Contents

Market Overview

Macro Review

The Fed’s May meeting dominated the week: the FOMC hiked its policy rate by 50bps as expected but Chair Powell also explicitly took the potential for a 75bp pace of hikes at subsequent meetings “off the table”, which provided a temporary boost to market sentiment. The Fed also signaled the start of gradual Balance Sheet reduction from June onward. Last but not least, Chair Powell suggested the FOMC expects that we will start to see inflation flattening but market participants seem to remain unconvinced that this might be the case in the face of Ukraine and China-related bottlenecks. In Europe, high frequency data pointed to mounting recession concerns, prompting comments from ECB board members that the Euro area economy is “de facto stagnating”. Against this challenging backdrop, the EU appeared to have reached political agreement over starting to implement a phased oil embargo on Russia, a major development in the effort to curtail European financial flows to Moscow. The plan calls for a complete import ban on crude and refined products, but with a carve-out for Hungary and Slovakia until the end of 2023. Chinese PMIs produced a shock this week as the NBS and Markit Caixin prints for April dropped further into contractionary territory to 42.7 and 37.2, respectively, amid ongoing strict multi-city lockdowns in response to the latest COVID surge. Most components of both indices reflected deterioration including production, exports orders, input prices, and delivery times and underperformed relative to already weak expectations. Elsewhere, headline inflation (CPI) in Turkey reached 70% year-over-year in April, driven by surging energy and food prices, while Producer prices (PPI) increased by staggering 122% year-over-year, marking the highest level since 1995.

EM Credit Update

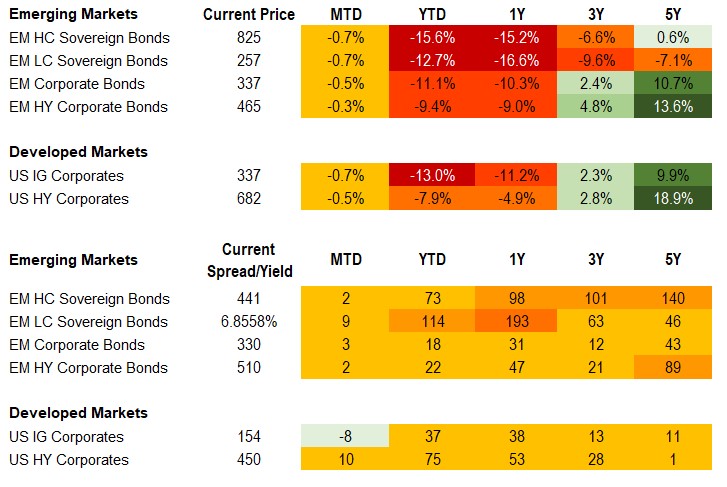

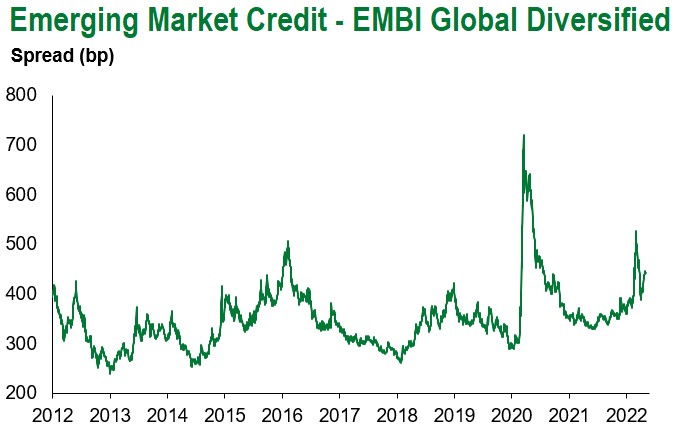

Emerging market sovereign credit ended the week down 0.7% with spreads 2bp wider. Outperformers over the week were Ukraine, Ecuador and Serbia, while Tajikistan, Tunisia, Zambia and Sri Lanka underperformed.

The Week Ahead

Macro data releases set to be released next week are likely to reinforce concerns about Europe’s economic outlook, including Germany’s investor confidence and the Euro area’s industrial production. Investors will be watching those release closely as the war in Ukraine and China’s extended lockdowns are putting renewed pressures on supply chains and energy risks are mounting, while German factory orders are falling in the face of easing global demand. In that context, the widening impact of China’s lockdowns will be a key development to watch in Asia next week. Data on Chinese export growth will give an indication on the level of pressure lockdowns are exerting on supply chains and the People’s Bank of China (PBOC) is likely to trim a key lending rate in a move to offer some relief. In broader EM, the focus will be on inflation prints in Brazil and Mexico and central bank policy rate decisions in Mexico, Malaysia and Peru.

Highlights from emerging markets discussed below include: Turkey’s unhinged inflation dynamics and China’s April PMI data and what it says about near-term activity

Fixed Income

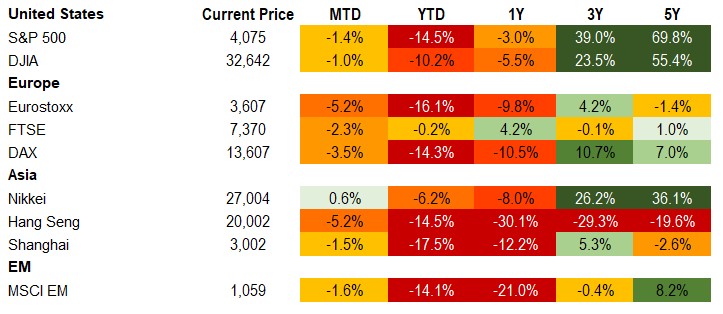

Equities

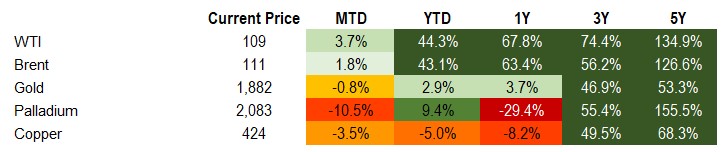

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of May 6, 2022 (mid-afternoon).

Emerging Markets Weekly Highlights

Turkey’s unhinged inflation dynamics likely to be addressed by another round of unconventional policy measures rather than market-friendly monetary tightening

Event: Headline inflation (CPI) in Turkey reached 70% year-over-year in April, driven by surging energy and food prices. Producer prices (PPI) increased by a staggering 122% year-over-year last month, marking the highest level since 1995.

Gramercy Commentary: The triple-digit producer price inflation signals further upside pressures on consumer prices in the coming months, from already record-high levels. Despite these concerning dynamics, the Central Bank of the Republic of Turkey remains highly unlikely to adjust its monetary policy approach due to political constraints that are set to only intensify in the run-up to presidential and parliamentary elections scheduled for June 2023. Turkey’s unprecedented “ultra-loose monetary policy experiment” stands in sharp contrast with most other major EM central banks that are in the midst of aggressive monetary policy tightening cycles against a backdrop of elevated inflation and higher DM rates. This leaves the Turkish lira (TRY) highly exposed to negative external dynamics amid USD strength, and a widening current account (CA) deficit. In this context, we think new rounds of heterodox policy measures by the government are likely in the near-term. We expect the use of remaining fiscal space to prop up growth and ensure relative FX stability ahead of scheduled (or potential early) elections, at the expense of exacerbating existing macroeconomic imbalances and further depleting external liquidity buffers. Concurrently, as we wrote last week, we expect President Erdogan’s geopolitical “charm offensives” toward regional and global powers to intensify in an attempt to secure fresh external financing and support FX stability amid an increasingly deteriorating macroeconomic and external backdrop.

China’s April PMI data shows significant hit to near-term activity

Event: NBS and Markit Caixin PMI prints for April dropped further into contractionary territory to 42.7 and 37.2, respectively, amid ongoing strict multi-city lockdowns in response to the latest COVID-19 surge. Most components of both indices underperformed relative to already weak expectations and reflected deterioration in production, exports orders, input prices, and delivery times.

Gramercy commentary: We see this as a negative for 2Q growth but expect a portion to be recovered later in the year as the announced policy response associated with boosted infrastructure investment gains momentum along with prospects for some tweaks to virus policy ahead of future waves. High frequency data suggests that the drop in activity is bottoming with a recovery likely to begin later this month and deepen as the quarter concludes. Looking at Hong Kong data, where the latest virus wave preceded that of China, hits to activity were also greater than envisaged by the market but data has begun to rebound solidly on reopening, with the April PMI moving back into positive territory. We expect a similar trend in Chinese data although perhaps with a flatter slope on a more cautious approach to loosening.

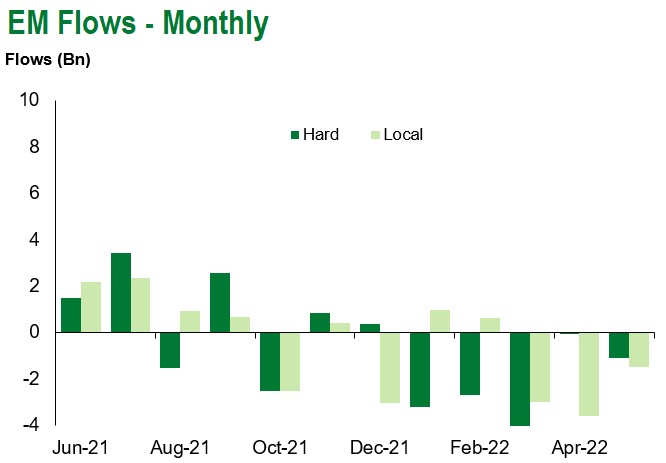

Emerging Markets Technicals

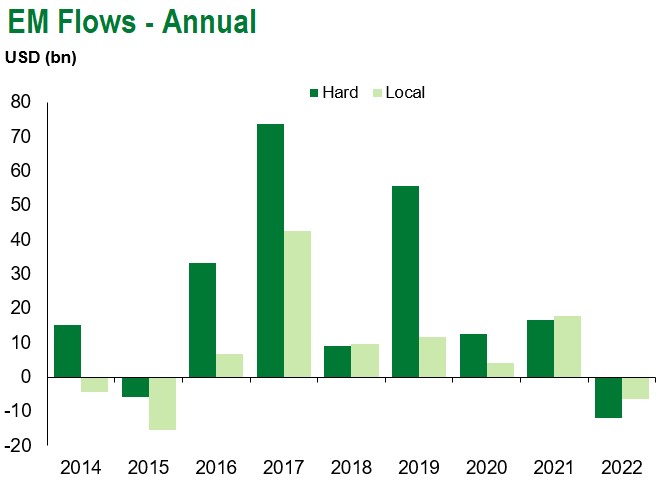

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of May 6, 2022.

COVID Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, CFA ESG, Director, Co-Head of Sovereign Research, [email protected]

Petar Atanasov, Director, Co-Head of Sovereign Research, [email protected]

James Barry, Director, Deputy Portfolio Manager, [email protected]

Tolu Alamutu, CFA, Director, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.