June marked the 25th Anniversary of Gramercy! Thank you to our valued investors, trusted business partners and team members without whom this milestone could not have been reached. We are excited for the opportunities we see ahead, and look forward to continuing to deliver upon our mission to have a positive impact on the well-being of our clients, portfolio investments (and their communities) and our team members.

Contents

Market Overview

Macro Review

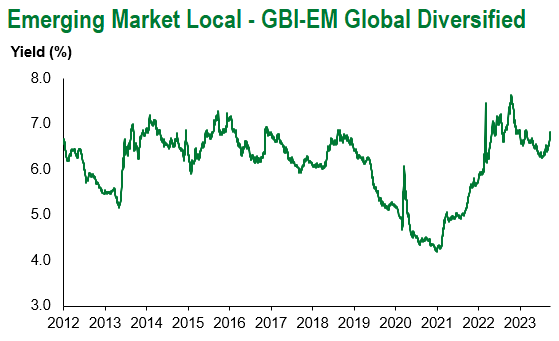

The interest rate shock through September has become difficult to ignore. The Fed’s higher-for-longer message is still in direct conflict to the market’s eternal optimism around future rate cuts. We are now left in a state where the long-end of core interest rate curves is vulnerable. The 30-year U.S. Treasury bond is 46bps higher in yield through September and 60bps higher from peak-to-trough. The quarterly move in 30-year U.S. Treasury bonds is now the largest on record. Unsurprisingly, the Bloomberg Aggregate Bond Index hit a fresh year-to-date low. The U.S. Senate cleared a procedural hurdle after agreeing to a bipartisan bill to avoid a U.S. Government shutdown. The passage through the House is the final element in the stopgap funding bill to November 17th. Moody’s has released a bulletin stating that a government shutdown would be negative for the U.S. Aaa rating. The next sequence weighing on a stronger U.S. dollar was higher oil prices. Oil supply tightness was triggered by OPEC+ voluntary supply cuts in July and August, which was exacerbated by Cushing inventories in Oklahoma falling to a 14-month low. Indeed, stockpiles in general have drifted lower over the past seven weeks. Elsewhere, Chinese industrial profits surprised to the upside and came in at 17.2% year-over-year, which assisted with equities rallying. The property sector still remains weak, although the larger focus was on Evergrande and the upcoming Country Garden coupon payments, along with the Golden Week. Other notable trends over the week were the weakness in EMFX, President Lula meeting with the head of the Brazilian Central Bank, Dubai’s debt-to-GDP falling 25% as it cures bailout proceeds from the 2009 default and Oman was upgraded to BB+ by Fitch as the highest among the three rating agencies. Finally, India’s inclusion in GBI-EM indices was announced and Indian rupee bonds will be included in the index from June 2024.

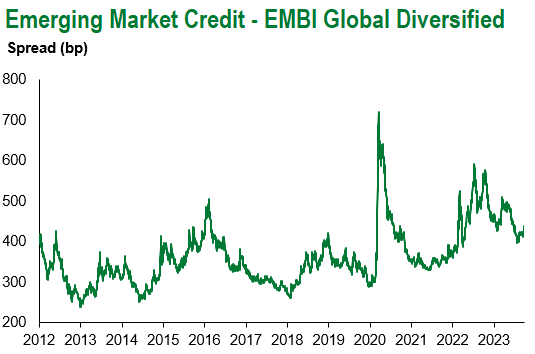

EM Credit Update

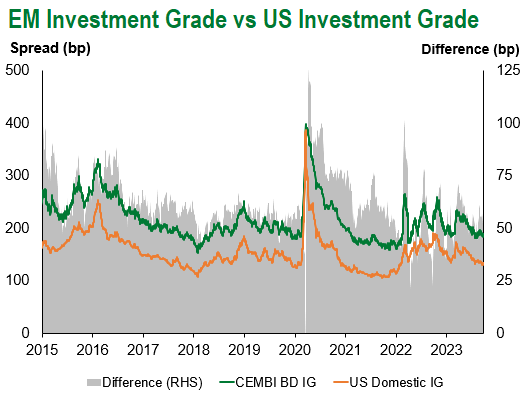

Emerging market sovereign credit (cash bonds) ended the week down 1.6% with credit spreads 16bps wider. Sovereign outperformers were Sri Lanka, Suriname and Papua New Guinea, while Zambia, Argentina and Tunisia underperformed. The broader theme over the week was higher-for-longer, and in particular, the weakness in core rates from European Government Bonds and UK Gilts. For EM investors, the new development was CDS indices with tranches in EM investment grade and EM high yield for the first time.

The Week Ahead

We begin the weekend with some angst over a U.S. Government shutdown and look toward Nobel Prize announcements and the FTX co-founders fraud trial. In between those events, U.S. payrolls and JOLTS data are important for global macro. Chinese PMIs also fall over the weekend, just as the Ryder Cup intensifies in Rome. Key central bank decisions are due from the Reserve Bank of Australia as well as the Reserve Bank of New Zealand, along with EM interest rate decisions from India (6.5%), Peru (7.5%), Poland (6.0%), Romania (7.0%) and Sri Lanka (11.0%). We would expect Poland to cut rates ahead of the election on October 15th. Finally, Turkish inflation is expected to rise to over 60%, which is in line with the Central Bank’s forecasts.

Highlights from emerging markets discussed below: Markets misread comments on debt relief for emerging markets from President Ruto of Kenya, Ghana’s Central Bank hits the brakes on policy tightening, and Thailand’s Central Bank delivers another 25bps hike, likely the last in the current cycle.

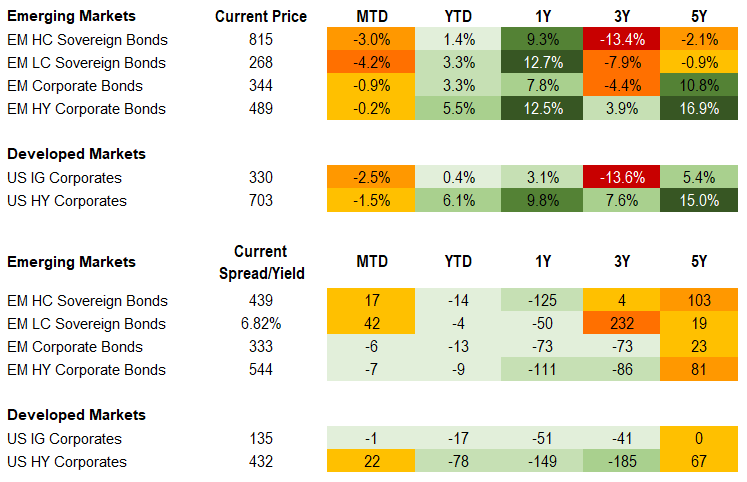

Fixed Income

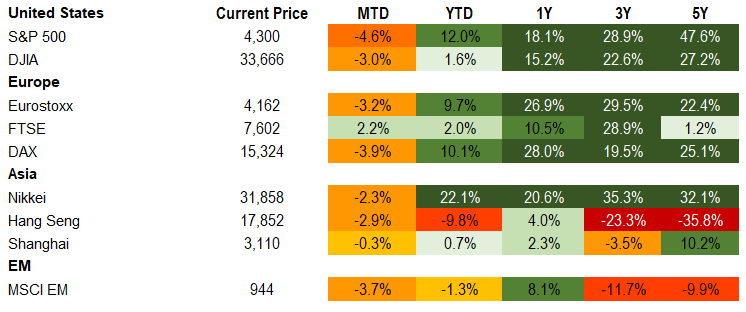

Equities

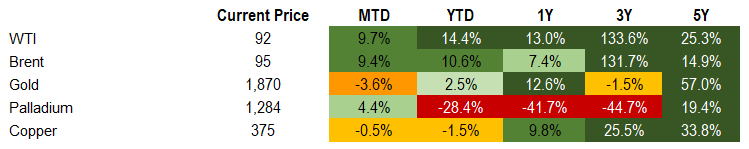

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of September 29, 2023 (mid-afternoon).

Emerging Markets Weekly Highlights

Markets misread comments on debt relief for emerging markets from President Ruto of Kenya

Event: In remarks during the UN General Assembly in New York, Kenya’s President, William Ruto, criticized the existing sovereign debt restructuring architecture and called for a new streamlined approach by multilateral and bilateral creditors on providing debt relief for poor nations.

Gramercy commentary: The Kenya sovereign bond complex underperformed following Ruto’s call for a new debt framework for highly indebted poor countries, which in our opinion reflects markets misreading his comments or lacking the proper context. We do not think Ruto’s intention was to send a signal that Kenyan authorities might be reconsidering their position that they intend to continue repaying external debt obligations on time and in full. Rather, they reflect a prudent attempt by Ruto to capitalize on international momentum behind issues such as climate change and combating deeply rooted social issues plaguing Africa and to position himself and Kenya as the continent’s “spokesperson” in front of the global community. Amid lack of market access, markets have been concerned about Nairobi’s ability to refinance its next large Eurobond maturity of $2bn that comes due in June 2024. However, in order to meet their upcoming external liquidity needs, we expect the authorities to use a combination of syndicated bank borrowing, additional multilateral funds, and, if necessary, existing FX reserves. Remarks by Central Bank Governor Kamau Thugge on the authorities’ preparedness to use FX reserves for external bond repayment confirms this and attests to a strong willingness to repay, but also contradicts the market’s reaction to President Ruto’s comments in our view.

Ghana’s Central Bank hits the brakes on policy tightening

Event: Ghana’s Central Bank paused its steepest ever rate hike cycle at 30% but gave guidance that it stands ready to resume tightening if the inflation outlook worsens.

Gramercy commentary: With annual inflation finally on a downward trajectory and an improved medium-term outlook, the Ghanaian authorities felt the appropriate moment for pausing monetary tightening has come. Real interest rates remain in negative territory, but the currency has remained stable recently with support from the IMF and other international partners, which should support deflation dynamics in the coming months. Importantly, the end of the monetary tightening cycle should also provide welcome respite to the local private sector and households that have struggled with the aggressive tightening of financing conditions in the economy. This being said, we expect the Central Bank to remain vigilant for renewed upside risks to inflation in the context of higher energy prices or utility tariffs.

Thailand’s Central Bank delivers another 25bps hike, likely the last in the current cycle

Event: The Bank of Thailand’s Monetary Policy Committee voted unanimously to raise the policy rate to 2.50%, delivering the eighth straight quarter point increase since August 2022 and signaled that rates are unlikely to go higher.

Gramercy commentary: Amid a challenging global macro backdrop and upcoming significant fiscal stimulus by Thailand’s new Administration, we think the authorities preferred to err on side of caution and deliver a final rate hike in this cycle to strongly anchor inflation expectations. Already solid economic momentum is expected to get a further boost from a raft of stimulus measures to the tune of 560 Bn baht ($15.3 Bn) planned by Prime Minister Srettha Thavisin’s Administration to spur growth ranging from cash handouts to energy subsidies. Looking ahead, the Central Bank’s stance should help keep inflation expectations anchored, considering the fiscal stimulus and wage hikes ahead.

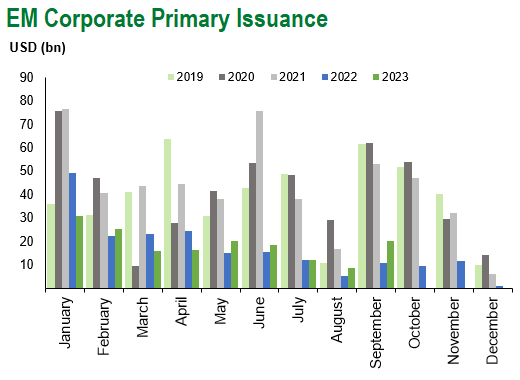

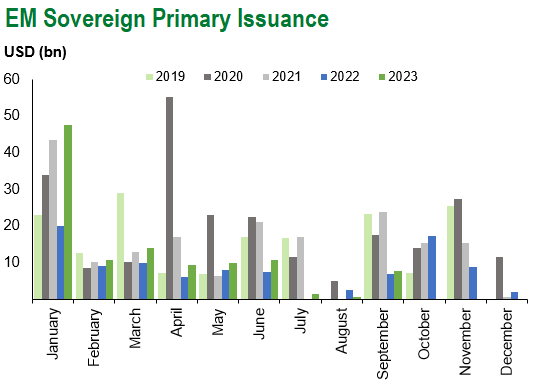

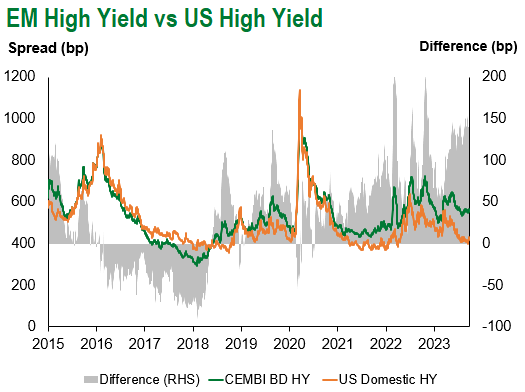

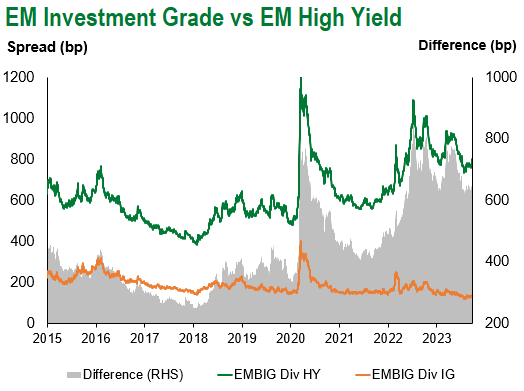

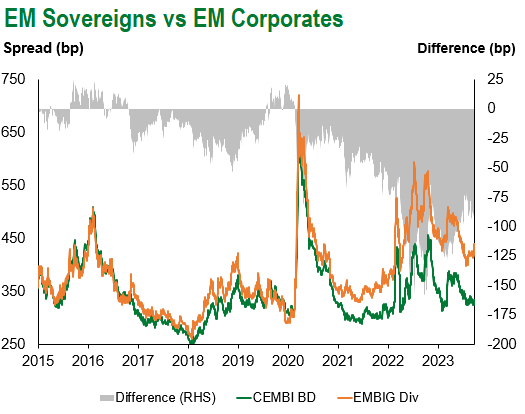

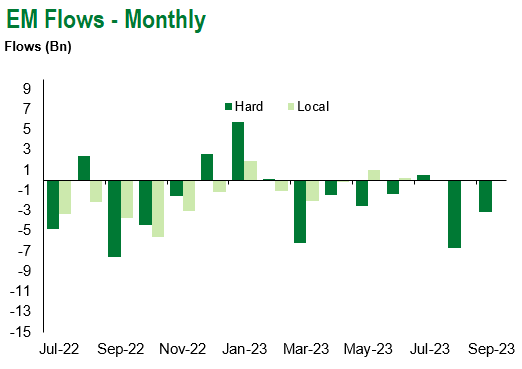

Emerging Markets Technicals

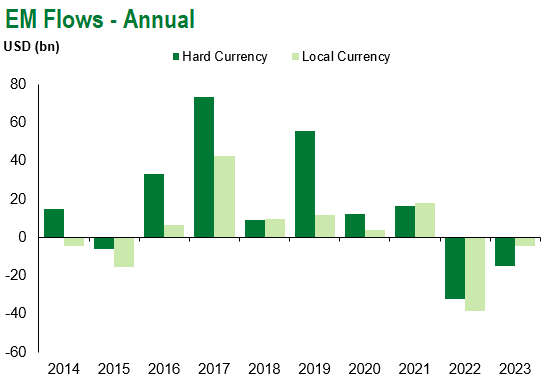

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of September 29, 2023.

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.