Contents

Market Overview

Macro Review

U.S. inflation rose at its fastest pace since 1982. The CPI metric rose to 7% in December, the day after Chair Powell’s re-nomination hearing when he geared the market for a rate lift-off. The market is now anticipating a 91% probability of March hike, but with 3.8 hikes priced-in for 2022 the focus has shifted to quantitative tightening. A possible summer announcement could see the Fed scale back its balance sheet by $25bn/month. However, weak retail sales, NFP and ISM in December could stoke “Team Transitory” once again. In any case, balance sheet reduction by $25bn/month is the current expectation, and increasing the quantum of UST/MBS sales by year-end to $75-100bn/month is the latest chatter. Such views have become more commonly accepted after the sheer number of Fed speakers over the past week. Nevertheless, the 2yr U.S. yield continued to rise, but the pace of widening slowed relative to early 2022 even if 2s10s and 2s30s were still 10bp tighter over the week. The degree to which Fed policy is seemingly understood and priced-in has seen the DXY begin to give-up 2021 gains as it dipped below the psychologically important level of 95. This lifted G10 FX along with EMFX, with notable high beta pairs, such as BRL, ZAR, TRY, CLP and even HUF all outperforming. Less can be said for Russian and Ukrainian assets with escalating tensions. The “three track talks” in Geneva, Brussels and Vienna failed to restore calm, indeed the U.S. has pursued further sanction bills through the Senate and the Kremlin’s rhetoric is increasingly destabilizing. Meanwhile, state-backed Vanke was initially interested in Shimao’s assets, R&F bought back less debt than previously stated, Sunac engaged in an $580m equity raise, Country Garden struggled to raise enough to issue a $300m convertible bond and Yuzhou offered a distressed exchange for its upcoming 2022 notes.

EM Credit Update

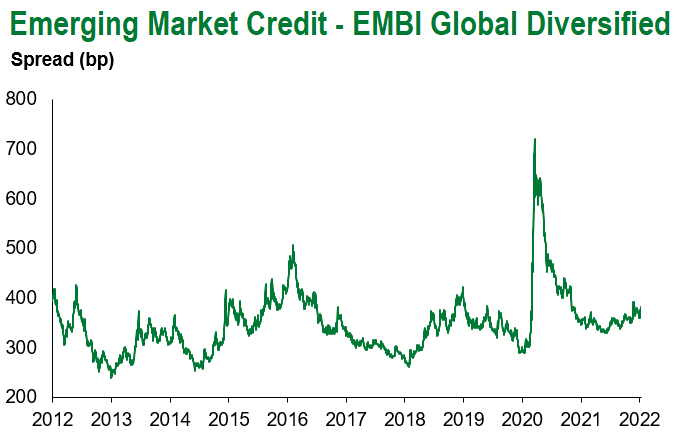

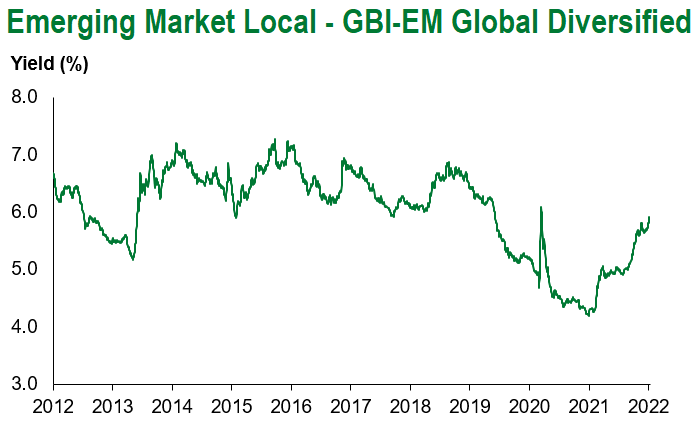

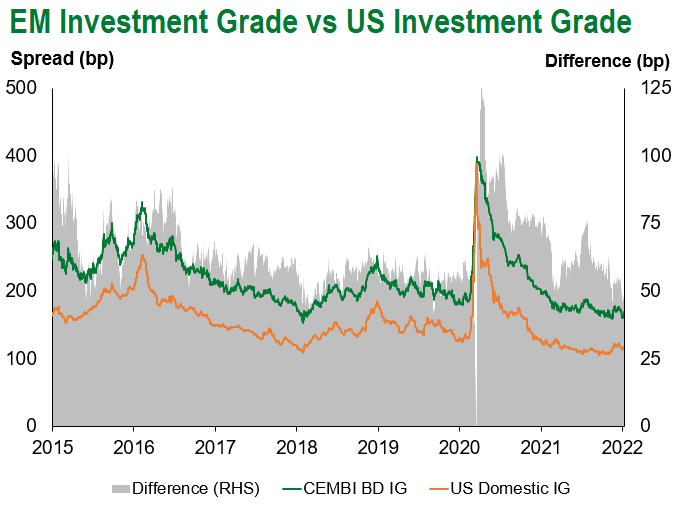

Emerging market sovereign credit ended the week down 0.6% or 14bp wider in spread. Zambia, Ethiopia and Lithuania outperformed this week, while Ukraine, Sri Lanka and Argentina lagged. U.S. Treasuries began 2022 by widening of 20-28bp in the first week of the year, but closed 1-2bp tighter this week. Investment grade assets remain under pressure this week, where the reduction in central bank liquidity is having an impact. The global supply of negative yielding debt is once again below $10tn for the first time since April 2020.

The Week Ahead

China’s GDP could dip below 4% as consensus is currently 3.3%. China’s industrial production is also expected to dip to 3.5%, with fixed asset growth slowing. The idea of a cut in the MLF rate has also risen, across both the 1yr and 5yr rates next Thursday, but not enough to move consensus expectations yet. Otherwise G10 central banks will be in focus with monetary policy meetings from the Bank of Japan and Norges Bank, followed by ECB minutes. Other interest rate decisions are due from Indonesia (3.5%), Malaysia (1.75%), Turkey (14.0%) and Ukraine (9.0%). This will be followed by economic activity data out of Poland and Israel and inflation releases from Hong Kong, Poland and South Africa. Beyond that U.S. earnings will likely be a talking point, as will geopolitical tensions between Russia and the U.S.

Highlights from emerging markets discussed below include: The challenging security talks between Russia and the West; the outlook for growth in China and the quest for “normal” in emerging markets corporates.

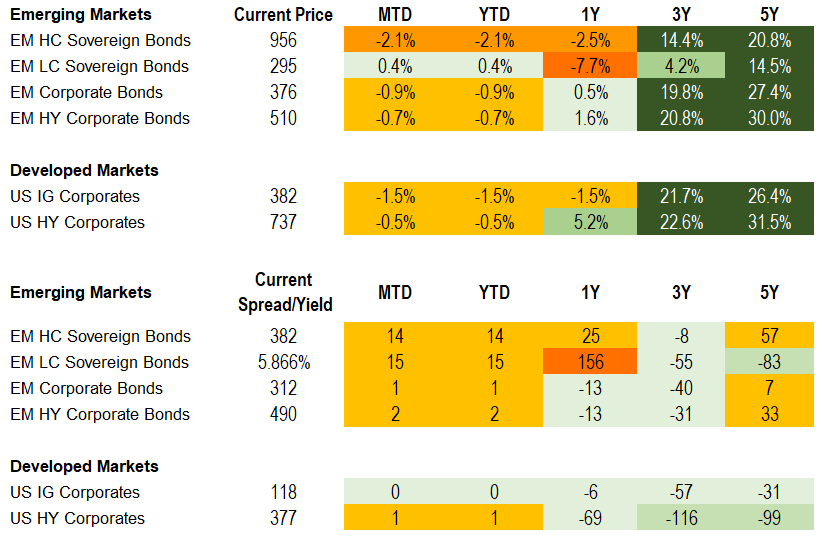

Fixed Income

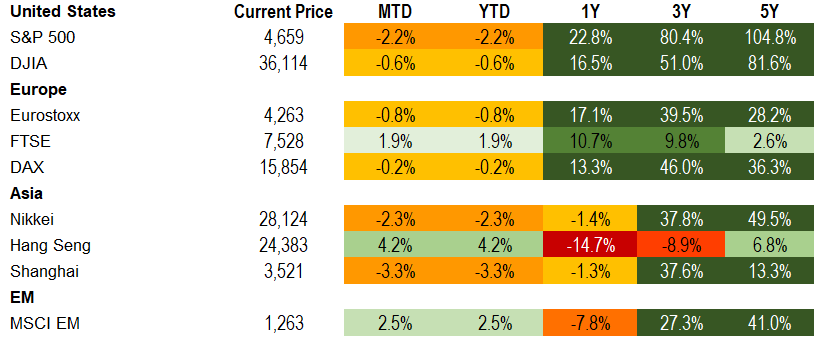

Equities

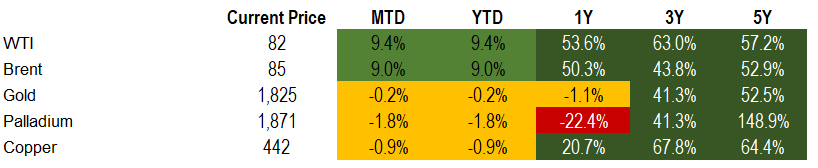

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of January 14, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Security talks between Russia and the West will remain highly challenging and uncertain, but market concerns about a near-term breakdown in diplomacy and military risks for Ukraine seem overdone

Event: High stakes geopolitical negotiations between Russia and the West (i.e., U.S., NATO, OSCE) kicked off this week. The meetings highlighted, yet again, significant differences between the two sides on several critical security issues in Eurasia, but also signaled willingness to continue the dialogue to manage their relationship and mitigate risks.

Gramercy Commentary: Some market participants and observers have perceived a “dead-end” in the discussions that could even serve as “pretext” for the Kremlin to escalate pressure on the West in the aftermath of “failed talks”, including Russia invading Ukraine. We tend to disagree with this assessment, and, as argued in previous editions of our Weekly, we continue to see war in/over Ukraine as a low probability scenario. Analyzing local sources, we would argue that there has been a level of disconnect between what has been communicated by the Russian side following the discussions and the interpretation in western media that informs market perception. Against this backdrop, we believe that for the time being diplomacy remains the preferred option of both sides for addressing some of their differences over NATO’s presence in Eastern Europe and Russia’s perceived threats to its national security arising from it. “Resolving” the key strategic issues is highly unlikely any time soon, especially Russia’s demand that NATO close the door to further expansion in the post-Soviet space and withdraw coalition forces to NATO’s pre-1997 territories. However, our expectation is that the White House and Kremlin will be able to find some space for “managing” the thorny issues at a level that mitigates the worst-case market scenarios for Ukraine in the near-term. As such, while we recognize that an additional “security risks” premium is justifiably priced in for Ukrainian assets, we believe that recent weakness is overdone. Markets have assigned significant probabilities to fat-tail scenarios in the Russia-West-Ukraine standoff, which leaves space for a decent rally on signs of minor de-escalation or no further escalation. Investors are facing very high uncertainty in the current episode and the geopolitical scenarios can change abruptly, but the risk of further Russian incursion into Ukrainian territory beyond Donbass and Crimea remains low, in our view.

China December data points to incremental growth and inflation improvements while their zero-tolerance COVID-19 strategy poses risks

Event: High frequency data through year-end showed marginal activity gains with a nearly two point rise in the Caixin composite PMI to 53.0, a multi-point drop in producer input prices within manufacturing PMI surveys, easing of PPI and CPI prints to 10.3% and 1.5%, respectively, and an uptick in total social financing growth to 10.5% y/y. This comes at the same time that additional cities are facing new Omicron related restrictions.

Gramercy Commentary: We see December data as supportive for the growth-inflation mix heading into 2022, although we expect volatility in monthly prints due to Omicron-related measures that are likely to continue in the backdrop of the authorities’ commitment to a zero-tolerance strategy. We envisage annual growth to be in the 4.5% area, lower than current consensus, under the assumption that more lockdowns will occur and drag-down growth but will likely be partially offset with policy easing in the context of a politically sensitive year.

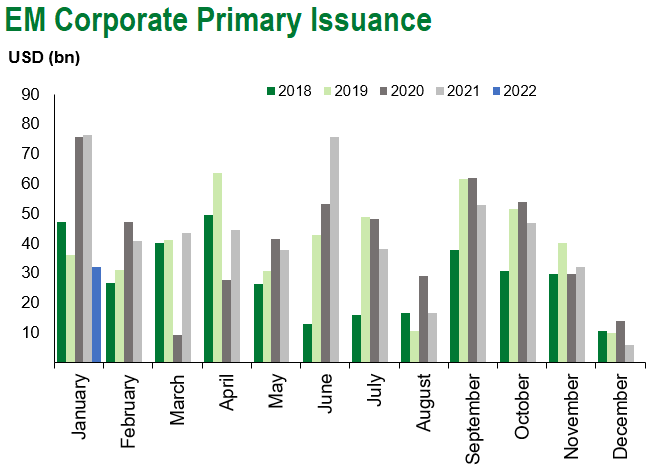

Global emerging markets corporates in focus: The quest for ‘normal’

Event: Two years into the COVID-19 pandemic, it is not fully clear when (or if) the world will go back to the way things were. For emerging markets corporates, this can present a dilemma – do these corporates carry on regardless of virus spread or wait for a return to ‘normal’?

Gramercy Commentary: The rise of the Omicron variant appears to have heralded a new phase in the pandemic, with many more discussions about living with COVID-19 rather than seeking to eliminate it. For corporates, this can be positive. It may mean CAPEX and other decisions will not be delayed, revenue generation could be more resilient as activity levels may not drop as much as before, business models ‘move with the times’ adapting to the environment that prevails and more investments are made in flexible and remote working options for employees. In addition, clients may not be lost to domestic or other competition during periods of closure and corporates need less support from governments, shareholders or even bondholders. There are challenges with this strategy too. Dependence on other companies and/or markets with different approaches may make this unworkable, corporates may be subject to stringent laws that do not permit continued operation and management might need to make multiple strategic changes which can be expensive. Further, employees could revolt and business adaptation may prove costly or even impossible. On the other hand, corporates can decide to adopt their own ‘zero-tolerance-COVID’ policy, putting business on hold until a return to pre-pandemic conditions. This might save some business adaptation costs and help companies avoid short-term changes in strategic direction. However, the nature of some businesses mean it is difficult (or even impossible) to shut down completely. In addition, employees and customers may be lost during periods of closure, it may be more difficult to adapt to a reopened world after extended absence/closure and performance may be more volatile as fixed costs would still need to be covered but revenue generation would very likely drop. It is unclear when COVID-19 will be deemed a thing of the past in emerging markets. Some argue that it will always be with us in some form (i.e. there may never be a COVID-19 free world). Perhaps we settle on a new normal, where lessons learned in the darkest days of the pandemic mean emerging markets corporates become even more resilient to significant shocks.

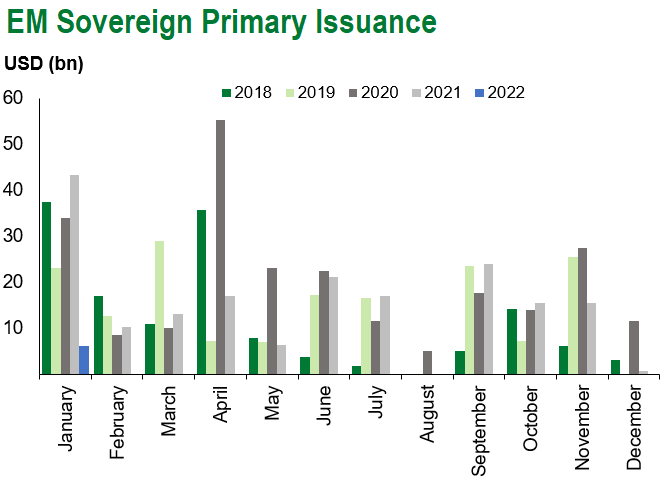

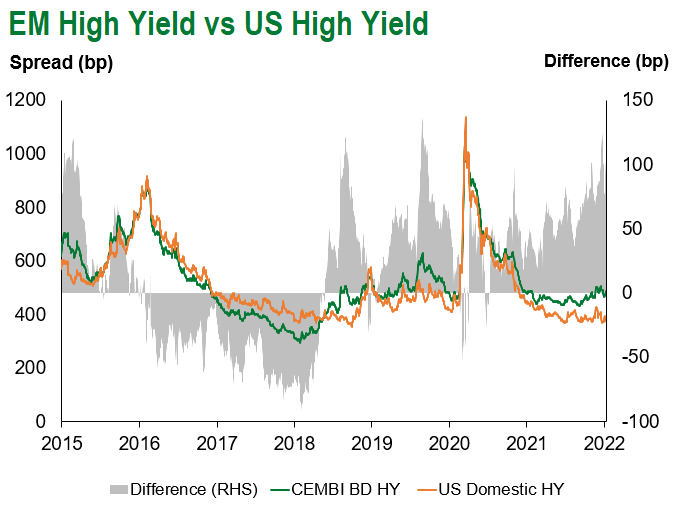

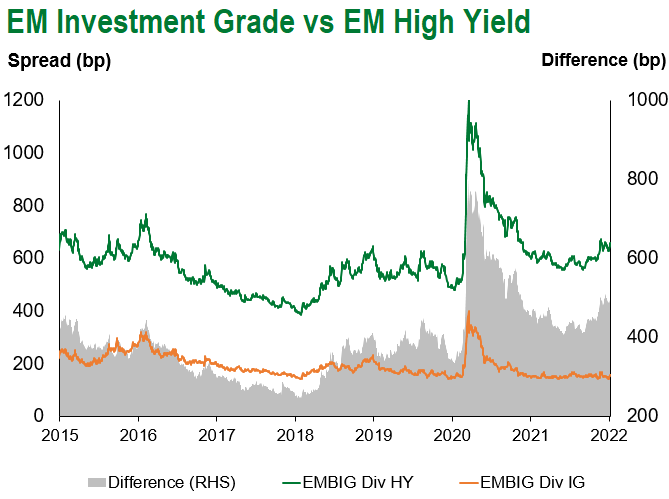

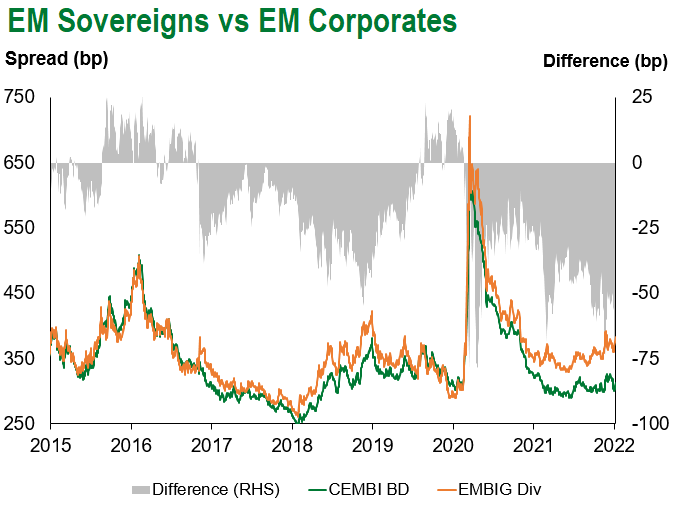

Emerging Markets Technicals

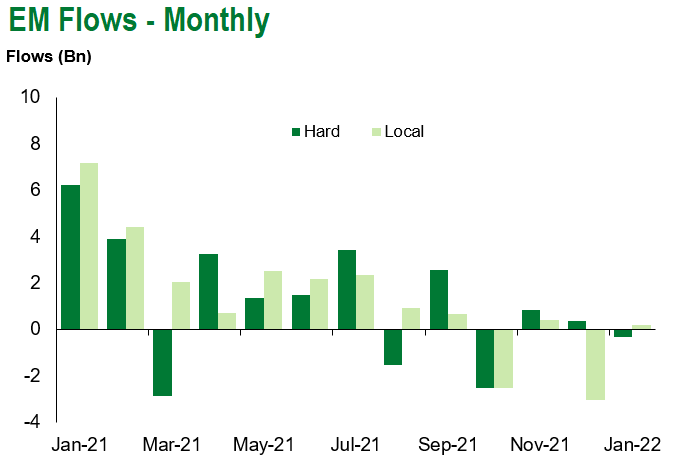

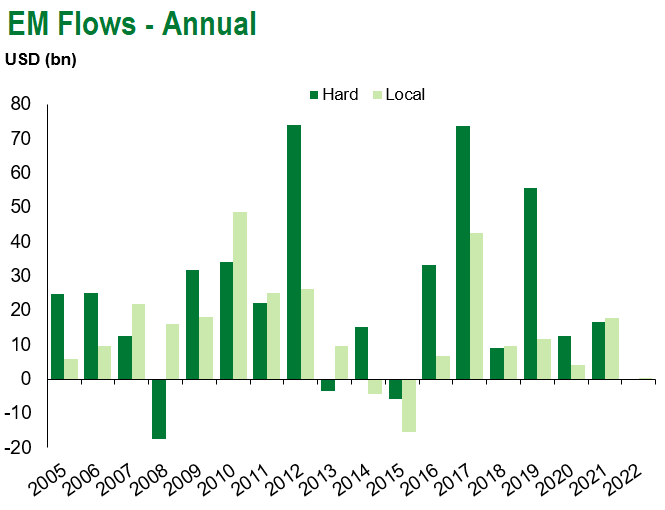

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of January 14, 2022.

COVID Resources

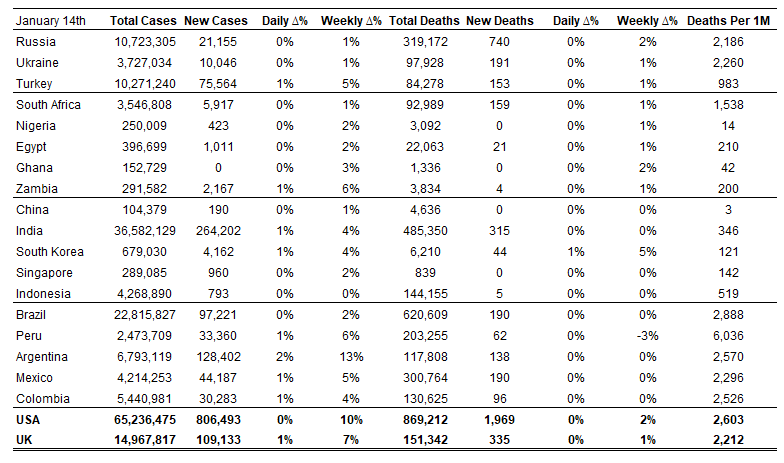

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of January 14, 2022.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.