Contents

Market Overview

Macro Review

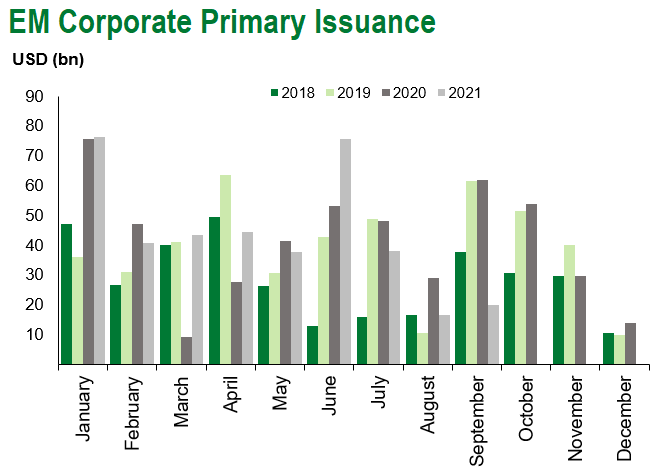

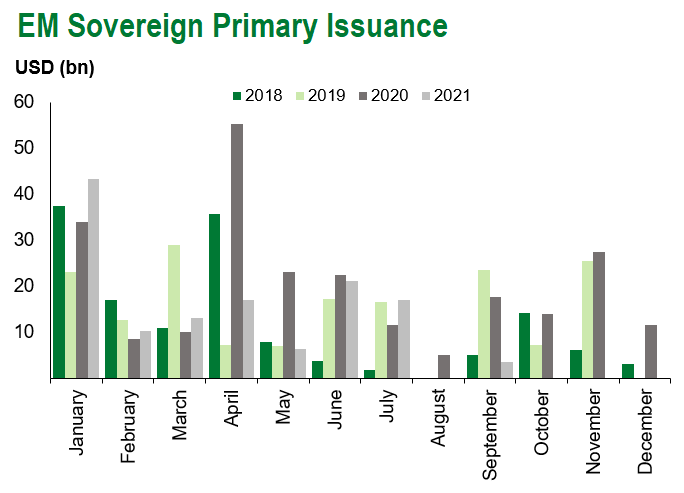

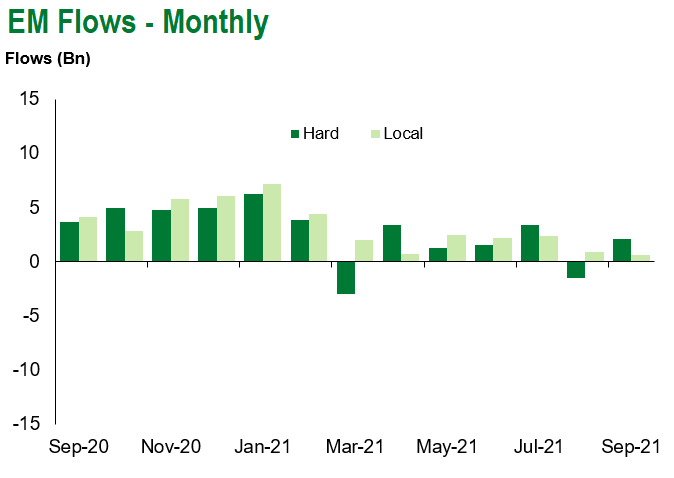

The lady isn’t tapering. Instead the ECB is simply recalibrating. The choice of buzzwords is endless, but what we do know is that the pace of the ECB’s €85bn/month PEPP asset purchases will moderate relative to 1Q and 2Q as consensus points to €60-70bn/month, even if the ECB has not put an explicit number to it. Eurozone growth forecasts were also upgraded, with real GDP set to exceed its pre-pandemic level by 4Q21, which ultimately added 0.4ppts to the 2021 growth picture taking it to 5.0%. In any case, global bond markets were under no significant pressure, and the ECB pivot occurred prior to Labor Day, but bunds are still 16 bps over a three-week period. Instead the theme of the week is one of stagflation following a weak jobs report, but also higher PPI readings out of the U.S. and China, while every [large] LATAM country now sees inflation above targets. This is consistent with the picture out of Eastern European economies. Russian CPI came in at 7.1% as the CBR were steadfast in hiking on a fifth consecutive occasion, reflecting an appetite to get ahead of the curve. A view less commonly shared by the Fed’s Williams, who still views tapering as a premature move. That view isn’t too distant given vulnerabilities in the U.S. economy, which are mainly around growth. Goldman downgraded U.S. growth once again (FY21 now 5.7%) just as Atlanta GDPNow dipped to 3.7%, while MS and CS became more bearish on U.S. equities. Indeed, the S&P posted four consecutive daily declines for the first time in three months, just as the DXY weakened through the 50dma. The technical was more upbeat in EM and fixed income markets as the 10yr U.S. Treasury moved below the 200dma, EM markets saw continual inflows, primary market issuance picked up and select EM credits rallied.

EM Credit Update

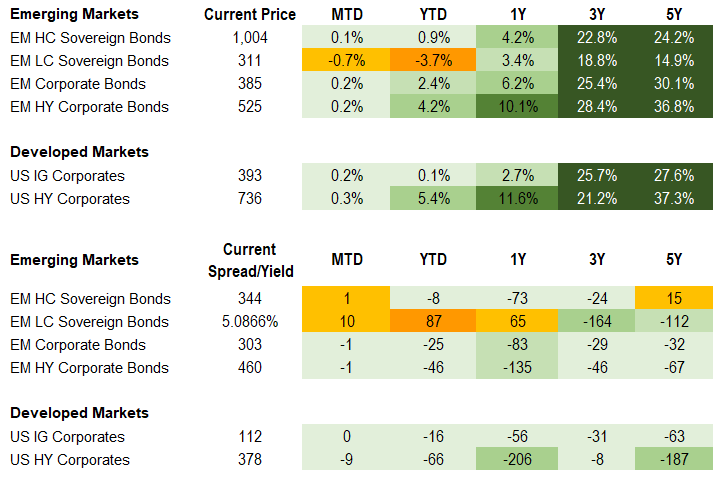

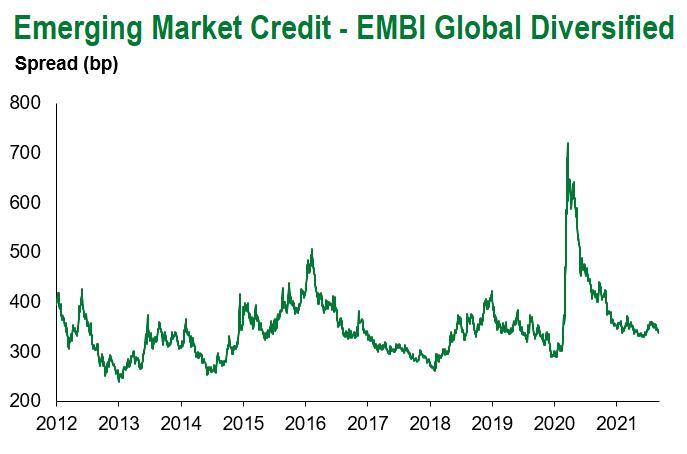

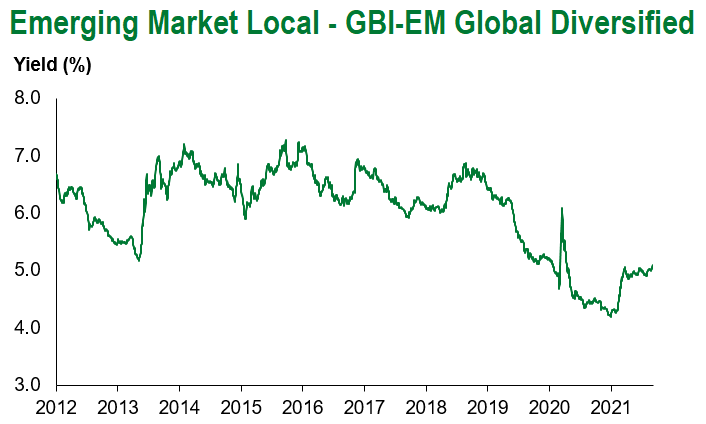

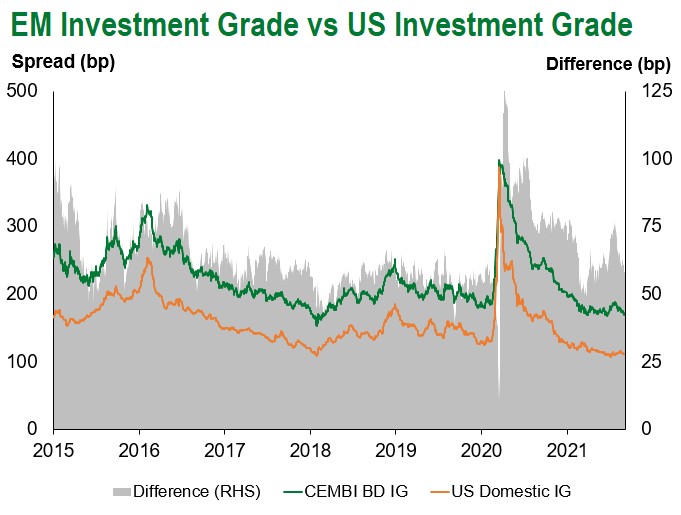

EM credit ended the week up +0.1%, with spreads 1 bp tighter. Belize, Tajikistan and Lithuania outperformed, while Guatemala, Argentina and Tunisia lagged. Most of the weakness was associated with EM local bonds that ended down -0.7% where Chile and Brazil have traded weak, while South Africa has outperformed with a stronger ZAR.

The Week Ahead

Inflation and retail sales is the theme in DM next week, which will be led by the U.S. China’s activity data is also set to highlight a slowing recovery and follow the underlying weakness that recent PMIs pointed to. Retail sales are set to come in at least 1.5pts weaker than July at 7.0% m/m, with larger risks to the downside, given what service PMIs did. Consensus on Chinese Industrial production sits at 5.8%, which is only down 60 bps from the previous month. There will only be one interest rate decision out of Egypt (8.25%). Inflation releases are also limited to just Israel, India and Poland, but Brazil’s BCB is set to publish inflation expectations which will become key running into the next MPC. A possible 100 bps increase has been mooted once again, after three consecutive hikes. Turkey’s current account release is also due, with consensus pointing toward a further narrowing as per the previous release. Otherwise, the Argentina PASO will take place on Sunday.

Highlights from emerging markets discussed below include: Mexico’s 2022 budget proposal relatively benign; Argentina’s mid-term primary vote on Sunday to provide insight into November outcome; Ecuador reaches staff-level agreement with the IMF on renegotiated program; less aggressive near-term fiscal adjustment targets support President Lasso’s ability to navigate his first major governability test in approving the reforms; and Global emerging market corporates in focus: Power to the people.

Fixed Income

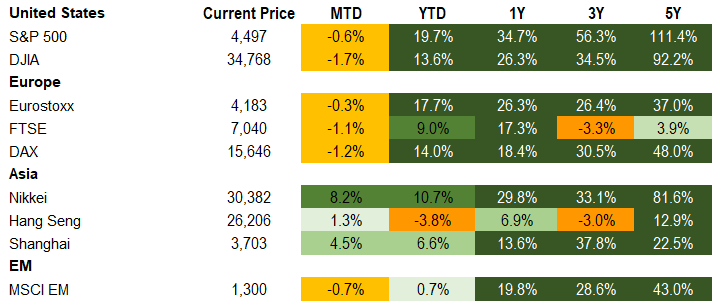

Equities

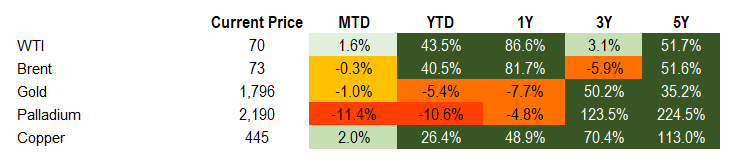

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of September 10, 2021 (mid-afternoon).

Emerging Markets Weekly Highlights

Mexico’s 2022 budget proposal relatively benign

Event: The new Finance Minister, Rogelio Ramirez de la O, presented the 2022 budget to Congress this week, which entails a slightly looser fiscal stance than previously envisaged with a primary deficit of 0.3% of GDP compared to a 0.4% surplus estimated in March. The overall fiscal balance target is 3.1% of GDP while growth, oil price, and production assumptions are 4.1%, $55/bbl, and 1.8mbpd, respectively. Public spending is set to increase by 8.6% in real terms and the lower revenue sharing rate paid by PEMEX (40% from 54%) is proposed to become permanent. The Lower House and Senate need to approve the income side by October 20th and 31st, respectively, while the Lower House expenditure side approval is required by November 15th.

Gramercy Commentary: We see the budget as broadly aligned with AMLO’s goals of dedicating additional resources to PEMEX as well as social areas and specific projects while maintaining fiscal stability in the near term. While oil revenue assumptions are more realistic than in the past, the growth estimate may be optimistic. The budget did not include any additional new support or clarity on financing for PEMEX, albeit we anticipate this to come at a later date. The debate over the use of the $12bn IMF SDR allocation will continue as per de la O’s comments in a recent interview. Our view is that the authorities will attempt to resolve the issue in a way that preserves fiscal and institutional credibility with the potential for a small portion of the funds to be indirectly rather than overtly and explicitly used for PEMEX support over time. While this budget is neutral from a market and credit perspective, gradual erosion of fiscal buffers in recent years limits fiscal flexibility and space over the medium-term, absent revenue measures, and could become a more pressing issue in the coming years, particularly if growth slows.

Argentina’s mid-term primary vote on Sunday to provide insight into November outcome

Event: Argentines will head to the polls in their primary mid-term election (PASO) on September 12th where all parties will compete and participation is compulsory. Polls remain tight both at the national level as well as in the key race in the Province of Buenos Aires (PBA). The incumbent coalition Frente de Todos (FDT) and the main opposition coalition Juntos por el Cambio (JPC) have, on average, similar levels of support at the national level of around 35%. Undecided and blank votes remain high at around 10% in many polls, given the unprecedented backdrop of the election and frustration among the electorate. The government’s candidate in the Province of Buenos Aires race, Victoria Tolosa Paz, has averaged just below 30% support in polls over the past month while opposition candidates Diego Santilli and Juntos Manes have garnered a similar amount combined. Undecided and null ballots are similarly above 10%. The actual mid-term election is scheduled for November 14th where a third of the 72 Senate seats are at stake and 129 out of the 257 seats in the Chamber of Deputies will be renewed.

Gramercy Commentary: We do not expect material changes to Congress as a result of the election with FDT likely to retain a majority in the Senate although it may lose some support and fall short of a majority in the Lower House. The race in PBA is too close to call at this juncture in our view. Historically, the PASO results have accurately predicted the outcome of the actual election results at the national level. However, unique aspects of this vote may reduce its predictive power on the margins, given the elevated portion of undecided voters as well as potential market impact that alters the sentiment and economic position of the voters in the interim. Regardless of the electoral outcome and still challenging domestic political dynamics in the aftermath, we expect the authorities to reach a deal with the IMF by 1Q22 with prospects for announcement on a technical agreement sooner.

Ecuador reaches staff-level agreement with the IMF on renegotiated program; less aggressive near-term fiscal adjustment targets support President Lasso’s ability to navigate his first major governability test in approving the reforms

Event: The authorities reached a staff-level agreement with the IMF on economic policies to conclude the combined second and third reviews of Ecuador’s 27-month $6.5bn Extended Fund Facility (EFF) program. Upon approval by the IMF’s Executive Board, Ecuador will receive around $800m, which the authorities would use for budget support.

Gramercy Commentary: In addition to the $800m from the combined second and third reviews that have been delayed and will now be disbursed, Ecuador could receive another $700m from the IMF before year-end if the government continues to meet the program’s targets. When accounting for available lending from all multilateral sources, Ecuador can access as much as around $4.5bn of concessional financing by the end of 2022, a critical funding lifeline for a dollarized economy still recovering from the massive economic shock due to the pandemic. In order to receive cheap multilateral funding, Ecuador needs to continue to deliver on IMF’s reform conditionality. This is no easy task for the government in the context of a highly fragmented National Assembly dominated by populist-leaning forces. As such, the next few weeks will likely be a critical test for the Lasso Administration’s ability to govern relying on support by ad-hoc coalitions. As we wrote last week, Lasso is enjoying record high approval ratings, which we believe should help his Administration navigate the challenging political landscape in the National Assembly and secure support for the economic program agreed with the IMF. In addition, in line with our expectations, the Fund continues to be highly flexible with Ecuador. This has manifested in what appears to be a significantly less aggressive fiscal adjustment targets in the renegotiated program: 0.7% of GDP in additional tax revenue from tax reform vs 2.0% of GDP in the original version negotiated by the Moreno Administration last year. Taking into account both Lasso’s popularity and the relatively benign revenue increase targets, we think the Administration’s chances to secure support in the National Assembly on the key reforms for the IMF improve and we remain constructive on Ecuador’s sovereign credit trajectory. However, we are also vigilant about any potential risks that could derail this credit’s impressive market performance since Lasso won the presidency back in April. From our perspective, the main downside risk on the horizon comes in the form of a “referendum” on economic policy that the president has lately been alluding to in the event his economic policy agenda gets seriously stalled in the Assembly. Such a referendum could lead to a sudden escalation in political noise/tensions that would be concerning from a market perspective given risks in that scenario associated with Lasso’s diverse and fragile legislative coalition.

Global emerging market corporates in focus: Power to the people

Event: The divergent effects of the COVID-19 pandemic have undoubtedly helped reinvigorate debates about income inequality all over the world. China’s focus on ‘common prosperity’ appears to be intensifying, corporate tax rates in select countries are rising and wages in some sectors are increasing. These trends have significant implications for corporates in emerging markets.

Gramercy Commentary: Corporates’ social initiatives are likely to gain attention in more countries, with issuers potentially setting aside greater amounts to cover community projects and other not-for-profit activities. While this may affect the bottom line, in some cases these initiatives can quell government scrutiny and help improve relations with the state. Given the significant increase in expenses many governments have recorded as a result of the pandemic, higher taxes of some sort appear almost inevitable, even away from the income disparity debates. For corporates, post-tax profitability may be impacted. Added to this, much-discussed labor shortages in some industries may lead to higher wage and general personnel costs, also pressuring bottom line profitability. These added costs could have implications for shareholders’ returns at a time when dividends are also coming under pressure due to higher taxes on that form of income in some jurisdictions. All this suggests there may be a shift in returns away from some forms of capital and towards labor. The focus on income inequality could also have implications for producers of luxury goods and related items and services, as demand for some goods and services may fall. In focusing on income disparity, the aim of governments should ultimately be to improve the lives of lower-income households. In emerging market jurisdictions where there are stark differences in income/wealth levels, well-targeted policies that lead to better outcomes for less-well-off persons may lead to additional costs for some corporates in the near term. However, these policies, if implemented correctly, can eventually benefit all.

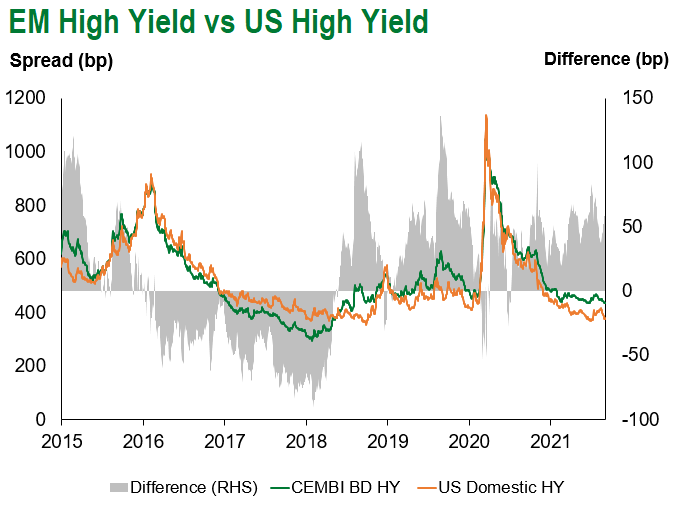

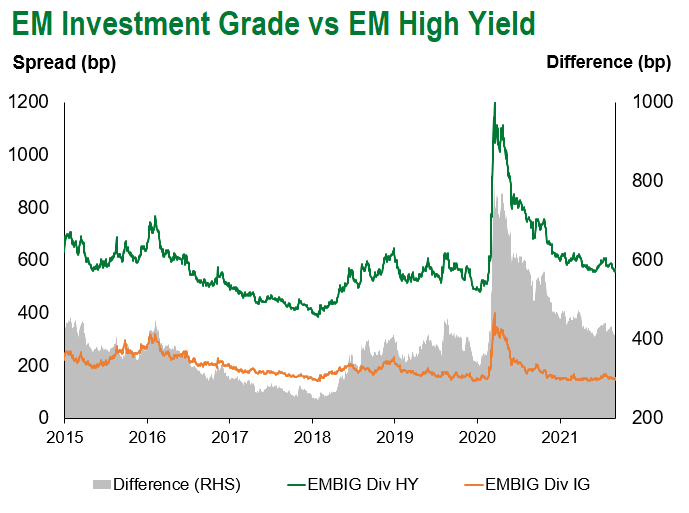

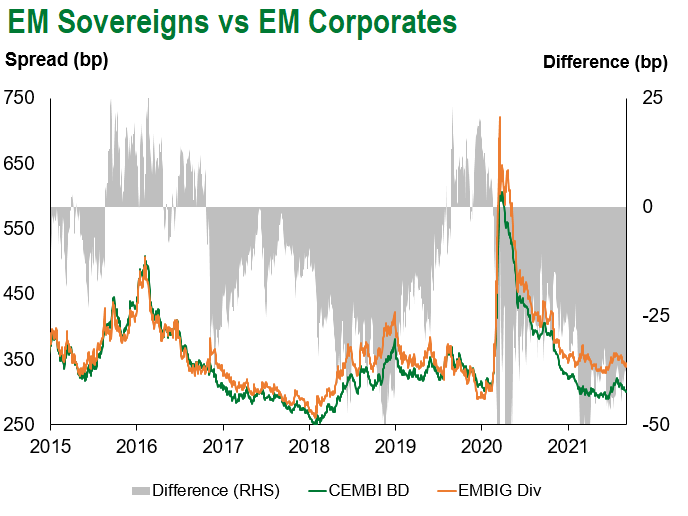

Emerging Markets Technicals

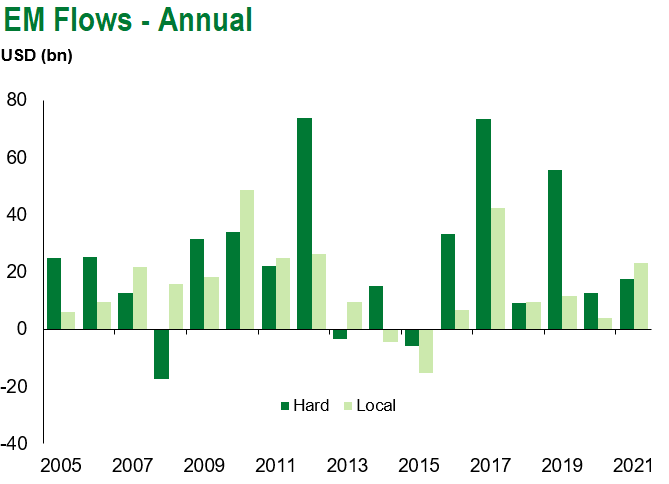

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of September 10, 2021.

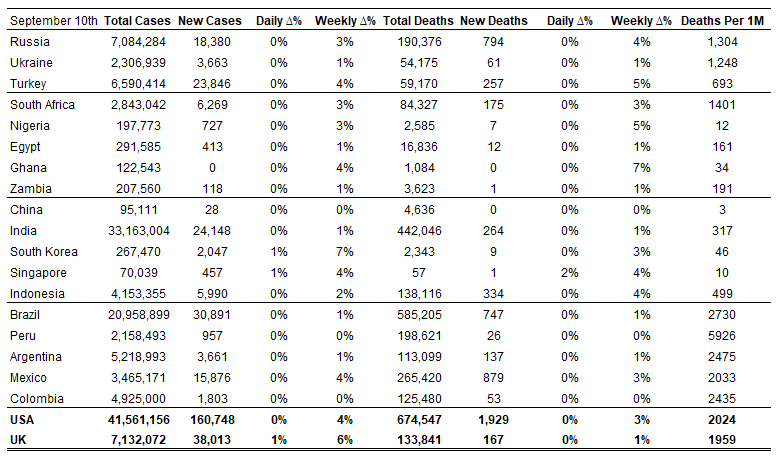

COVID Resources

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of September 10, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.