Contents

Market Overview

Macro Review

Fed signals accelerated taper and retires the word “transitory”. We have already seen a tidal wave of EM central banks follow suit. The National Bank of Hungary is a prime example. Ending the QE program is a more direct response to 1yr inflation expectations, while the Central Bank has already hiked deposit rates on multiple occasions, prior to the main policy rate on Wednesday (20bp to 3.10%). The National Bank of Poland have also determined that inflation is no longer transitory, but indeed “burdensome”. Meanwhile, the Central Bank of Russia seems set to hike another 100bps this month but did flag that inflation would likely fall to 4-4.5% in 2022. Russian inflation is currently running above 8%, which is the highest since January 2016. Nevertheless, a faster-than-anticipated U.S. taper and possible conclusion by Spring has led to a sharp flattening of global rate curves, where the 30yr UST is anchored close to the technical 1.75% level, but 2yr and 3yr yields are significantly wider. However, inflation expectations have receded some 15-21bps over the past week in the U.S. across 2-5yr tenors. Within EM, Brazil’s manufacturing PMI slipped into contraction, just as 3Q GDP puts the country into a technical recession. In spite of a weaker BRL, Brazilian equities ended the week higher and credit spreads rallied 29bps, just as S&P affirmed the rating. By the same token in DM, 3Q GDP out of Australia was also notably weak at -1.9% after +0.7% in 2Q. Elsewhere, Turkey’s Minister of Finance and CBRT officials resigned, FX reserves remain in question given [failed] currency intervention on two occasions and headline inflation is now above 20% for the first time in two years (PPI is a more depressing picture). The Turkish lira ended the week 10% weaker, though the authorities seem set to defend 14 using FX reserves. Meanwhile, OPEC+ maintained its commitment to a 400k bpd increase in production, even if Russia flagged disagreement. Oil may have corrected 13-15% over the past seven sessions, but rallied on Friday to close unchanged on the week. Broader omicron headlines are clearly determining the direction of travel for now, with both realized and implied volatility across the market remaining elevated. In fact, the last time the VIX remained above 25 for four sessions was in January.

EM Credit Update

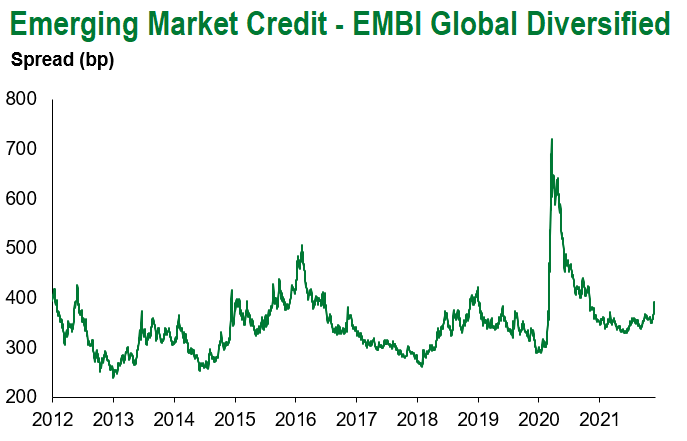

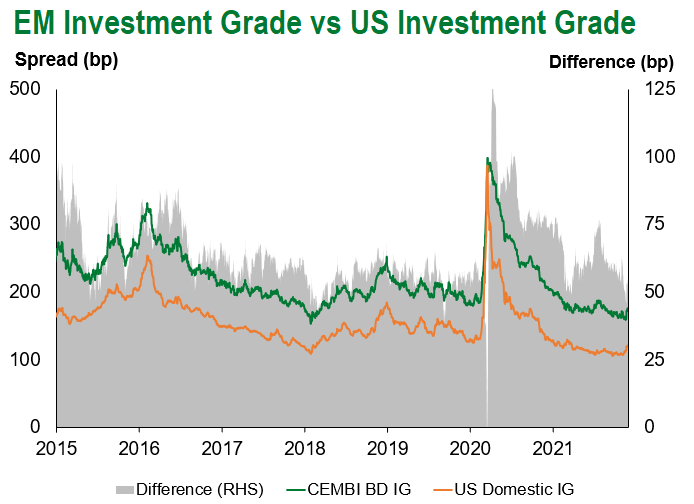

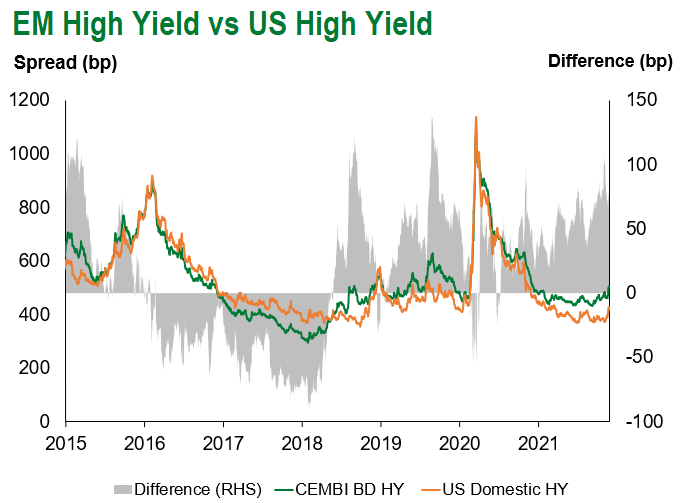

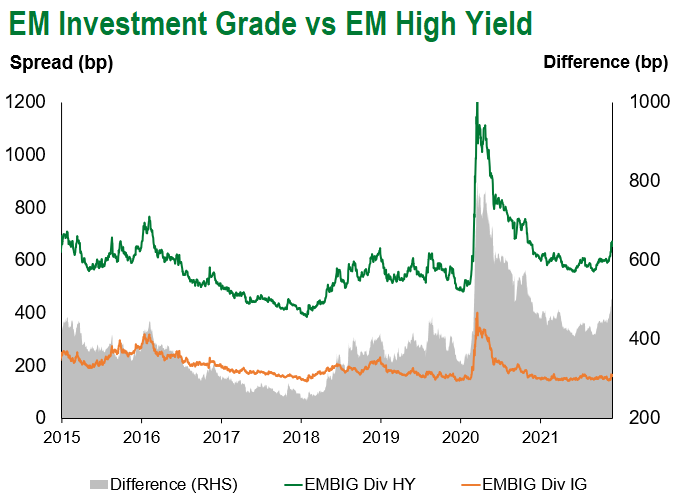

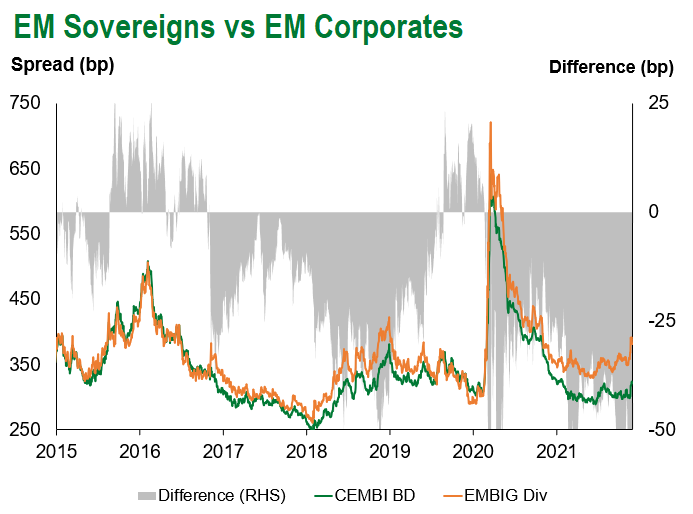

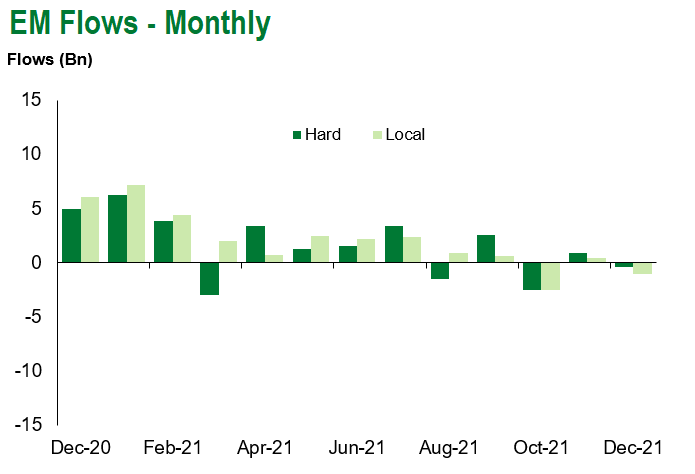

Emerging market sovereign credit ended the week up 0.9%. With IG +0.9% and HY +0.8%, as IG spreads rallied 7bp and HY was some 12bp tighter, as U.S. Treasuries bear flattened. Suriname, Argentina and Ghana outperformed, while Sri Lanka, Ethiopia and El Salvador lagged. Despite EPFR outflows of $401m, which is measured up to each Wednesday, EMB flows provide a more accurate “live” picture. EMB inflows this week amounted to $269m, given a large inflow on Thursday, in spite of the volatility. On the flip-side, Lipper outflows in US IG reached $3.86bn, which reflects the largest outflow since April 2020.

The Week Ahead

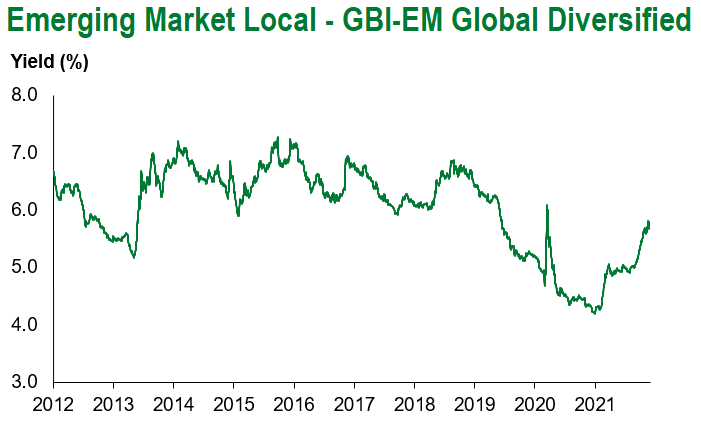

Other than omicron fears, Chinese credit data will be the main fixture of next week. Export and import growth are both expected to moderate, then the focus ought to shift to CPI and PPI with M1/M2 growth. Inflation will of course be the theme of the week, and not just with the U.S. as EM releases include Chile, Colombia, Czech Republic, Hungary, Mexico, Philippines and Taiwan. The coping strategy will of course be the main reaction function with plenty of hikes expected from this list of MPC candidates: Brazil (7.75%), India (4.0%), Kazakhstan (9.75%), Peru (2.0%), Poland (1.25%) and Ukraine (8.5%). Other focal points rest with Australia’s RBA decision, Japan and South Africa’s 3Q GDP, and Germany’s first new chancellor in 16 years will be sworn in.

Highlights from emerging markets discussed below include: The Turkish lira’s (TRY) extraordinary rout could have profound medium-term political implications; Mexico’s change in Banxico governor nominee increases uncertainty; Global emerging markets corporates in focus: Another COVID-19 variant – here we go again?

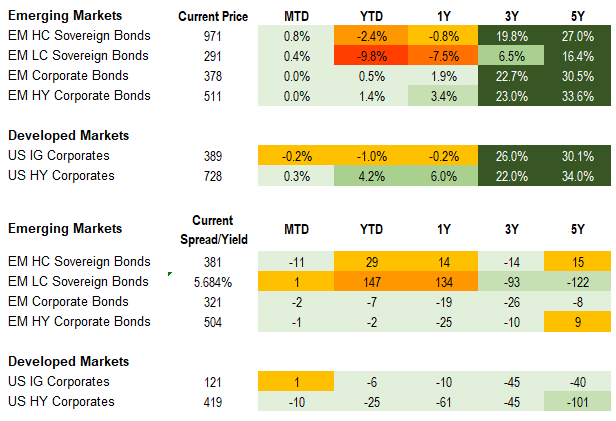

Fixed Income

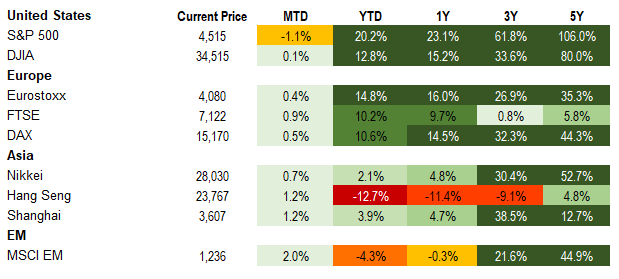

Equities

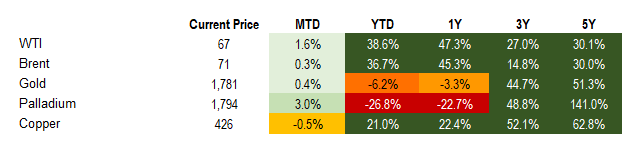

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of December 3, 2021 (mid-afternoon).

Emerging Markets Weekly Highlights

The Turkish lira’s (TRY) extraordinary rout could have profound medium-term political implications

Event: Selling of FX reserves by the Central Bank of Turkey (CBRT) this week did little to support the free falling currency (-43% since November 1) amid concerns about the continuation of monetary policy easing, President Erdogan’s doubling-down on heterodox views around economic policy and Finance Minister Lutfi Elvan’s resignation and replacement by Nureddin Nebati, an Erdogan loyalist.

Gramercy Commentary: The Turkish Central Bank does not have the fire power to support the lira via sustained market interventions and we think that selling of already significantly depleted FX reserves is a strategic mistake doomed to fail, especially in the current tense environment. We see risks that an overly aggressive approach and/or a material policy error by the authorities could trigger a more disorderly local market reaction in the near future. Given recent acute TRY weakness, inflation is set to remain a significant problem in 2022, unless countered by tighter monetary policy, which remains unlikely for the time being, in our view. High and unhinged inflation will very likely pose material risks to President Erdogan’s political future ahead of elections scheduled for 2023. Against this backdrop, we believe incentives for an economic policy reversal that would be TRY and local debt-supportive (i.e. tighter monetary policy) will likely gradually grow stronger in the coming months. This being said, we also think the medium-term “damage” by the current crisis to Erdogan’s political standing might prove difficult to reverse. We are starting to see stronger signals that the “social limits” of Turkey’s current economic and political framework might be getting close to being reached. As such, we are of the view that the odds for potential credit-positive “regime change” in Turkey by 2023 might be improving. That could open the door to a one-of-kind opportunity for active investors from deeply oversold levels, given Turkey’s overall solid sovereign and corporate fundamentals and large, diversified and dynamic economy.

Mexico’s change in Banxico governor nominee increases uncertainty

Event: Last week, President Lopez Obrador (AMLO) changed his nominee for Central Bank President to Undersecretary of Expenditures and Technocrat, Victoria Rodriguez, from former Finance Minister, Arturo Herrera. Meanwhile, mid-November inflation printed above expectations at 7.05% (vs. 6.36% in October) on non-core drivers including produce and energy as well as more muted broad-based upticks in core items.

Gramercy Commentary: We view the development as a move by AMLO to improve his relations with the Central Bank and further his agenda. However, we continue to expect preservation of Banxico autonomy and orthodox interest rate policy, particularly in the backdrop of elevated inflation. We do not think AMLO will have an issue with the continuation of gradually higher rates in 2022 but rather, expect to see greater pressure on regulatory and use of extraordinary revenue matters. This would contribute to the ongoing broader erosion of institutional quality and rating pressure over the medium-term but maintain local and market FX stability in the short-term, assuming Rodriguez maintains an otherwise orthodox approach.

Global emerging markets corporates in focus: Another COVID-19 variant – here we go again?

Event: A new variant of COVID-19 has emerged, marking another chapter in the battle against the pandemic. Unsurprisingly, news about the omicron variant has dominated the headlines since its discovery was first announced, raising concerns about growth, supply chains and more. Much will depend on whether this variant responds to currently available vaccines. We consider some of the potential implications of the latest twist in the COVID-19 saga for emerging markets corporates.

Gramercy Commentary: Discovery of the new variant led, almost immediately, to renewed travel restrictions. These restrictions have impacted airlines as well as corporates operating in related sectors. In particular, some corporates in countries which rely on tourism have come under pressure. These corporates will likely be closely watched as more data on the new variant emerges. There may be a quick recovery if concerns about the new variant turn out to be little more than a storm in a teacup. Growth forecasts, which had already been revised lower by some could be cut further, partly reflecting renewed concerns about supply chain disruption and the resurgence of demand. Further disruptions to global supply chains may mean importers of both inputs and final goods face higher prices. This may lead to lower margins. Having said this, lessons learned from previous lockdowns may mean that such disruptions are resolved much quicker. Should the new variant lead to more stringent lockdowns and other restrictions, there may be questions about state support. Government finances in many nations have come under significant pressure since the pandemic began. As such, some authorities may be more selective in the support choices. In addition, schemes offered may not be as generous as was previously the case. This may mean that with further restrictions, each corporate’s standalone fundamentals may be more important. Offsetting this, we note that some supervisors have already extended forbearance and other measures, and in some cases, such extensions run beyond 2022. The emergence of the omicron variant has also led to greater calls for existing vaccines to be distributed more widely. This may be a positive for emerging market economies which have not reached the same levels of vaccine coverage reported by many developed market peers. Improved, global vaccine coverage would be a positive for emerging market corporates in general as it may reduce the likelihood of other COVID-19 variants causing serious illness or death. This may mean stringent lockdowns and other restrictions (including travel) become a thing of the past.

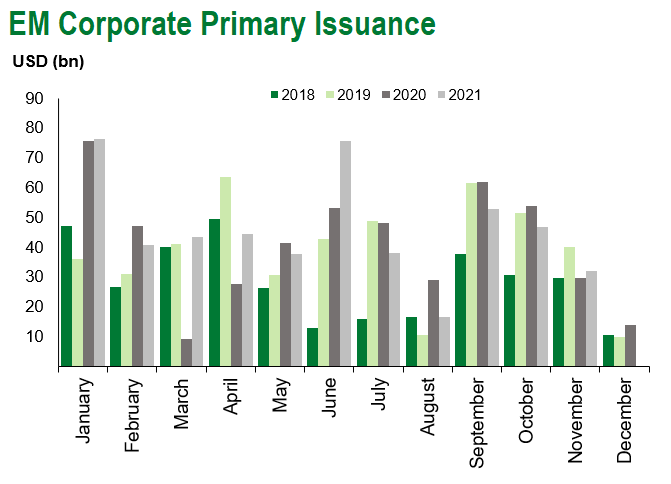

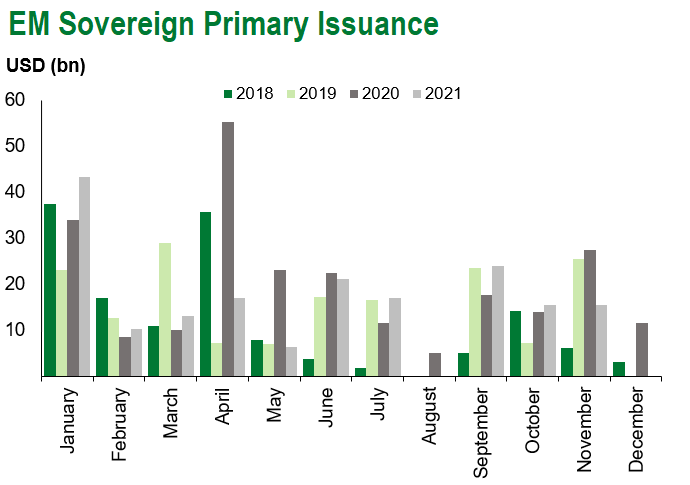

Emerging Markets Technicals

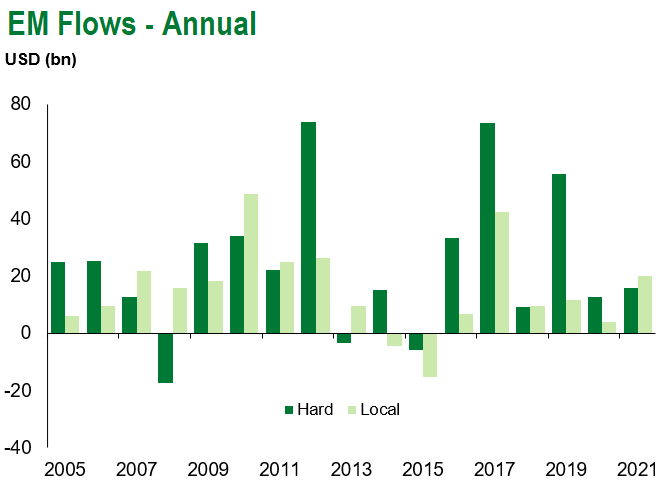

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of December 3, 2021.

COVID Resources

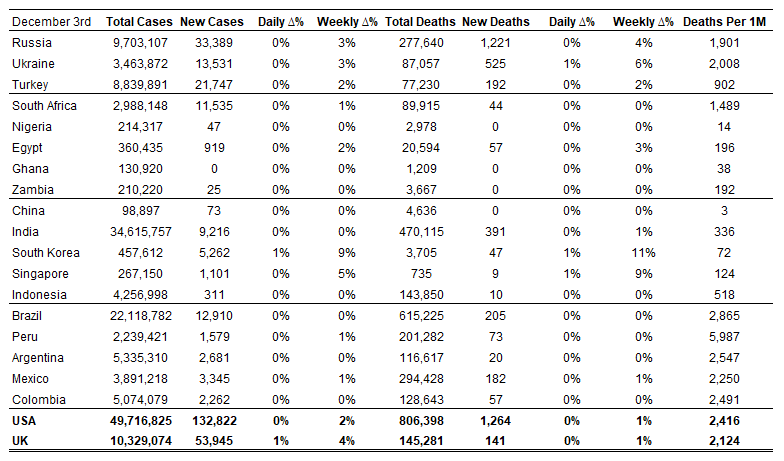

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of December 3, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.