Contents

Market Overview

Macro Review

This week, all eyes were on the FOMC meeting and Chair Powell’s press conference following the Fed’s decision to hike the policy rate by 75bps to 4.0%, the fourth consecutive increase of this magnitude. The decision was widely expected by markets but Powell’s message was mixed in terms of the outlook for U.S. monetary policy: he appeared to signal that the pace of Fed tightening could slow down in coming months (to 50bps from 75bps), but that the “ultimate level of interest rates could be higher than previously expected”, depending on how macroeconomic data evolves. In that context, data on the U.S. labor market released on Friday revealed that the rate of job creation continued to slow, but the U.S. still added 261,000 jobs in October, which was much better than expected. Meanwhile, average hourly earnings were also firmer, suggesting ongoing inflation pressures from the jobs market. On the flipside, the ISM services employment component suggested a slowdown in hiring momentum. As such, in a dynamic and often quite contradictory data environment, whether the Fed would be downshifting the pace of tightening in December appears likely to remain an open question for markets in the coming weeks. Meanwhile, Eurozone Q3 GDP growth and October inflation data surprised to the upside, suggesting that it is probably too early for the ECB to make a dovish pivot either. The week ended on a more upbeat tone as rumors intensified around potential earlier than expected recalibration of China’s “zero-COVID” policies, driving market optimism about a stronger pickup in Chinese economic activity next year.

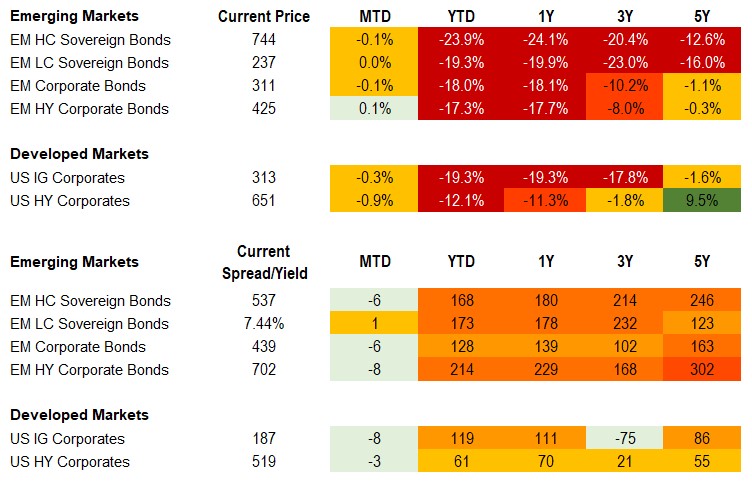

EM Credit Update

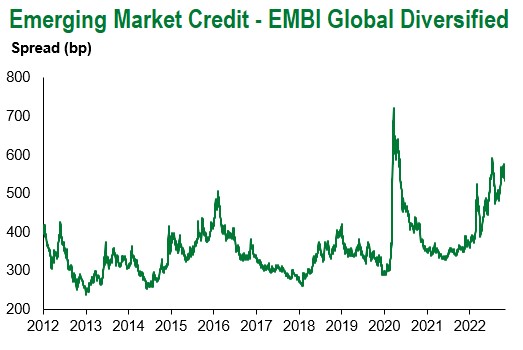

After delivering strong returns last week, emerging market sovereign credit (cash bonds) ended the week 0.5% lower with spreads virtually unchanged. EM corporate credit was 0.2% lower with spreads 8bps tighter. Sovereign outperformers over the week were Ethiopia, Ghana and El Salvador while Sri Lanka, Ukraine and Pakistan underperformed.

The Week Ahead

The main predicament for global investors at the moment is whether or not the Fed will be in a position to slow the pace of rate hikes in December. As such, the key U.S. data release next week will be month-on-month core CPI on Thursday. Beyond economic data releases, markets will also be focused on the U.S. mid-term elections on Tuesday and implications for the policy outlook in Washington, DC. In Asia, trade data from China and Taiwan will be published that may indicate slowing global trade. EM central bank meetings next week will be held in Poland, Romania, Mexico and Peru. In all four cases, the market consensus expects further rate hikes, but some of the central banks may signal a reduction in the pace of tightening going forward.

Highlights from emerging markets discussed below: Lula elected President of Brazil in a very close runoff against Bolsonaro

Fixed Income

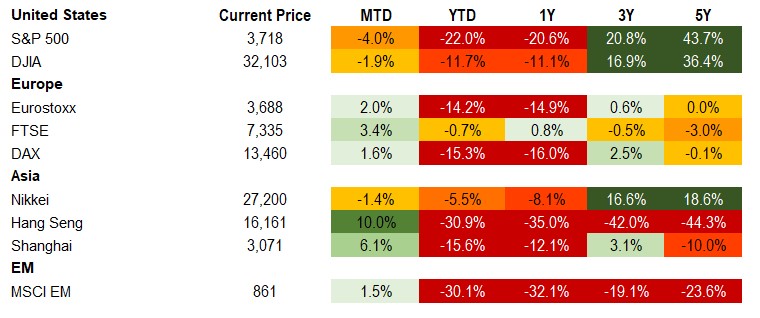

Equities

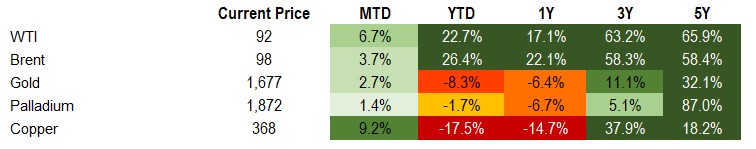

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of November 4, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Lula elected President of Brazil in a very close runoff against Bolsonaro

Event: In the tightest Presidential Election race since the restoration of democracy in Brazil in the 1980s, left-wing former President Luiz Inacio Lula da Siva narrowly edged right-wing incumbent Jair Bolsonaro with 50.9% vs 49.1%. Lula prevailed in the runoff with a margin of just over 2 million votes (60.3mn vs 58.2mn) and each candidate won 13 of Brazil’s 26 states, further illustrating the tightness of the elections. At the time of writing, Bolsonaro has not formally conceded defeat, but ordered the transition process to begin and vowed to act in accordance with Brazil’s constitution.

Gramercy commentary: We see Bolsonaro’s statement as a major step toward the peaceful transition of power to Lula, who is set to take over the Presidency on January 1, 2023. We think that a meaningful institutional crisis in Brazil is highly unlikely despite ongoing protests by Bolsonaro supporters. With election uncertainty now out of the way, in coming weeks the market focus shifts to Lula’s cabinet nominations, more specifically his economic team. Investors will also be looking for signals on the path of economic policy in general and fiscal policy in particular. Consultations have already started, and Vice President-Elect Geraldo Alckmin was confirmed as the coordinator of the transition cabinet. Alckmin is an experienced politician from the political center, so his confirmation as a leading figure in the cabinet formation process is a constructive signal from a market perspective. Investors will be particularly interested in Lula’s pick for Economy Minister given Brazil’s relatively tight fiscal space and concerns that a left-leaning Administration would have a bias toward expanding fiscal spending. As such, the appointment of a credible economic team would be a signal that fiscal sustainability will be maintained. We expect that economic policy in the early stages of the incoming Lula Administration will be characterized by a moderate/centrist approach that would be welcomed by markets. Lula’s track record indicates that he is a pragmatic politician who would appreciate that the space for increasing taxes in Brazil is limited, which means aggressively boosting public spending would come at the cost of fueling concerns about public finances. We believe this is something that the new Administration would like to avoid. Furthermore, Brazil’s newly elected Congress has the most conservative composition in the last twenty years, which is likely to also catalyze policy moderation. A centrist Congress gives us comfort that a material shift in the economic policy framework is unlikely to occur under Lula’s third term in office as Brazil’s President.

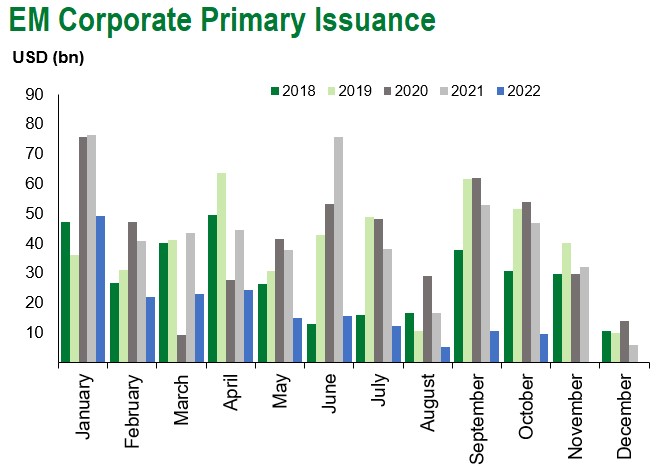

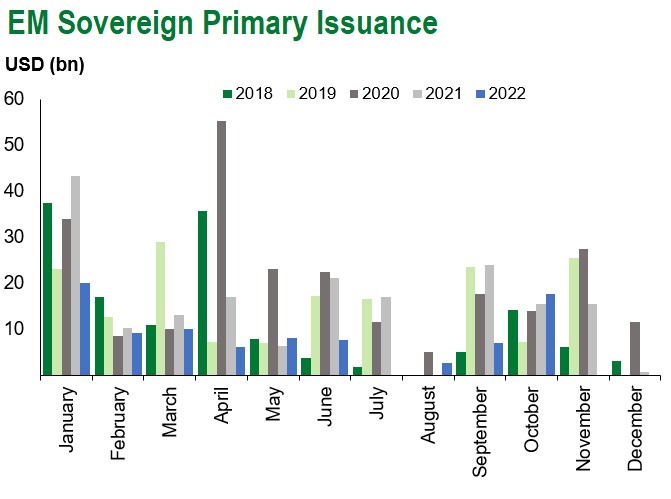

Emerging Markets Technicals

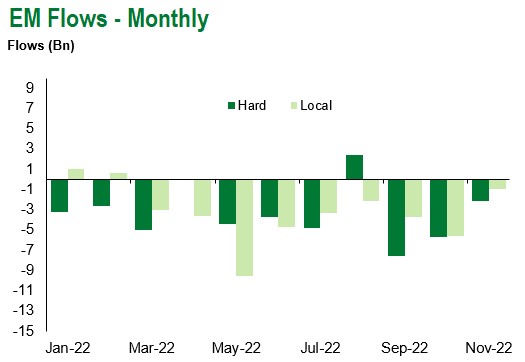

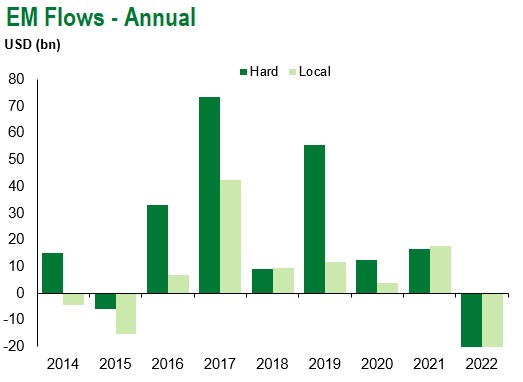

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of November 4, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.