Contents

Market Overview

Macro Review

Another hawkish twist by Powell. The Fed Chair said if the FOMC needs to raise the Fed Funds Rate by more than 25 bps at a future meeting, then it will do so, and “no one expects a soft landing in the current context”. Not only did Powell acknowledge an exceptionally tight labor force, but also that “forecasters widely underestimated the severity and persistence of supply-side frictions”. Bostic added further fuel to the fire noting that an “extremely aggressive rate path is appropriate”. This leaves the Bloomberg U.S. Treasury Index down 5.7% YTD, which is now the worst year-to-date start since its inception in 1974 after surpassing 1980 when returns were down 5.5%. Goldman Sachs were also the first to forecast 50 bps hikes at the May and June meetings, while revising their year-end 10-year forecast to 2.70% from 2.25%. They even expect the U.S. Treasury curve on a 2s10s basis to invert by 20 bps, from its current level of 20 bps, although 2s10s forwards have already breached 0 bps. Of equal importance, Ukraine’s Zelensky continues to ramp-up pressure on NATO and indeed spoke at the Thursday Summit, as Biden was in Europe meeting with key policymakers. NATO is set to deploy further troops to Bulgaria, Hungary, Romania and Slovakia, while Sweden and the UK will supply more weapons to Ukraine. In turn, the U.S. and Canada are set to export more oil and LNG to the EU, which caused some softness in oil. However, a storm caused significant damage to a pipeline in the Caspian Sea (CPC) that exports Kazakh and Russian oil with volumes of up to 1m bpd, which underpins the recent strength in crude. Meanwhile, the front-loaded hiking cycle in emerging markets is well underway in CEEMEA and LATAM. Argentina hiked 200 bps to 44.5% after 250 bps in February. South Africa hiked for a third time as ZAR continues to strengthen, with upside to inflation and growth, while Brazil is expected to hike 100 bps in May and 50 bps in June before the tightening moderates. After the assumed hikes over the next two months, it would bring the total tightening cycle in Brazil to 1,025 bps since liftoff in March 2021.

EM Credit Update

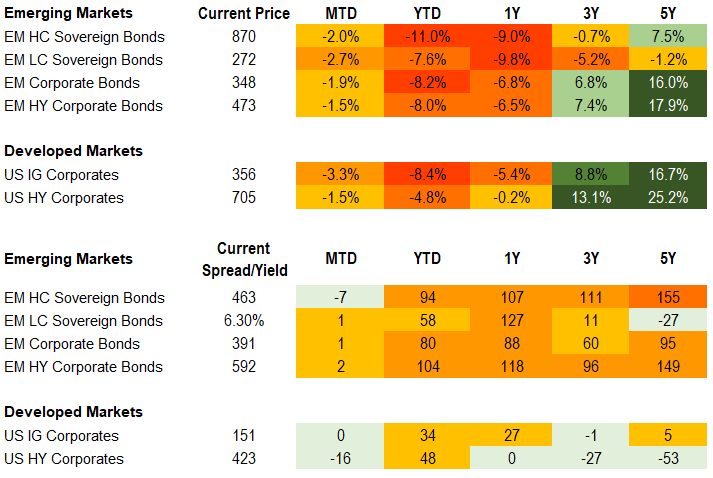

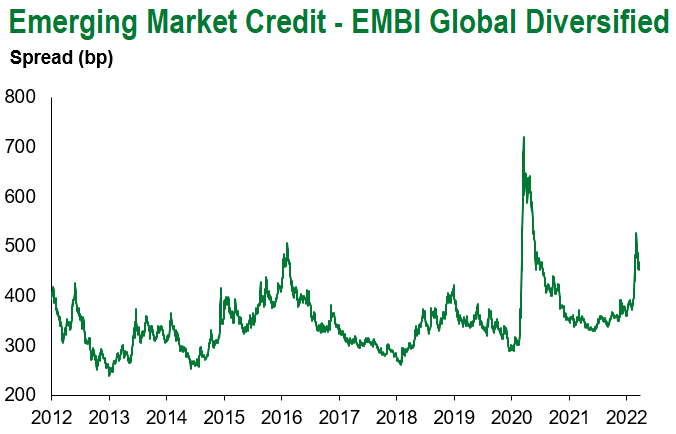

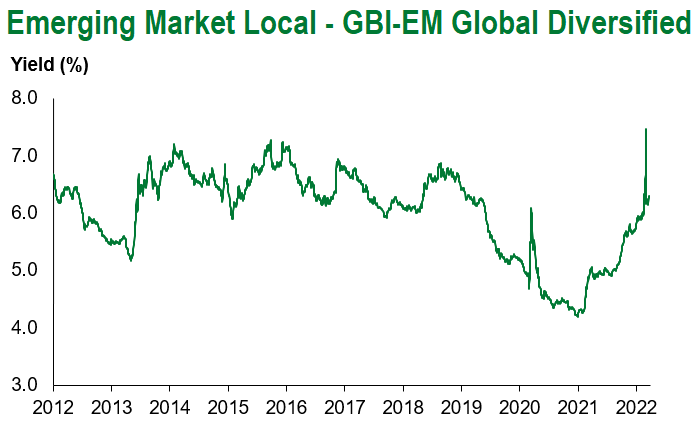

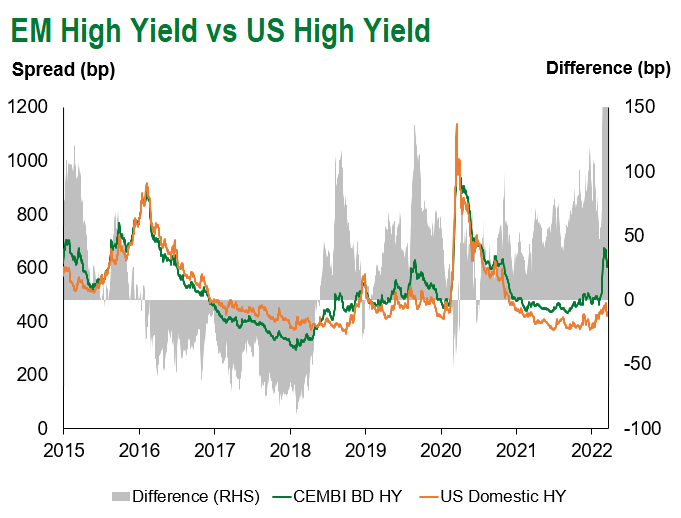

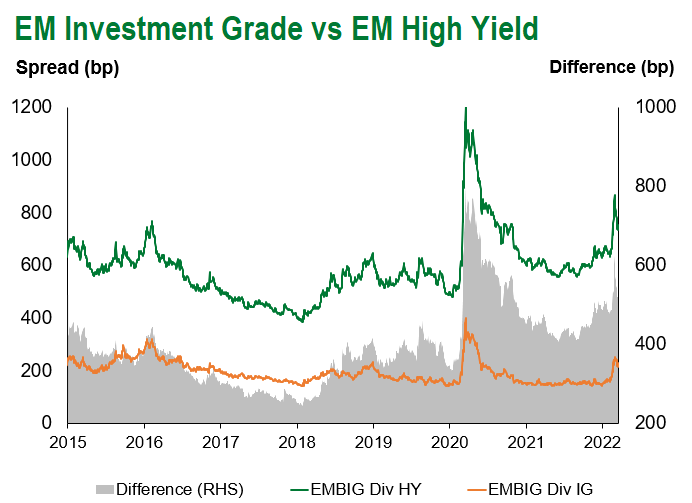

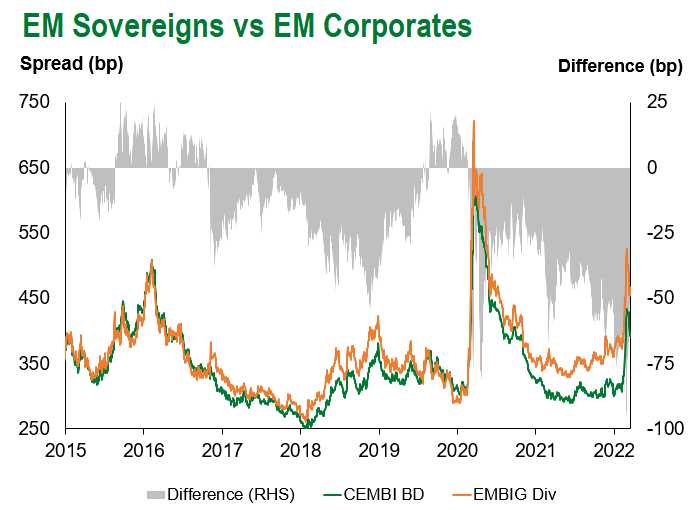

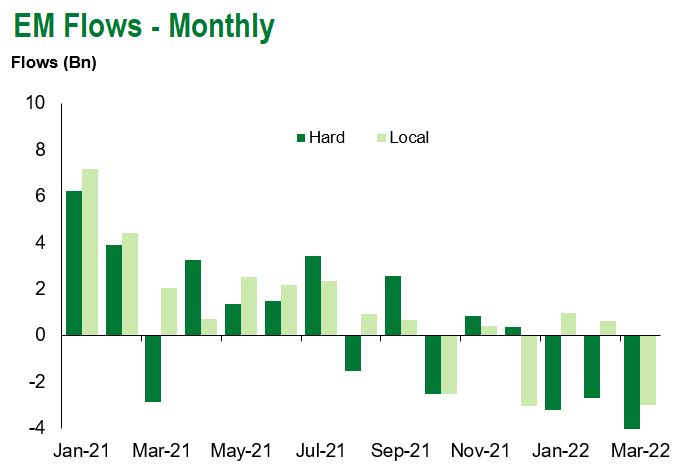

Emerging market sovereign credit ended the week down 1.3% but emerging market corporate credit was virtually unchanged. Sovereign credit spreads were some 4 bps wider, while corporate credit spreads rallied 17 bps. Outperformers over the week were Tajikistan, Armenia and Bolivia, while Belarus, Russia and Ukraine underperformed. Given the move in corporate credit spreads, the asset class is now almost unchanged in the month of March, where the underlying weakness is driven by U.S. Treasuries widening. As the green shoots emerge for emerging markets, we have also witnessed the first inflows in emerging market credit in almost ten weeks. This comes against some renewed weakness in the Chinese property sector as several issuers have postponed FY21 results as auditors take a more cautious approach, in addition to the volatility in Russia and Ukraine.

The Week Ahead

The EU-China Summit is the main fixture of next week, rather than Hollywood’s 94th Oscars. Brussels is set to reiterate to Beijing that serious consequences should be expected if China softens Western sanctions against Russia. Second, China’s manufacturing PMI is due with an expected decline after recent lockdowns were enforced, despite subsequently being lifted. Then a slew of interest rate decisions are due from Chile (5.5%), Colombia (4.0%), Czech Republic (4.5%), Kenya (7.0%) and Thailand (0.5%). In addition, while there is not a scheduled BoJ meeting until April 28th, we could see some form of intervention given 10-year JGB rates are at the upper limit of the YCC threshold of 0.25%. Beyond that we see inflation releases out of Indonesia, Peru and Poland, then the trade deficit reading out of Turkey which is expected to narrow considerably after very weak print in January (-$10.3 bn).

Highlights from emerging markets discussed below include: Stalemate on the ground in Ukraine dims prospects for ceasefire in the near-term; West increases sanctions pressure on Russia, Egypt and Ghana opt for orthodox policy measures amid market uncertainty and Argentina reached tentative deal with Paris Club and hiked rates with IMF board approval soon.

Fixed Income

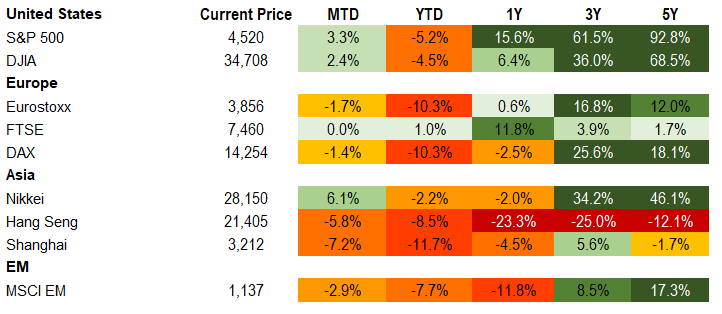

Equities

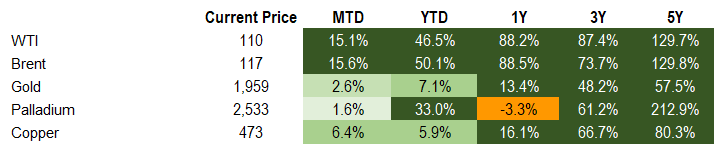

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of March 25, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Stalemate on the ground in Ukraine dims prospects for ceasefire in the near-term; West increases sanctions pressure on Russia

Event: The past week was characterized by an increasing stalemate in the Russian ground offensive and even partial counter-offensives by Ukrainian forces leading to recapturing of some territories. Summits of U.S. and EU leaders in Brussels confirmed Western unity in support of Ukraine and added new sanctions against Moscow, although the EU remains constrained by member-states’ energy dependence on Russia. Meanwhile, President Putin demanded payments for natural gas by consumers on Russia’s “unfriendly countries” list to be made in RUB going forward, in an apparent counter-sanctions attempt.

Gramercy Commentary: One month into Russia’s invasion of Ukraine, the Kremlin appears to be sticking to its original maximalist objectives, including imposing formal neutrality for Ukraine, regime change, demilitarization and territorial demands in Crimea and Donbas. Such demands are clearly unacceptable to Ukraine’s government in the context of lack of decisive progress by Russian forces on the ground. Russia’s offensive has been largely stopped by Ukraine’s extremely motivated and well-armed defenders, forcing the invaders to resort to long-distance shelling and allegedly committing war crimes against civilians. Given the massive negative repercussions for Russia’s economy from ongoing global isolation and tightening sanctions, significant losses in terms of lives and equipment, and potential domestic political implications, we struggle to see an “off-ramp” for President Putin in the current environment. This means that a ceasefire and substantive peace negotiations are unlikely in the near-term, unless Russia manages to secure a better bargaining position. Moreover, an outright defeat in Putin’s military gamble could threaten his regime’s political survival, raising the stakes dramatically. This signals to us that further escalation in the conflict carries a significant probability, regardless of the price that Russia is likely to pay in terms of economic and human loss. For its part, the West appears unified in its financial and military support for Ukraine and has strong incentives to make sure the “price” President Putin pays in Ukraine is as high as possible. As for developments on the ground, an important signpost we’ll be watching next week is whether Belarus’ President, Lukashenko is able to persuade his military and political elites to join the war under strong pressure by the Kremlin. If Belarusian forces were to invade Western Ukraine, a risk Ukrainian intelligence has been warning about, that would present significant challenges to Ukraine’s defense efforts and might threaten vital supply corridors through the Polish border. It would also likely bring active fighting closer to NATO territory. In the context of a lingering conflict, we expect implications for global inflation and growth, food supply, and energy/commodity prices to be increasingly coming to the surface, with significant political, social and market implications across emerging markets.

Egypt and Ghana opt for orthodox policy measures amid market uncertainty

Event: This week, Egypt devalued its currency just over 15% coupled with a 100 bps hike in its policy rate as well as a formal request for IMF policy assistance. Similarly, Ghana announced key macroeconomic stabilization measures, including a 250 bps rate hike, 30% reduction in wages, and FX intervention plans.

Gramercy Commentary: We view the actions of both governments as constructive as it provides an indication of the authorities’ intended policy approach in backdrop of renewed global economic uncertainty. Egypt’s measures should help partially stabilize financial account pressures while committing to renewed IMF guidance seemingly leaving open options for a policy-only or funded program. Given the country’s net trade vulnerabilities amid the war, particularly related to reliance on wheat imports, fiscal and social risks will persist depending on the course of the conflict and thus, early action is a necessary precondition to effectively manage through the crisis. In the case of Ghana, the new expenditure measures are of particular importance as markets remain skeptical over the government’s ability to meet its ambitious 7.4% of GDP deficit target for this year particularly following headwinds to revenue related measures. The monetary measures should help alleviate financial account pressure while positive terms of trade effects should be a boost to the current account working as an initial step to stabilize the cedi.

Argentina reached tentative deal with Paris Club and hiked rates with IMF board approval soon

Event: Following a trip to France, Minister Guzman reportedly reached a tentative agreement with Paris Club creditors regarding its $2 bn outstanding debt which involves partial payments proportional to payments made to other bilateral creditors during the recently agreed 30-month EFF IMF program. An agreement is set to be finalized by June 30th. Meanwhile, BCRA hiked rates by 200 bps bringing its 28-day Leliq rate to 44.5%. The IMF released a press release over the weekend indicating that the board will meet this Friday to review the staff level agreement and extend the government’s payments to month-end, avoiding an arrears scenario.

Gramercy Commentary: The developments are credit positive as they reflect the authorities’ intentions to maintain constructive multilateral and bilateral relations and take incremental macroeconomic steps needed to abide by program parameters. Uncertainty remains elevated and has in part contributed to a lackluster asset price reaction as political tensions persist while pre-war staff level program assumptions may need to be revised in the backdrop of the new environment. The IMF’s most recent press release suggested this may occur before board approval otherwise likely at the first or second reviews. We generally envisage IMF program compliance with some surmountable slippage. Downside risks could stem from domestic political challenges which could drive bouts of higher uncertainty regarding disbursements.

Emerging Markets Technicals

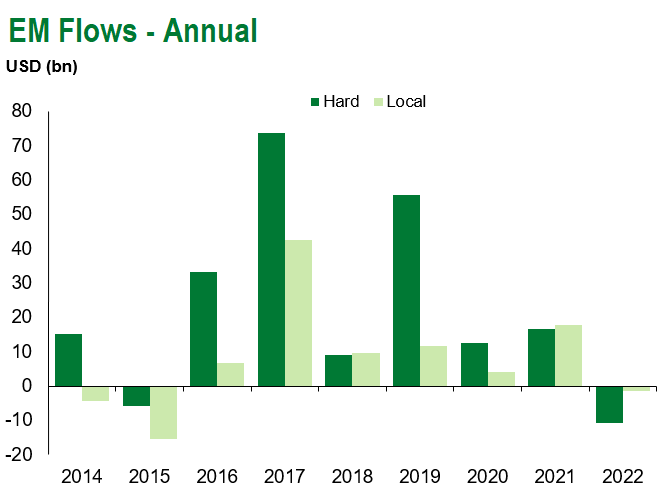

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of March 25, 2022.

COVID Resources

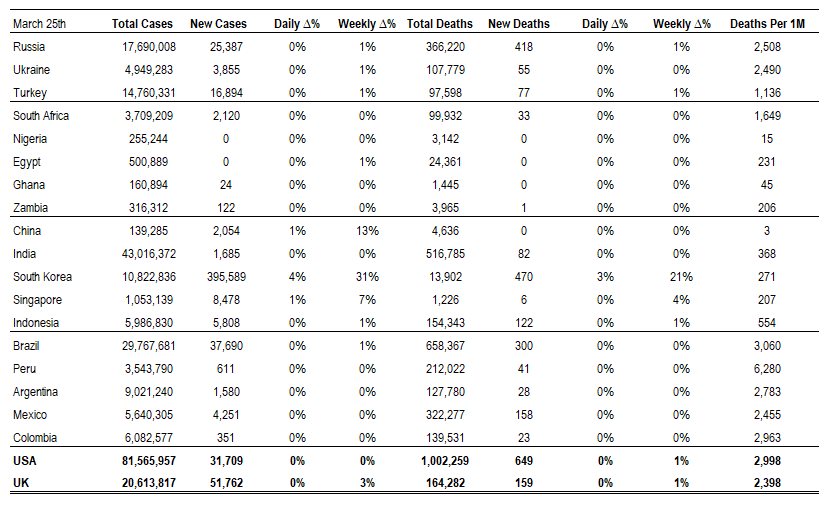

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of March 25, 2022.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.