Contents

Market Overview

Macro Review

Delta concerns fuel market nervousness. Powell could also add to that sentiment come the Jackson Hole Symposium. On top of that, China’s regulatory crackdown comes just as the Sell-Side scrambled to revise growth forecasts lower, while GS also downgraded U.S. 3Q GDP. Over the week we have seen Bloomberg’s Commodity Spot index decline 3.3%, as brent fell -6.5%, copper -7.1% and iron ore -11.6%. With crude oil falling over seven consecutive sessions, it is now framed as the longest losing streak in 2021, which has weighed on equities globally this week. That said the S&P 500 did reach its 49th all-time high in 2021 on Monday. Most of the equity pain is attributed to China with the Hang Seng and Shanghai Comp down -5.8% and -3.6%, respectively. Indeed, the regulatory crackdown extended to pharmaceuticals and liquor licenses this week, just as stricter data privacy laws were approved. The latter took Alibaba’s stock to fresh all-time lows, with CNH under pressure as it slipped below the 200 day moving average and weakened beyond the psychologically important 6.50 mark (reflecting a three-week low). European stocks felt the extent of the Chinese slowdown, with Prada down -14%, along with Kering -8% and Moncler -6%, as the French CAC index was down 4.6% this week. Meanwhile, one COVID-19 case in New Zealand prompted a nationwide lockdown, which was extended by four days as the cases grew to eleven. Perhaps more importantly the strategies continue to vary from zero-COVID (New Zealand along with Australia) to living with the disease (UK). Over the next fortnight we will have a better indication of how these policies will impact global central banks and whether it deflates some of the hawkish mantra.

EM Credit Update

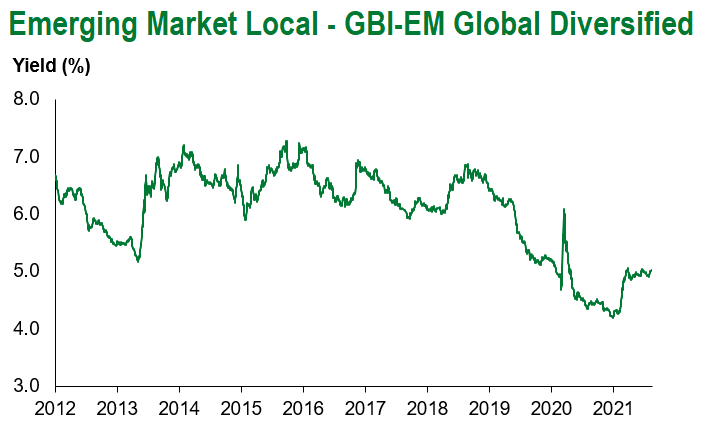

EM Sovereign Credit ended the week up +0.2% with spreads 4bp wider as U.S. Treasuries rallied 4-6bp. Outperformers on the week include Zambia, El Salvador and Lithuania, while Suriname, Tajikistan and Argentina lagged. One of the notable themes was that consensus “overweight” sovereigns were under pressure and lagged, while “underweight” names typically outperformed this week. However, the pain trade this week has been in EM Local as the GBI-EM index was down -1.1% this week, which is -5.5% YTD just as the DXY moved to a 10-month high and the ZAR and BRL traded poorly all week.

The Week Ahead

The Jackson Hole Symposium will be the key feature next week. The language around tapering will be key, but also the extent to which the Delta variant will be used as an excuse to be dovish, which would be a similar tactic used by the RBNZ and one that South Korea’s BoK are set to use. Beyond that, U.S. and German 2Q GDP will hit the tape, while Mexico will be out with 2Q GDP, CPI inflation and Banxico minutes. Elsewhere we can expect interest rate decisions out of Hungary (1.2%), Israel (0.1%) and South Korea (0.5%), followed by a slew of Eurozone PMIs.

Highlights from emerging markets discussed below include: Maduro-controlled Venezuelan National Assembly approves a Memorandum of Understanding with members of the opposition; Geopolitical risks in Central Asia increase with Taliban takeover of Afghanistan, but remain manageable for Uzbekistan due to prudent foreign policy, solid fundamentals and large buffers; and Zambia’s presidential election result surprised to the upside in sizeable opposition victory.

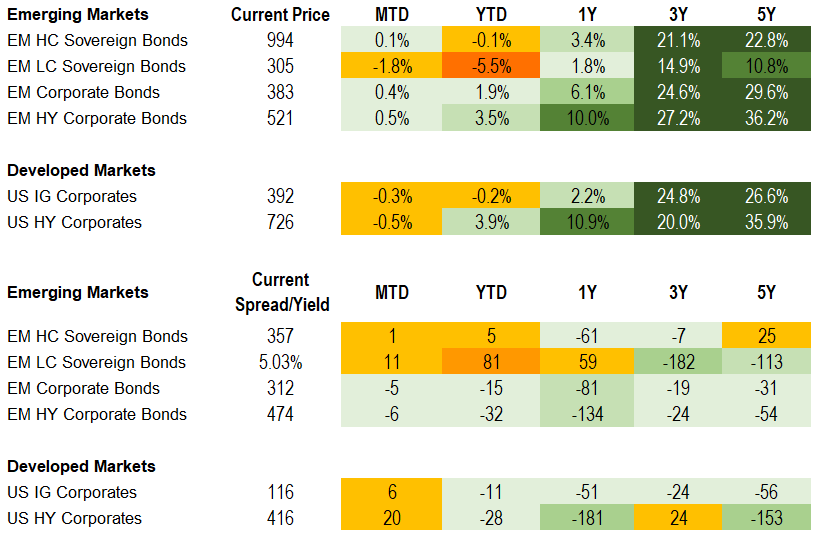

Fixed Income

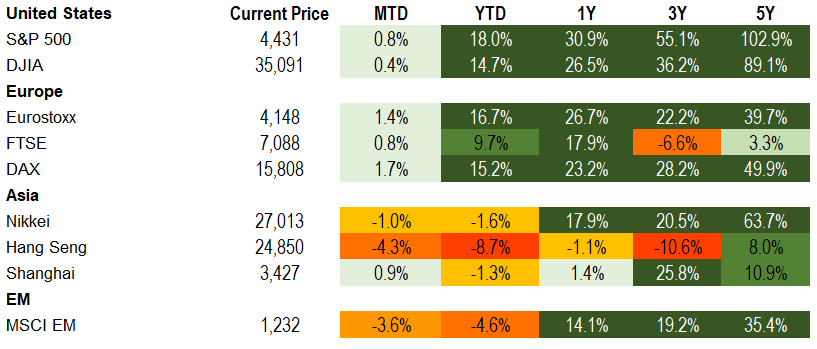

Equities

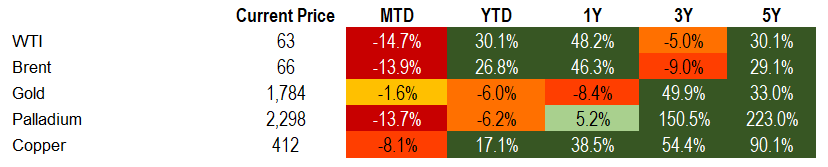

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of August 20, 2021 (mid-afternoon).

Emerging Markets Weekly Highlights

Maduro-controlled Venezuelan National Assembly approves a Memorandum of Understanding with members of the opposition

Event: Representatives from Maduro’s government and members of the opposition held meetings in Mexico, mediated by Norway. The engagement produced a Memorandum of Understanding (MoU) containing seven items: 1. political rights for all, 2. electoral guarantees for all and a timetable for observable elections,3. lifting of sanctions and restoration of rights, 4. respect to the constitutional rule of law, 5. political and social coexistence, renunciation of violence and reparation to victims of violence, 6. protection of the national economy and measures to protect the Venezuelan people, and 7. guarantees of implementation, monitoring and verification of the agreed-upon issues. Venezuela’s National Assembly promptly approved the MoU this week.

Gramercy Commentary: Holding internationally recognized elections is the key to resolving Venezuela’s political impasse. As such, a MoU between the Maduro regime and opposition members is a promising signal, especially given that it seems to address issues such as electoral guarantees and a timetable for observable elections. This being said, some critically important questions come to mind of Venezuela-watchers in the context of prior failed attempts at similar political agreements. With respect to the Maduro regime, the main concern we have is whether or not genuine willingness to implement/deliver on such promises exists. As for the opposition, unity has been elusive, so it remains to be seen if all key leaders/camps can get behind an initiative that involves negotiating with the Maduro Government, a strategy that some opposition factions vehemently oppose. In addition, both the regime and opposition continue to have abysmal approval ratings among a politically disillusioned population preoccupied with navigating years-long economic and social crises. Further, meetings are planned for early September, some potentially to take place in Venezuela, which should provide important signposts on how the process is evolving. On a few occasions in recent months, Maduro appeared to signal that he is ready and willing to sit at the negotiating table in an attempt to ease his country’s international isolation and domestic political stalemate. Meanwhile, Western diplomats have expressed willingness to review sanctions if meaningful progress toward organizing “free and fair” elections is achieved. If the momentum for internal dialogue in Venezuela gets stronger, geopolitical quid-pro-quo by the key players could pave the way toward a potential “negotiated transition” while also offering sufficient assurances to Chavismo and military elites on their participation in “future Venezuela”. A policy approach by the Biden Administration that introduces some “carrots” (e.g. humanitarian relief, amnesty, negotiations with key regime figures) to complement the existing “sticks” (i.e. sanctions) should improve the odds of regime change within the next two years, in our view.

Geopolitical risks in Central Asia increase with Taliban takeover of Afghanistan, but remain manageable for Uzbekistan due to prudent foreign policy, solid fundamentals and large buffers

Event: The U.S.-backed Afghan government collapsed and fled the country as the Taliban entered Kabul, Afghanistan’s capital. The Taliban now appear poised to re-gain control over most of the country, 20 years after having been forced out of power by the post-September 11, 2001 U.S. invasion. This has refocused market attention on geopolitical risks for Afghanistan’s neighbors in central Asia.

Gramercy Commentary: The latest developments in Afghanistan have increased risks to regional political and geopolitical stability, but the extent of the spillover into neighboring countries will likely depend on a number of factors, including their respective internal political, social and economic conditions and buffers. In that context, we are the least worried about Uzbekistan and think the credit is in a better position to weather the crisis than other regional sovereigns with outstanding external market debt such as Tajikistan and Pakistan. In the last few years, Uzbekistan’s authorities have embarked on an impressive political and economic reform program (albeit from a low base) and have achieved a lot of progress in improving the internal economic and political stability of the country. Fiscal and external financial buffers are sizable, which supports a strong shock absorption capacity and gives us comfort from a market perspective. Diplomatic relations with Russia, the security guarantor in Central Asia, and China are good and those with the West (EU, U.S.) have improved a great deal in recent years. In addition, Uzbekistan has the largest population among all former-USSR states in Central Asia and one of the strongest security apparatuses. This makes it a formidable opponent that the Taliban would not be keen to provoke militarily, in our view. We think that significant Afghan refugee flows into Central Asia are unlikely, but if they materialize, they should be manageable for Uzbekistan who can rely on large financial buffers and international support. Last but not least, security in Central Asia is a key strategic priority for Russia and the Kremlin is firmly committed to ensuring stability in the region. From that perspective, we expect financial, political and military (if necessary) support from Moscow for friendly countries such as Uzbekistan in managing any spillover risks from Afghanistan.

Zambia’s presidential election result surprised to the upside in sizeable opposition victory

Event: Last week, Zambia held presidential elections where the main contest was between incumbent President Edgar Lungu of the Patriotic Front (PF) and five-time opposition United Party for National Development (UPND) candidate Hakainde Hichilema (HH). HH secured a sizeable victory with 2.81mm votes compared to 4.86mm votes cast, comfortably exceeding the 50% +1%pt requirement for an outright first round win. High voter turnout among the youth population contributed to the outsized victory relative to polls and expectations.

Gramercy Commentary: The relatively smooth and largely uncontested outcome combined with more reform minded leadership under HH improves the outlook for an IMF program and restructuring negotiations under the common framework. However, the process will likely be lengthy with a high degree of uncertainty around the common framework process and transparency challenges. The market’s focus will now turn to cabinet appointments and resumption of talks with the Fund and bondholders. We see moderate upside to prices in the event of significant reform commitment and steady pace of progress towards debt resolution, depending on copper price evolution over this timeframe. While the election outcome significantly reduces the probability of more aggressive downside scenarios, more complicated and prolonged debt dialogue or lower copper prices could result in price volatility or ultimate recovery values below current levels.

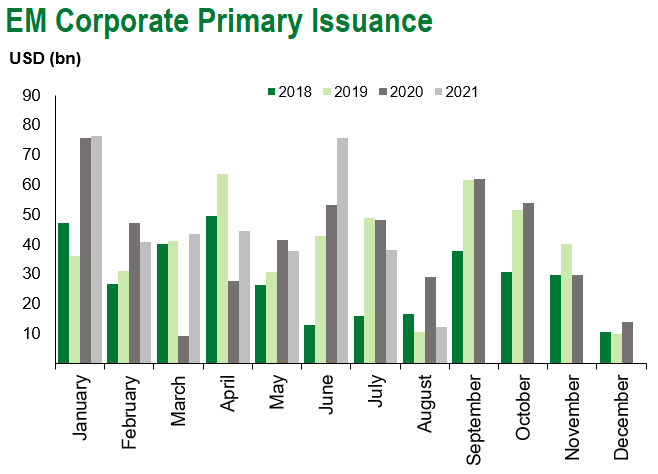

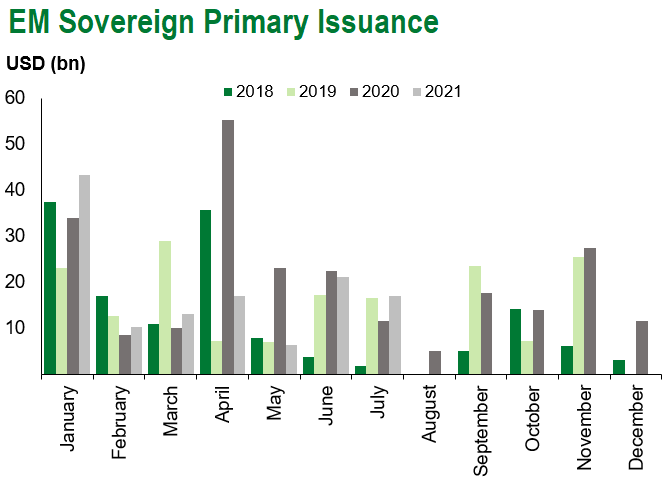

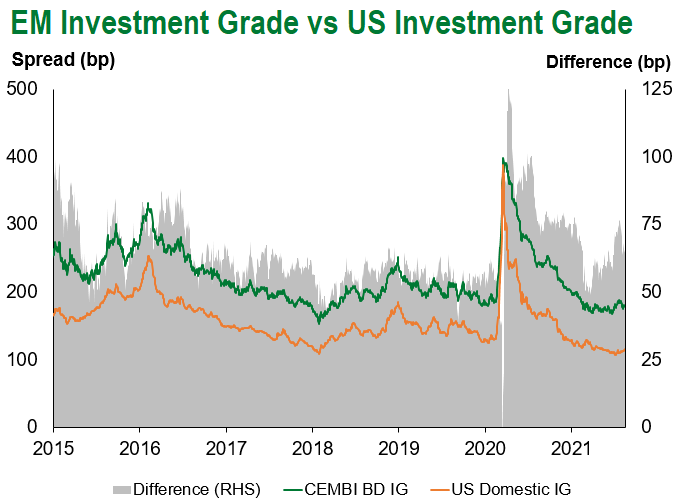

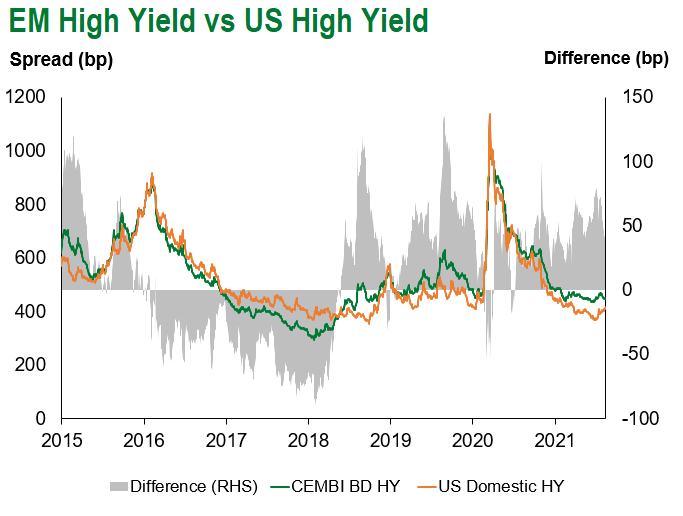

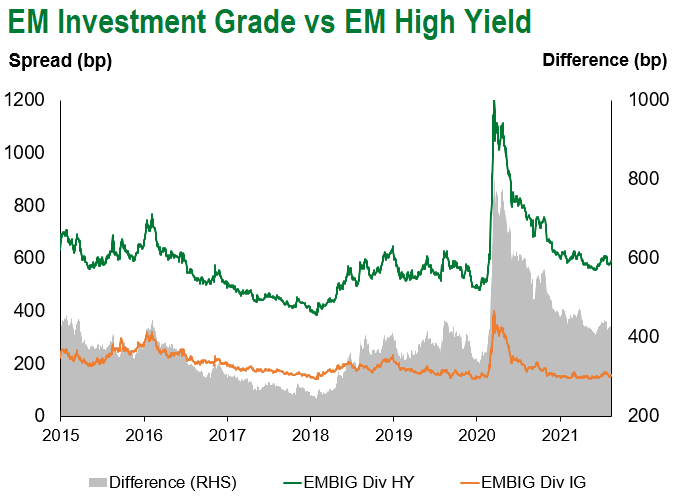

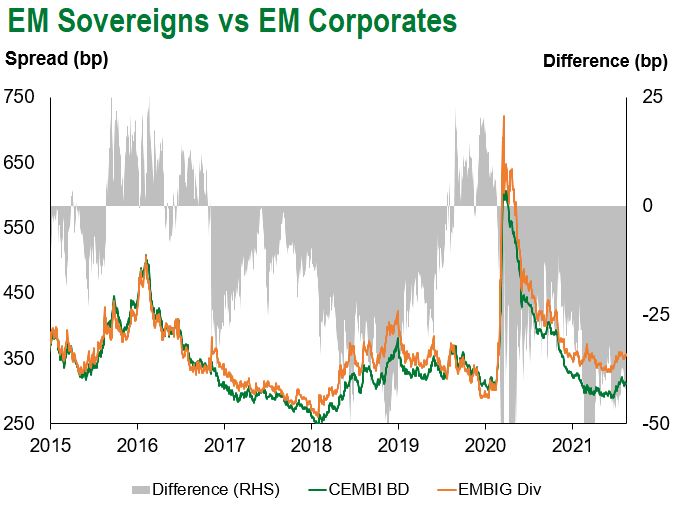

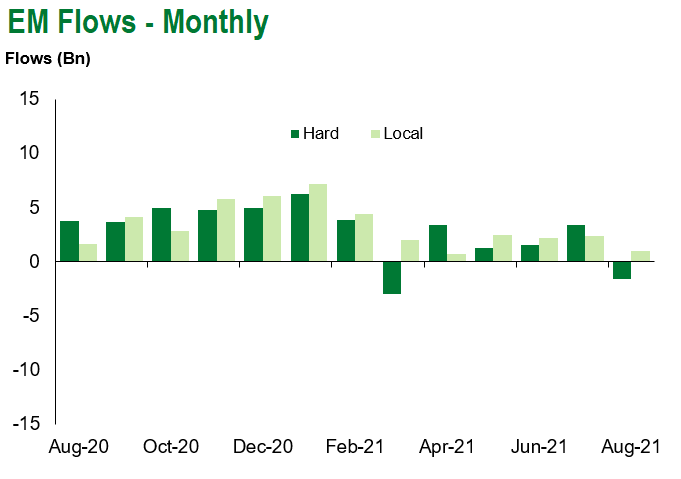

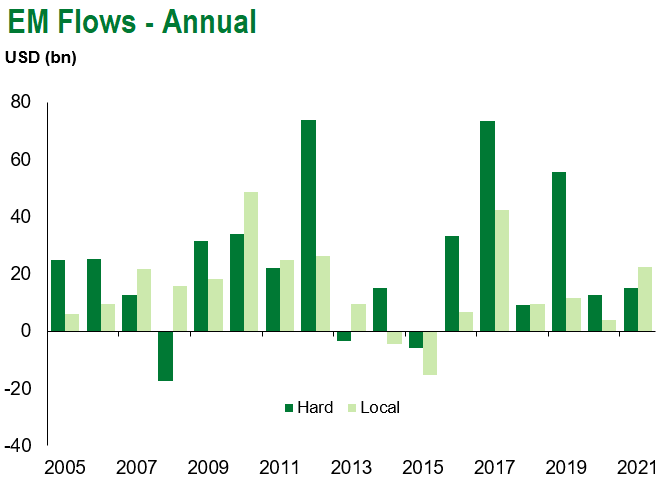

Emerging Markets Technicals

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of August 20, 2021.

COVID Resources

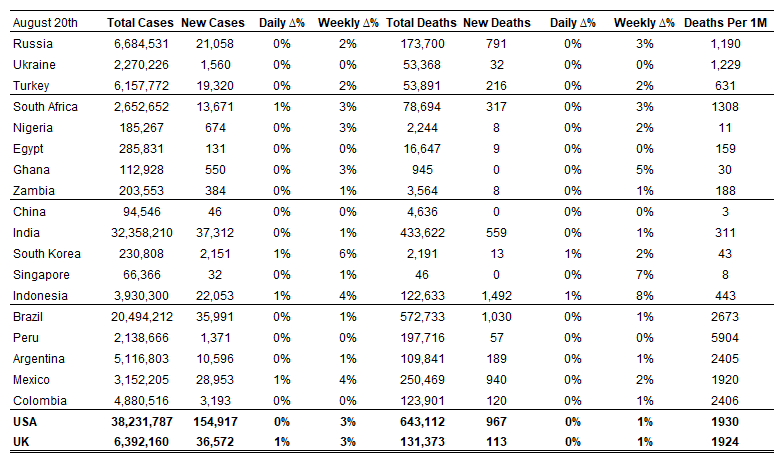

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of August 20, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.