Contents

Market Overview

Macro Review

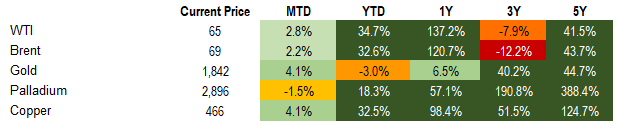

The largest NFP miss since 1996 and largest beat in CPI since 1981. In a week where 5yr breakevens widened to highs last seen in 2006, the Fed continues to double down on its inflation outlook (with one outlier in Robert Kaplan). The chorus of critics saw former Fed Governor Dudley draw an uncomfortable parallel to the 2004/06 hiking cycle. Indeed, the rotation to value that unfolded saw the Nasdaq drawdown decline to -8.5% from April 29th highs, although it ended the week with a bounce just as the VIX retraced after spiking to 28%. Following this theme, the drawdown in Chinese equities moved the MCHI into bear market territory given a 20% drawdown since February. For now, the “sell in May” rhetoric has fastened its grip on markets, which followed renewed volatility in Bitcoin over Telsa’s environmental concerns. The Bloomberg Commodity Index also turned its course after a strong 21.5% rally YTD to fall 2.3% this week (iron ore -8.7%). Aside from volatility in Taiwanese equities and troubling developments out of Israel, the spillover into EM Credit and Local Currency markets was limited. Nevertheless, thinner liquidity given Eid celebrations saw certain EMFX pairs trade in a vacuum and mostly stronger, with the exception of the Turkish lira that tested all-time highs of 8.51 once again.

EM Credit Update

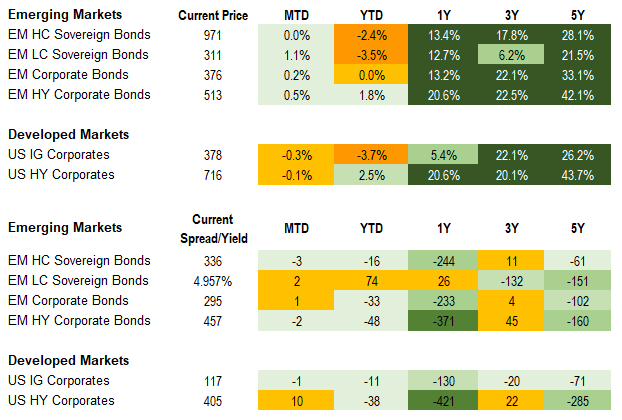

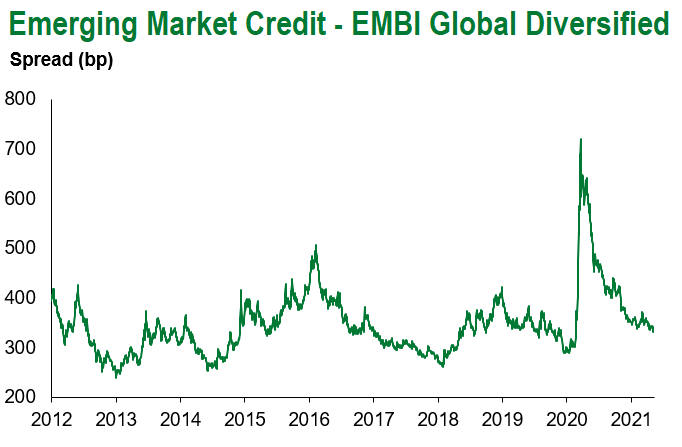

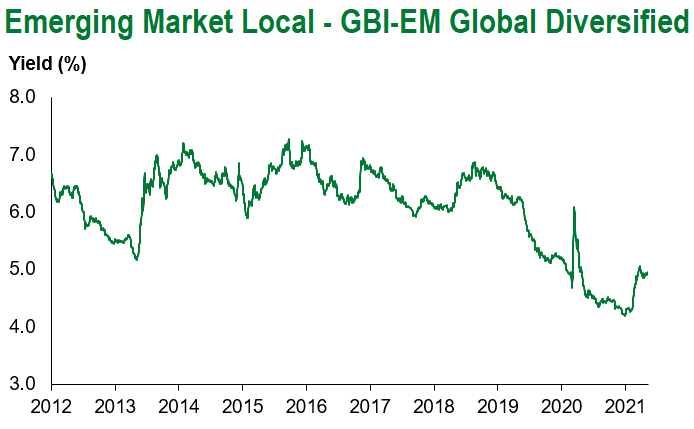

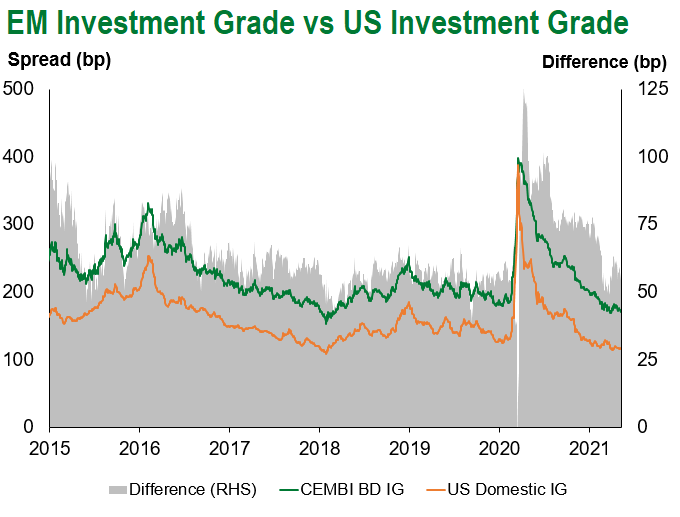

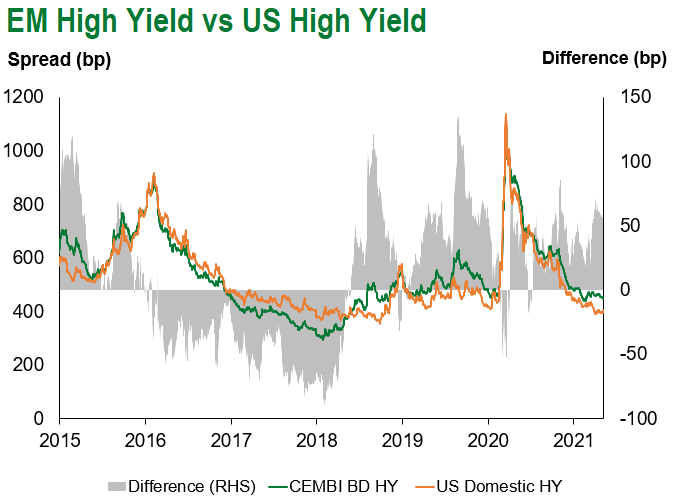

EM Credit ended the week down 0.6%, unwinding the outperformance from the previous week as U.S. Treasuries widened 7-10bp. Cameroon, Sri Lanka and Tajikistan outperformed, while Zambia, Iraq and Lithuania lagged. However, the High Yield segment of the market is outperforming. EM Corporate HY is up 1.8% YTD and ended the week unchanged. In fact, it is up 0.5ppts in May alone and has heavily outperformed U.S. HY markets.

The Week Ahead

Key events next week will rest with FOMC minutes. The UK will also move to the next round of easing, although measures are intensifying in Asia (particularly in Taiwan). Chileans head to the polls over the weekend, with China set to publish industrial production and retail sales before the week commences in Europe and the U.S. (1yr and 5yr LPR decisions are later in the week). Fedspeak from Clarida on Monday will be watched closely to better understand if the “staleness” in last Wednesday’s commentary is adjusted. Otherwise, a slew of CEE, Kazakh and Israeli GDP releases will hit screens, where South Africa’s print along with retail sales and the SARB’s MPC meeting will be closely watched after the impressive run in ZAR.

This week’s emerging markets highlights discussed below include: Early polls give Lula the edge over Bolsonaro in Brazil’s 2022 presidential elections; Bolsonaro’s re-election chances hinge on economic recovery in 2H 2021 and early 2022 ahead of what will likely be a highly competitive race between the current and former Presidents. Argentine leaders hold talks on upcoming Paris Club payment while use of forthcoming SDR funds is debated domestically; FX reserves drift higher. Peru polls narrow and Castillo moderates on the margins; S&P confirms wait and see approach.

Fixed Income

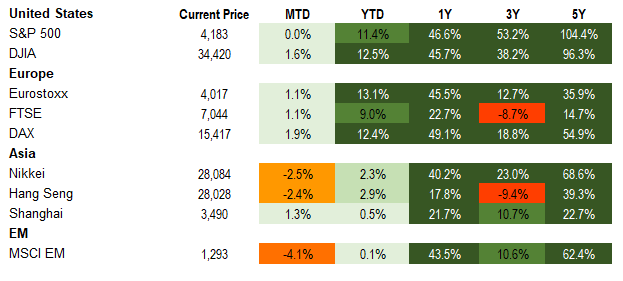

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of May 14, 2021 (Mid Afternoon).

Emerging Markets Weekly Highlights

Early polls give Lula the edge over Bolsonaro in Brazil’s 2022 presidential elections; Bolsonaro’s re-election chances hinge on economic recovery in 2H 2021 and early 2022 ahead of what will likely be a highly competitive race between the current and former Presidents

Event: Early polls for Brazil’s 2022 presidential election published this week showed former President Luiz Inacio Lula da Silva with a large lead over current President Jair Bolsonaro. Datafolha’s poll in particular indicated a staggering 23 percentage point difference (55% vs 32%) in a hypothetical runoff between the two candidates.

Gramercy Commentary: While the two latest polls (by Datafolha and PoderData) show Lula with a very large lead over Bolsonaro, other surveys from early May have signaled a much tighter race. In any case, it is still very early (the elections are almost a year and a half away) so polls’ ability to predict actual voter behavior in October 2022 is likely very low at the moment. This being said, Bolsonaro’s current underperformance vs. Lula undoubtedly reflects his Administration’s persistent mishandling of the COVID-19 crisis and response as well as a confluence of economic, political and social challenges that Brazil has faced over the last few months amid one of the worst outbreaks globally. As the country seems to slowly emerge from the worst phase of the pandemic and vaccination efforts hopefully pick up steam in the near future, the economic and political environment is likely to turn more favorable for Bolsonaro. However, politically resurrected Lula and his team will undoubtedly be eager to capitalize on any policy or political mistakes by the Bolsonaro Administration and will likely deliver an increasingly loud message against the current government’s policies. In that context, Brazil’s macroeconomic trajectory in the second half of this year and in early 2022 will be a key determinant of the political outlook and the relative chances of Lula and Bolsonaro. We expect the economy to recover well in 2H21 provided the pandemic is brought under control, but we recognize that any economic underperformance will likely pressure Bolsonaro’s popularity even further. An adverse macro scenario could elicit some erratic behaviors by the President and increase the opposition’s electoral appeal. We expect Brazilian markets to be driven by the pace and scope of economic recovery in 2H 2021 and increasingly by what will likely be a highly competitive political battle between Lula and Bolsonaro.

Argentine leaders hold talks on upcoming Paris Club payment while use of forthcoming SDR funds is debated domestically; FX reserves drift higher

Event: President Alberto Fernandez and Economy Minister Martin Guzman held discussions with European officials this week on the country’s upcoming $2.4bn Paris Club payment on May 31st and reportedly agreed on terms for temporary extension. At the same time, a domestic debate continued over use of the forthcoming $4.5bn SDR allocation. Meanwhile, FX reserves increased by roughly $600mm since the beginning of May amid elevated commodity prices.

Gramercy Commentary: The constructive European dialogue and tentative agreement to delay the government’s upcoming Paris Club payment while they continue IMF negotiations is positive as it allows the government to avoid immediate repercussions of entering into arrears and should provide the government with greater ability to focus on the domestic political consensus needed for an IMF program. While we expect the supportive external backdrop and electoral considerations to continue to divide and limit the Administration on moving forward with an IMF agreement in the near term, we anticipate underlying macroeconomic imbalances and eventual need for external capital to catalyze a deal at a more politically opportune time. This should boost asset prices with the scope and sustainability dependent on program conditions, policy execution, and prospects for FX reserve accumulation.

Peru polls narrow and Castillo moderates on the margins; S&P confirms wait and see approach

Event: Latest surveys indicate a tightened race between radical leftist presidential candidate, Pedro Castillo and center-right candidate, Keiko Fujimori. Castillo is ahead by roughly 5 to 6 points compared to initial polls, which had his lead at 10 to 20 points. Castillo pledged a marginally more moderate stance calling for respect of judicial power and international treaties. Relatedly, S&P released a statement that it intends to wait to review the credit until after the election given the high degree of uncertainty.

Gramercy Commentary: We had expected the gap between the candidates to narrow as the race nears and alliances take shape, and asset prices to retrace some of their initial losses as a result. However, the ultimate outcome remains difficult to predict with increased political challenges and possible downward rating pressure in either scenario. The market reaction to a Castillo victory would likely be fairly negative given the high degree of policy uncertainty despite a lack of majority in Congress and limited ability to execute on some of the most radical aspects of his agenda. Conversely, there are limitations to the upside over the medium-term in the context of a Fujimori victory given governability risks and still populist pressures from Congress.

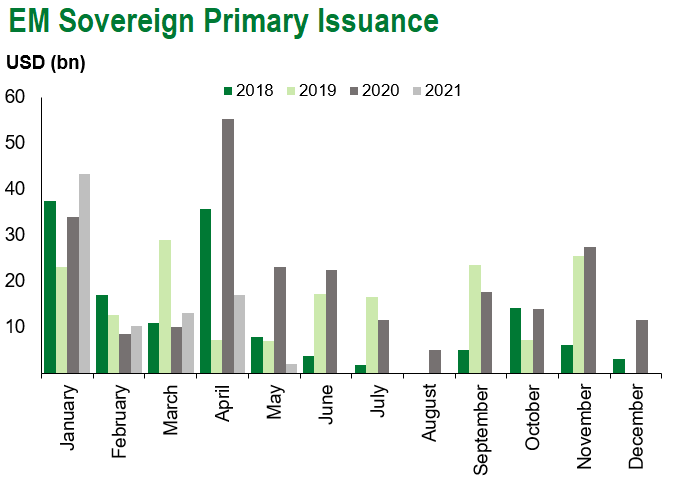

Emerging Markets Technicals

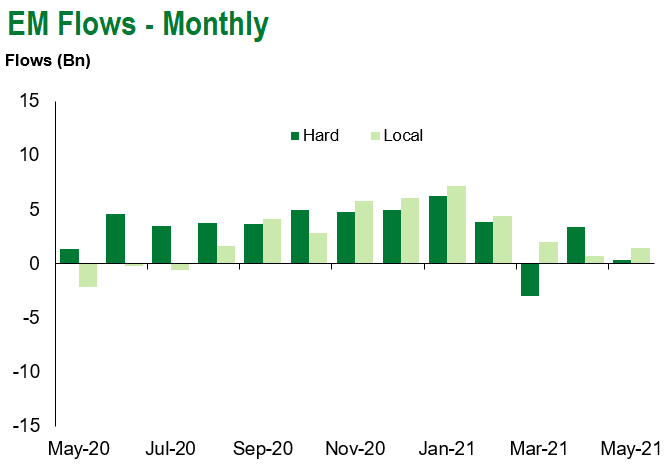

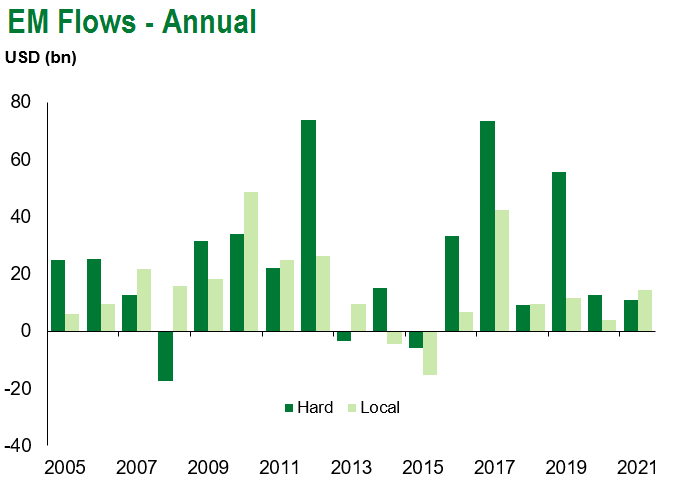

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of May 14, 2021.

COVID Resources

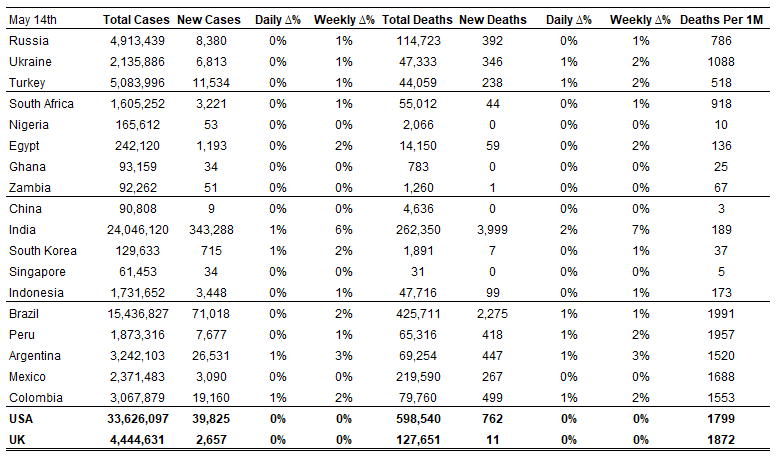

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of May 14, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.