June 2023 marked the 25th Anniversary of Gramercy! Thank you to our valued investors, trusted business partners and team members without whom this milestone could not have been reached. We are excited for the opportunities we see ahead, and look forward to continuing to deliver upon our mission to have a positive impact on the well-being of our clients, portfolio investments (and their communities) and our team members.

Contents

Market Overview

Macro Review

Higher for longer? This week, markets seemed to be in a mood to question the popular mantra as U.S. initial jobless claims rose more than expected, adding to the payrolls miss last Friday and unemployment ticking up to 3.9% as signs that the U.S. labor market might be cooling off. For its part, the Bank of England (BoE) signaled at Thursday’s policy meeting that it might be getting closer to a first rate cut, which also contributed to improved sentiment that less restrictive monetary policy by the systemic central banks might be on the horizon. The USD was firmer earlier in the week but gave up some gains as the tone turned more dovish with U.S. data. Oil prices remained under pressure with Brent dropping to ~$80 on rumors that Russia may consider pushing for increased OPEC+ output. China trade data surprised to the upside with solid export and import prints for April, pointing to resilient external demand and domestic momentum. In EM, Jose Raul Mulino, a conservative right-wing candidate favored by markets, won Panama’s Presidential elections. In Mexico, reports emerged that the government is reviewing options to support Pemex with around $40bn in debt coming due over the next presidential term. In Brazil, after having delivered six consecutive 50bps rate cuts, the BCB slowed down the pace of easing to 25bps this month, lowering the SELIC to 10.5%. Peru’s Central Bank also delivered a 25bps cut to 5.75%, while Malaysia (3.0%) and Poland (5.75%) kept rates unchanged.

EM Credit Update

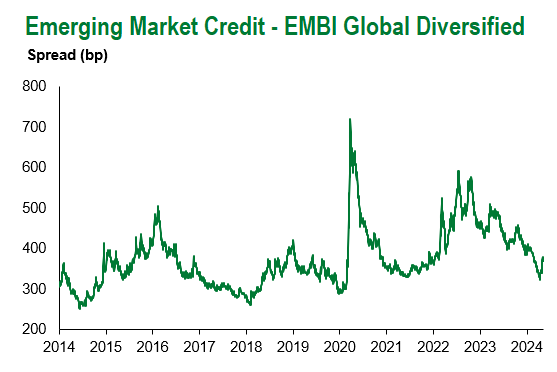

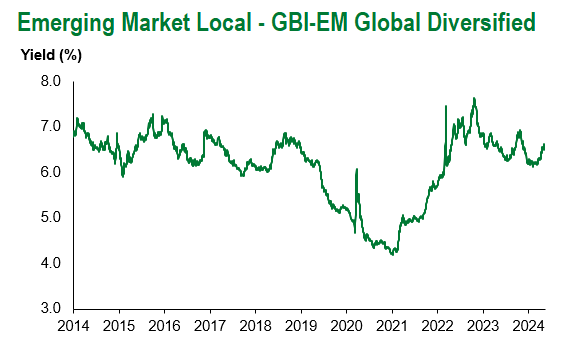

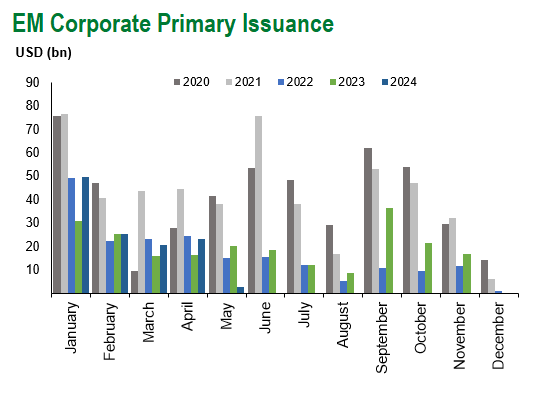

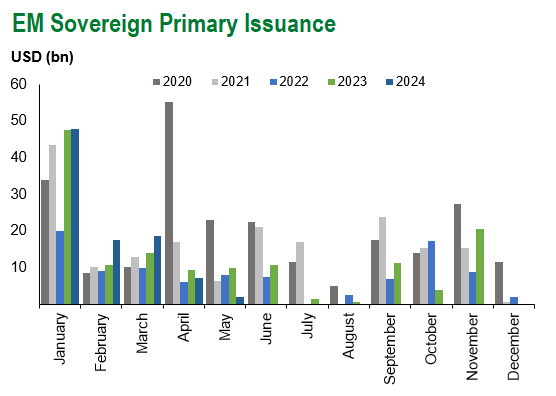

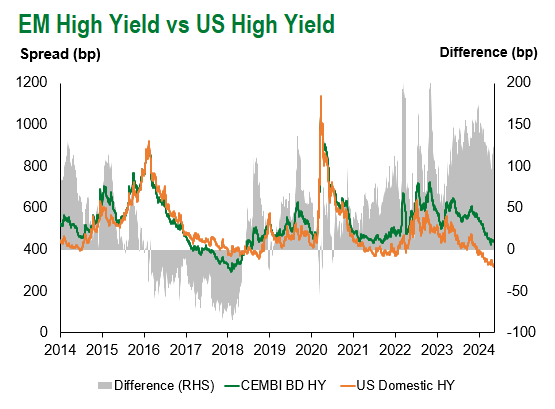

Emerging market hard currency sovereign credit (cash bonds) gained 0.6%, with spreads 4bps tighter. Corporate credit was 0.3% stronger at the index level with spreads 2bps tighter. Sovereign outperformers over the week were Iraq, Paraguay, and Mongolia, while Namibia, Uruguay, and Ethiopia underperformed. EM local debt gained 0.3% this week.

The Week Ahead

Next week, markets will dissect U.S. CPI data, especially on the core side, for signs that momentum might be slowing. In the Euro region, details on April inflation will be published that could support the case for a first ECB cut in June. Additionally, there are a few major data releases out of China: CPI and PPI inflation data over the weekend, followed by credit data, industrial production, retail sales, and fixed asset investment. Markets will also focus on housing price data given recent optimism that we could see a bottoming out of property prices in tier one and two cities. India inflation data and Brazil economic activity will be on the docket, too.

Highlights from emerging markets discussed below: Mulino wins Panama’s Presidency; focus shifts on cabinet selection, governability, and ratings outlook and Mexico studying options to evolve Pemex support; Banxico kept rates on hold.

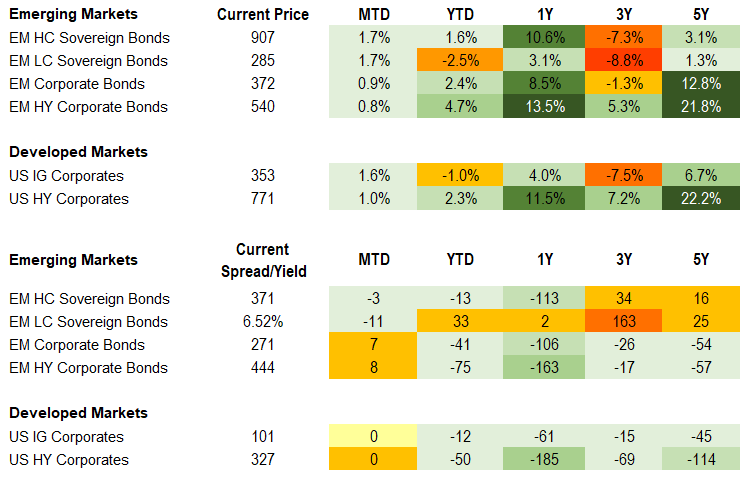

Fixed Income

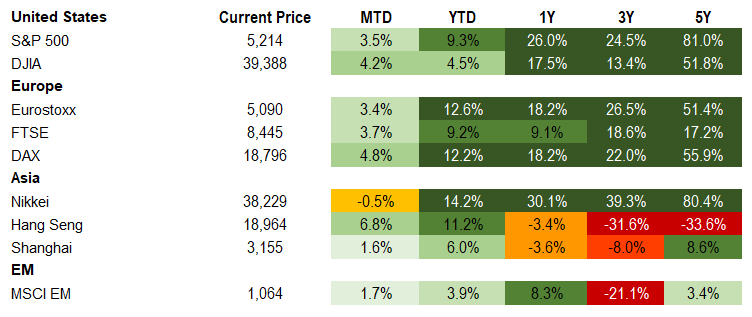

Equities

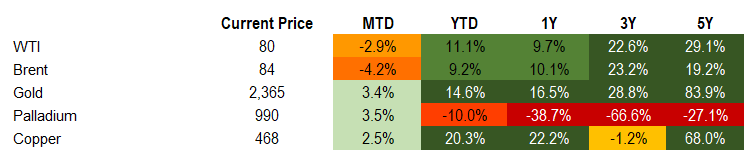

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of May 10, 2024 (late-morning).

Emerging Markets Weekly Highlights

Mulino wins Panama’s Presidency; focus shifts on cabinet selection, governability, and ratings outlook

Event: Right-wing Jose Raul Mulino, substitute for ex-President Martinelli who remains Panama’s most popular politician even after being convicted of corruption and banned from participating in elections, won the presidency with 34% of the vote ahead of populist-leaning Ricardo Lombana, who came in second with 25% of the vote. Mulino will take over on July 1st from highly unpopular outgoing President Cortizo and will face challenges constructing a working majority in a fragmented National Assembly.

Gramercy Commentary: In Panama’s current socio-political and economic context, Mulino’s win was the best election outcome from a market perspective, in our view. We think he is the candidate with the best chance to build support in a fragmented new National Assembly dominated by independent candidates and implement urgently needed reforms. As such, the new administration should enjoy a governability window, at least in the initial “honeymoon period” after taking office on July 1st. After a series of economic and social setbacks under the outgoing administration, Mulino’s government will need to address fiscal and pension system challenges to avoid losing the sovereign’s coveted Investment Grade (IG) rating from Moody’s or S&P, as well as to restore Panama’s standing as one of EM’s most dynamic small economies. Drought conditions have also disrupted operations at the Panama Canal, the country’s most important economic asset; the situation around water levels has improved lately, but improving canal infrastructure and operations will be among the priority items on the Mulino Administration’s agenda in its early days in office.

Mexico studying options to evolve Pemex support; Banxico kept rates on hold

Event: The Ministry of Finance is reportedly reviewing options to support Pemex with roughly $40bn in debt coming due over the next presidential term. On Thursday, Banxico held its policy rate at 11.0% following an initial 25bps cut at its prior meeting. This followed a slightly higher than expected inflation print for April of 4.65% y/y.

Gramercy Commentary: The latest comments on Pemex support reflect continued strong sovereign backing for the company with prospects for a more transparent and formal structure to gradually de-lever the company over the medium-term. Additional details of any new program are unlikely to emerge until after the election on June 2nd and formation of the 2025 budget later this year. We think it is more likely that they adopt a multi-year buyback or injection strategy closer to recent mechanisms albeit with perhaps greater clarity alongside requirements for governance and policy enhancements rather than providing an explicit guarantee. At the same time, fiscal consolidation will move into focus for the 2025 budget as the deficit is set to widen to around 5% of GDP this year. On monetary policy, we see the pause as constructive given still-elevated inflation and global rate uncertainty.

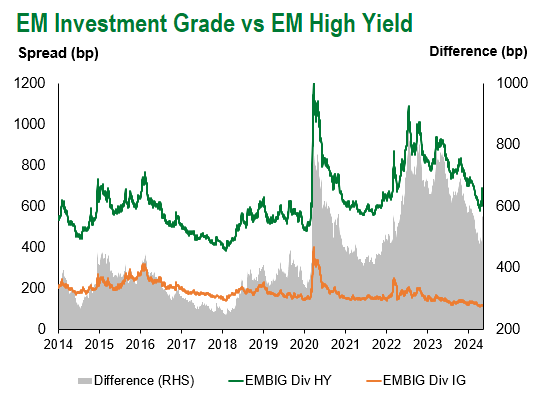

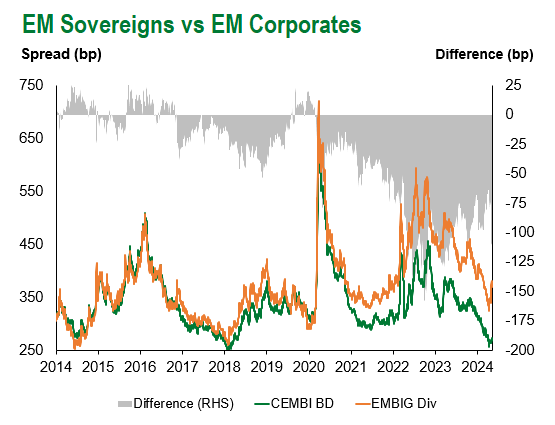

Emerging Markets Technicals

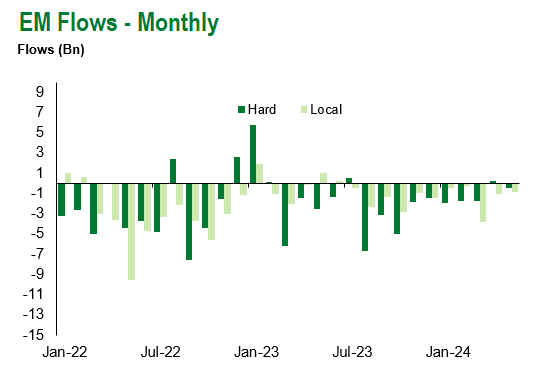

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of May 10, 2024.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.