Contents

Market Overview

Macro Review

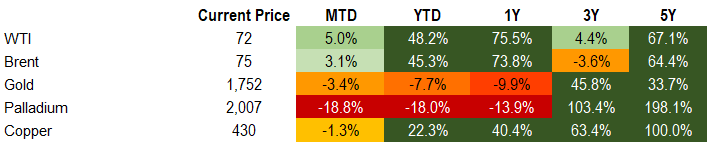

The Chinese property sector remains under pressure. The regulator stated that Evergrande would not pay interest on upcoming bank debt obligations. This caused offshore bonds to trade flat of accrued interest. Following this and engagement of lawyers and financial advisors, Evergrande bonds traded down 4-5pts over the week. For the first time since early August, we also saw weakness in higher quality Chinese credits, with the likes of Country Garden and Shimao coming under pressure (-3-6pts). Although, higher beta Single B credits like Kaisa and Sunac were down 7-9pts. The PBoC acted swiftly to prevent a liquidity crunch associated with Evergrande suppliers by injecting RMB90bn via 7d and 14d reverse repurchase agreements as liquidity often tightens into Golden Week. Evergrande’s liability profile only reflects 20bp of China’s total loans, but the idea of containing the crisis is clearly paramount. CNY volatility was similarly short-lived in the case of other major defaults, such as Baoshang Bank in 2019, YongMei in 2020 and also with Huarong this summer (even if the latter was not an explicit default). Beyond property, the regulatory crackdown extended to the Macau casino sector. A consultation review over the next 45 days will re-determine government involvement, dividend distribution, and licenses, which caused significant volatility. The equity of Wynn Macau was sent to fresh all-time lows. Elsewhere, weak retail sales dominated, although the U.S. did exceed expectations but China missed (2.5% vs expectations 7.0%) as did South Africa (-11.2% vs expectations -2.7%). Oil markets traded higher with crude ending the week up 3.5% to >$75/bbl, which kept equities on a stable footing even if the S&P and DXY continue to flirt with their respective 50 day moving averages. Equally, the U.S. Treasury market fobbed off the threat of any tantrum, as November is viewed as the date of a likely tapering announcement. Long bonds continued to rally as duration remains in vogue with 10s30s hitting 55bp (18-month lows).

EM Credit Update

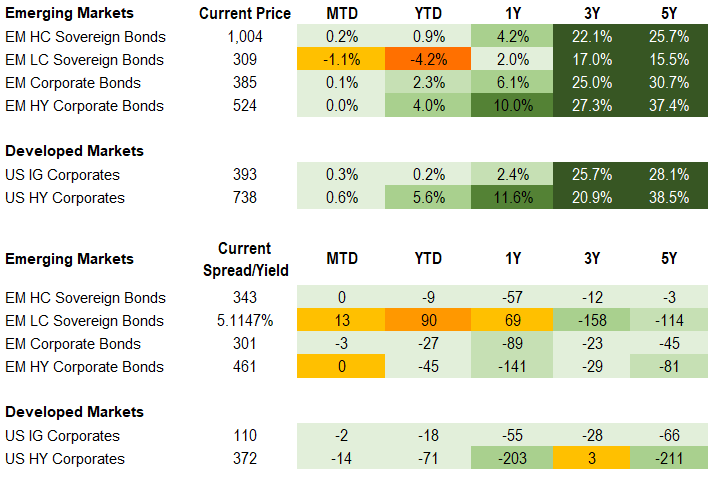

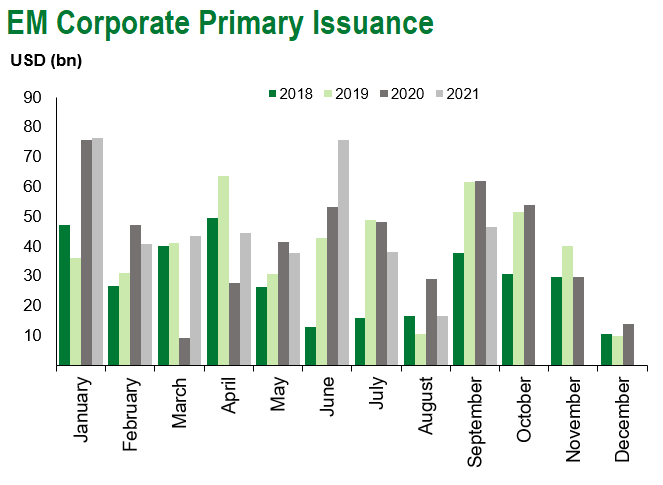

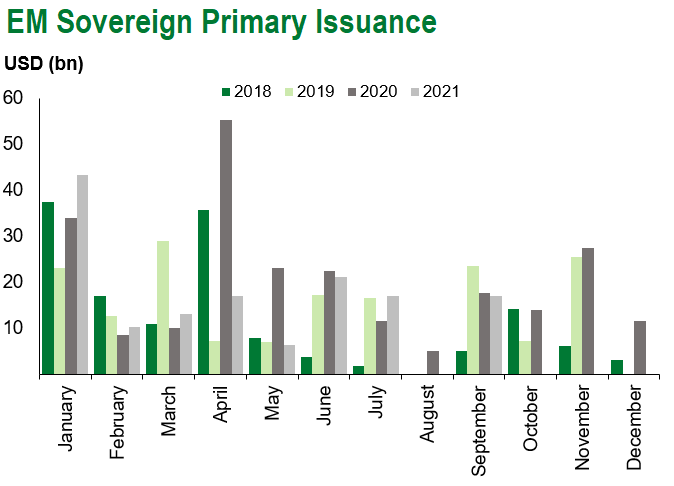

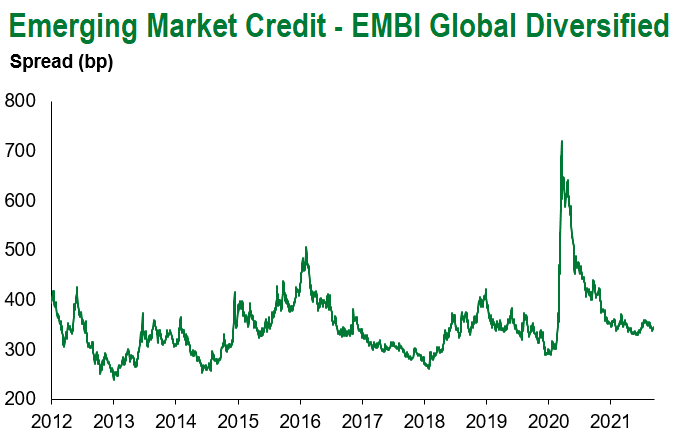

EM Credit ended the week flat, with spreads 3bp wider, offsetting the move in U.S. Treasuries that tightened this week. Suriname, Iraq and Argentina outperformed, while Sri Lanka, El Salvador and Ecuador lagged. Primary market supply was the main focus with $39bn issued this week, with $13bn from sovereigns and $25bn from corporates. Taking one-step back, issuance so far in 2021 sits at $565bn, which includes $145bn from EM sovereign issuers (down 23% versus last year) and $420m from EM corporates (up 7% y/y). Impressively, ESG issuance in 2021 now exceeds $100bn, with $107bn this year already relative to $45bn in 2020.

The Week Ahead

G10 central bank decisions are the main fixture next week. The Fed, Bank of England, Bank of Japan, Norges Bank and Riksbank are due, but the major focus will be on Chair Powell. China is expected to keep its 1yr and 5yr loan prime rates unchanged at 3.85% and 4.65%. Developed market PMIs and German Ifo data will also feature in the equation, but EM central bank decision are plentiful with Brazil (5.25%), Hungary (1.50%), Philippines (2.0%), South Africa (3.5%), Taiwan (1.125%) and Turkey (19.0%). We will also await inflation releases from Hong Kong, Mexico and South Africa. Finally, after a sharp rally in Argentinian assets after the PASO result, GDP will be released for 2Q. Finally, elections in Russia over the weekend will determine the composition of the 450 State Duma seats.

Highlights from emerging markets discussed below include: Argentine government’s weak performance in primary vote deepens coalition divisions; gradual consolidation and IMF program assumptions outlined in 2022 budget trumped by political headlines; and Lebanon forms a government after 13 months of institutional standstill, but prospects for meaningful reforms are slim, while economic, social and political challenges remain formidable.

Fixed Income

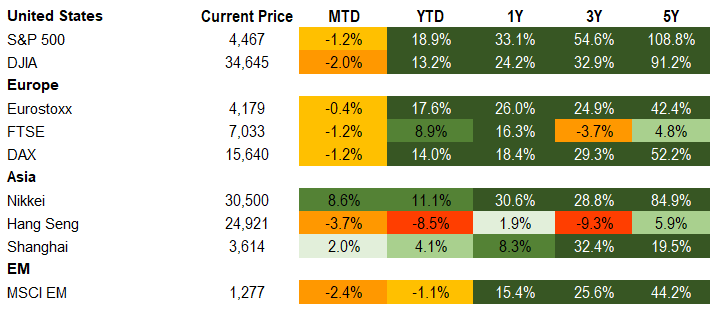

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of September 17, 2021 (mid-afternoon).

Emerging Markets Weekly Highlights

Argentine government’s weak performance in primary vote deepens coalition divisions; gradual consolidation and IMF program assumptions outlined in 2022 budget trumped by political headline

Event: The ruling Frente de Todos (FDT) coalition garnered just 30.2% of the vote at the national level in the mid-term primary election held over the weekend. The opposition Juntos por el Cambio obtained 40.5% of votes. If translated to the election on November 14th, the government would lose its majority in the Senate as well as its position as the largest party in the lower house. The race in the largest province, Province of Buenos Aires (38% of votes), also went to the opposition candidates with an aggregate support of 38% versus 33.6% for FDT. Later in the week, several Kichnernist ministers submitted their resignation to President Fernandez including those from the Ministry of Interior, Public Social Security (ANSES), Commerce, Environmental Affairs, Science & Technology, Culture, and Public Healthcare. At the time of writing, Fernandez had yet to accept or reject the resignations or announce plans for other changes in the cabinet but did indicate a desire for a unified coalition. At the same time, the 2022 budget was presented to Congress with a primary fiscal deficit target of 3.3% of GDP, growth assumption of 4%, and assumption of an IMF deal.

Gramercy Commentary: The incumbent party’s sizeable defeat reflects the electorate’s frustration with the unprecedented environment and government’s inadequate response. On the positive side from a credit standpoint, this provides a very early indication for prospects of a return of the opposition and/or more pragmatic policy on the back of the 2023 presidential election. However, in the near term, the cabinet resignations reflect the strength of Cristina Kirchner and her dissatisfaction with the moderate wing of the government, leaving a complicated domestic political environment regardless of Fernandez’s response to the resignations. On one hand, replacement of moderates other than Minister of Economy Martin Guzman and sustained unification of the coalition would limit disruption, although it is unclear if this would be enough to appease the CFK wing absent some loosening of the 2022 budget or implementation of near term heterodox measures. On the other hand, accepting the resignations with the loss of La Campora’s support in Congress would significantly increase uncertainty and governability challenges but could open a path for Fernandez to attempt a more pragmatic approach even if execution on policy would face greater resistance and complication amid CFK opposition. We remain of the view that the government will ultimately push forward with IMF negotiations regardless of the domestic political backdrop.

Lebanon forms a government after 13 months of institutional standstill, but prospects for meaningful reforms are slim, while economic, social and political challenges remain formidable

Event: Lebanon’s political class managed to reach an agreement this week to form a government. Najib Mikati, a billionaire businessperson, was appointed as Prime Minister (PM).

Gramercy Commentary: For context, the previous government under PM Hassan Diab collapsed in the aftermath of the devastating deadly explosions at the port of Beirut in August 2020. The appointment of the Mikati Cabinet put an end to 13 months of a power vacuum without a functioning government. This is undoubtedly a step in the right direction that could unfreeze discussions with the IMF over financial assistance and with creditors over a sovereign debt restructuring. However, it is a necessary, but not a sufficient condition for material improvement in the country’s precarious situation, in our view. We remain pessimistic about the prospects for tangible progress on IMF and private creditor talks, as well as on the multitude of crises facing the country. General elections scheduled for May 2022 will likely inhibit any significant reform momentum in the coming months. As we have argued in previous commentaries on Lebanon, a complete “reset” of the existing political system appears to be necessary before the country can hope to deliver the type of economic and social reforms that could unlock sizable financial assistance by the international community. Moreover, a number of complex geopolitical pieces need to fall into place to allow for robust political and financial foreign support from regional and global powers. These processes are likely to progress only gradually at best, or could remain paralyzed. In the meantime, the list of reforms that the new administration needs to start tackling is long and daunting, including items such as public finance and energy sector reform, banking sector restructuring, Central Bank audit, and sovereign debt restructuring, among others. All of this comes in the context of a profound economic crisis, social tensions running high, and a population overwhelmed by the almost complete collapse of goods and services provided by the public sector (i.e. law and order, healthcare, education, etc.). In such an environment, we are of the view that recent constructive developments in terms of government formation do not represent an inflection point in the credit story yet, and we expect any upside for the bond complex to be limited.

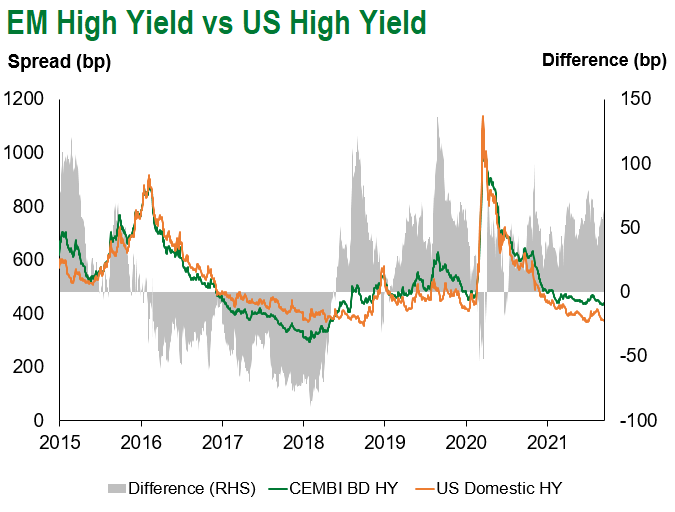

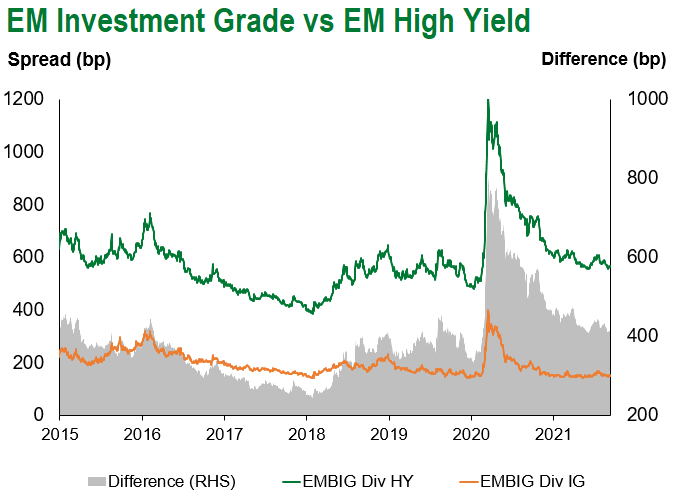

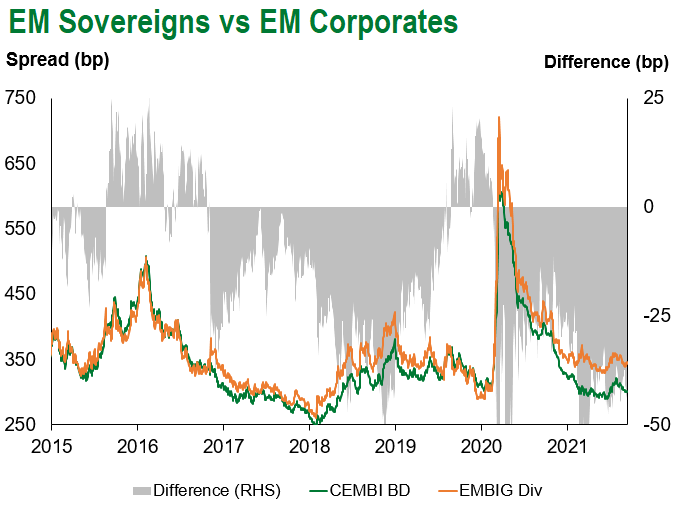

Emerging Markets Technicals

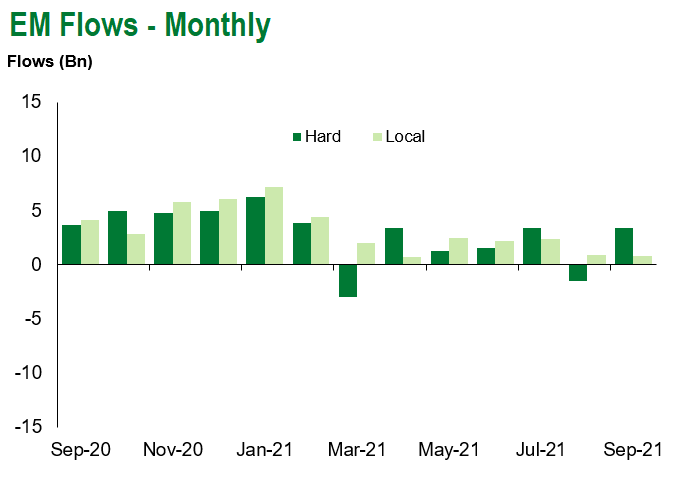

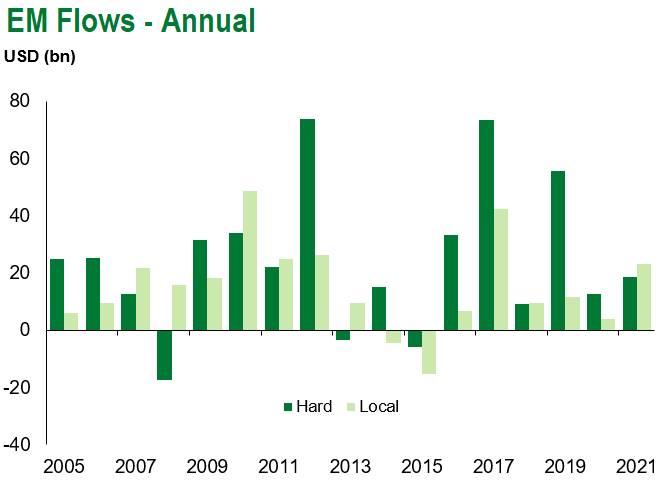

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of September 17, 2021.

COVID Resources

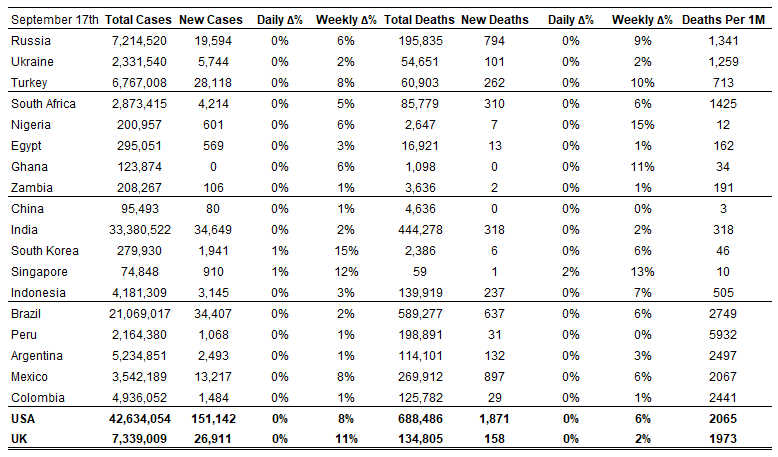

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of September 17, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.