Contents

Market Overview

Macro Review

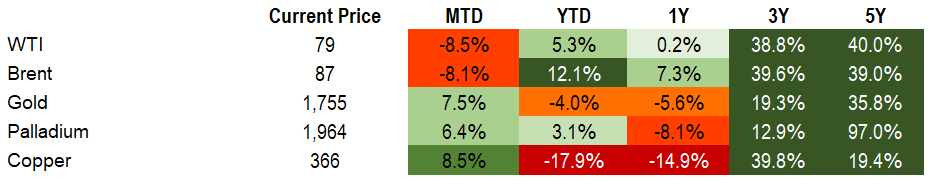

Cryptocurrencies stabilized while oil destabilized. Enron may well have been blamed for falsifying accounts, but now FTX is blamed for simply not keeping accounts. The move in oil also caused alarm with WTI falling over 10% this week. Then came UK inflation which further emphasized the diverging path with the U.S. The larger focus was on the UK’s Autumn Statement with higher taxes and public sector cuts, while the Chancellor of Exchequer noted that the UK was already in a recession. The UK’s budget watchdog also stated that in the absence of the energy price guarantee, inflation would have peaked at 13.6% rather than 11.1% (the actual reading). The same inflationary feature was consistent with the Czech Republic. Elsewhere, China’s domestic activity softened as retail sales, industrial production, and investments underwhelmed. Despite this, China’s property sector was a buoy. Beijing’s sixteen-point plan appeared to act as a policy-put and the rally intensified over the week. Country Garden’s equity doubled with its bond prices tripling. Whichever way one looks, the recession narrative is becoming louder. Japan’s 3Q GDP growth unexpectedly shrank 1.2%. But there were two EM exceptions this week: Colombia’s 3Q GDP growth of 7.0% was resilient while Poland’s 3.5% growth was positive, although this was overshadowed by geopolitics. Hungary’s GDP fits the narrative more clearly with 3Q GDP growth of -0.4% but again the focus is around whether the EU will approve concessional funding on Tuesday. The starker example is out of LATAM with Chile close to entering a technical recession after their 3Q GDP shrank 1.2% when 2Q was 0%. Finally, Brazil’s fiscal loosening risks repeating what we saw out of the UK in September, although risk markets did retrace the weaker price levels on Friday.

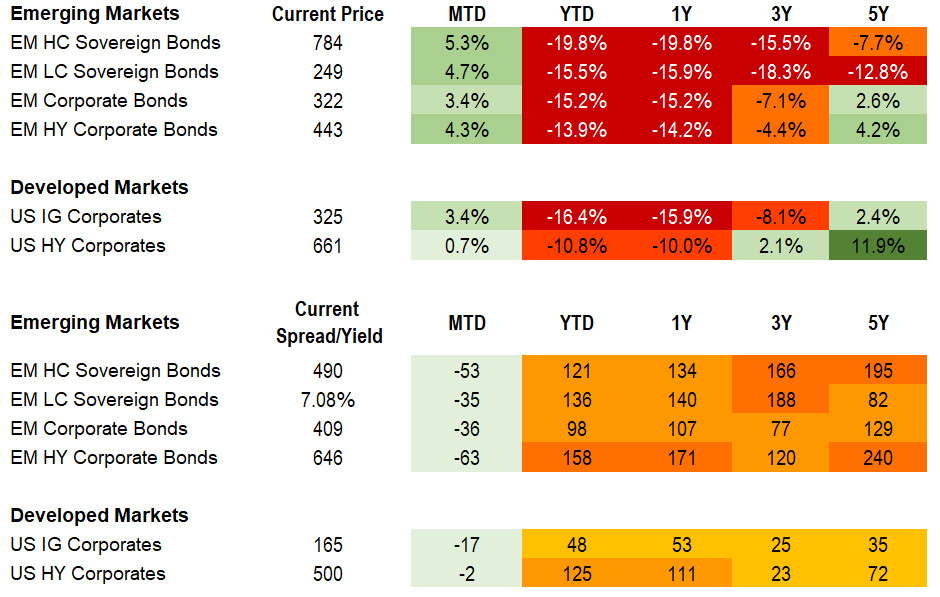

EM Credit Update

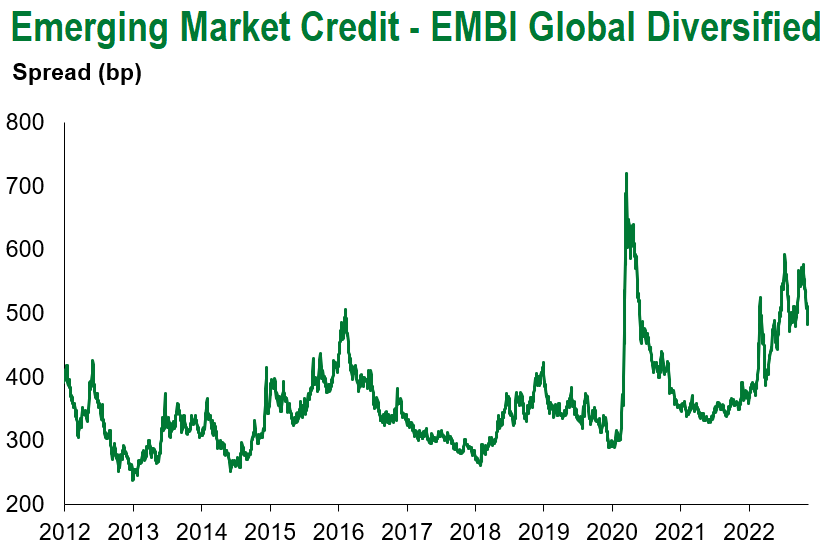

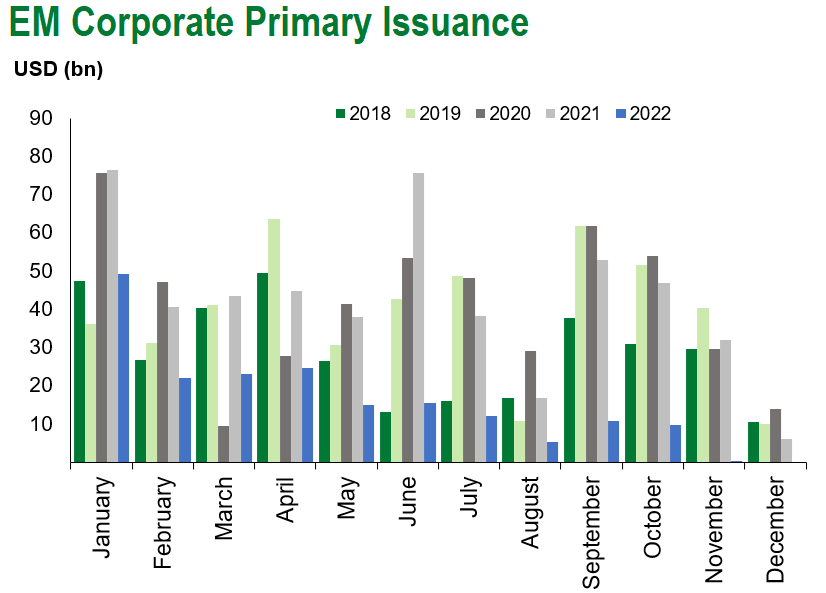

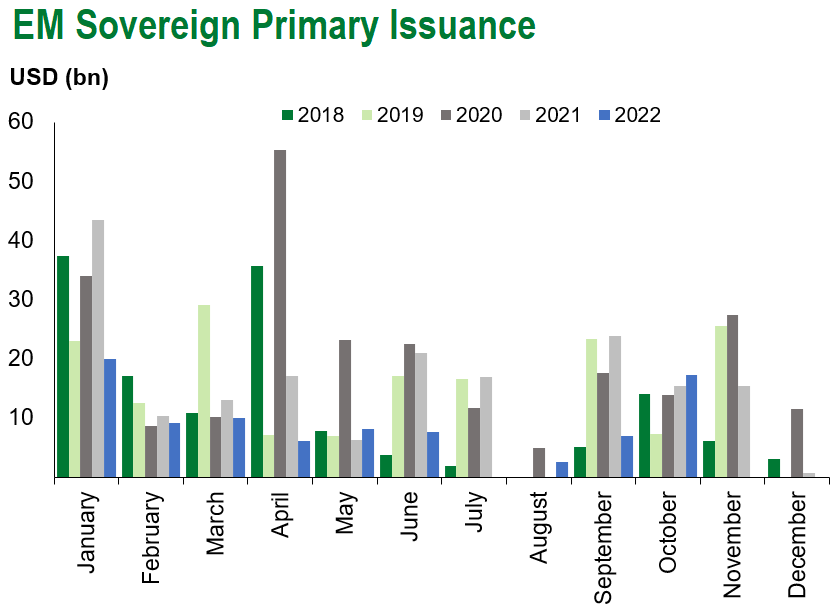

Emerging market sovereign credit (cash bonds) ended the week +1.8% with spreads 21bps tighter. Outperformers over the week were Sri Lanka, Zambia and Ghana, while El Salvador and Angola underperformed. The post-CPI rally continued and with the market strength, the primary issuance market re-opened for low beta financials.

The Week Ahead

Next week will be dominated by the FIFA World Cup, Thanksgiving and Black Friday sales. Aside from that, we’ll be blessed with FOMC minutes. Within G10 rates, the Reserve Bank of New Zealand, Riksbank, Bank of Israel and Bank of Korea will update policy rates. Within EM, there is a Colombian monthly board meeting, but no policy decision is scheduled, followed by China’s one-year (3.65%) and five-year (4.30%) LPR rate decisions. Then, after Chile’s surprise GDP growth to the downside, Peru will publish its 3Q response and Brazil will offer a mid-monthly inflation update. Finally, Malaysia will head to the polls to pick its fourth prime minister in a mere four years, where the opposition candidate is polling well.

Highlights from emerging markets discussed below: China refined COVID regulations and deepened real estate policy support; uncontentious Biden-Xi meeting at G20; Lula’s transition team signals larger-than-expected fiscal spending plans; Deadly blast in Istanbul could have meaningful medium-term credit implications.

Fixed Income

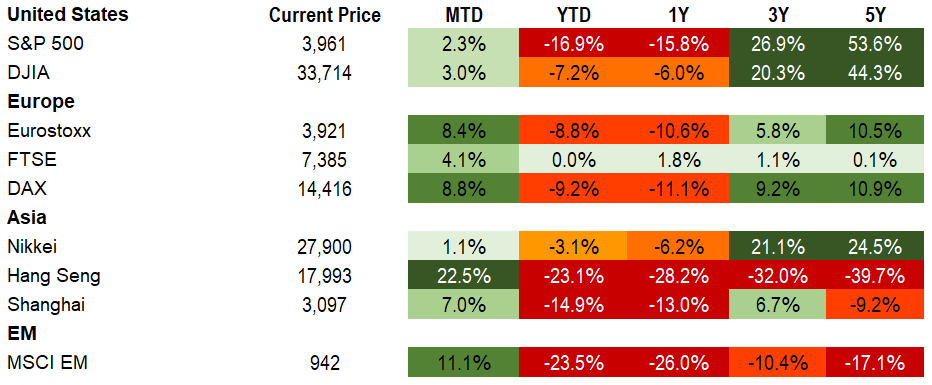

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of November 18, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

China refined COVID regulations and deepened real estate policy support; uncontentious Biden-Xi meeting at G20

Event: Last week, authorities reduced quarantine requirements for close contacts and inbound travelers, enhanced targeted mobility restrictions, laid groundwork for vaccination acceleration, and increased COVID-related medical capacities amid rising cases. These measures were followed by a deepening of largely existing policy support for the real estate sector including the extension of developer loans for up to one year, stabilization of financing from asset management products, issuance of special loans for guaranteed buildings to accelerate completion of overdue projects, support for M&A of stranded projects, and extended time for banks to reduce exposure to the sector. On Monday, Biden and Xi met at the sidelines of the G20 where both aimed to cool surface level tensions, agreeing to resume bilateral meetings on climate and addressing global health and hunger concerns but maintained stern positions on Taiwan and other security related matters.

Gramercy commentary: We see the incremental zero COVID policy relief and the real estate measures as constructive. Further, the measures are in line with our expectation for a window for such actions after the conclusion of the Party Congress and a needed bridge to manage growth and liquidity conditions through the winter. While they are unlikely to have an immediate material effect on activity and the property market recovery, we think the policies should help limit default pressures in the coming months and represent a more material loosening of policy than witnessed thus far this year. Our base case remains for continued adjustment of COVID related measures to set the stage for a more meaningful evolution in 2023 upon improved seasonal and vaccination dynamics. At the same time, we see room for a broadening of the response to the property sector and a more material pick-up in sales as next year progresses.

Lula’s transition team signals larger-than-expected fiscal spending plans

Event: The transition team of Brazil’s President-Elect Lula presented an initial proposal for a constitutional amendment (PEC) that calls for the permanent removal of the Auxilio Brasil/Bolsa Familia welfare program from the spending cap. The cap serves as Brazil’s fiscal anchor that limits the federal spending growth to past inflation (i.e., ensures no increase in overall budget spending in real terms). A removal of the popular welfare program from the cap would free up as much as BRL175bn (~2% of GDP) for other expenditures.

Gramercy commentary: The amount of additional public sector spending envisaged by the initial draft proposal of Lula’s transition team is higher-than-expected by markets. Also, the increase in spending is not limited to next year, which, if implemented, could put significant pressure on Brazil’s already stretched fiscal framework over the incoming administration’s term. This contributed to a sell-off across Brazilian assets as investors reassess the fiscal policy outlook and a “pragmatic Lula” narrative that dominated the pre-election environment. Although we acknowledge that initial messaging on economic policy by the transition team has not been ideal from a market point of view, we are of the view that mounting pessimism about fiscal sustainability in Brazil seems premature. We expect some inevitable dilution of the initial proposal to happen during negotiations in Congress. More importantly, it is now, more than ever, all about the economic team. We think that the real signal amid all the noise about Lula’s fiscal intentions will emerge only when the new Finance Minister and their team is announced. As this week’s markets started to price a shift from “pragmatic Lula” to “populist Lula”, appointment of a credible economic team has the potential to deliver a significant credit-positive surprise.

Deadly blast in Istanbul could have meaningful medium-term credit implications

Event: A bomb blast on Istanbul’s busiest commercial street killed six and wounded dozens of people last Sunday. The authorities have blamed the attack on YPG, the U.S.-allied Kurdish militia group in Northern Syria that Turkey considers an affiliate of the Kurdistan Workers’ Party (PKK), the Kurdish militant political organization and armed guerrilla movement in Turkey. The PKK has denied involvement in the attack.

Gramercy commentary: The near-term credit implications for Turkey related to this tragic event are limited. However, medium-term credit implications could be significant. President Erdogan has already spoken about the possibility of Turkish security forces resuming cross-border operations in northern Syria and Iraq. Looking ahead to the main credit event on the horizon for Turkey, presidential and parliamentary elections due by June 2023, potential cross-border military activity may trigger concerns about postponing the elections on “national emergency” grounds. Furthermore, the attack has brought back to the surface lingering tensions between Turkey and its NATO allies, most notably the U.S. as the main YPG supporter, and could have repercussions for Ankara’s required approval of Sweden and Finland joining the alliance. Even more importantly from a market perspective, historically, when similar terrorist threats in Turkey appeared to be on the rise, increased domestic support for President Erdogan has followed, who has already been enjoying improving political momentum. Last but not least, exceptionally strong tourism activity in 2022 provided vital support to Turkey’s particularly challenging Balance of Payments (BoP) dynamics. A potential reversal in this trend on higher security risk perception by foreigners could also have material economic and social implications amid the pre-election environment in 1H23.

Emerging Markets Technicals

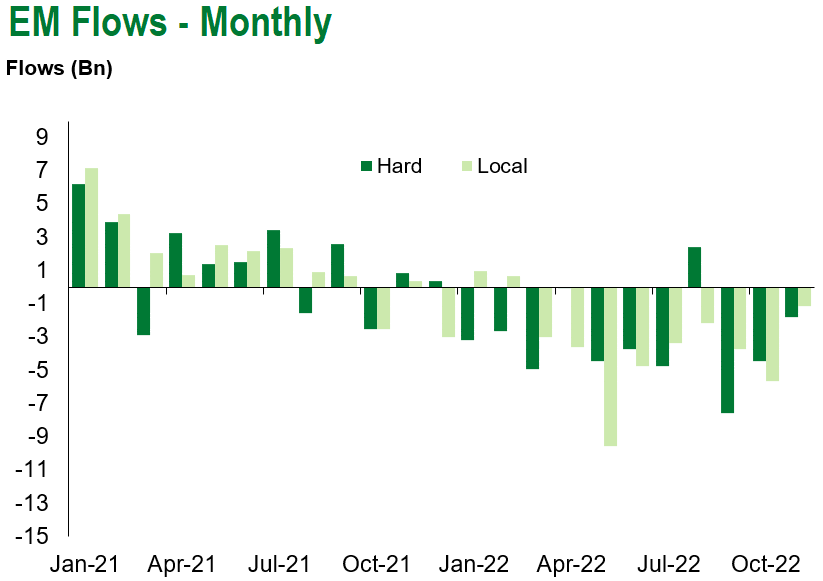

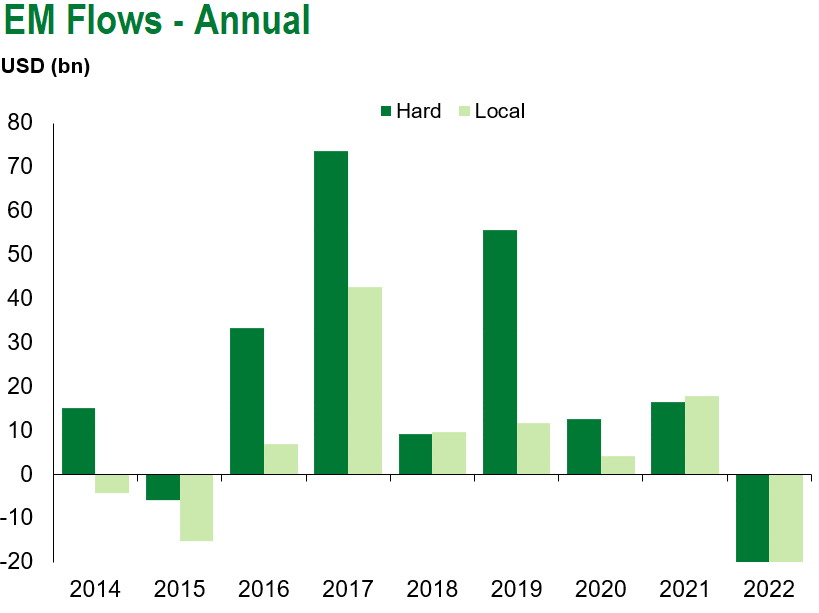

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of November 18, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. References to any indices are for informational and general comparative purposes only. The performance data of various indices mentioned in this update are updated and released on a periodic basis before finalization. The performance data of various indices presented herein was current as of the date of the presentation. Please refer to data returns of the separate indices if you desire additional or updated information. Indices are unmanaged, and their performance results do not reflect the impact of fees, expenses, or taxes that may be incurred through an investment with Gramercy. Returns for indices assume dividend reinvestment. An investment cannot be made directly in an index. Accordingly, comparing results shown to those of such indices may be of limited use. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.