Authored by:

Robert Koenigsberger, Managing Partner & Chief Investment Officer

Mohamed A. El-Erian, Chair

Petar Atanasov, Senior Vice President & Co-Head of Sovereign Research

Kathryn Exum, Senior Vice President & Co-Head of Sovereign Research

June 29, 2021

Decoding the Global Macro Environment: A Top-down Perspective and the Related Implications for Emerging Markets Heading into 3Q 2021

Divergence in growth performance across countries in the global economy, a theme that Gramercy espoused six months ago in the Year Ahead Outlook, has now become conventional wisdom – and understandably so given developments on the ground. The more it persists, the greater the tug-of-war for policymakers, especially in emerging economies, as they navigate that delicate balance between responding to domestic priorities and those imposed on them from outside. Meanwhile, financial market differentiation remains relatively subdued as investors continue to set aside individual country circumstances in favor of the predominant “global common factor” of the recent past – that of ample and predictable liquidity injections by the Federal Reserve and the European Central Bank.

Some emerging economies risk finding themselves on the wrong side of the global growth divergence. This is especially so for those experiencing high numbers of COVID-19 infections, battling new variants, and/or lagging in vaccinations. Their economic and financial challenges are compounded by an erosion in policy flexibility.

Others, including oil producers and other commodity exporters, are benefiting from the significant tailwind associated with the exceptionally rapid growth in China and the United States, as well as an improving European economy. Their policy challenges are much reduced, but not eliminated. They too must navigate the spillover of the monetary policy inflection point facing the U.S. Federal Reserve, the most systemic of all central banks.

Together, all this constitutes an extremely rich opportunity set for those emerging market investors equipped with granular analyses and smart structuring. Or, at least you would think so.

In reality, however, the general investment thesis for this and the vast majority of other asset classes has remained a simple one in the short-term: continue to respect the impact of central bank liquidity injections. That is what the vast majority of investors have been doing; hardwiring into the marketplace extreme confidence in the persistent of the golden trifecta of strong global growth, transitory inflation, and uber-friendly central banks.

The apparent simplicity and attractiveness of this proposition is set to get more complicated over time. Abundant external liquidity cannot disguise all domestic ills. Moreover, the markets’ conviction in the persistence of such “pedal-to-the-metal” monetary stimulus is likely to be pressured, especially in the case of the United States, by growing evidence that not all of the current inflation surge is purely transitory. The more the world’s most powerful and influential central bank is viewed to be behind the curve, the greater the risk of it having to slam on the brakes and send disruptive waves through the global financial system.

This rather complicated landscape pulls to the top of the list of risk factors both policy and liquidity risks, joining that coming from COVID-19 management. It calls for agility in portfolio structuring, together with clarity in what constitutes tactical positioning and those with a much greater structural and secular orientation. And, over time, it will require an even bigger weight to be placed on country, corporate and market segment differentiation.

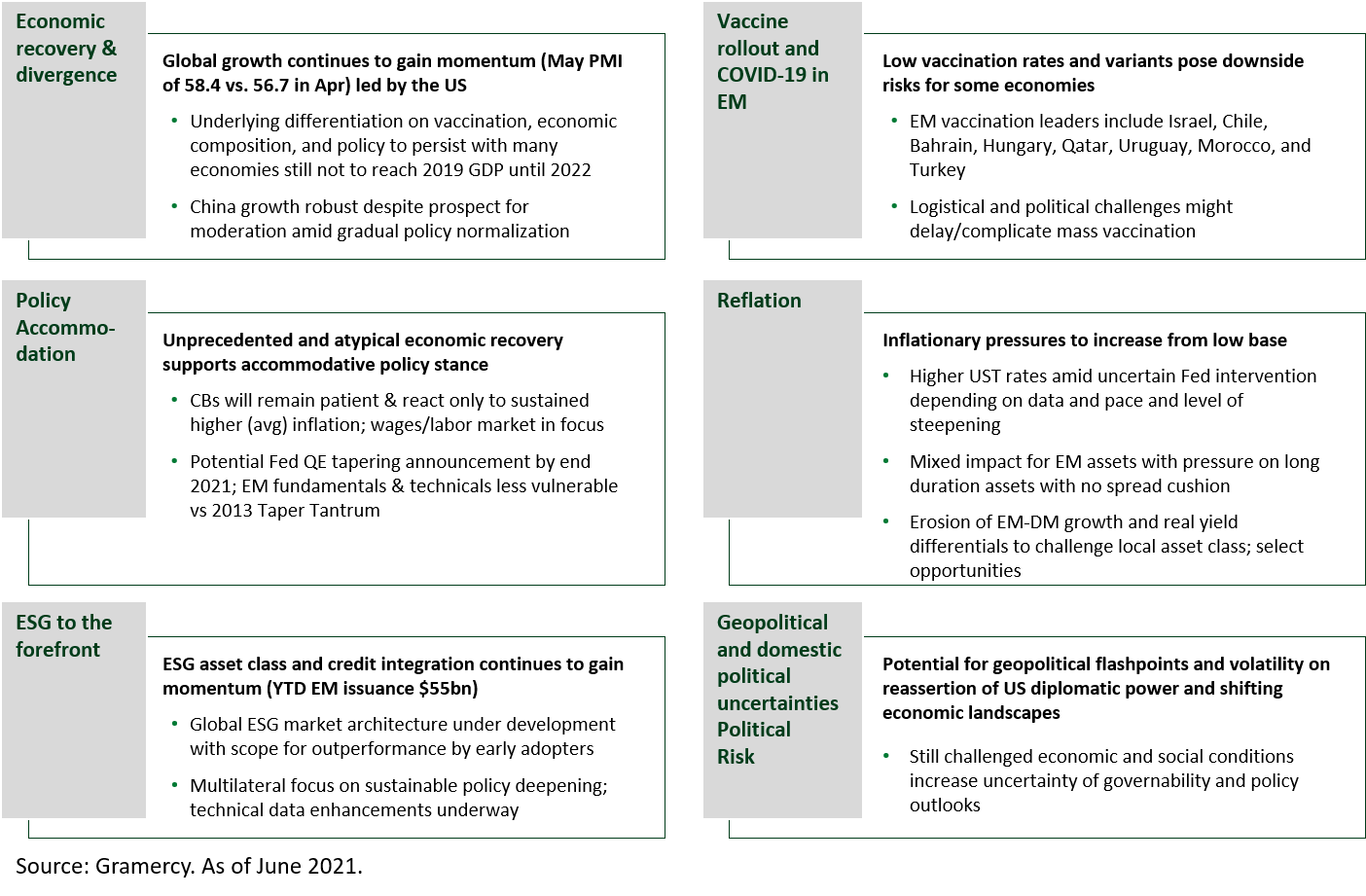

Themes Influencing Investment Decisions in 3Q 2021

Supportive global growth environment should persist…

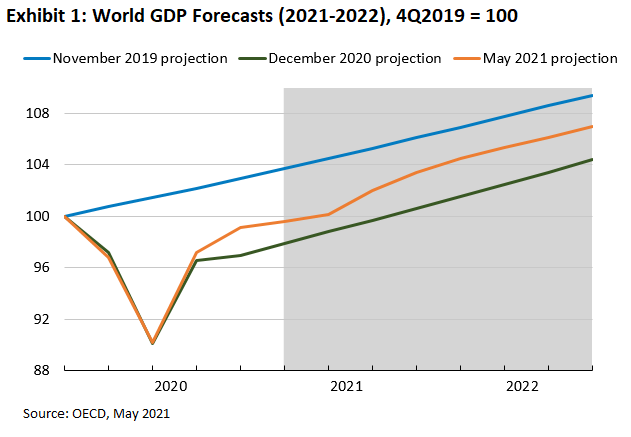

Significant recovery in world GDP is expected to remain on course with further upward 2021 global growth revisions to 5.8% by the OECD in May and a market median forecast of 6.0%, roughly half a percentage point above March estimates. Continued outperformance of high frequency data and stimulus, particularly in the U.S. and more recently Europe amid vaccination and economic reopening, helped support the revisions.

Global GDP is now back at pre-pandemic levels albeit still short of what was expected by 2022 pre-crisis (Exhibit 1). Upside risks stem from elevated levels of household savings in the developed markets (“DM”) as well as buoyed commodity prices in emerging markets (“EM”) while inflationary dynamics should not yet threaten near-term growth.

…with variation across EM on vaccination rates, economic composition, and policy management

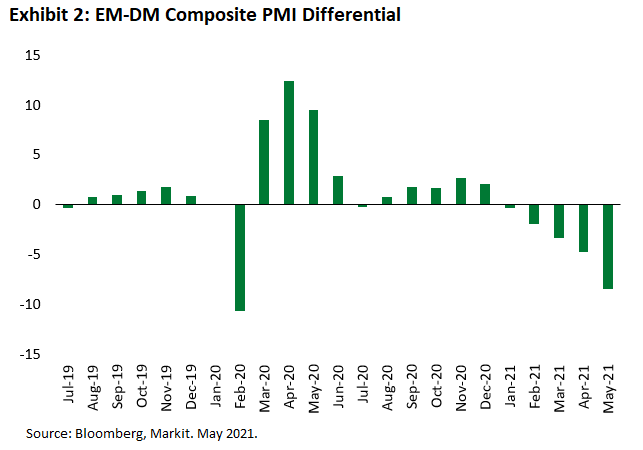

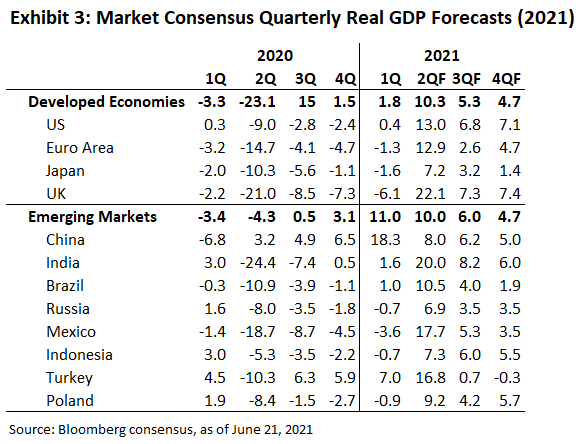

The pace of vaccination in EM is likely to gather some steam as we head into the second half of the year. With COVID-19 largely moving into the rearview mirror in the developed world, there should be greater room for focus on support to emerging markets via vaccination donations and multilateral and bilateral financial assistance. In the near-term, we still envisiage pressured aggregate EM-DM growth differentials (Exhibit 2) and differentiation of scope and speed of recoveries across

EM economies likely due to variations in vaccine distribution capabilities, economic structure, and macroeconomic policy (Exhibit 3). EM vaccination leaders continue to be Bahrain, Israel, Chile, Qatar, Hungary, and Uruguay with over 30% of populations fully vaccinated. The downside risks to activity of low vaccination should continue to depend on the policy response and the severity and duration of a new virus wave. Closed, service oriented economies that are not benefiting from the supportive external environment would be more greatly impacted should a domestic resurgence occur.

China should continue to grow at a solid clip for the remainder of the year despite anticipation of further modest and gradual policy tightening across monetary and fiscal channels and associated easing in sequential activity momentum as the cycle progresses. While additional measures and associated price volatility to cool commodity price pressure are possible, we anticipate the supply effect to be moderate and broader global demand dynamics to limit ultimate downside price action.

In this context, most commodity export oriented economies should further benefit from positive terms of trade in the coming quarter albeit to a lesser degree than in 1H. Commodity import countries have been somewhat less negatively impacted than during previous bull markets amid softer domestic demand and a supportive external financing environment but incremental pressure could rise as recoveries progress and rates drift higher. Open economies with trade and remittance links to the U.S. should continue to perform well while green shoots may emerge in select tourism markets.

Higher UST yields amid reflation to drive bouts of volatility in EM assets…

With continued re-opening, robust vaccination rates and overall improving economic prospects, inflation expectations for the U.S. economy have been consistently increasing throughout the year, focusing the attention of global market participants on the U.S. Federal Reserve’s reaction function. Throughout the year thus far, Fed officials have generally maintained a unified narrative about inflation being “transitory”, which has put a lid over market concerns about “tapering” of asset purchases and higher interest rates going forward. This being said, the Fed’s economic forecasts in June suggested two rate hikes could arrive in 2023 versus earlier projections that indicated no hikes before 2024. In general, the June FOMC meeting signaled to markets that Fed officials appeared to feel better about the economic outlook and perhaps less certain about the transitory nature of inflation in the U.S. economy amid robust demand and various bottlenecks fueling stronger inflation through the spring.

The change in Fed dots that show participants expect hikes earlier increases uncertainty for investors in our market that have been guided by the Fed to look through near-term inflation prints and have positioned for a quieter summer of carry in EM fixed income. In fact, the hawkish shift in Fed rhetoric is a great example of what we believe are episodes of volatility that EM assets, especially those with longer duration and limited spread cushions, would be prone to in the coming quarters. Meanwhile, there are those market participants who believe that by continuing to postpone tapering, the Fed is actually making a serious policy mistake and falling further behind the curve. As such, the Fed might find itself in a situation in the not so distant future when it is forced to “hit the breaks” (i.e. raise interest rates) while still “taking its foot off the accelerator” (i.e. tapering asset purchases), with significant negative market implications.

…but fiscal and monetary stimulus remains abundant and supportive for risk assets

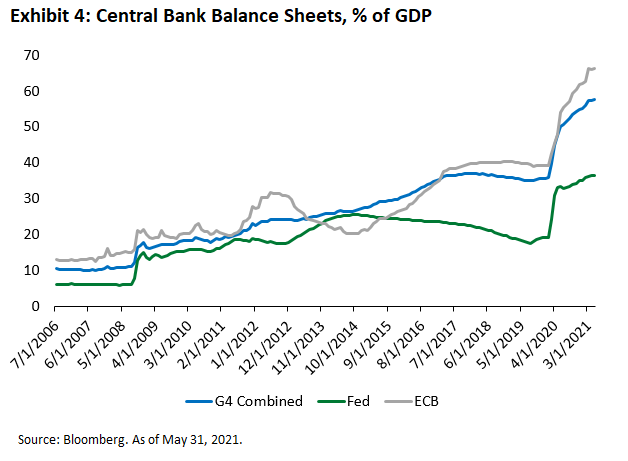

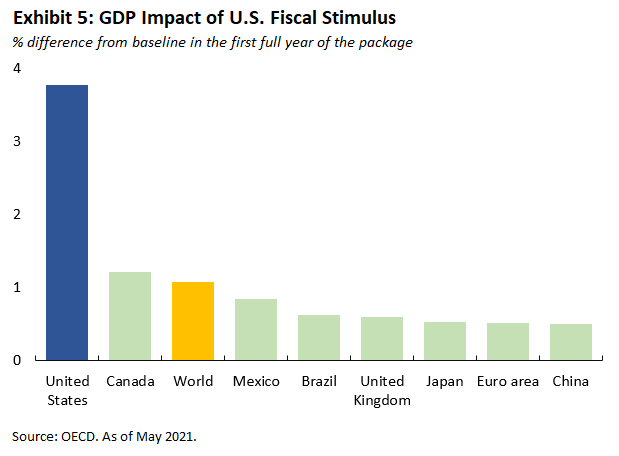

In the meantime, however, nothing of what the Fed and other systemic central banks have said or done materially undermines the supportive paradigm for risk assets, which are likely to continue living in a “liquidity moment” in 3Q 2021 (see Exhibit 4). A Fed starting to talk about tapering more loudly in the coming months should be a base case for most investors and the timeframe for eventual tapering remains unchanged, likely starting in 1Q 2022 or, at the earliest, in December 2021. Meanwhile, we are also observing a structural shift in both developed and emerging market economies toward looser fiscal policy, targeting inequality problems exacerbated by the COVID-19 pandemic. Fiscal stimulus has been most pronounced in the U.S. by the Biden Administration, with positive economic spillover effects globally (see Exhibit 5), and should remain a supportive factor for markets in 3Q.

As this highly benign global economic policy backdrop starts to turn incrementally less supportive, we believe that EM as an asset class is in a less vulnerable position overall relative to the so-called taper tantrum of 2013. Although debt burdens for global sovereigns have increased materially in that period, especially as result of the economic/fiscal emergency inflicted by the pandemic, other key credit and technical metrics for EM are in much better shape. For example, inflation dynamics and external balances in EM are materially better compared to 2013. Also, credit bubbles do not seem to be a wide-spread/systemic problem at present, while EM is also enjoying a considerably more benign technical picture. Last but not least, investor surveys indicate that U.S. duration positioning is already very short in contrast to the situation before the taper tantrum in 2013. As such, looking forward to 3Q, we continue to expect fundamentals-driven differentiation among sovereign and corporate credits, but no major outflows from EM asset classes.

ESG relevancy to grow as recovery progresses

The ESG momentum witnessed in the first half of the year of greater portfolio integration, issuer information flow, data enhancements, and policy coordination should persist in the coming quarters. EM Green, Social and Sustainability bond issuance YTD exceeds $55bn, more than double the level in the first quarter and comfortably above 2020 aggregate issuance of $45bn. The bulk of the financing thus far has been at the corporate level (80%) out of early adopting markets such as Korea, China, and Chile. At the sovereign level, the IMF launched its new climate dashboard supporting data efforts on the “E” front while the World Bank and other multilateral agencies engaged with the private sector on future ESG financing and integration frameworks. Lastly, the G7 Build Back Better World (B3W) Partnership, announced at the June Summit, aims to foster FDI into the developing world in technology, climate, health, and gender equality projects in effort to compete with China’s One Belt, One Road initiative. This should further deepen the importance of ESG credit integration, help to underpin growth in recipient economies beyond cyclical recovery, and catalyze additional capital inflows over time although the ultimate scale and longevity of such an initiative in part likely rests on political leadership in the U.S.

Geopolitical and domestic political dynamics could drive volatility

With the Biden Administration beginning to formulate and execute its foreign policy strategy, combined with the varied and unprecedented aftermath of the pandemic, we expect geopolitical and domestic politics to be a key investment theme in the coming months ahead.

On U.S. and China relations, the White House’s approach thus far has largely been aligned with the combined offensive and defensive tactics we outlined in our 1Q Outlook piece. This includes the recent refinement and expansion of Trump era investment restrictions on military and surveillance linked companies and Senate passage of the U.S. Innovation and Competition Act of 2021 which encompasses $250bn for research and development, subsidies for chipmakers, as well as punitive measures associated with violation of antitrust and competition laws and loosely defined malign behavior. We expect U.S.-China trade dynamics to remain benign through most of upcoming quarter with some prospects for select tariff reduction later in the year or in 2022, particularly if inflationary pressures prove to be less transitory in nature.

We anticipate the U.S. to re-enter the Iran nuclear deal in 2H following solid momentum in dialogue and negotiations in recent months. However, we will closely monitor for any deviations from the anticipated course under Iran’s new supreme leader following recent elections. Sanctions rollback should be incremental with the bulk of the rise in Iranian oil production (~700k bpd) occurring within roughly three months of an agreement. OPEC+ will likely work closely with Iran to understand and manage the supply thus reducing price impact.

In Latin America, we expect domestic politics to trump geopolitical developments in the near-term as the region faces the political repercussions of the last year. The uncertainty and polarization following the razor thin and controversial election outcome in Peru should persist for much of the quarter as assumed President-elect Castillo attempts to form a cabinet and provide greater clarity on his macroeconomic agenda in the backdrop of a divided Congress and population, as well as continuing to battle the pandemic. In Argentina, focus will begin to narrow in on the PASO, the mandatory primary vote expected to be held in September for the mid-term elections in 4Q. While the unprecedented nature of the election increases uncertainty, economic conditions and pandemic management should be a headwind for the current Frente de Todos (FDT) party. Similar to the recent mid-term election outcome in Mexico, the ruling FDT could lose some of its support. This should be incrementally supportive for asset prices in the near-term, all else equal, on the potential of a more meaningful counter-force to the current policy approach and supportive of current expectations of an IMF deal post elections. Beyond the near-term, investors may begin to extrapolate opposition strength to the presidential election in 2023. Further entrenchment of current policy remains a key risk although it will face increasingly significant limitations over time. On the geopolitical front, the U.S. will remain supportive of Argentina’s ongoing IMF negotiations while the Venezuela strategy will likely progress behind the scenes.

We expect “baby steps” toward “strategic stability” and more predictable U.S.-Russia relations to continue in the wake of the inaugural head-to-head meeting between Presidents Biden and Putin in mid-June. The two military superpowers share mutual interest to cooperate in a number of globally important areas such as cybersecurity, arms control, and climate change. Improved dialogue and finding avenues for cooperation on “low hanging fruit” issues is positive and should contribute to reduced geopolitical uncertainty for markets, however, the risk of flare-ups in diplomatic tensions remain significant, in our view.

Optimal Asset Allocation within EM in this context

For remainder of 2021, we believe it likely that U.S. public market asset prices will continue to inflate and 2021 will be a good year for risk markets:

• COVID-19 vaccine roll-out in the U.S has met or exceeded projections from six months ago. Currently, the U.S. has less daily COVID-19 cases than at any point since mid-March 2020. Absent some remote event such as a variant that is immune to current vaccination pipeline, COVID-19 is now moving to the rear-view mirror for the U.S. from an economic standpoint.

• While the Fed has signaled rate hikes may come in 2023, it is still committed to a very loose monetary policy for the next several years.

The big question is when the rest of the world will catch up to the U.S. on the vaccination front. Until such time, global growth will be very uneven.

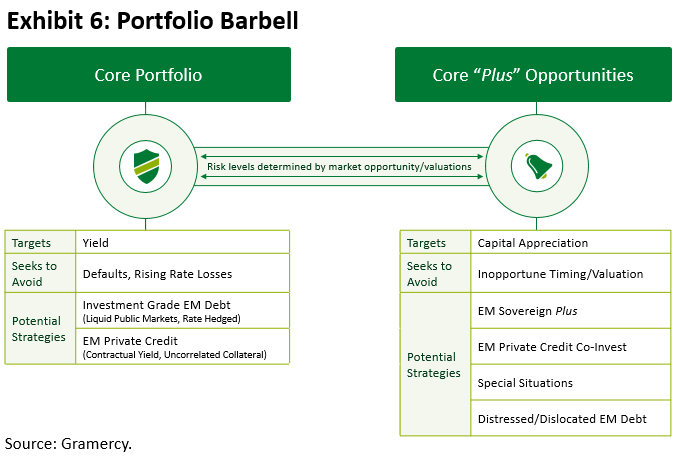

All that being said, today, on the one hand we live in a world of FOMO (fear of missing out) and TINA (there is no alternative). On the other hand, everyone is uncomfortably long hoping that they can find a chair when the music stops. For us in EM, that means looking for high conviction, intelligent ways to participate in the market yet simultaneously build ROA (resilience, optionality and agility). EM today provides an opportunity to achieve these dual objectives via a multi-asset, dynamic, bar-belled approach (See Exhibit 6).

On one side of the barbell, we are combining high quality IG EM names (on an interest rate hedged basis) with well collateralized, structured, private credit. Private credit in EM allows one to pick-up substantial yield, and security as well as explicit compensation for illiquidity. Too many EM investors park in “liquid” instruments when they don’t really need the liquidity. The opportunity cost of doing so is quite high.

The other side of the barbell is anchored in opportunistic and dislocated credit and special situations (as they present themselves). These opportunities may arise on both a systemic basis (March 2020) or idiosyncratic basis (Turkey 2018).

We think of the barbell as a power plant with different sources of energy/return. The combination of IG and private credit on the left side is similar to conventional power, always there and blended, with a focus on consistent yield. The other side of the barbell is similar to alternative sources of energy that become available as conditions permit. The expected returns on this side tend to come from additional yield and capital appreciation for opportunistic and dislocated credit and PE type multiples for special situations.

When we put this together, it is very similar to operating a combined conventional/alternative power plant; capturing high returns, that are uncorrelated and risk mitigated.

One of the biggest challenges in EM today (and other credit markets) is the potential for dislocation risk. EM corporate debt outstanding is 5x larger today than it was in 2010. Yet due to fewer banks and smaller market-making operations at those banks, there is insufficient liquidity when investors look to exit the market. This is exacerbated by the fact that so much of that risk is embedded in ETFs, UCITS and other “liquid” vehicles. Just because the vehicle is supposedly liquid does not ensure liquidity for the underlying portfolio. When there are outflows from EM debt, they will create volatility/dislocations as there will prove to be pockets of illiquidity amongst all of the “liquidity” that is in the markets today. This poses both a risk and an opportunity for investors in EM.

In our dedicated EMD strategies:

EM debt has fared relatively well YTD considering the move in U.S. Treasury yields (10yr still wider by 56bps and 2-10 curve steeper by 79bps, despite tightening that we saw in the 2Q). However, dispersion of returns within the universe is high.

• As we expected, and in-line with our positioning, high yield outperformed investment grade and corporates outperformed sovereigns (hard and local currency).

Source: Bloomberg. As of June 22, 2021.

• Better performance of EM debt compared to other episodes of significantly higher U.S. Treasury yields in a short period of time continues to be driven by combination of better growth/results than initially feared, attractive relative valuations vs developed markets and continued solid technicals. We believe that:

*Emerging markets have a robust medium-term growth outlook vs developed markets after a temporary decline in the aftermath of the COVID-19 crisis. EM’s traditional growth premium over DM is projected to increase sharply over the medium-term, supporting financial inflows and fiscal consolidation efforts in EM economies. Current accounts have adjusted across the board and tend to be in surplus for many EM economies. Compared to the time of the “Taper Tantrum”, inflation dynamics are under control in most major EM economies, while external imbalances/weakness have eased, and, in some cases, completely reversed; this allows EM central banks more flexibility in terms of using monetary policy to support economic growth and absorb external shocks.

*EM corporate fundamentals overall proved to be resilient in 2020 with only a slight increase in net leverage of 0.2x and 0.3x for EM corporate IG and HY, respectively. EM IG corporate net leverage remains about a turn lower than for U.S. credits while the HY differential has widened materially to 1.7x as EM HY corporate kept more cash on their balance sheets to shield themselves from macro headwinds.

*EM corporate credit metrics should continue to improve beyond pre-pandemic levels on the back of strong economic recoveries and rebound in commodity prices.

*EM corporate default rates are expected to remain relatively benign at 2.5% for 2021, which is broadly in line with U.S. HY, and recovery rates remain elevated at over 40%.

*Flows should remain strong – EM hard currency inflows were $12.6bn in 2020 ($40bn of inflows from March onward after outflows of $27bn in March). 2021 has begun in strong fashion with $13.9bn in inflows already. EM local inflows reported the largest weekly inflow since 2012 on January 22 ($2.8bn). YTD inflow stands at $19.6bn. The EM local index is continually changing, but a higher weighting to China is leading to significant inflows, with no sign of slowing.

*Valuations in HY still look compelling with spreads still about 108bps from the 2018 tights for corporates and 200bps for sovereigns, respectively. EM corporate IG and HY also provide additional spread of 61bps and 45bps relative to U.S. IG and HY, respectively.

• We are entering a decisive quarter with U.S. inflation picking up and prospects for a decision on tapering by the FOMC in September. With an unexpectedly hawkish FOMC meeting late June and the Fed starting to acknowledge that inflation might not be so transitory, we continue to prefer shorter duration return streams with a healthy spread buffer that should perform well in a rising rate environment.

• This means we prefer EM corporates over sovereigns, high yield over investment grade and hard currency over local currency.

• To the extent that recent treasury performance continues into the 3Q quarter, in spite of any further hawkish moves from the Fed, short dated spread product should also perform well, as was the case in 2Q.

• While an increase in rates may be negative for sentiment, we believe the catalyst for such a rise – an improved macroeconomic picture with higher inflation (i.e. commodity prices) – will provide a positive tailwind for our universe which, when combined with the attractive spread pick-up relative to developed markets, will lead to resilient performance of certain EM debt return streams, particularly EM corporate HY.

In our opportunistic credit strategies:

Our distressed allocation within liquid strategies has exposure to Ecuador, Sri Lanka, Argentina and Venezuela.

• The Sri Lanka story continues to unfold favorably as the country makes progress in the collection of the sources of capital necessary to refinance a material bond maturity in July 2021.

• There was positive news on Ecuador in early 2Q21 as the market-friendly Presidential Candidate Guillermo Lasso was elected and bonds repriced materially higher as he followed-through on cabinet appointments and policy agenda points that reflected a path towards debt sustainability working in concert with the IMF.

• In Argentina, supportive external dynamics continue to persist and have resulted in roughly $2.5bn in net FX reserve gains thus far in 2021 as economic activity exceeds expectations and the blue chip swap rate remains in check. Combined with positive dialogue with the Paris Club and the IMF, we are optimistic that the November 2021 midterm elections will be a catalyst for higher bond prices as a result of: 1) FDT losing some support (similarly to the Mexico mid-terms in June); 2) an agreement reached with the IMF by the March 2022 deadline which seems highly likely after partial payments to the Paris Club in July 2021 and February 2022; and 3) investors re-enter the complex given the step-up in coupons and current income.

• In Venezuela, investors’ attention remained focused on the global stage and in particular on the Biden Administration’s strategy toward Venezuela. In line with our expectations, 1Q produced signals that resolving the Venezuelan situation, the most significant political, economic and humanitarian crisis in the Western Hemisphere, remains a U.S. foreign policy priority. However, the strategy is being re-calibrated: we believe the Biden foreign policy toward Venezuela would involve a combination of “sticks” (e.g. sanctions) and some “carrots” (e.g. humanitarian relief, amnesty, negotiations with key regime figures). This should improve the odds of regime change within next two years, in our opinion.

Private Credit:

Whereas DM private credit is a developed asset class, EM private credit is in a relatively early stage and has significant growth opportunity. We believe this is the case due to:

• Less competition / sophisticated capital.

• More bespoke, ‘covenant-heavy’ financings with non-correlated collateral. Unlevered returns are attractive on a relative basis with structures that are simple.

• Significant arbitrage opportunities can be captured as local and international banks are not active.

• ESG – a great opportunity to use private capital to ‘impose’ greater ESG standards on EM borrowers.

• The greatest risks are macro and currency risk. One needs to avoid good homes in bad neighborhoods. You need a strong top-down view and avoid credits that assume too much currency risk.

Within capital solutions/private credit, we continue to see an active market with opportunities for sourcing new investments in sectors such as infrastructure, healthcare, trade finance and financials. Activity continues to increase as traveling becomes more accessible. We are seeing the effects of it in the growth or our exclusive credit platforms. Our ability to source and monitor our credits through the establishment of these platforms has become a crucial component to carry out our underwritings in the EM space.

From a top-down perspective, the arrival of winter in the southern hemisphere caused a re-intensification of COVID-19 cases which has brought the need for a repeat of closures and restriction in several countries. On the political front, we have seen elections in Peru and Mexico. The first one, while still contested, could bring a negative change of direction and has the market watching it carefully. In the case of Mexico, a slight advance of the opposition is not viewed as a factor to derail AMLO’s main policies. In that context, we expect to continue to see his support for Pemex’s production recovery in line with the thesis. Furthermore, this result paves the way for a second half of an AMLO mandate supportive for economic activity.

Special Situations:

In special situations, we see continued investment opportunities in international arbitration related to EM countries and U.S. litigation finance. In particular, we are focused on opportunities whereby insurance is available against the ultimate verdict (biggest risk). Securing such insurance permits us to structure deals that look more like call options than bonds, offer great expected returns on capital, and even better expected returns on capital at risk (mitigated by the insurance).

In conclusion, despite certain risks and uneven initial conditions, we believe the balance of 2021 will prove to be a strong period for both economic and financial market performance in certain EM markets and assets. We intend to continue to lean-in and participate in both public and private EM credit markets as well as in special situations. However, we will do so consistent with the global top-down themes that we have identified. We will be keen to differentiate between winners and losers and dynamically allocate assets as absolute and relative value changes. This will entail constant triage of both top-down and bottom-up factors that will inform our dynamic asset position/allocation, planning the trade/trading the plan and agile hedging to ensure resilience, optionality and agility.

About Gramercy

Gramercy is a dedicated emerging markets investment manager based in Greenwich, CT with offices in London, Buenos Aires and Mexico City with dedicated lending platforms in Mexico City, Istanbul, Peru, London/Africa, Brazil and Colombia. The firm, founded in 1998, seeks to provide investors with attractive risk-adjusted returns through a comprehensive approach to emerging markets supported by a transparent and robust institutional platform. Gramercy offers alternative and long-only strategies across emerging markets asset classes including multi-asset, capital solutions, private credit, distressed debt, USD and local currency, sovereign, high yield/corporate debt, and special situations. Gramercy is a Registered Investment Adviser with the SEC and a Signatory of the Principles for Responsible Investment (UNPRI). Gramercy Ltd, an affiliate, is registered with the FCA.

Contact Information:

Gramercy Funds Management LLC

20 Dayton Ave

Greenwich, CT 06830

Phone: +1 203 552 1900

www.gramercy.com

Joe Griffin

Managing Director, Business Development

+1 203 552 1927

[email protected]

Investor Relations

[email protected]

This document is for informational purposes only, is not intended for public use or distribution and is for the sole use of the recipient. It is not intended as an offer or solicitation for the purchase or sale of any financial instruments or any investment interest in any fund or as an official confirmation of any transaction. The information contained herein, including all market prices, data and other information, are not warranted as to completeness or accuracy and are subject to change without notice at the sole and absolute discretion of Gramercy. This material is not intended to provide and should not be relied upon for accounting, tax, legal advice or investment recommendations. Certain statements made in this presentation are forward-looking and are subject to risks and uncertainties. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account information currently available to us. Actual results could differ materially from the forward-looking statements made in this presentation. When we use the words “believe,” “expect,” “anticipate,” “plan,” “will,” “intend” or other similar expressions, we are identifying forward-looking statements. These statements are based on information available to Gramercy as of the date hereof; and Gramercy’s actual results or actions could differ materially from those stated or implied, due to risks and uncertainties associated with its business. Past performance is not necessarily indicative of future results. This presentation is strictly confidential and may not be reproduced or redistributed, in whole or in part, in any form or by any means. © 2021 Gramercy Funds Management LLC. All rights reserved.