Contents

Market Overview

Macro Review

ADP is always a poor predictor of NFP. The strong Non-Farm Payrolls and higher prior revisions saw U.S. rates widen 4-12 bps in the immediate aftermath, with U.S. equities initially re-rating lower. The move in U.S. Treasuries saw the Eurodollar futures price in a higher probability of more than five hikes in 2022 briefly, just as the probability of a 50 bp hike in March rose. Earlier in the week, six Fed officials had backed a 50 bp hike in March, although not all were voting members. Bullard is perhaps the most aggressive as he called for five hikes stating that it is “not too bad a bet”. Meanwhile, the sell-side shifted to five hikes from four in aggregate, with BAML suggesting seven hikes are possible (i.e. a hike at each remaining FOMC meeting this year). On a broader and more global setting, the quantum of negative yielding debt shrunk considerably over the past week by 25% to $6tn, as Japan and Germany’s 5-year government bonds turned positive and with the 10-year JGB approaching the upper limit of the BOJ’s target. It remains possible that the Bank of Japan could prompt another hawkish pivot for a G10 country. Indeed, a hawkish pivot akin to the Bank of England and to a lesser extent, the ECB, which were clearly visible over the past week. Further evidence comes with the Goldman Sachs U.S. Financial Conditions Index which reached its tightest level since the pandemic began. Within EM, the geo-political twist continued and showed signs of improvement, while OPEC+ contributed to a more buoyant sentiment. Tensions between Russia, Ukraine and the West continue showed early signs of de-escalation as dialogue channels appeared to open. Ukraine was also one of the top performing credits in EM this week, but the path forward remains uncertain. Otherwise, political changes in Peru with a new market-friendly Finance Minister made headlines and Chile appointed its first female central bank Governor, as the incumbent was promoted to the Finance Ministry.

EM Credit Update

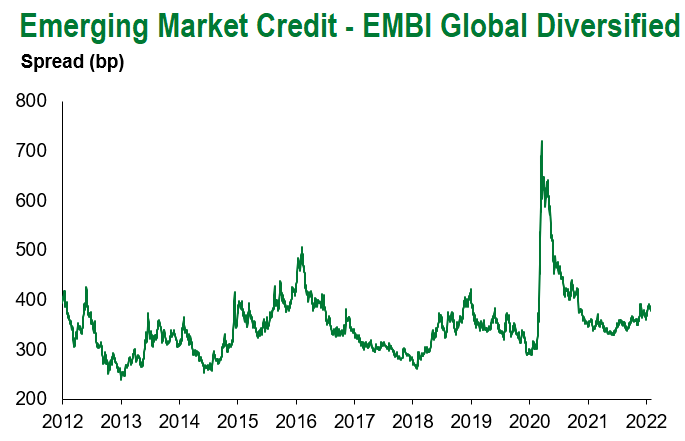

Emerging market sovereign credit ended the week up 0.4%, with credit spreads tightening 11 bps. U.S. Treasuries offset some of the move by widening 5-8 bps and the real yield on the 30-year tenor has now turned positive. In terms of outperformers in EM, Zambia, Tunisia and Ukraine led the way, while Slovakia, Belize and Suriname lagged. Across EM corporate credit, spreads were 2 bps tighter with total returns of 0.3%, but the clear victor on the week was the oil and gas sector. The sector rallied 14 bps given crude oil traded up to a seven-year high of $93.50.

The Week Ahead

We expect the focus to remain squarely on U.S. inflation next week. After Lunar New Year celebrations, the PBoC is back in action with M2 data, along with loan and credit releases, followed by the Caixin PMIs. Interest rate decisions from India (4.0%), Indonesia (3.5%), Mexico (5.5%), Peru (3.0%), Poland (2.25%), Romania (2.0%), Russia (8.5%) and Thailand (0.5%) are also due. In the same breath, Brazil’s Copom minutes may reveal further insights into the future hiking cycle. Then inflation out of Chile, Colombia, Hungary, Mexico and Russia could offer signs of moderation, while the continuation of corporate earnings season in DM and EM may create further volatility.

Highlights from emerging markets discussed below include: President Putin’s initial reaction on U.S./NATO written response to Russia’s security demands signals cautious optimism, Turkey’s inflation reaches highest level during Erdogan’s 20 years in power, Peru embarks on third cabinet reshuffle as governability challenges persist and Pakistan’s previously suspended IMF program resumes.

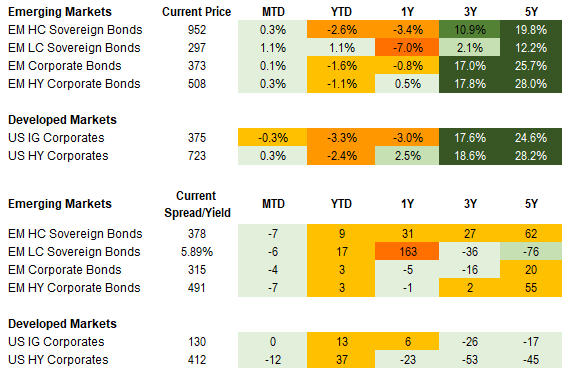

Fixed Income

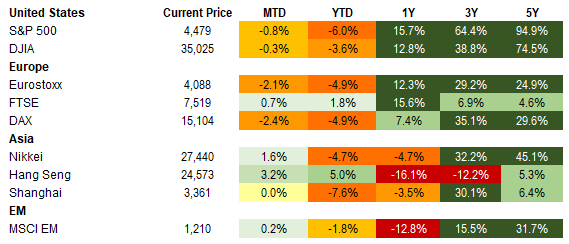

Equities

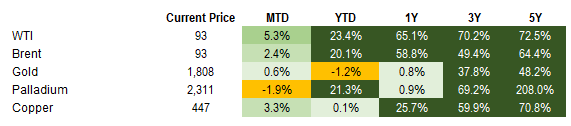

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of February 4, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

President Putin’s initial reaction on U.S./NATO written response to Russia’s security demands signals cautious optimism

Event: President Putin indicated that he hopes the security dialogue will continue and a solution to ongoing tensions between Russia and the West will be found.

Gramercy Commentary: As we wrote in last week’s commentary, the key signpost in the Russia-West geopolitical standoff for markets to watch this week was President Putin’s personal reaction to NATO/U.S.’s formal written response to Russia’s key security concerns. Putin’s reaction, as well as other signals across Russia’s political leadership, clearly signal a strong preference for continuation of diplomatic efforts to find a mutually acceptable equilibrium over Ukraine and European security in general. Based on this and other high-profile diplomatic initiatives involving European, Ukrainian and Russian leaders and diplomats during the week, a higher number of market participants appear to have grown more comfortable with our structural view that a large-scale conventional military conflict in/over Ukraine remains a very low probability event, despite claims by the U.S. and UK administrations about “an imminent Russian invasion” having fueled significant market concerns in recent weeks. Provided that the tone from Washington and London moderates (Ukraine’s authorities have openly requested this) and signals on using diplomatic channels for managing U.S.-Russia differences grow stronger in the coming weeks, we expect the excessive risk premium built into Ukrainian and Russian assets to continue to be re-assessed by markets. Meanwhile China’s government has also sent a message that it “opposes war in Ukraine”, as President Xi Jinping hosts President Putin for the opening of the Beijing winter Olympics.

Turkey’s inflation reaches highest level during Erdogan’s 20 years in power, but the President remains unperturbed in pursuing lower interest rates

Event: Headline CPI accelerated in January to 48.7% YoY, from 36.1% YoY in December, marking the highest level in 20 years; PPI, i.e., the Producer (Output) Prices index, reached 96.8% YoY in January, from 79.9% in December.

Gramercy Commentary: The extraordinary inflation dynamics at the start of the year in Turkey come as no surprise to markets, but still highlight the complete loss of credibility and effectiveness of CBRT’s current monetary policy management. Market implications of unprecedented ex-post real interest rates of around -35% (calculated by subtracting realized inflation from CBRT’s 14% policy rate) are likely to remain limited in the near-term due to the fiscal measures implemented in December 2021 to shield domestic savers from FX-fluctuations and dis-incentivize switching their TRY deposits into hard currency. From that perspective, the measures have been successful in “buying” some temporary relief for the currency and avoiding a collapse in domestic confidence. However, we think they come at significant contingent fiscal costs and are exacerbating macroeconomic imbalances, as signaled by a considerable jump in the economy’s trade deficit for January. We think the Erdogan Administration’s ad-hoc emergency measures are unlikely to sustain market calm beyond the next 3-6 months without a pivot to a more orthodox monetary policy approach. Due to political reasons and the President’s commitment to lower interest rates, such a market-friendly pivot remains unlikely for the time being, in our view. As such, we believe that Turkish assets remain exposed to renewed bouts of acute volatility this year.

Peru embarks on third cabinet reshuffle as governability challenges persist; inflation surprises to the downside

Event: President Castillo swore in a new cabinet with 11 out of 19 fresh ministers following Prime Minister Mirtha Vasquez’s resignation earlier in the week. Congress is now led by Hector Valer Pinto, a lawyer and Congressman who has frequently changed parties from the radical right Renovacion Popular (RP) to the centrist Somos Peru and most recently to center-left Peru Democratico. The most market relevant Economy and Finance Minister post has been given to a relatively experienced technocrat, Oscar Graham. Congress now must approve the cabinet which requires 66 out of 130 votes. Meanwhile, January CPI came in lower than expectations, dropping 75 bps to 5.7% y/y in part due to lower than estimated transportation costs.

Gramercy Commentary: The changes reflect the deep ongoing political tensions that continue to challenge Peruvian policymaking. While Graham’s appointment has kept market concerns at bay, many of the new ministers are subject to allegations of unethical actions, keeping prospects for volatility and additional changes elevated. The statement of the radical right RP’s support for impeachment of Castillo following unveiling of the new cabinet is unsurprising and broader backing is still inadequate for success, but this does suggest that Valer, a former member of RP, is unlikely to be better at managing the tensions within Congress than his predecessor despite a history of cross-party affiliation. We expect political volatility to continue to plague policymaking and pose a headwind to investment and growth. Market reaction will likely remain contained so long as orthodox approaches are maintained at the MEF and BCRP, which is currently envisaged under Graham and Velarde, and the path back towards a positive real policy rate continues. Additional impeachment motions are likely, with growing chances for debate over time, and require 52 out of130 votes. The last motion in late 2021 received support from 46 members. For successful vacancy, 87 votes would be required after the hearings and the presidency would then be handed to Vice President, Dina Boluarte. In the event of her resignation or ouster, the PCM at the time would take over and set a date for new elections.

Pakistan’s previously suspended IMF program resumes

Event: The IMF board approved a $1bn disbursement to Pakistan upon long-awaited met criteria and completion of its sixth review under its previously paused $6bn EFF program. The Fund foresees FY 2022 growth of 4%, primary deficit of 1.3% of GDP, and current account balance of 4% of GDP. The next assessment should be conducted in the spring with the final review and disbursement in the late third to early fourth quarter. This follows a $1bn 7.95% 7yr sukuk issuance the prior week and $3bn in Saudi bank deposits in December.

Gramercy Commentary: The bilateral, multilateral, and market financing is a near-term constructive development for the credit as it looks to navigate an external environment with higher rates, higher oil import prices and limit downward pressure on the rupee. However, we see prospects for continued deterioration in the current account and in the current commodity price backdrop as well as possible renewed political headwinds later in the year as inflationary pressures challenge policy and 2023 elections come into focus.

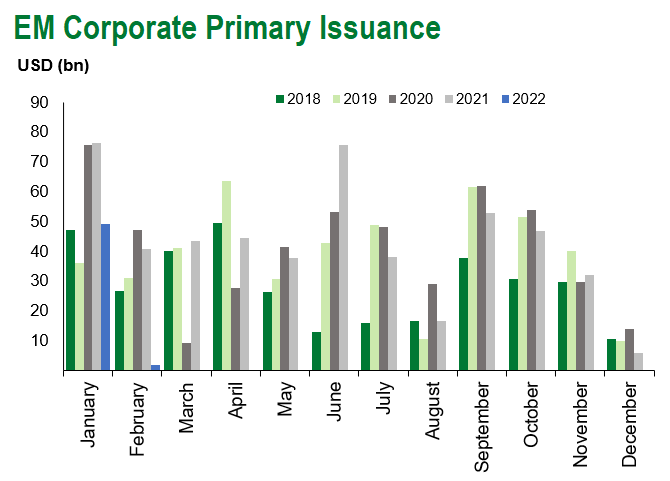

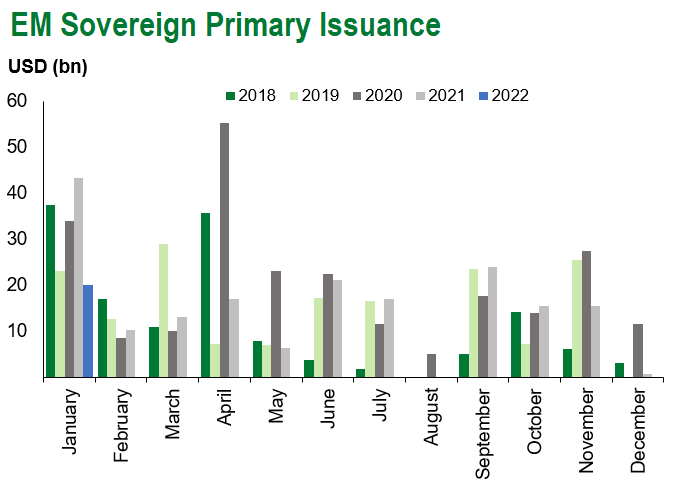

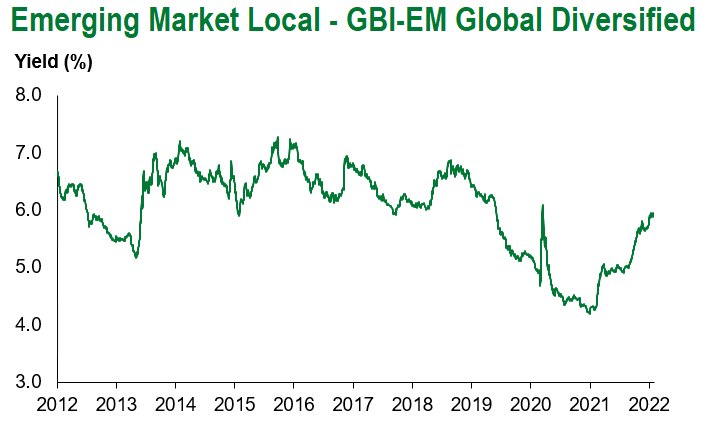

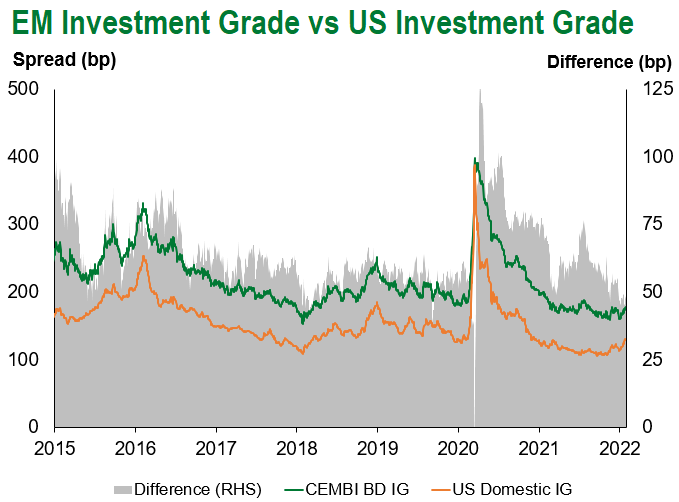

Emerging Markets Technicals

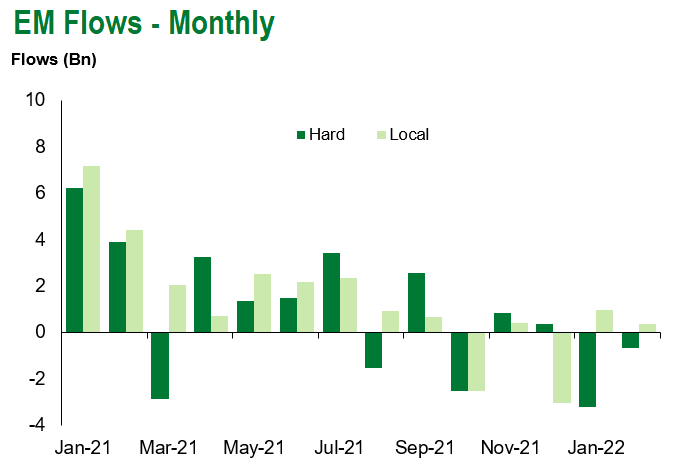

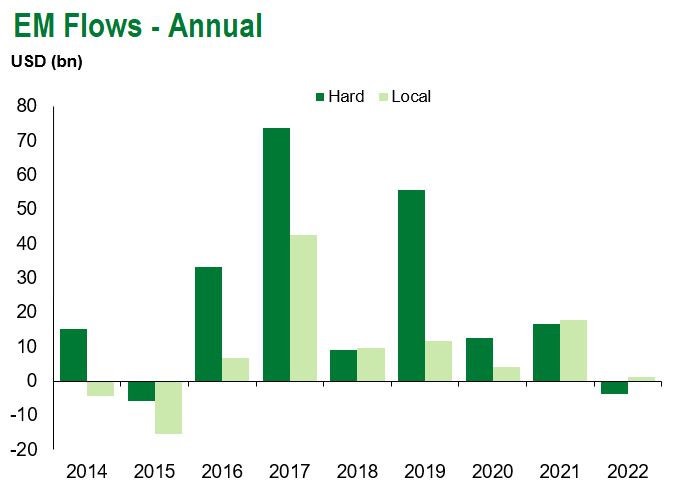

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of February 4, 2022.

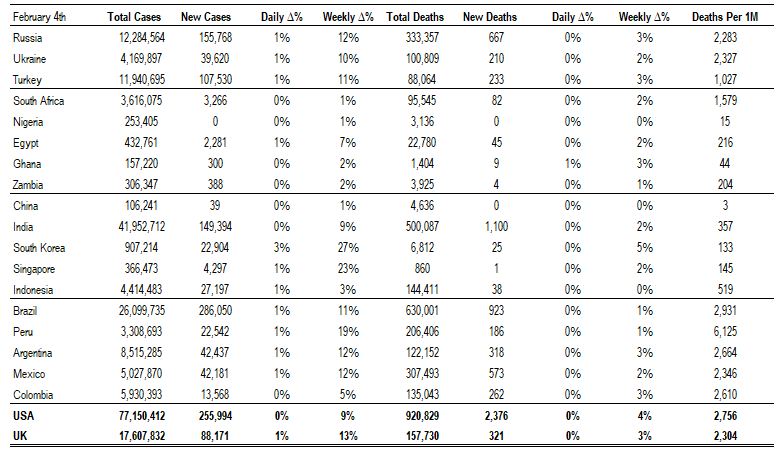

COVID Resources

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of February 4, 2022.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.