Contents

Market Overview

Macro Review

Growth concerns are back in focus. The World Bank downgraded global growth to 2.9% from 4.1% (-1.2%), just as the OECD revised its 38-member countries down to 3.0% (-1.5%). Within that, Eurozone economic growth in 2022 is forecast at 2.3% and 2.6%, with inflation of 7.1% and 7.0%, across the ECB and OECD, respectively. Meanwhile, the OECD remains concerned that UK GDP could grind to a halt next year and record the second worst growth figures, only to Russia, across G20. This is likely to be exacerbated even as Boris Johnson narrowly clung onto power after a vote of no confidence (surviving by 211 votes to 148 against). One trend over the past week was the synchronized G10 tightening across the Reserve Bank of Australia and ECB. The former hiked rates by 50bp, while the ECB announced intentions to hike rates by 25bp and end net asset purchases in July. Then, guidance for the September decision would be “gradual but sustained”, which meant the market began to price in closer to 50bp. The focus is also back on the Federal Reserve after U.S. CPI came in notably hot at 8.6% too. Within EM, the tightening cycle is already well underway. Brazil may have emerged as one of the first candidates to subsequently pause, while Chile and Poland increased policy rates by 75bp and India by 50bp. Though the inflation trend in Asia with Thailand and the Philippines is more striking. Headline inflation sharply increased to 7.1% in Thailand and 5.4% in the Philippines, although the latter seems more likely to raise rates. Elsewhere, the U.S. also tightened Russia’s access to the international debt markets. The latest guidance has effectively frozen capital markets and limited the ability to trade Eurobond debt. A full sovereign default later this month is increasingly inevitable, which incidentally has already been triggered by the CDS Committee given unpaid accrued interest associated with the late payment on the April 2022 bond (eventually paid on May 2).

EM Credit Update

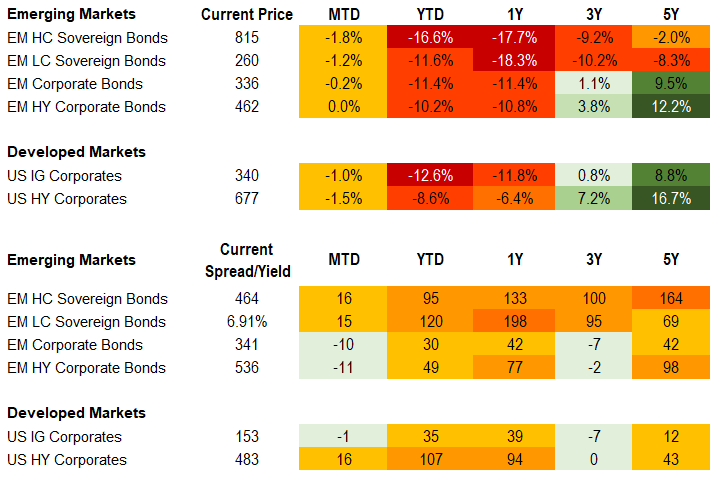

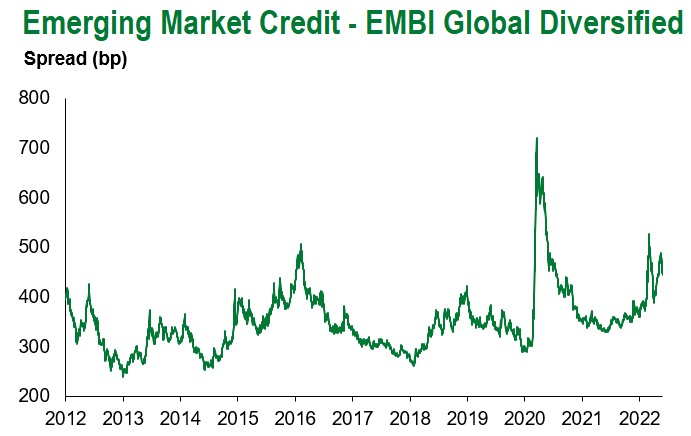

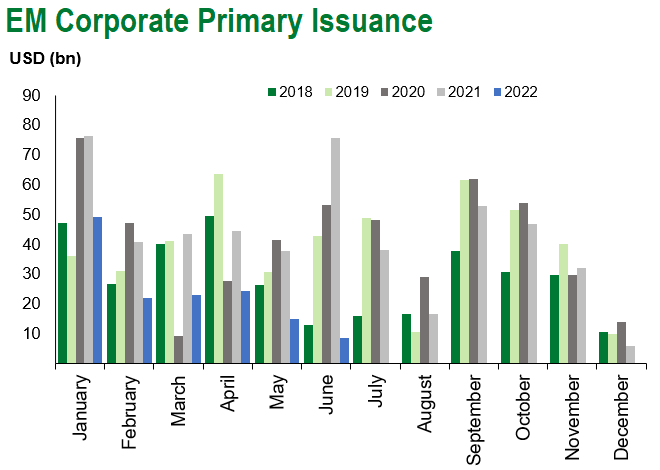

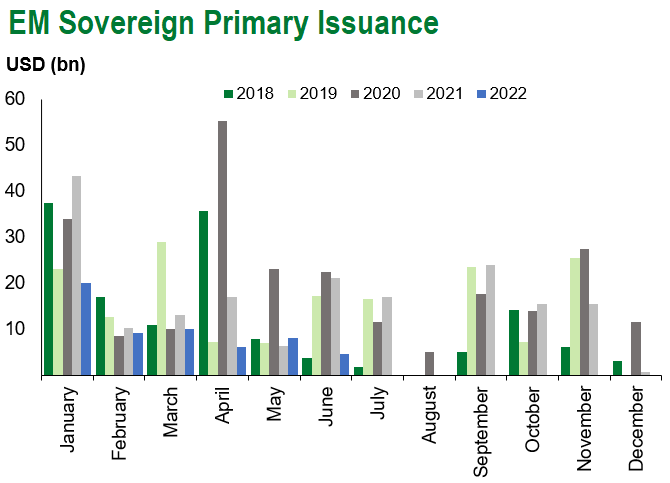

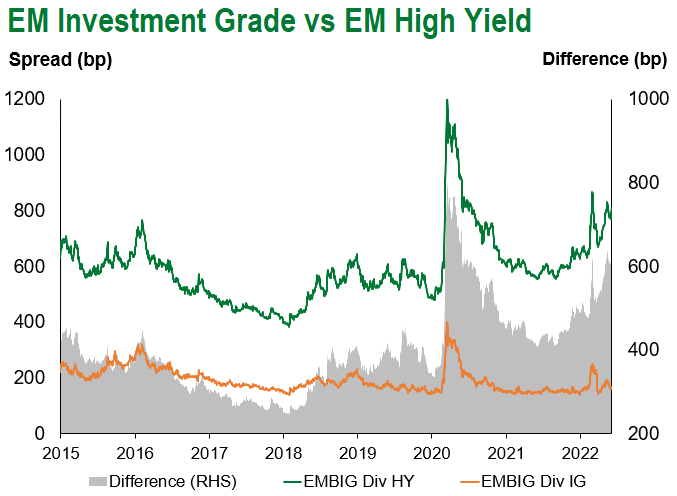

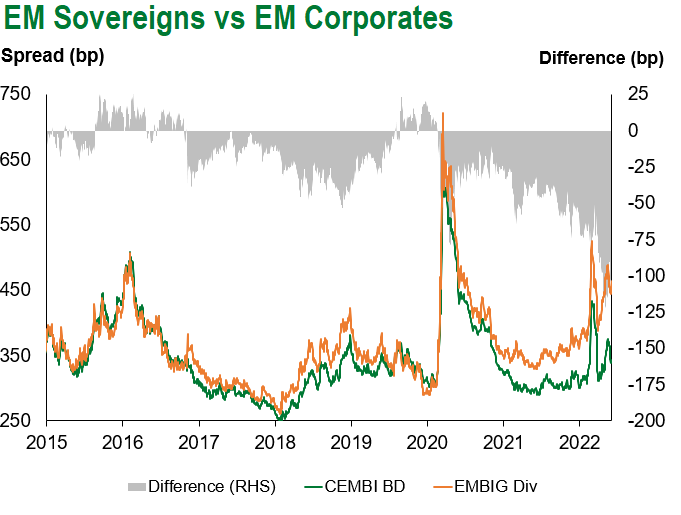

Emerging market sovereign credit ended the week down 1.5% with spreads 16bp wider. However, corporate credit was only down 0.2% with spreads tightening 4bp. The theme of late has seen EM corporate credit outperform EM sovereign credit. Outperformers over the week were Tajikistan, Pakistan and Papua New Guinea, while Zambia, Kenya and Argentina underperformed. There are now further signs that the primary issuance market is re-opening after Hungary, Indonesia and Jordan tapped markets, along with a number of corporates, albeit mainly Asian financials.

The Week Ahead

Key events next week rest with whether the Bank of England will hike for a fifth time. The ECB may well have guided lift-off in July, but the pressure is now turning to other G10 markets. The spillover includes the Bank of Japan, who thus far have maintained their Yield Curve Control policy stance, in spite of a weakening JPY. Out of China we will have industrial production growth, which is expected to show some softening, coupled with a contraction in retail sales. Interest rate decisions are due out of Brazil (12.75%) and Taiwan (1.375%), followed by inflation data out of Argentina, India and Poland. Finally, with the recent FX volatility and CDS widening 110bp over the past week, Turkey’s current account release is likely to be the focal point in CEEMEA.

Highlights from emerging markets discussed below include: Argentina receives IMF staff-level approval for 2nd EFF disbursement; Kenya could become EM’s next sovereign distress candidate as leading presidential contender vows to “reprofile” debt and increase public spending

Fixed Income

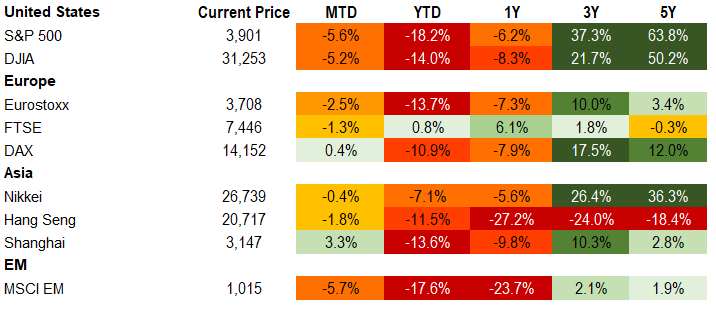

Equities

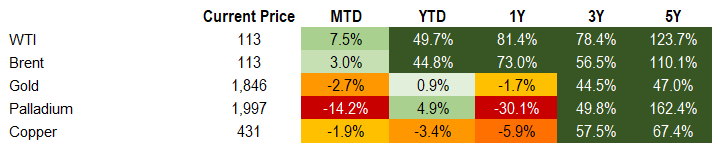

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of June 10, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Argentina receives IMF staff-level approval for 2nd EFF disbursement

Event: The Fund published a press release on the staff-level approval of the first review of the $44bn EFF program agreed earlier in the year. Following board approval, the government will have access to roughly $4bn, with the majority to be used to repay the Fund. All criteria and targets under the first review were met. Going forward, the annual targets are to remain intact albeit with flexibility or amended interim quarterly criteria.

Gramercy Commentary: We see the successful first review as constructive and largely anticipated. The indication of flexibility on the quarterly targets, with unchanged annual targets going forward, aims to preserve credibility on the incremental macroeconomic adjustment embedded in the program while providing room for adjustment amid a difficult external backdrop. The base case continuation of the IMF program, despite some uncertainty, should continue to provide a floor under Argentine asset prices with constructive pull to par and coupon-step up dynamics as the year progresses. More meaningful upside would only stem from an unlikely positive surprise on FX reserve accumulation or a more probable shift in focus to political change as 2023 nears.

Kenya could become EM’s next sovereign distress candidate as leading presidential contender vows to “reprofile” debt and increase public spending

Event: Opposition leader and front-runner in the polls for the August 9th Presidential Elections, Raila Odinga, made public comments this week that if elected, he would “restructure and re-profile” Kenya’s government liabilities to “ease the debt burden of future generations”, triggering a sharp increase in sovereign credit risk pricing.

Gramercy commentary: Kenya is one of several sovereign credit stories across emerging markets this year, including heavyweights such as Brazil and Turkey, where elections and their respective economic policy outlooks are at the center of investors’ focus and driving market dynamics. It is not unusual for political candidates, especially opposition ones, to make comments about reducing the public debt burden and increasing government spending for domestic political gains ahead of elections. However, in many cases we’ve seen moderation or even reversal of such proposals once a candidate takes office and faces the likely economic, social and political repercussions of potential sovereign distress on medium-term access to international capital markets and credits ratings, among others. This being said, as a net commodities importer and an economy dependent on tourism for fresh FX inflows, Kenya does find itself in a challenging spot against the current global economic and geopolitical backdrop. As such, whoever wins the elections in August, the new administration will need to tackle a difficult fiscal situation and USD shortages in the overall economy. This could lead to the “sovereign restructuring scenario” gaining more traction in the coming weeks and putting further downside pressure on the Eurobonds curve.

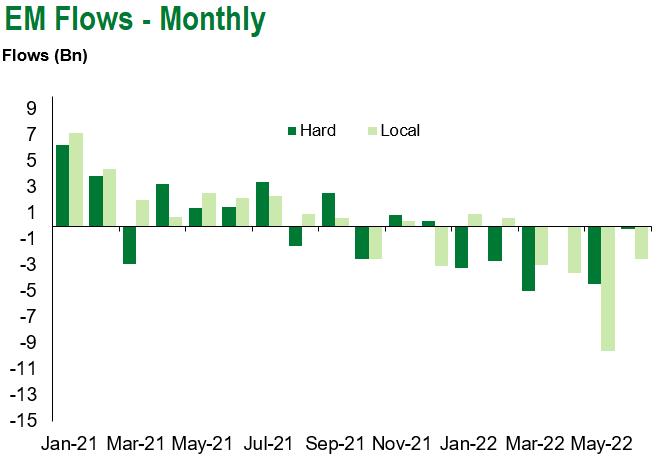

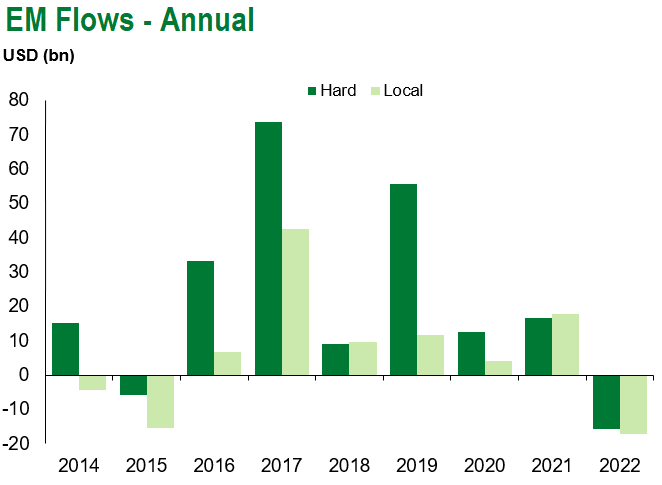

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of June 10, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

Tolu Alamutu, CFA, Director, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.