Contents

Market Overview

Macro Review

A comparatively quieter week for markets following last week’s volatility amid global central banks’ policy tightening. In the U.S., Federal Reserve Chairman Jerome Powell underwent Congressional testimony where he did not materially change his tone relative to the FOMC press conference, leaving open the possibility for another 75bp hike in July and keeping larger (and theoretically smaller) moves on the table in aim to boost flexibility. His comments emphasized that long run labor market strength is dependent on price stability, reiterating the Fed’s mandate and priority to fight inflation. Treasuries rallied moderately mostly led by the belly of the curve with some softening in commodities as focus shifted to the growth cool-down in context of material June flash PMI misses in the U.S. and Europe albeit both still in expansionary territory. In Asia, yen weakness in the backdrop of BOJ’s loose policy stance is bringing to light potential competitiveness issues for the region with the greatest impact likely on industrialized countries led by Korea and to a lesser extent Vietnam, Thailand, and Malaysia. In China, President Xi reemphasized the Party’s ambitious annual 5.5% growth target for the first time in months potentially opening the door for additional policy measures to shore-up the economy. Effectiveness will remain a key question mark with the greatest upside likely stemming from evolution of the zero covid approach, which faces steep political and social hurdles.

EM Credit Update

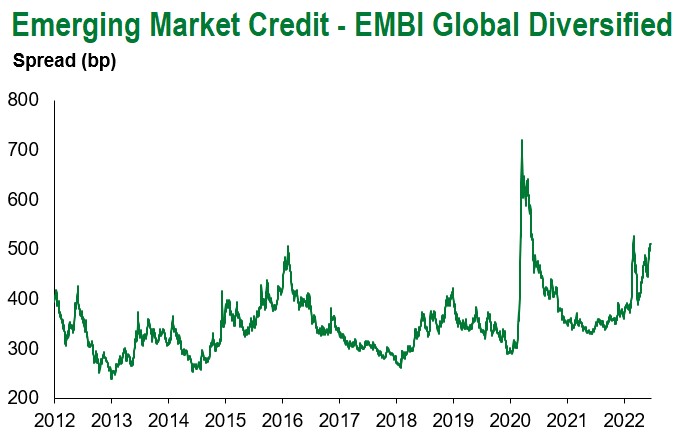

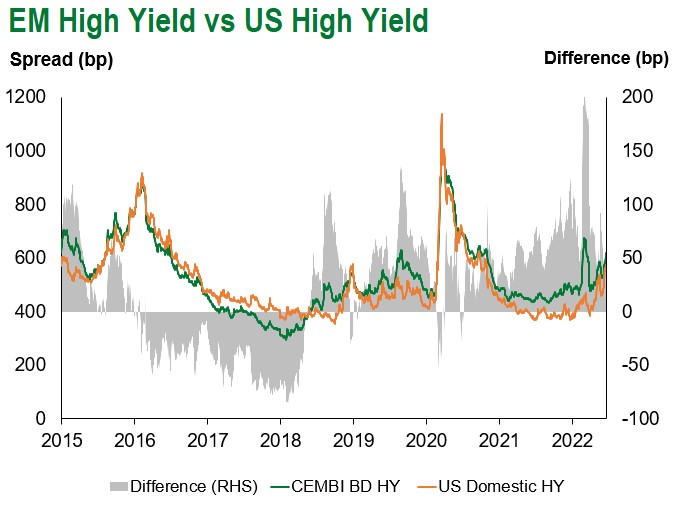

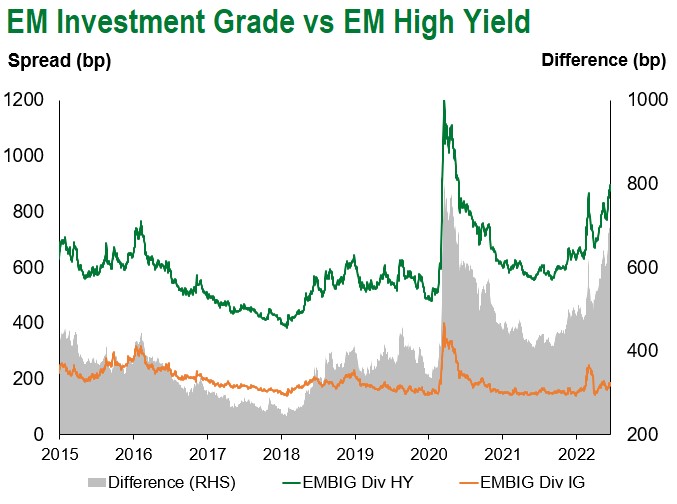

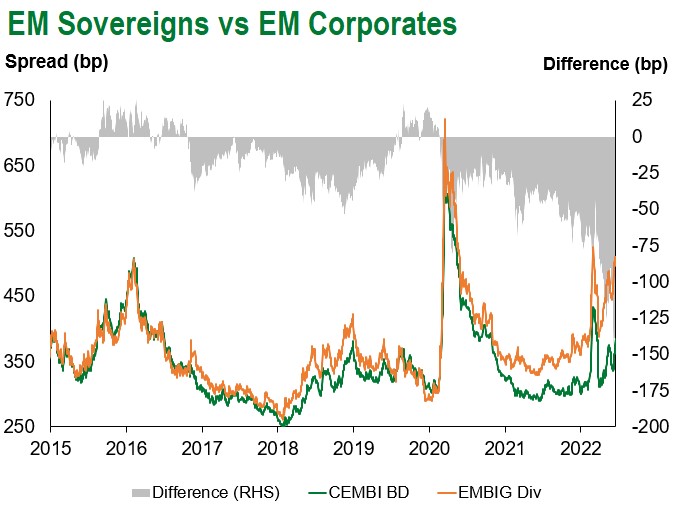

Amid stronger USTs linked to growing concerns around global activity and recession risk, emerging market sovereign credit ended the week up a slight 0.3% with spreads 10bp wider. Corporate credit was down 0.3% with spreads 22bp wider. Sovereign outperformers this week were Belarus, Turkey, and Jamaica while Ukraine, Sri Lanka, and Ethiopia underperformed.

The Week Ahead

In Europe, inflation figures for June will be in focus as the ECB charts its plans to manage stimulus withdrawal. Key events in EM next week include China June PMI data as well as inflation releases in Peru and Indonesia and an interest rate decision in Colombia. The gradual rebound in China activity is expected to continue with indices nearing or moving back into expansionary territory. All else equal, downside surprises could extend this month’s softening in commodity complexes and global growth fears.

Highlights from emerging markets discussed below include: Gustavo Petro as the first left-wing president in Colombia’s modern history, South Africa releases the final report on state capture and rate hikes in Mexico.

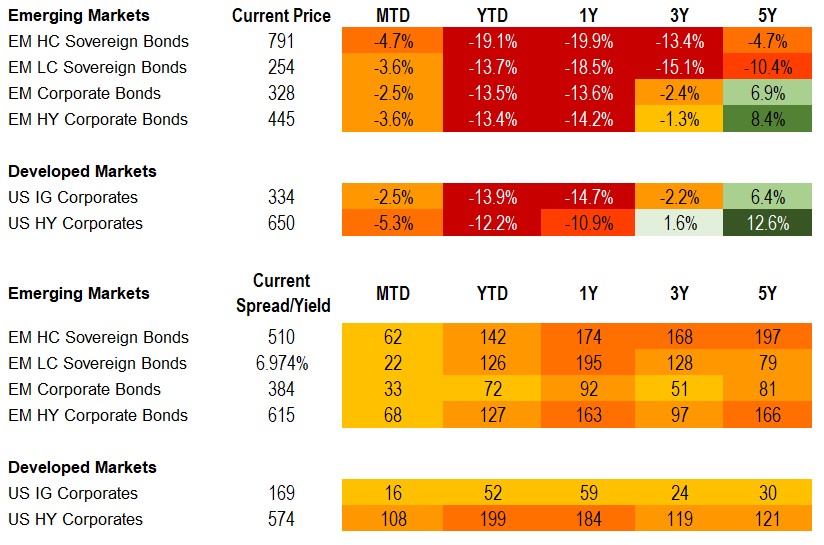

Fixed Income

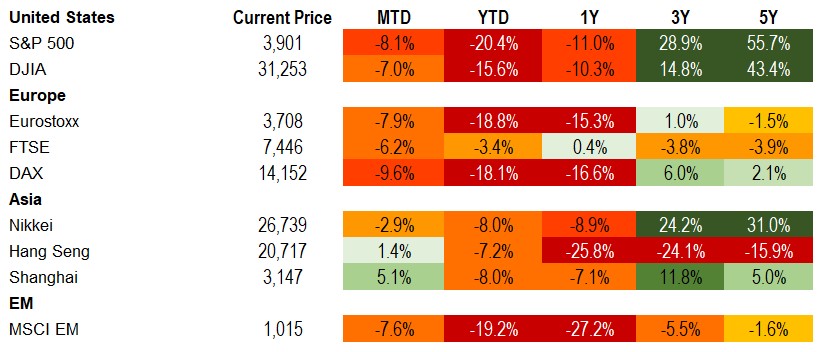

Equities

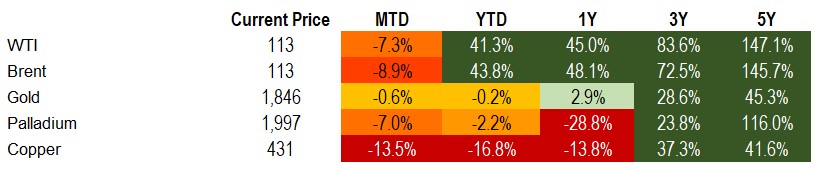

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of June 24, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Gustavo Petro becomes first left-wing president in Colombia’s modern history and will assume office in August with a mandate for change

Event: Petro obtained 50.4% of the votes in the presidential election runoff on Sunday, June 19th, compared with 47.3% for his populist opponent Rodolfo Hernandez. Petro will take office on August 7th with a four-year mandate.

Gramercy commentary: Petro is the first ever leftist president in Colombia’s modern history. Accordingly, his period in power implies potential meaningful shifts in economic and social policy compared to the recent past. We expect that higher uncertainty around the economic outlook will likely keep markets in a relatively cautious mood regarding Colombia. However, we note that early rhetoric from Petro’s camp appears to signal willingness by the incoming president to seek “national unity” and attempt to build political bridges between the two sides of a highly polarized electorate. A critical step from a market perspective would be the appointment of a credible technocratic economic team, which should assuage concerns about potential bias toward economic heterodoxy. Investors would be particularly focused on the positions of Finance and Energy Ministers in the new cabinet as well as clear commitments that Central Bank independence will be fully respected. Higher social spending and bigger involvement of the state in economic life were two of Petro’s pre-election campaign anchors that could prove to be particularly challenging in the context of Colombia’s elevated fiscal and external deficits and will likely retain sharp market focus in the first few months of the new Administration. In terms of foreign policy, Petro has vowed to seek a unified front on key global issues such as climate change and social equality with other left-leaning leaders across Latin America, as well as to normalize relations with Venezuela. The latter could introduce complications in Colombia’s strong relationship with Washington. The U.S. does not recognize Maduro as Venezuela’s legitimate president and has leaned on Colombia’s outgoing Duque Administration to exert maximum pressure on Caracas. Amid a new chapter in Colombia’s political history, investors will be looking to institutional checks and balances and a fragmented centrist-leaning Congress to limit potential radical departures from the country’s traditionally predictable policy environment and orthodox macroeconomic framework.

South Africa’s final report on state capture released; May inflation surprises to the upside

Event: Chief Justice Raymond Zondo published the last piece of the ongoing investigation into state capture under Jacob Zuma. This, in addition to prior implications, found Zuma’s political support of the Guptas’ media channels to be in breach of the Constitution and Executive Members’ Ethics Act and also determined that charges should be brought against Zuma’s son for facilitation of embezzled funds related to the Guptas. Additionally, the investigation found that Ramaphosa and the ANC were at fault for not doing more to prevent such actions. Meanwhile, May headline CPI data surprised 40 bps to the upside at 6.5% y/y, breaching the SARB’s upper target bound largely due to food and energy price pressures.

Gramercy commentary: The state capture report increases the risk of protests and unrest as the focus shifts to Ramaphosa’s response and actions deployed to prosecute Zuma, which must occur by October. Efforts taken to improve control over the security apparatus following last summer’s largely orchestrated social volatility should help to offset the scope and severity of protests, if they emerge. While not our base case, a broadening of discontent amid the accelerating inflation backdrop cannot be ruled out. While Ramaphosa and the ANC’s popularity will likely continue to face headwinds into the 2024 election as result of the investigation, we do not see Ramaphosa’s position as Head of the ANC under threat. Separately, upside risks to inflation continue to materialize, placing increased pressure on the Central Bank as seen globally. Given that the majority of the pressures remain outside of core inflation, we think the SARB will sustain its pace of 50 bps hikes for now. If broadening of inflationary pressures deepens in the coming months, particularly among services, and/or rand depreciation accelerates, a 75 bps hike becomes more likely.

Mexico moves to 75 bps hikes amid reacceleration in inflation

Event: 1H June inflation print exceeded expectations at 0.49% m/m (7.88% y/y) vs. Bloomberg consensus of 0.35% (7.73%) with the pick-up led by core goods related to food and services. Banxico responded with a market anticipated and unanimous 75 bps hike bringing its policy rate to 7.75%. The statement indicated that rate hikes of this magnitude are likely to continue in the coming meetings.

Gramercy commentary: The historical stickiness of Mexico inflation combined with external factors continues to support near-term upside risk to prices. That being said, with the real policy rate potentially nearing positive territory, as well as softening growth and base effects, there is room for stabilization and incremental improvement as the year progresses. While there was no specific guidance on a 100 bps move, it likely would be reserved for more material deterioration in inflation data and/or an even more aggressive Fed.

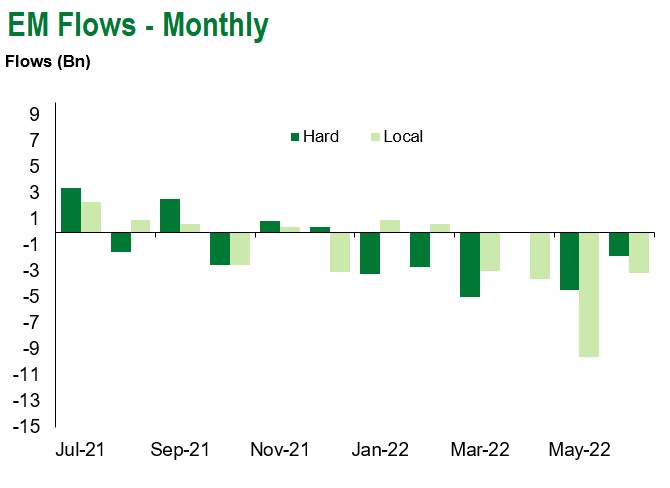

Emerging Markets Technicals

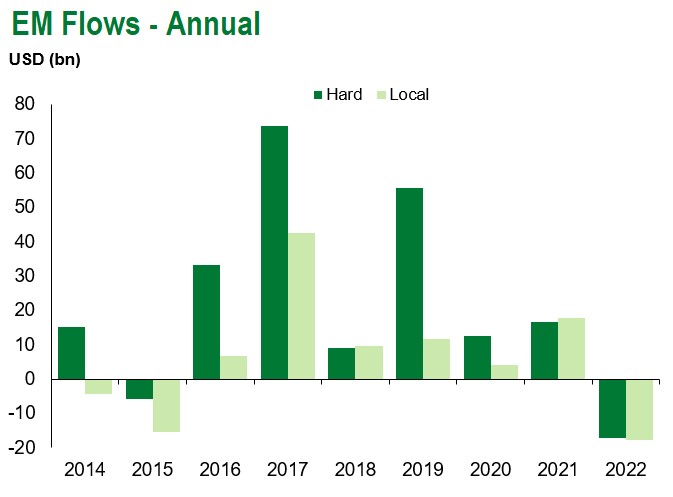

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of June 24, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.