Contents

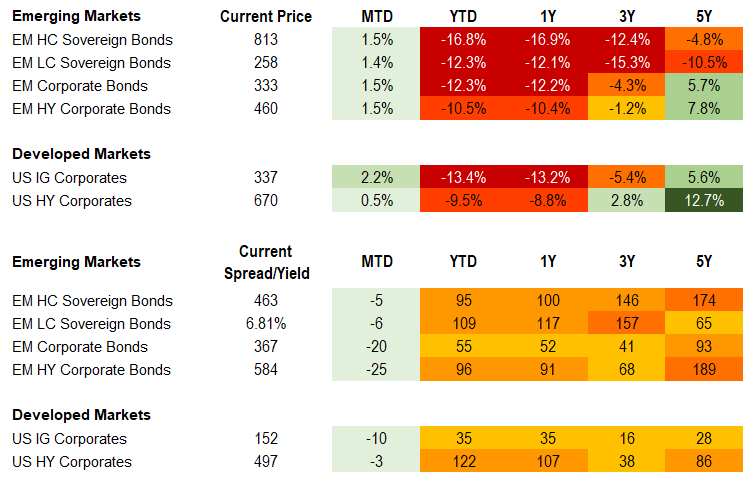

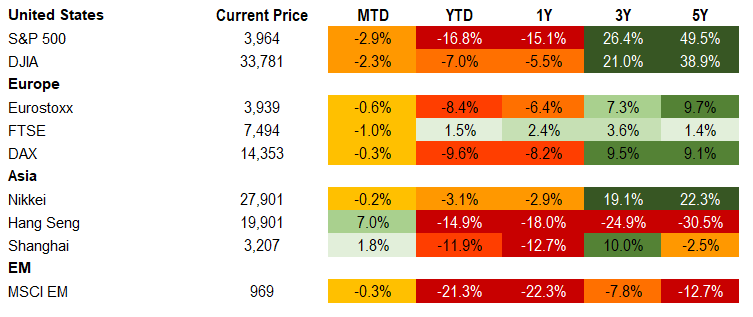

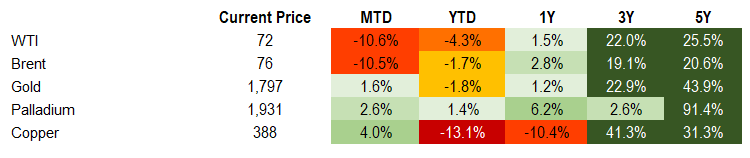

Market Overview

Macro Review

China is reopening. China’s trade data may well have weakened to levels not seen since the beginning of the pandemic, but it was largely ignored. Instead, the country’s relaxation of COVID-19 measures was center stage. This was also anticipated and reflected a clear buy-the-rumor-sell-the-fact, but the narrative was soon replaced with global recessionary pressures. One is hard-pressed to use the U.S. as a case study. The Atlanta GDPNow for 4Q rose to 3.4% from 2.8% and unemployment is forecast to only rise to 5.5% next year, but 3Q productivity did decline with a fall in unit labor costs. The latter is what drove U.S. Treasuries to rally 11bps on Wednesday, although rates were largely flat on the week. Commodities still paint a different picture. Crude oil has now erased all gains in 2022, after falling 11% this week or down 23% from the November peak. The news-flow is not much better in Europe either as construction PMIs were miserable, German industrial production is still contracting and UK house prices fell at the fastest rate since 2008. The German bund curve on a 2s/10s basis is now the most inverted it has been since 1992, just as the U.S. Treasury curve is the most inverted it has been since 1981. Inflation may be showing strong signs of peaking in emerging markets (even in Turkey), but we are yet to see a growth shock. Needless to say, the disinflationary trends across emerging markets were never expected to be uniform. Chile is the latest country to document a higher-than-expected CPI release, yet the Central Bank is expected to be the first emerging markets central bank to cut rates in 2023. CLP was actually the EMFX outperformer this week. The BCCh had hiked eleven consecutive times prior to holding rates unchanged this week. Indeed, FRA swaps are pricing in 85-90bps in 1Q alone. Hungary also recorded higher CPI inflation, but it will be more nuanced in coming months. The fiscal decision to remove gasoline price caps now risks inflation heading substantially higher and weighing on FX. Hungary’s energy crisis and fuel shortages are increasingly putting PM Orban on an awkward path with the EU, especially as the €7.5bn funds were postponed this week. India slowed the pace of hikes to just 35bps after three 50bps intervals, with inflation expected to slow to 6.8% next year. Meanwhile, Peru’s Castillo was impeached before he fled, only to be arrested as he was caught in heavy traffic while headed to the Mexican Embassy in Lima.

EM Credit Update

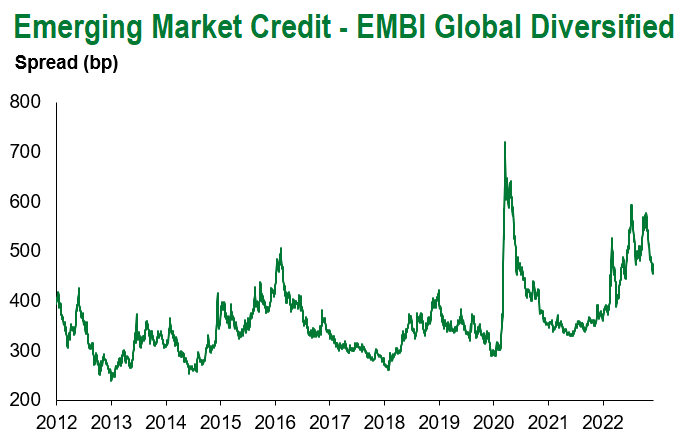

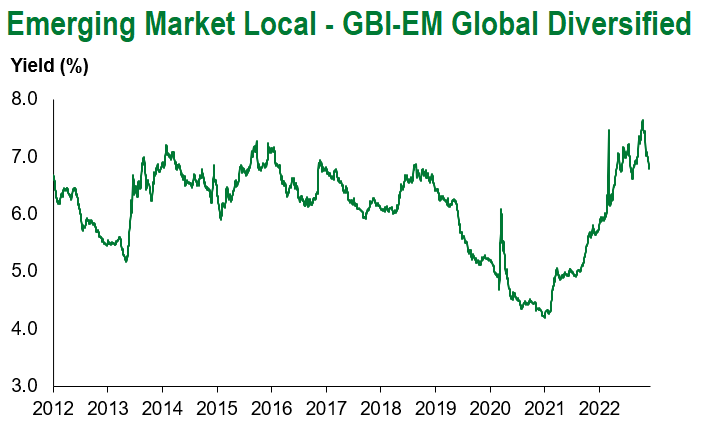

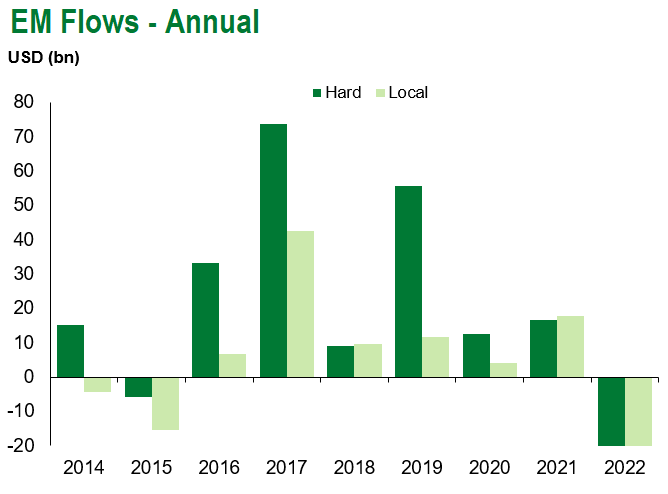

Emerging market sovereign credit (cash bonds) ended the week +0.1% with spreads 12bps tighter. Sovereign outperformers over the week were Zambia, Tajikistan and Iraq, while Sri Lanka, Pakistan and Ghana underperformed. Inflows into emerging market credit are now into the fourth consecutive week, which helps the year-end technicals. JP Morgan has forecast inflows in 2023 of $23bn, which marks a strong turnaround after $33bn in outflows this year. Finally, the idea of U.S. curves inverting comes just as the U.S. Treasury 10s/30s turned negative again this week, but emerging market curves are notably steep. The emerging market sovereign 10s/30s curve is currently 80bps, while the emerging market corporate 10s/30s curve is 90bps as both widened in November and thus far this month offering value into 2023.

The Week Ahead

Key interest rate decisions are coming up next week from the ECB, Fed and BOE. Chinese retail sales, industrial production and fixed asset investment data stands out, along with the 1-year MLF rates decision (2.75%). Other emerging market rate decisions include Colombia (11.0%), Costa Rica (9.0%), Mexico (10.0%), Philippines (5.0%) and Russia (7.5%). There will also be inflation releases out of Czech Republic, Hungary, Nigeria, Panama, Poland, Romania, and South Africa. Finally, the most imminent data release is Turkey’s current account deficit which will be reported on Monday with an inevitable focus on net errors and omissions.

Highlights from emerging markets discussed below: Peru Congress impeached Pedro Castillo; VP Dina Boluarte sworn in as new President; Ghana announced a local debt exchange while the IMF visit is ongoing; and the Chinese government announced several measures to support the property sector.

Fixed Income

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of December 9, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Peru Congress impeached Pedro Castillo; VP Dina Boluarte sworn in as new President

Event: Former President Castillo attempted to unconstitutionally dissolve Congress which was followed by a successful impeachment vote against him with 101 votes (87 were needed). The Vice President under Castillo, Dina Boluarte, has been sworn in as the new President. At the time of writing, the composition of the new cabinet is unknown. The market reaction has been relatively benign following some initial weakness on the view that governability should be similar or marginally better under Boluarte.

Gramercy commentary: The eventual removal of Castillo was largely anticipated with only growing momentum for his ouster since his inauguration last year. We see President Dina Boluarte as a similar leader to Castillo with a leftist ideology and separation from the radicals, most notably Vladimir Cerron. A key issue for markets will be the cabinet composition and the Ministry of Economy and Finance (MEF). If the MEF is led by another technocrat like Kurt Burneo or Oscar Graham and Prime Minister and cabinet appointments are generally acceptable to Congress, then the market reaction should be neutral to positive. In contrast, if Boluarte puts the MEF in the hands of an unknown/ideological individual or selects a Prime Minister who is unacceptable to Congress, market and political pressure may ensue. In the event Boluarte faces similar challenges to Castillo and leaves office, then new elections would be called where we see prospects for a repeat of the 2021 election with a wide range of candidates and prospects for outsiders.

Ghana announced a local debt exchange while the IMF visit is ongoing

Event: The government proposed a conversion of the local government bonds into four new issuances maturing in 2027, 2029, 2032, and 2037 with 0% interest in 2023, 5% in 2024, and 10% from 2025 paid semi-annually. The offer is set to close on December 19th with the option to extend to January 3rd. Over two thirds of the exposure sits with local banks and non-bank financial institutions. Pension funds, which hold just over 5% of the bonds, have openly rejected the offer. A $1bn fund is reportedly set to be launched to provide support to locally impacted institutions while the RRR has been lowered 200bps in an attempt to improve liquidity in the interim. Meanwhile, an IMF mission is ongoing in Accra and set to conclude next week.

Gramercy commentary: We see the proposal as constructive as it is a key component to the overall debt sustainability and credit recovery. The interest moratorium provides about 2% of GDP savings next year while savings through 2025 are estimated at over 12% of GDP. Additionally, the 2023 budget, which entails a 0.7% of GDP primary surplus, growth of 2.8%, and FX reserve cover of just over three months of imports, should be in the ballpark of the IMF’s desired adjustments with room for a greater push on expenditure reduction. While the pushback from domestic pensions may drag the local restructuring into 2023 with some adjustments, we think it will ultimately be successful. We believe a staff level IMF agreement is likely to happen by 1Q23, if not sooner, with a proposal for external bondholders likely imminent. In our base case, we see a restructuring outcome in 2023 above current prices and well-anchored with multilateral and regional support.

The Chinese government announced several measures to support the Property Sector

Event: In recent weeks, there was more positive news on the policy front after the 20th National Congress of the Chinese Communist Party, which concluded on the 22nd of October 2022, as the Chinese government has shown its support for and its focus on the sector and economy. A number of supportive policies have been introduced including: (1) the gradually easing of COVID-19 policies (e.g. quarantine was cut from 10 days to eight days for inbound travelers together with clear instructions for local governments to have targeted measures that balance livelihood with lives); (2) a package of 16 supporting measures for the property sector which are mostly focused on improving the financing channels of the sector were introduced (e.g. trust lenders were encouraged to lend to the sector and banks were encouraged to lend to construction companies); (3) the government has given clear instructions to local governments to start to loosen the escrow account rules; (4) the People’s Bank of China (PBOC) has been offering another CNY200bn (~USD 28.1bn) in new loan quotas at almost no cost to commercial banks to encourage lending to developers that have delayed delivery of homes (the first batch of CNY200bn was offered in August 2022); (5) the government has been instructing the six largest commercial banks in China to lend CNY1.3tn (~USD 180bn) to 17 property developers; (6) the government has reopened the onshore A-share equity financing channel which was closed for years to help support the property developers; and (7) the Chinese government has instructed its four largest state banks to lend offshore to higher quality property developers with onshore assets as collateral.

Gramercy commentary: We see these policy changes as constructive which confirms our thesis. Investor sentiment has improved in recent weeks, and we believe these measures will contribute to a gradual stabilization of the sector and improvement of home sales in the medium-term. Near-term positive catalysts include a gradual improvement in home sales after summer 2023 and more in 2024E, in addition to an expected improvement in the regulatory environment following the two sessions planned in March 2023 where the Chinese government will further support the property sector. We are also upbeat on further COVID-19 policy easing and improving financing conditions. In turn, we expect restructuring proposals from developers such as Evergrande, Logan, Sunac, Shimao and others, which may provide comfort to the market and trigger other developers to move forward.

Emerging Markets Technicals

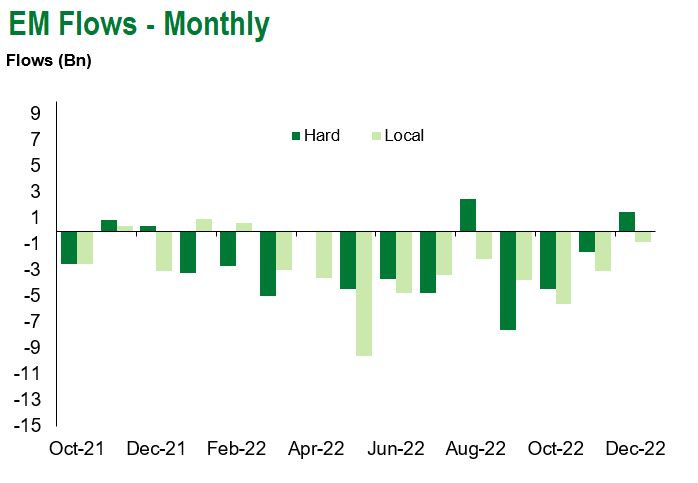

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of December 9, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.