headwinds for the global economy coming from higher rates and sticky inflation. Second, fundamental factors favoring significant market dispersion, as a handful of well-performing names leave others languishing, versus technical drivers that are inclined to broaden the rally.

The evolution of both these tug-of-wars will depend in large part on how systemically important central banks address the policy “trilemma” facing them – that is, lowering inflation without undue damage to economic activity while maintaining financial stability.

For three of these central banks – the Bank of England (BoE), the European Central Bank (ECB), and the U.S. Federal Reserve (the Fed) – this involves the delicate balance between tightening monetary conditions to win the war against inflation without tipping their economies into recession and/or reigniting financial instability in both banks and NBFI (non-bank financial institutions). For the Bank of Japan, this involves an orderly process of exit from the regime of YCC (yield curve control).

While there is a pathway for central banks to strike the appropriate balance in an orderly manner, it is an uncertain one that remains vulnerable to both internal and external disruptions. The bumpiness of this journey is accentuated by changing structural influences associated with the energy transition, geopolitical tensions, technological evolution, and the liquidity depth of certain important market segments.

This top-down analysis calls for a highly differentiated approach to risk taking. Balance sheet robustness, agile management, and market positioning are key factors in assessing investment opportunities among the “up-in-quality” segment of the markets, as is the ability to navigate occasional shocks to market liquidity. Elsewhere, it points to the likelihood of interesting opportunistic investment possibilities associated with occasional price air pockets and stress in certain segments of corporate funding chains. It also emphasizes the need for careful liquidity management.

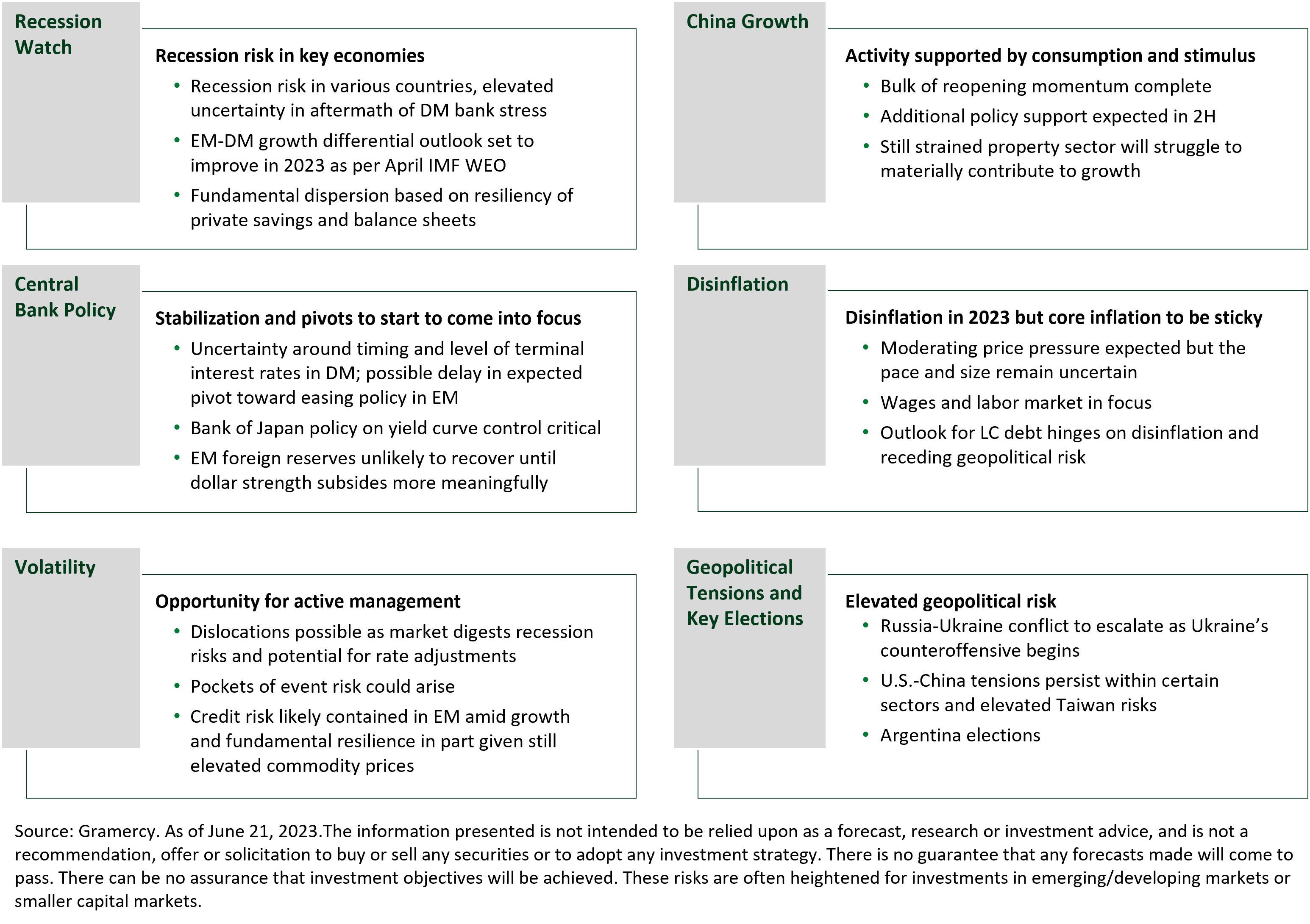

Themes Influencing Investment Decisions in 3Q 2023

Growth resilience amid latent recession risk

Global activity held-up well in 2Q with PMI strength in emerging markets and developed markets (“EM” and “DM”), pointing to 1H23 global growth of around 2.8%, notwithstanding some softness in Chinese data. At the same time, inflation eased but to a lesser extent than envisaged by the market in many jurisdictions, leaving financial conditions volatile and moderately tighter by the end of 2Q relative to the end of 1Q. The EM-DM real GDP growth differential dipped at the start of the quarter but has regained momentum in recent months. The persistent economic resilience despite tighter monetary policy is likely explained in part by still healthy balance sheets, fiscal spending in many economies, and lastly wage gains combined with continued drawdown of excess savings which has supported consumption (see Exhibit 1).

Looking ahead to 3Q, we see room for a steady growth backdrop particularly in light of the recent pause in central bank tightening, although, we acknowledge that identifying the timing of the impact of the lagged effect of the current policy regime poses a downside risk to this view. While Chinese stimulus should be forthcoming, we do not expect it to be in excess of what is needed to meet or moderately exceed the consensus growth targets of just above 5%. Our base case still envisions a shallow U.S. recession later this year that is not necessarily akin to typical recessions where activity contracts mildly, disinflation occurs, thus allowing for eventual evolution of monetary policy; but labor market destruction may not be as significant as in past contractions. The odds of the low probability scenario of a more severe downturn could increase in the event of a reacceleration of inflation which requires swift central bank action or results in renewed banking distress.

Exhibit 1: Resilient global growth for now amid fluid EM-DM growth differential

Source: IMF, July 2023.

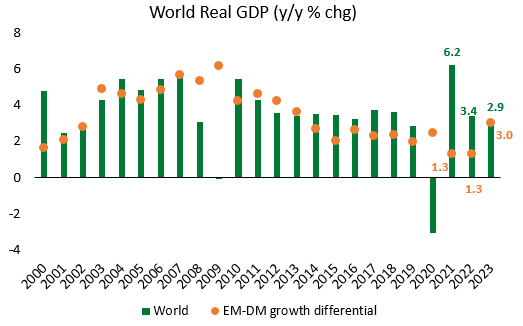

EM central banks’ tone in 3Q is likely to lean dovish on the back of improving inflation dynamics

Inflation dynamics across EM have improved through the first half of the year, consistently coming in below market expectations as indicated by Citi’s “Inflation Surprise” Index (see Exhibit 2). As such, we expect an increasing number of EM central banks to be in a position during 3Q to transition toward monetary policy easing cycles and start unwinding the significant tightening delivered over the last couple of years. All else being equal, this should be supportive for GDP growth dynamics and market sentiment in general, although more tangible macro improvements are likely to be felt with a lag.

Exhibit 2: EM inflation has been consistently lower than market expectations in 1H23

As for DM, inflation dynamics have improved as well but to a lesser extent when compared to EM, with upside surprises still occurring regularly through the first half of the year. Against this backdrop and robust labor markets, especially in the U.S., we expect that the systemic global central banks will remain cautious and refrain from sending strong dovish signals. In fact, the most recent signaling by the major institutions – the Fed, ECB and BoE – suggests that DM interest rates will keep rising and stay elevated. Accordingly, market expectations are firmly pointing to more hikes by the Fed and its peers over the coming months after the initial optimism about a dovish pivot after the Fed pause in June. As such, further rate increases in DM should not be too disruptive to EM asset performance unless inflation dynamics deteriorate again, forcing more aggressive policy tightening than what is already expected/priced in.

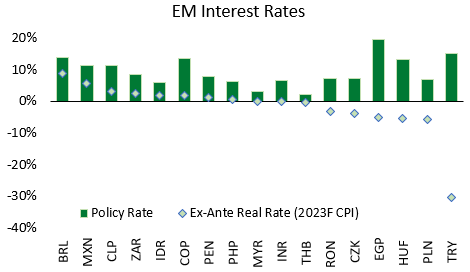

Most EM economies, especially those in Latin America, are entering the third quarter with stronger forward-looking real interest rate buffers, anchoring an overall FX-supportive backdrop at the start of 2H 2023 (see Exhibit 3). The EM economies that have enjoyed a strong disinflationary path in the first half of the year (e.g., Brazil, Chile, Mexico, among others), now offer real carry returns significantly higher than the recent past, which should support the attractiveness of local debt assets. The stories offering prospects for rate cuts soon, combined with supportive FX backdrops (e.g., good BoP dynamics, credible monetary policy frameworks, etc.) are the ones we expect to focus on. An essential element of the overall investment outlook for EM local assets in 3Q will be the direction of the USD. Unless U.S. inflation dynamics deteriorate, forcing a market reassessment of Fed policy prospects, we believe USD risks for EMFX are likely to be relatively muted in the coming months.

Exhibit 3: Latam economies continue to offer the highest forward looking real rates in EM

Source: Bloomberg, national authorities, June 2023.

China stimulus step-change?

Pockets of weak economic data coupled with low inflation amid stabilizing external rate conditions have increased speculation around more material Chinese stimulus measures in 2H23. Recent rate cuts are likely an indication of policy direction in the weeks and months ahead, although they have been moderate in scope and do not necessarily point to a step-change in terms of the authorities’ desire to stimulate at the expense of their structural priorities of preserving financial stability and evolving the economy away from property. Depending on the pace of domestic and external economic activity, stimulus could amount to 1-3trillion RMB comprised of a mix of additional monetary, property and fiscal measures in part leveraging policy bank lending to state owned enterprises. Announcements could be ad hoc in the short-term with the possibility of larger packages unveiled in the aftermath of the late July Politburo meeting as well as the 3rd Plenary session of the 20th Central Committee. In the near-term, growing pressure at the local government level is likely to continue to be dealt with on a case-by-case basis with prospects for potential relief on financing. A more strategic solution could begin to take shape during the year-end policy meetings, setting the stage for execution into 2024. This all points to 2023 growth near the government’s target of 5%, with more optimistic sell-side views north of 5.5% recently trimmed back to 5-5.5%. If stimulus size or effectiveness falls short at the same time global growth stalls, the government could miss its target as it did last year.

On geopolitics, we do not anticipate escalation in the coming quarter over Taiwan or U.S. – China relations despite latent risks. Focus on Taiwan and U.S. elections could bring these risks closer to the surface later in the year and into 2024. In the meantime, we continue to anticipate Xi Jinping to leverage opportunities to enhance his clout on international relations, particularly as the EU and Western leaders encourage China’s role as a mediator in the Ukraine-Russia conflict. Lastly, progress in Zambia’s debt restructuring, with the recently announced deal with official creditors and China as the largest lender, is a positive signpost for common framework restructuring momentum in the coming quarters.

Update on pivotal 2023 Argentina elections

Argentina’s electoral cycle is underway with candidate registrations finalized and the primary vote (PASO) scheduled for August 13th. The recently renamed ruling coalition, Unión por la Patria (UxP), ultimately selected a singular unity candidate and market favorite, current Economy Minister Sergio Massa, following previously announced and then retracted bids from long-time politician Daniel Scioli and Interior Minister Eduardo de Pedro. On the opposition side, Juntos por el Cambio’s (JxC) two main candidates, City of Buenos Aires Mayor Horacio Larreta and Macri’s implicitly backed contender Patricia Bullrich, have been known for some time. Lastly, the rise of the outsider and anti-establishment candidate Javier Milei of La Libertad Avanza, following years of economic and political volatility, positions him as a potentially competitive contender heading into the PASO. In the event of strong opposition performance in the PASO, positive price momentum could ensue albeit, at the same time, outsized gains by Milei could risk asset price and macroeconomic volatility given personality unknowns and his controversial views over dollarization and abolishing the Central Bank. Despite high transition risk in a competitive Milei scenario, he has pulled the policy debate to the right and would likely face constraints to his most radical views in the event of his victory. Our base case remains for constructive macroeconomic policy change in the aftermath of the election in 4Q which should catalyze more meaningful price gains over the medium-term.

Ukraine’s counteroffensive during the summer months to drive global geopolitical risk outlook for the rest of the year

The success or lack thereof of Ukraine’s ongoing counteroffensive to drive Russian forces out of areas under Russian occupation since February 2022 will likely be the key factor determining market perception about the timing and nature of an eventual “endgame” in the Ukraine-Russia conflict. News flow at the end of 2Q about initial Ukrainian gains and the Russian mercenary “Wagner” group’s alleged “mutiny” against the official Russian military drove market optimism about reaching some sort of settlement favorable to Ukraine quicker than expected. Additionally, Ukrainian sovereign bonds received a boost from a bipartisan bill that was filed by two U.S. Senators that, if it becomes law, would allow Washington to seize Russian sovereign assets and potentially use them for the rebuilding of Ukraine after the conflict is over. We believe such optimism is pre-mature. From our perspective, a sustainable peace agreement in/for Ukraine between the West and Russia is highly unlikely unless the West returns control over the frozen assets back to Russia. We believe this condition is likely to be among the critical ones posed by the Russian side when the time for cease-fire and peace talks eventually comes. As such, using the frozen Russian assets for rebuilding post-war Ukraine appears to be an unrealistic prospect in our view and the market would likely need to adjust consensus expectations on that front. In the meantime, we do not expect a material breakthrough in the war to take place over the coming months, which means that a resolution to the conflict unfortunately remains a distant prospect.

Investment Strategy Review and Outlook

Multi-Asset Strategy

Consistent with the volatility theme outlined previously, the Multi-Asset Strategy leveraged the early Q2 bank crisis induced dislocations to deploy available cash that was raised at the end of Q1’23. This allowed us to deploy a large portion of our dry powder (cash went from 23% to 15%). Some highlights include:

- Increased allocation to private credit to ~28.5% from ~25% and expect to continue increasing exposure over the quarter.

- Added equity exposure in a Colombia oil and gas company as well as a new investment that we lent money to via a convertible note.

- On public performing debt, over the quarter, we slightly reduced on a net basis into continued market strength. While we hold a core position (24%), we would still need more clarity on the trilemma to increase further.

As the quarter came to an end, we used materially higher prices to monetize some of our opportunistic credit longs. We have re-initiated our global hedge bucket as the cost of doing so has decreased significantly and the asymmetry of having such hedges in place has returned. Lastly, on the two year anniversary of the strategy, we are pleased with the track record, both in absolute terms and relative to difficult market conditions over the past 24 months.

Emerging Markets Debt

There are several constructive observations from the first half of 2023 that offer a bullish narrative for the second half. Upbeat performance in EM kept pace with global equities, but EM local currency has been exceptional. We believe the rate cutting cycle is soon to begin across Latin America, but Vietnam, Georgia and Costa Rica have already begun reducing policy rates and Hungary has indirectly loosened policy. Higher yields across U.S. Treasuries have been surprisingly well digested, although there are early indications of strain across the U.S. consumer market. The main theme had been around the lagged effects of the Fed tightening cycle, which has weakened U.S. domestic activity. The U.S. came close to further damage as it approached the debt ceiling, but a temporary default on Treasury Bills as in 1979 (20 days) was avoided at the last minute. The more pertinent theme was around the persistent inflationary backdrop that has been stickier in DM relative to EM, which had generally declined in 1H. These events in the first half of the year have seen U.S. Treasury bond yields bear flatten to the point where the curve is extremely inverted at over 100 bps. Should the growth picture deteriorate, equity-style returns in fixed income are a possibility.

China’s uneven recovery became more volatile in 2Q. This culminated in additional fiscal and monetary stimulus. The renewed softness in the property sector was notable, along with LGFV funding concerns, an uncertain external environment which weighed on exports, and a growth path that has been downgraded by several sell-side economists. Nevertheless, the strong EM/DM growth dynamic, under-positioned investors in EM, monetary space to cut EM policy rates, strong diversification benefits and reasonably attractive valuations keep EM credit in a sweet spot.

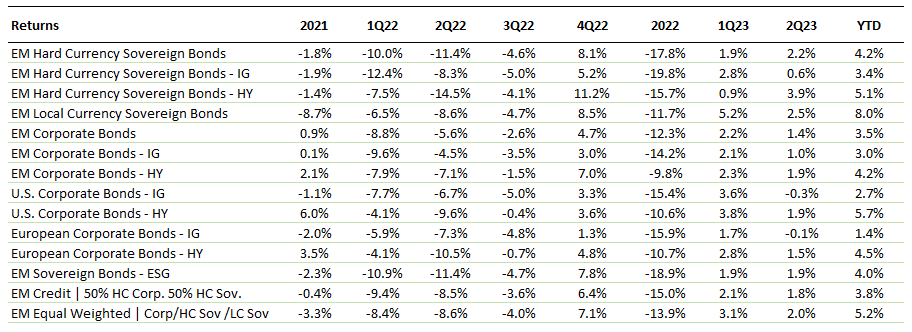

Amid the volatile macro backdrop, EM index performance has been very strong during the first half of 2023 with local currency sovereigns (+7.8%) and EM sovereigns (+4.1%), outperforming EM corporates (+3.6%). The orthodox IG/HY compression rally was visible with high yield outperforming, as EM corporate HY outperformed EM corporate IG (+4.3% vs +3.1%, respectively). The same trend was visible in EM sovereign HY outperforming EM sovereign IG, albeit by a larger margin (+4.8% vs +3.4%, respectively).

One can categorize strong returns in EM as being driven by spreads and carry, as U.S. Treasury yields increased. The EMBI Global Diversified Index tightened 52 bps in 2Q, with the IG component -22 bps and HY component -83 bps. EM sovereign credit mostly outperformed EM corporate credit, with the exception of IG. The CEMBI Broad Diversified Index was approximately 31 bps tighter, with the IG and HY components 30 bps and 32 bps tighter. U.S. Treasury yields increased on sticky inflation and a higher probability was attached to a “stop-go Fed”, with two or more hikes expected before year-end. As such, the two-year yield rose 87 bps, five-year by 58 bps, ten-year by 37 bps and thirty-year 21 bps. Within this context, credit spreads across U.S. HY were 65 bps tighter but EM sovereign HY was 83 bps tighter. Despite core rates moving north, IG/HY compression was a theme and hard currency indices outperformed local currency bonds.

Exhibit 4: Global Market Index Returns

Source: Bloomberg, JPMorgan as of July 5, 2023.

Episodes of outsized volatility in EM are likely to remain. We expect fixed income volatility to remain elevated, while equity volatility has dramatically fallen. Active management remains critical to manage risk in a dynamic way. In an environment of uncomfortably high inflation, weakening U.S. demand and the potential scar-tissue from overtightening monetary policy, we believe active management is required to navigate through the choppy macro waters. Gramercy is particularly focused on generating alpha through its rigorous bottom-up investment process, given the top-down uncertainty.

Supportive technicals are returning to EM credit. EM issuance in 2Q was lower than 1Q, although only because January was a block-buster issuance month. Green shoots are emerging with a number of mandated capital market transactions and a growing number of non-deal roadshows aimed at testing market appetite. These are clear signs that activity is picking up as sovereign and corporate borrowing had been muted for several months. Another feature is slowing outflows which has helped sentiment and recent investor surveys suggest mild outflows have been covered by drawing down on high cash balances. The mild outflows are also a far-cry from the historical outflows of $42.6bn in 2022, which left investors under-positioned in the asset class.

From a fundamental perspective, some EM corporates have felt some balance sheet deterioration, although the credit strength is noteworthy and leverage remains relatively low. The main risk is around refinancing, but the ability to borrow improved through June. We continue to take comfort in the fundamental strength of EM corporates on a standalone basis and expect default rates to be substantially lower than 2022. We would also reiterate that EM banks within the CEMBI Broad Diversified Index for the most part are well-capitalized, systemically important national champions with sticky deposit bases and low leverage. These banks are likely to benefit from a flight to quality in terms of deposits.

Higher U.S. policy rates and contracting G4 central bank balance sheets created the outflow environment in 2022 and for some of 2023. Chair Powell and other Fed officials also reiterated that the fight against high inflation is not over. The committee continued to send a strong signal that two or more hikes are needed before year-end, although the market-implied terminal rate only indicates one hike in July and a possible final hike in September. The market-implied pricing is only 32 bps, which suggests that we are close to the peak before a pause will ensue. It is also worth noting that historically, the Federal Reserve has loosened policy within 7-8 months of the final hike.

Given the data-dependency of the Fed, we remain highly tactical and agile in the way we are managing our portfolios and will focus on bottom-up credit selection as a means of generating alpha for clients.

Capital Solutions

Lack of clarity regarding the Fed’s path on inflation fighting and its effects on the economy have kept a lid on the new issue market for some EM corporates during the second quarter. As the lack of access prolongs itself, it is having an impact on the private credit markets. Corporates that have been postponing their CAPEX investments or waiting to refinance their debts, hoping for a better market, are starting to react. The effect of this being that more corporates, especially larger ones with better governance that had accessed public markets in the past, have begun to tap into private credit markets. We have been able to benefit from these market dynamics and deploy new loans to larger corporates and regional companies that in previous years would not have considered our highly structured and collateralized facilities.

In today’s market, larger corporates value our speed and certainty of execution and have proven their willingness to pay the additional cost to access long-term capital. Our capital could function as a bridge to better market access or permanent capital depending on the conditions. We are in the advanced stages of drawing down over 10 loans to companies with EBITDA in excess of $100 million, highlighting the competitive advantage of private credit in the current cycle. As a result, we have been able to further diversify within our target jurisdictions to cater to a wider universe of companies. The most notable result has been the increase in credit quality throughout our portfolio, while maintaining attractive mid-teen returns and even enhancing our collateral packages.

Separately, and similar to an already established trend in developed markets, approximately a third of our portfolio is invested in strong cash flow-generating asset-backed instruments within EM financial services companies, focusing on shorter-term consumer products, trade finance senior secured portfolios, leasing, factoring, and technology to finance smaller suppliers within larger companies supply chain. Such diversification, alongside tight financial covenants to trigger early repayments and deep dive analysis into the specific portfolio dynamics, has allowed us to deliver differentiated performance. While some of these markets have suffered from the downturn of their macro environment, exacerbated by increased funding costs that led to underlying portfolios’ deterioration (i.e., consumer lending in Colombia, factoring in Brazil, and the NBFI crisis in Mexico), our asset-backed facilities have outperformed comparable credits in their respective markets. Furthermore, in all our platforms, our NPL ratios are outperforming those of the specific markets and sectors they operate in.

During the second quarter, we deployed three new loans and upsized three existing facilities, amounting to $43 million, directed towards the real estate, power generation, TMT, and financial sectors. As we come to the close of the second quarter, we have a pipeline of over $105 million in the process of being funded, enhanced by the ability to deploy larger ticket sizes and our clear market-leading position in EM and especially Latin American private credit. Additionally, we have approximately $75 million in the advanced due diligence stage and an additional $750 million between deals in advanced discussions and those in early-stage conversations. The pipeline has exceeded our established platforms, covering sectors such as Peruvian mining services, Mexican asset-backed merchant financing services, North American digital infrastructure, O&G infrastructure in Brazil, and Global EM energy transition players, positioning our team with differentiated expertise and setting the stage for the development of additional credit platforms.

Conclusion

This past quarter certainly witnessed the tug-of war between the policy trilemma facing central banks and climbing of the wall of worry that was characterized between positive carry and pull to par. We would not be surprised to see the next phase resulting in inflows that chase the recent returns and propel the asset class higher. We expect continued volatility that will permit for tactical positioning of capital driven by our top-down and bottom-up perspectives on the asset class and will therefore, continue to respect and embrace the volatility in the markets by planning the trade and trading the plan.

Gran Merci

Over the past 25 years, Gramercy has been dedicated to delivering upon our mission to positively impact the well-being of our clients, portfolio investments, and our team-members. Gramercy’s commitment to excellence has been reflected in its numerous accolades over the years. These achievements are a testament to the integrity, hard work and dedication of the firm’s talented team of professionals.

As we reflect on the past 25 years, we are reminded of the challenges that Gramercy has faced and overcome, including: Russian Debt Crisis a.k.a. Vodka, Brazilian Crisis a.k.a. Caparihna, Argentina Crisis a.k.a. Tango (and a few more thereafter), the September 11th terrorist attacks, the Global Financial Crisis, the European Debt Crisis, Brexit, the COVID-19 pandemic/lockdown, and the Russian Invasion of Ukraine.

Not many firms, particularly investment managers in emerging markets, can say they have navigated all of those challenging events. Through it all, the team has remained steadfast in its commitment and our aspiration of delivering strong risk-adjusted returns to our clients supported by a transparent and robust institutional platform. Looking ahead, we are excited to see what the future holds for Gramercy and our clients.

We have a quarter-century under our belts, but we remain aspirational for the growth and success that is embedded in our DNA. We are celebrating 25 years, but we have the infectious energy and intensity of an exciting start-up. With our strong track record, our dedicated team, and our innovative approach, we are confident that the firm will continue to thrive and make a positive contribution to our constituents in the years to come.

Thank you to our great clients, trusted business partners and dedicated team-members.

About Gramercy

Gramercy is a dedicated emerging markets investment manager based in Greenwich, Connecticut with offices in London, Buenos Aires, Miami, West Palm Beach and Mexico City, and dedicated lending platforms in Mexico, Turkey, Peru, Pan-Africa, Brazil, and Colombia. The $5 billion firm, founded in 1998, seeks to provide investors with attractive risk-adjusted returns through a comprehensive approach to emerging markets supported by a transparent and robust institutional platform. Gramercy offers alternative and long-only strategies across emerging markets asset classes including multi-asset, private credit, public credit, and special situations. Gramercy’s mission is to positively impact the well-being of our clients, portfolio investments and team members. Gramercy is a Registered Investment Adviser with the SEC and a Signatory of the Principles for Responsible Investment (PRI), a Signatory to the Net Zero Asset Managers initiative and a Supporter of TCFD. Gramercy Ltd, an affiliate, is registered with the FCA.

Contact Information:

Gramercy Funds Management LLC

20 Dayton Ave

Greenwich, CT 06830

Phone: +1 203 552 1900

www.gramercy.com

Joe Griffin

Managing Director, Business Development

+1 203 552 1927

[email protected]

Investor Relations

[email protected]

This document is for informational purposes only, is not intended for public use or distribution and is for the sole use of the recipient. It is not intended as an offer or solicitation for the purchase or sale of any financial instruments or any investment interest in any fund or as an official confirmation of any transaction. The information contained herein, including all market prices, data and other information, are not warranted as to completeness or accuracy and are subject to change without notice at the sole and absolute discretion of Gramercy. This material is not intended to provide and should not be relied upon for accounting, tax, legal advice or investment recommendations. Certain statements made in this presentation are forward-looking and are subject to risks and uncertainties. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account information currently available to us. Actual results could differ materially from the forward-looking statements made in this presentation. When we use the words “believe,” “expect,” “anticipate,” “plan,” “will,” “intend” or other similar expressions, we are identifying forward-looking statements. These statements are based on information available to Gramercy as of the date hereof; and Gramercy’s actual results or actions could differ materially from those stated or implied, due to risks and uncertainties associated with its business. Past performance is not necessarily indicative of future results. This presentation is strictly confidential and may not be reproduced or redistributed, in whole or in part, in any form or by any means. © 2023 Gramercy Funds Management LLC. All rights reserved.