Contents

Market Overview

Macro Review

U.S. inflation may prompt further FOMC action. Expectations are still for a 75 bp hike in two weeks, although some institutions have moved to a full 100 bp in tightening, even if the Fed’s Waller and Bullard regard 75 bps as adequate. The implications across global markets are more telling. Recession concerns have prompted renewed USD strength and could be validated by 2Q downward earning revisions, which is a view loosely echoed by Jamie Dimon. Weaker oil prices dominated, although planned maintenance of Nord Stream 1 saw natural gas futures tick higher and kept EUR under pressure. Deutsche Bank have been quick to forecast a German recession in 2023. Mario Draghi’s surprise resignation introduces further risks. In many respects there were a handful of symbolic moves this week. The Hungarian forint broke above 400, South African rand headed above 17, Chilean peso traded above 1000, Argentina’s blue-chip FX rate topped 300 and the Turkish lira breached 17.50. The depreciating trend in EMFX had become clearer against a strong USD as the DXY reached 109. Indeed, the euro broke through parity for the first time in two decades. The Reserve Bank of India responded in May with an emergency hike, the Philippines did so this week and the Chilean Central Bank announced an FX intervention tool of $25bn to defend the currency. Other developments this week include the National Bank of Poland revising the inflation outlook higher and expecting core to peak in 4Q (10.4%) and headline to peak in 1Q (18.8%). Chinese 2Q GDP disappointed at 0.4%, which weighed on NDIRS 5-year rates which rallied 14 bps this week, which was the largest weekly move this year. To top that off, the IMF cut the U.S. growth forecast for 2022 to 2.3% from 2.9%, whilst also lowering the 2023 forecast to 1.0% (from 1.7%).

EM Credit Update

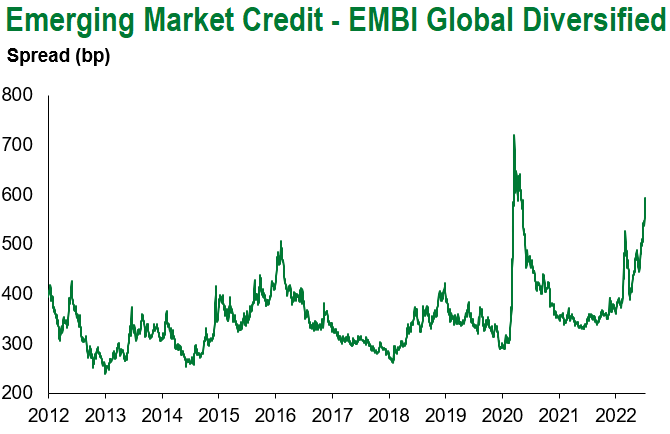

Emerging market sovereign credit ended the week down 2.6% with spreads 56 bps wider. Outperformers over the week were Poland, Vietnam and China while Ukraine, Sri Lanka and Zambia underperformed. After a volatile week, we note several key bond price moves: long bonds in Angola fell below 60cts, Kenya and Pakistan dipped below 50cts, Ecuador slumped to just under 40cts, El Salvador took a plunge to below 30cts and Ukraine ended the week with bond prices in the mid-teens (i.e. falling below 20cts). Finally, on Friday, Belarus officially defaulted on its 2027 notes as it failed to pay $22.9m in interest as the 30-day grace period expired.

The Week Ahead

The ECB decision next Thursday could result in rate lift-off for the first time since 2011. We also expect more details around the new Transmission Protection Mechanism, which is aimed at tempering fragmentation across the Eurozone. Prior to that, the European Union are set to unveil contingency plans should Russia choose not to resume gas flows from Nord Stream 1. The pipeline has been closed as part of a ten-day planned maintenance schedule but rallying natural gas futures suggest re-opening the pipeline is anything but a foregone conclusion. Within G10, focus will also be on the Bank of Japan given the fierce resistance to ending YCC, which caused impressive weakness in the yen. Aside from that, China’s 1-year and 5-year loan prime rate decisions are due and other updates will be coming out of Indonesia (3.5%), South Africa (4.75%), Russia (9.5%) and Ukraine (25.0%). Inflation releases will filter out across Hong Kong, Malaysia, Mexico, South Africa and Poland. Within DM equities, the theme is 2Q earnings after JPM, MS, Wells and Citi published results in the U.S. last week, however we can expect plenty more very shortly. Finally, the week will wrap-up with the Tour de France ending on the Champs-Elysees in Paris on Sunday.

Highlights from emerging markets discussed below include: The outlook for Sri Lanka’s sovereign debt restructuring hinges on resolution of the power vacuum after ousting of President Rajapaksa, Pakistan reaches a staff level IMF agreement on program resumption and China trade data is robust despite concerns of softening external demand as the housing crisis lingers.

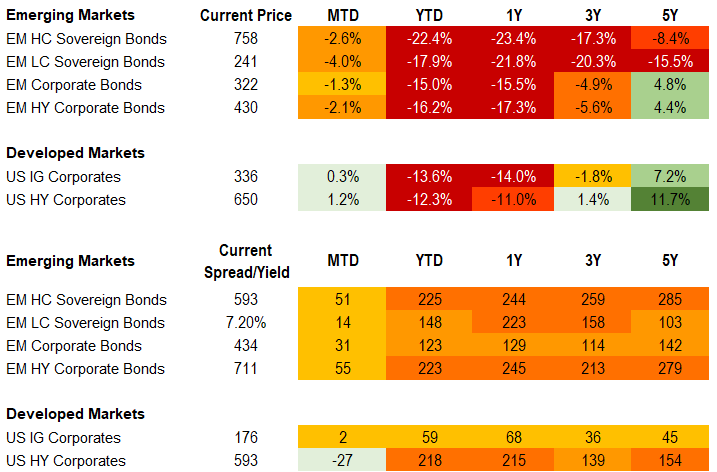

Fixed Income

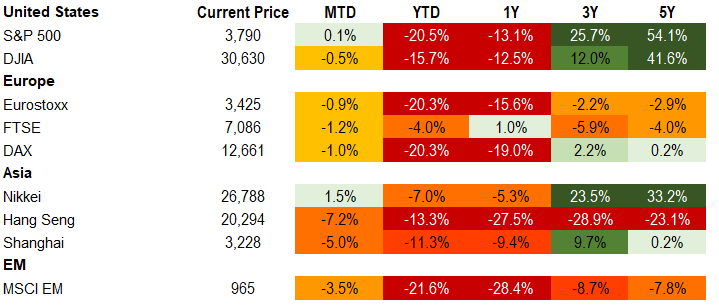

Equities

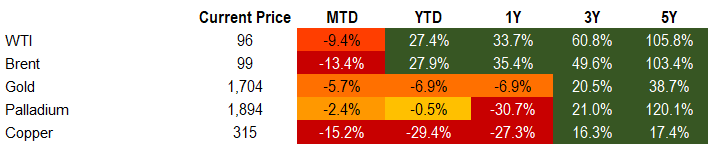

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of July 15, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Outlook for Sri Lanka’s sovereign debt restructuring hinges on resolution of power vacuum after ousting of President Rajapaksa

Event: Months of street protests against President Gotabaya Rajapaksa and his Administration amidst Sri Lanka’s worst economic crisis in modern history culminated in the storming of the presidential palace by an angry mob. After being forced to initially flee to an undisclosed location, the President and his closest entourage left the country shortly thereafter. On Thursday, Mr. Rajapaksa formally stepped down from the Presidency, submitting his resignation from Singapore.

Gramercy commentary: The dramatic events of the last few days have increased near-term political uncertainty in Sri Lanka as the country now faces a power vacuum, which piled additional downside pressure on an already deeply distressed sovereign bond complex. As such, the critical questions in front of investors now are how quickly a peaceful transition of power to a new interim government can be achieved and what the impact of the latest developments on ongoing negotiations with the IMF over a bailout program and creditors over public debt restructuring would be. As a first step toward de-escalation, Parliament will vote on a new interim president on July 20. While the exit of the Rajapaksa clan (including former Finance Minister, Basil Rajapaksa, the President’s brother) from power was the key demand of months-long anti-government protests, the political and economic situation in the country remains highly complex and challenging. We think that the former President’s departure provides an opening for a gradual fading of social unrest. In that context, an orderly and relatively quick political transition could set the stage for a more constructive medium-term outlook for Sri Lanka and the debt restructuring process. Of course, an improved medium-term narrative hinges on a new government that has the willingness and ability to continue negotiations over an IMF bailout package and commit to the required difficult economic adjustments amid a highly tense social environment.

Pakistan reaches staff level IMF agreement on program resumption

Event: The Government of Pakistan and the IMF reached a staff level agreement on the 7th and 8th reviews of its previously paused $6bn EFF program. Following Board approval, Pakistan is due to receive a $1.2bn disbursement. Additionally, the Fund is considering an extension of the facility, set to conclude in September of this year, to June 2023 as well as a $1bn upsizing.

Gramercy commentary: The development is constructive news following months of uncertainty amid political and market volatility. We expect Board approval to occur within the coming weeks, paving the way for the release of funds helping to cover the country’s external financing needs. We think the Fund could grant the extension particularly in the event of solid performance upon the next review. This will be a function of the willingness and ability of authorities to execute in the backdrop of tough political, economic, and social conditions, combined with the evolution of current external stressors.

China trade data robust despite concerns of softening external demand; housing crisis lingers

Event: Last month, exports grew 17.9% y/y compared to expectations of 12.5% y/y and May’s figure of 16.9%. Imports were softer than envisaged by the market and thus, delivered a robust trade surplus of $98bn; up $20bn relative to May. Meanwhile, rural bank runs and stopped mortgage repayments on at least 100 projects across 50 cities combined with an uptick in COVID cases kept concerns over activity elevated.

Gramercy commentary: In isolation, the solid trade figures are indicative of still resilient global demand and reflect constraints domestically amid ongoing zero COVID policies and property sector weakness. We see room for mild volatility in upcoming activity data depending on how current case evolution evolves, with mid and high risk COVID jurisdictions back to elevated levels, but ultimately see somewhat shallower activity troughs and lower peaks on input cost dynamics. As of now, the rural bank stress and mortgage repayment risk appears contained from a systemic perspective with only moderate macroeconomic impact aside from sentiment. We think authorities will try to manage in-line with the current policy approach of targeted supportive measures to limit economic fallout and shore-up confidence, but we acknowledge the elevated uncertainty and complexities of fine tuning a crisis.

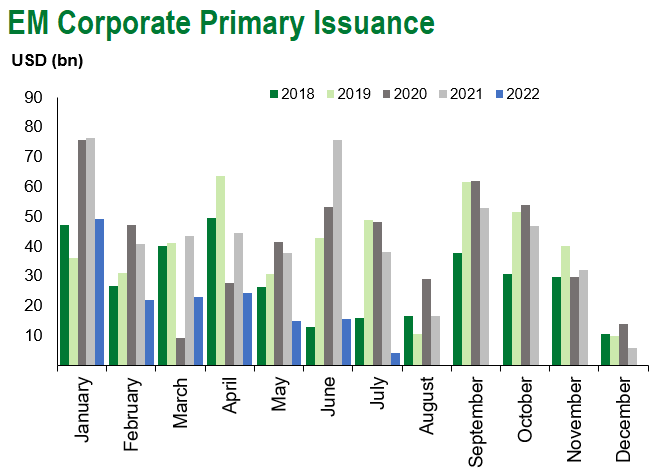

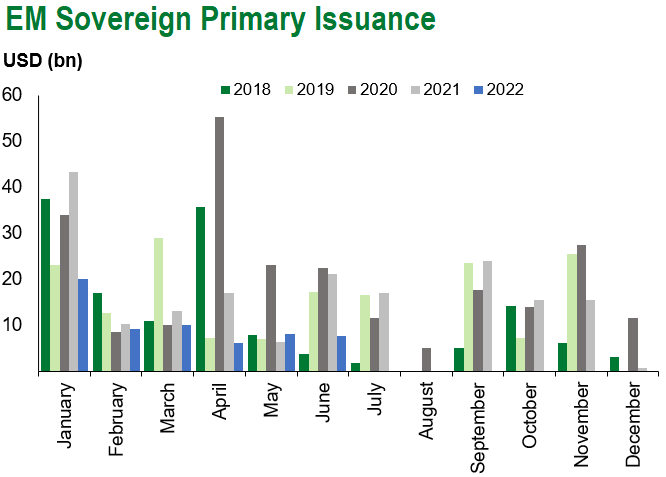

Emerging Markets Technicals

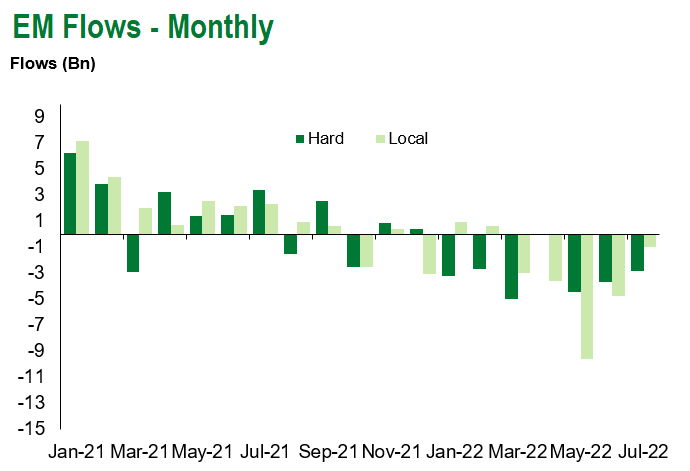

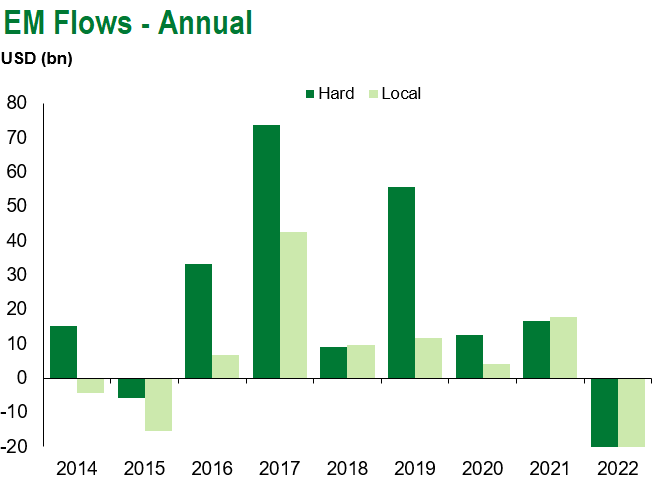

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of July 15, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.