Contents

Market Overview

Macro Review

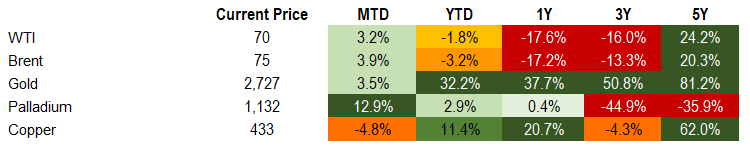

Volatility was the theme of the week. Investor caution was evident with the soon-approaching U.S. election, strong economic data, question marks around Chinese stimulus, and ever-pressing geopolitical risks. Yields on U.S. Treasury bonds moved to an intra-day peak of 4.25% last week. The recalibration of sticky inflation, strong jobs data and limited fiscal discipline from either U.S. Presidential candidate weighed on markets. The idea of “Trump trades” being priced-in stole most of the market narrative, with Polymarket and Betfair implied probabilities of a Trump presidency rising above 60%. These factors contributed to the MOVE index rising to 130pts, which is the volatility index of U.S. Treasury yields. Meanwhile, the Bank of Canada cut policy rates by 50bps, but the comments from Governor Macklem were more telling that price pressures are no longer broad-based. The Central Bank also upgraded its 2025 GDP projections in a positive move. A similar sentiment on inflation was shared by the Bank of England’s Governor that inflation is fading faster than expected, but this was complicated by the presence of the Labour Government budget due on October 30th. Elsewhere, the focus was on global PMIs, but the theme remained consistent with weak Eurozone data and strong Indian readings. In fact, the softer U.S. PMI allowed for U.S. Treasury yields to decline briefly on Thursday. The next question for U.S. data is seasonality with Hurricanes Helene and Milton. With a mixed global economic outlook, gold moved to another all-time high. However, oil for the most part was lower on EIA inventory data.

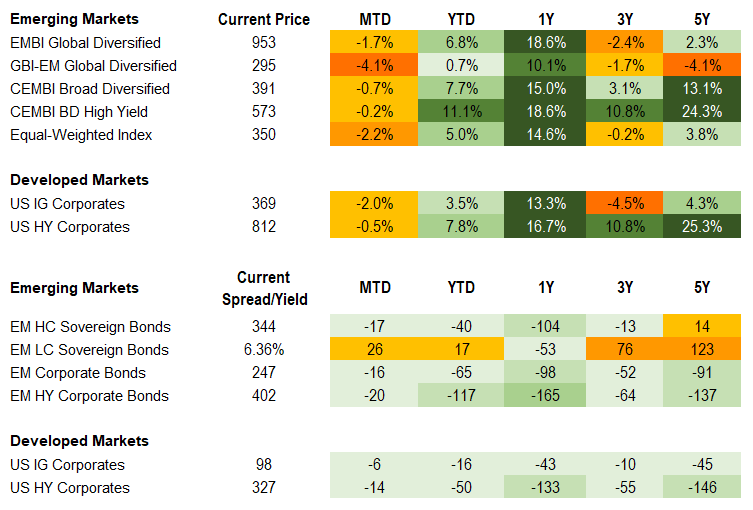

EM Credit Update

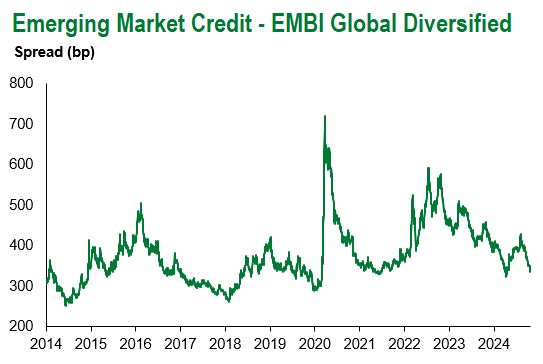

Emerging market sovereign credit (cash bonds) ended the week down -1.0% with credit spreads 6bps wider. Sovereign outperformers were Argentina, Ukraine and Honduras, while Sri Lanka, Mozambique and Bolivia underperformed.

The Week Ahead

The Treasury quarterly refunding announcement on Monday will determine the fiscal path ahead for the U.S. economy and the deficit for 2024. The week will then close out with the non-farm payroll report, just days before the U.S. election. In the near-term, a key Parliamentary Election over the weekend will take place in Georgia. The “Georgian Dream” has not faced strong opposition in 12 years, but its authoritarian support has waned in favor of smaller parties. It is set to be the most contested election in its recent history. Elsewhere, the UK budget is due on October 30th, which will be a key driver for Gilt yields. The event shares the same date as the South African Medium-Term Budget Policy Statement. South Africa could see some heightened volatility given that its development bank (DBSA) was rumored to have secured a credit line from Russia’s VEB (a U.S. sanctioned bank), although it was subsequently denied. We can also expect PMIs out of China. Global interest rate decisions are limited to Colombia, Japan and Ukraine.

Highlights from emerging markets discussed below: IMF World Economic Outlook showed a stable but underwhelming growth picture.

Fixed Income

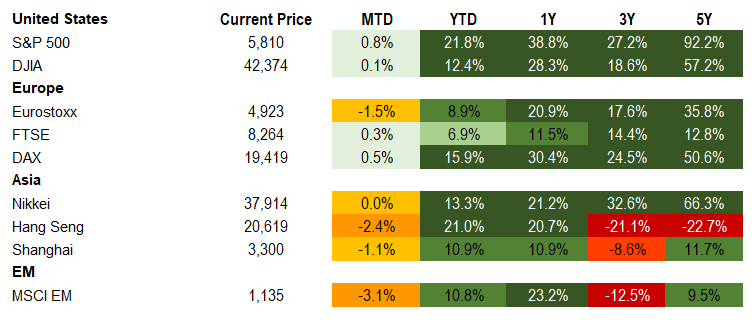

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of October 25, 2024 (early-morning).

Emerging Markets Weekly Highlights

IMF World Economic Outlook showed a stable but underwhelming growth picture

Event: The World Economic Outlook reaffirmed its global growth forecast for 2024 at 3.2% (the forecast was increased 0.1% in July). However, global growth in 2025 was reduced by 0.1% to 3.2%. The IMF increased the U.S. growth forecast by 0.2% to 2.8% in 2024 and by 0.3% for 2025 to 2.2%. Meanwhile, the IMF downgraded Euro Area growth by 0.1% and 0.3% in 2024 and 2025. Advanced economies are set to grow 1.8% in 2024 and 2025, while emerging and developing economies are expected to grow at 4.2% over the same points.

Gramercy Commentary: The EM-DM differential slipped to 2.4ppts. This was attributed to higher advanced economy growth. However, it was 0.1% lower than the July report and now 0.4% lower than the April report. The IMF forecasted EM growth of 4.2% in 2024 and 2025, while the 2025 growth figure was revised down 0.1%. The Chinese slowdown is expected to be gradual. The persistent weakness in the real estate sector and low consumer confidence weighed on growth forecasts. However, the IMF has only projected growth to slow to 4.8% in 2024 but down to 4.5% in 2025. The IMF does cite that better-than-expected net exports has improved the outlook for the Chinese economy.

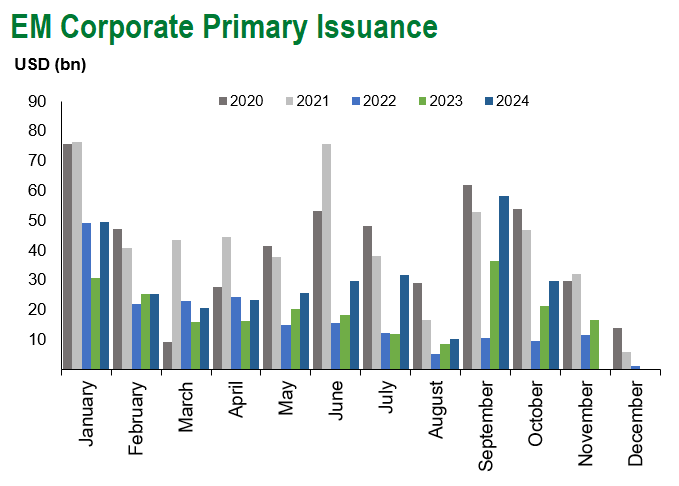

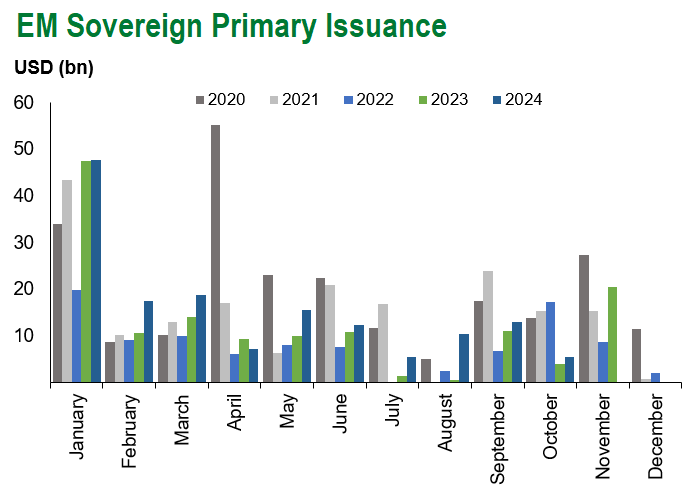

Emerging Markets Technicals

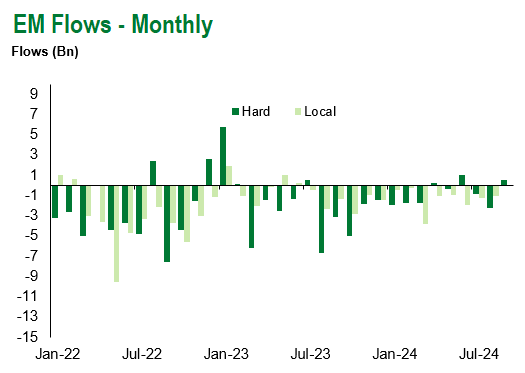

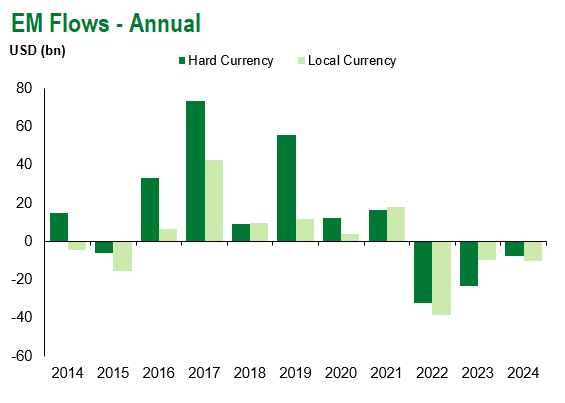

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of October 25, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.