Contents

Market Overview

Macro Review

USD downside offers green-shoots for EM. U.S. Treasuries received a surprise wake-up from the Bank of Canada over intensions to taper QE sooner-than-expected. The ECB might have been a muted affair, but global PMIs and U.S. data eventually pushed U.S. Treasuries wider after initially ignoring a strong initial jobless claims print (lowest since March 2020). Rates had been technically supported after the 20yr auction, yet the strength was not enough to break through the key 50dma (1.54%). Equities ended the week slightly weaker but Bitcoin was down 20% given headline risk associated with the Biden Administration’s tax plan. EM events ensured it was a volatile week as U.S./Russia tensions peaked, Lukashenko puts Belarus’ sovereignty into question, Navalny seems to be in better health and Putin/Zelensky dialogue channels are opening up. Meanwhile, tensions between the U.S. and Turkey are set to deteriorate with the official removal from the F-35 program, just as Biden is set to address historical references between the country and Armenia. Elsewhere, there is a growing focus on the Asian economic growth outlook. Thailand’s GDP growth has been revised lower by both Citi and Moody’s given the renewed Covid threat, which comes just as India’s daily case growth spirals out of control and Japan enforces new restrictions. The market is once again dominated by event risk, rather than structural U.S. Treasury risk but third wave concerns are never too far away.

EM Credit Update

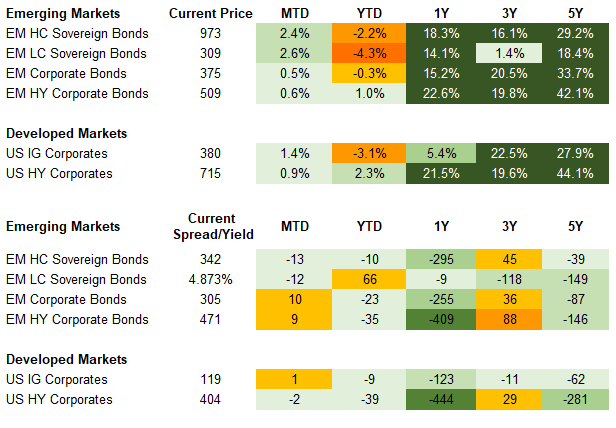

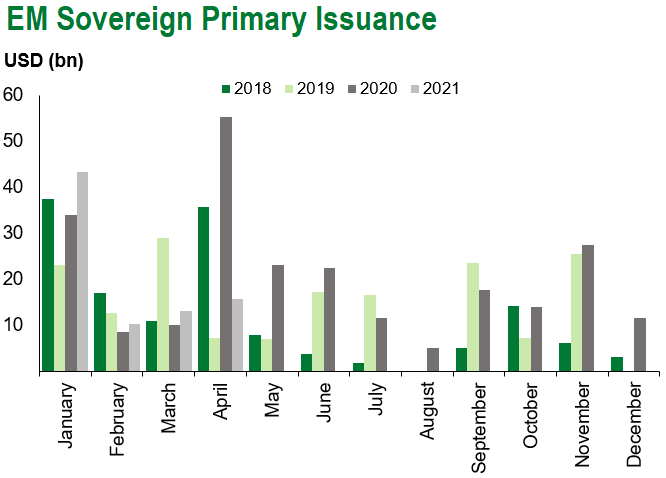

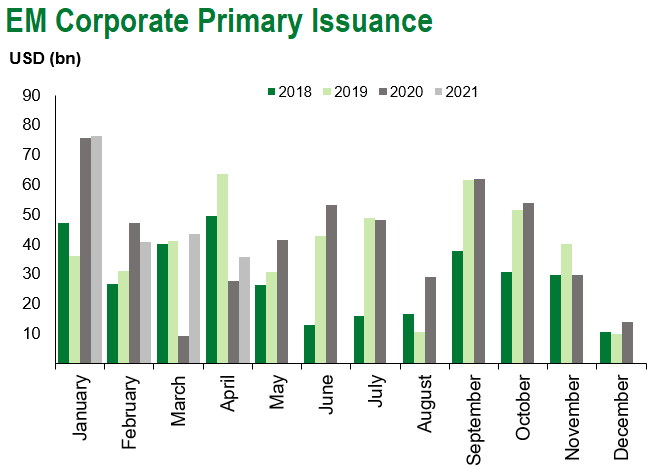

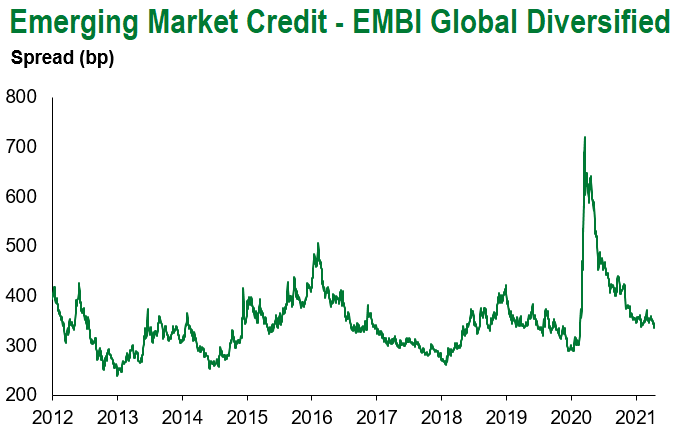

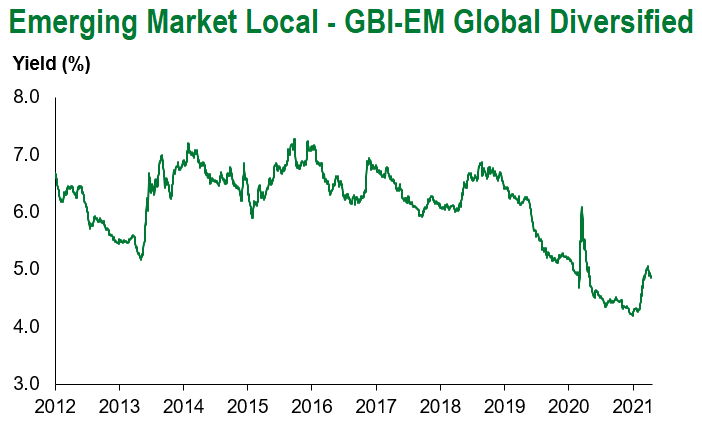

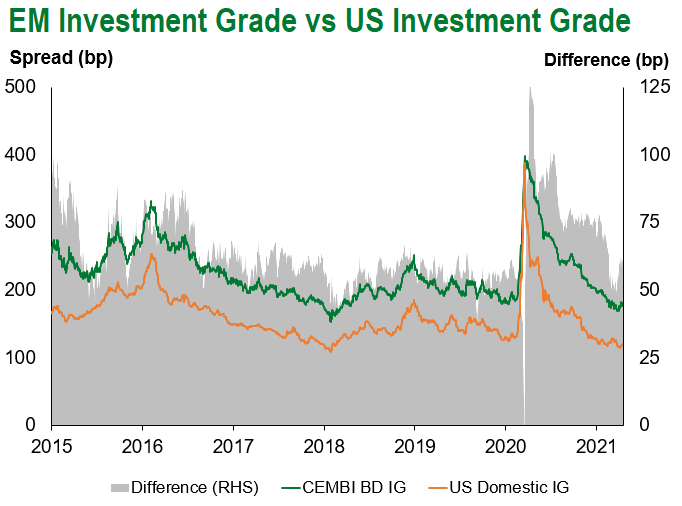

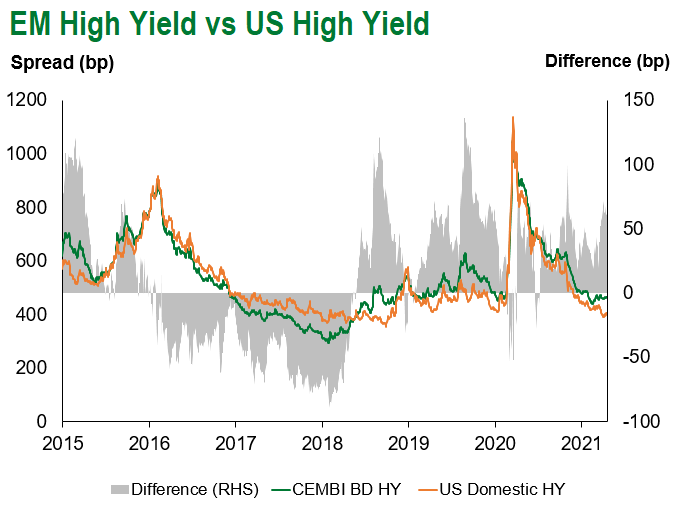

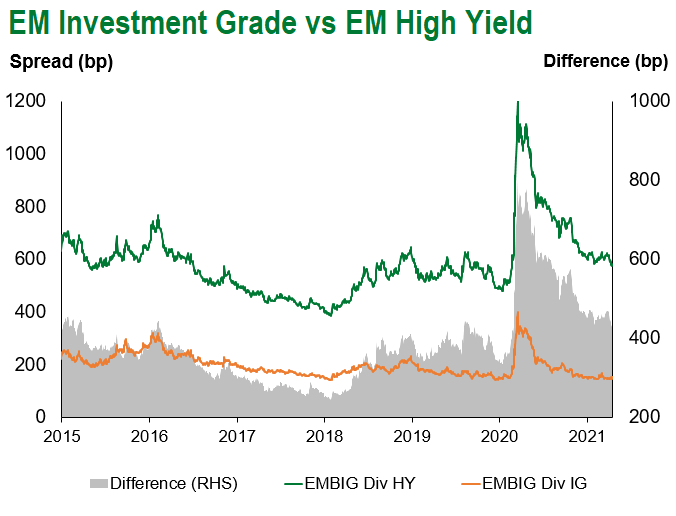

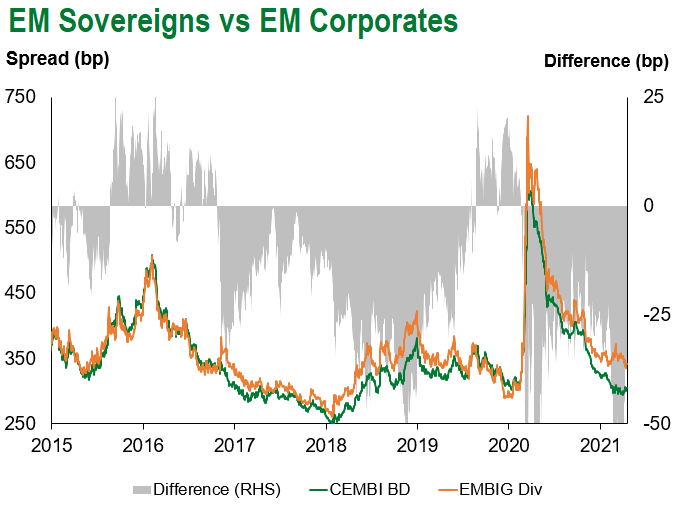

EM Sovereign and Corporate Credit were unchanged on the week. Credit spreads widened 2-3bp and were simply a mirror reflection of US Rates. Suriname, Ecuador and Belarus outperformed, while Sri Lanka, Peru and Colombia lagged. Returns year-to-date in EM Sovereigns stand at -2.2%, with EM Corporates up 0.5%. However, the narrative around US rates has calmed and instead the focus has shifted to idiosyncratic risks but largely an ever-growing new issuance pipeline. We have already seen $279bn in primary issuance, split $82bn across EM Sovereigns and $197bn across EM Corporates, which is 4% ahead of the 2020 run-rate.

The Week Ahead

Markets remained quiet in the run-up to the ECB, just as the Fed was in blackout. The key event next week is of course the FOMC on Wednesday. Beyond that rate decisions out Colombia and Hungary stand-out, along with central bank minutes from Ukraine after the surprise 100bp hike on April 15. The week ended with flash PMIs out of the US and Eurozone, but EM participants will similarly be watching Chinese manufacturing data. Before that, we’ll have Turkish inflation a week prior to the next CBRT decision, then 1Q GDP Mexico, Taiwan and South Korea.

This week’s emerging markets highlights discussed below include: The reduction of Russian forces near Ukraine’s borders and a couple of other developments signal a de-escalation of tensions in the near term, Peru initial second round election polls point to a competitive Castillo and Global Emerging Markets Corporates in Focus: Questioning support.

Fixed Income

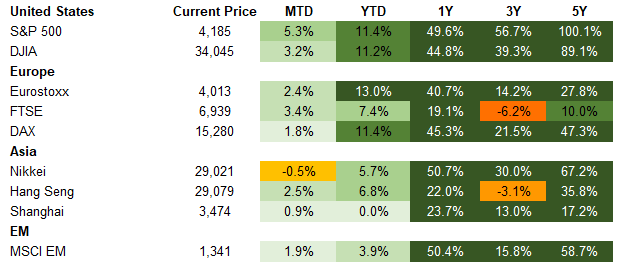

Equities

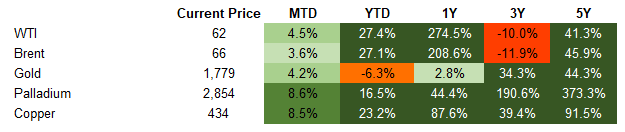

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of April 23, 2021 (Mid Afternoon).

Emerging Markets Weekly Highlights

Reduction of Russian forces near Ukraine’s borders and a couple of other developments signal a de-escalation of tensions in the near term

Event: On Thursday, Russia’s defense ministry announced that military exercises close to Ukraine’s borders are completed and troops will be returning to their bases. Meanwhile, President Putin signaled willingness to meet with President Zelenskiy in Moscow for direct talks and participated in the virtual Global Climate Summit organized by President Biden on Earth Day.

Gramercy Commentary: Following a tense period characterized by a number of geopolitical moving parts, including Russian military buildup near the conflict zone in Ukraine’s Donbas region and in Crimea and new U.S. sanctions on Russia, this week finally brought some clear signals of de-escalation, at least in the near term. As we wrote last week, with the latest round of U.S. sanctions out of the way (unless a new substantial development materializes), a more constructive narrative could start to emerge around Russia’s relations with the U.S./EU under President Biden and on Ukraine. The most recent signals seem to support our view that tensions are set to ease in the near-term as both sides shift attention to areas of potential cooperation such as the global climate crisis, nuclear proliferation and relations with China, among others. We believe that cooperation on such issues of global importance could provide a framework for the White House and Kremlin to start repairing the bilateral relationship from a low base. Going forward, we expect investors’ focus will be on a potential summit between the U.S. and Russian presidents in the not-so-distant future as well as a possible meeting between Putin and Zelenskiy to clear the air around the recent escalation of tensions on Ukraine. In that context, pressure on Russian and Ukrainian assets should continue to ease as investors price in a lower risk of material escalation in the near term. Meanwhile, another constructive development during the week was related to Russian opposition leader Alexei Navalny who received medical care in prison from “outside doctors”. Navalny is on hunger strike and his supporters have cautioned that his life was in danger unless he received proper care, which now seems to have occurred. As a reminder, Navalny’s deteriorating health condition while in custody has prompted strongly worded warnings against the Kremlin by U.S. and European diplomats.

Peru initial second round election polls point to a competitive Castillo

Event: Ipsos and Datum polls released this week reflected solid support for leftist radical candidate, Pedro Castillo of 42% and 41%, respectively. This compares to support of 31% and 26% for market-friendly, albeit controversial, candidate Keiko Fujimori. Undecided and null votes remain elevated around 30%. Peruvian assets underperformed over the week with the sol trending back towards its weakest level this year.

Gramercy commentary: We expect Castillo to initially maintain his lead in the polls but think there are prospects for a tighter race as the second round vote nears on June 6th. A portion of undecided voters are likely to support Fujimori in the backdrop of limited moderation in Castillo’s rhetoric and approach. Regardless of the ultimate outcome, the political outlook for Peru is likely to remain challenging with elevated risks to stability, particularly in the case of a Fujimori presidency, and policy in the case of Castillo with significant prospects for higher royalties on the mining sector, contract revisions, challenges to BCRP independence and calls for a new constitution. Peruvian assets should retrace some of their losses if polls narrow but will likely come under more significant pressure in the event of a Castillo victory with prospects to stabilize as the market digests cabinet appointments and specifics of his agenda. Conversely, a Fujimori win combined with a constructive copper price backdrop should drive markets higher in the short-term but political headwinds from a fragmented Congress and corruption charges will likely make it difficult to sustain outperformance into the medium-term.

Global Emerging Markets Corporates in Focus: Questioning support

Event: Following a delay in publishing results and related concerns about standalone fundamentals, support for state-owned entities such as China Huarong Asset Management Company has, once again, become a topic for discussion.

Gramercy commentary: Explicit government support for bonds, such as an irrevocable government guarantee, may be preferable in cases where there is a significant difference between the state’s financial strength and the standalone fundamentals of an entity it owns or controls. However, it may not be possible or desirable to extend such guarantees in all circumstances. Implicit, often less formal support is therefore commonplace. Such arrangements are likely to remain a popular choice for some time – the detrimental effects of the COVID-19 pandemic on some governments’ finances may mean these authorities seek to avoid the additional burden on already-stretched metrics which explicit guarantees could entail. Whether or not a government chooses to provide support depends on a number of factors including the systemic importance of the issuer, with larger market participants often seen as more likely to receive assistance. An issuer’s significance may not solely be linked to its size. The provision of a service considered to be vital or coverage of a key community may mean that even relatively small entities are deemed important when support decisions are made. Potential contagion risks can also play a role. Governments may choose to extend the funds or other help needed to avoid spillovers to other issuers and/or significant market disruption. In addition, the ranking of issued securities can be important. Senior obligors may be made whole, for example, but subordinated securities may be written down. In a similar vein, language covering implicit support can also be important. Some clauses may give bondholders greater recourse to the state than others. Further, some bond indentures may allow for loss absorption. Ownership of securities can be vital too. As an example, if a bond is primarily held by retail investors, this can make it more likely that a government will intervene. The importance of future market access is another factor. If an issuer requires ongoing funding and this would only be available with support, governments may decide to step in. The support decision can be a complex one. Even where governments would prefer not to extend help, forces outside their immediate control may mean that such assistance is eventually offered, in some form.

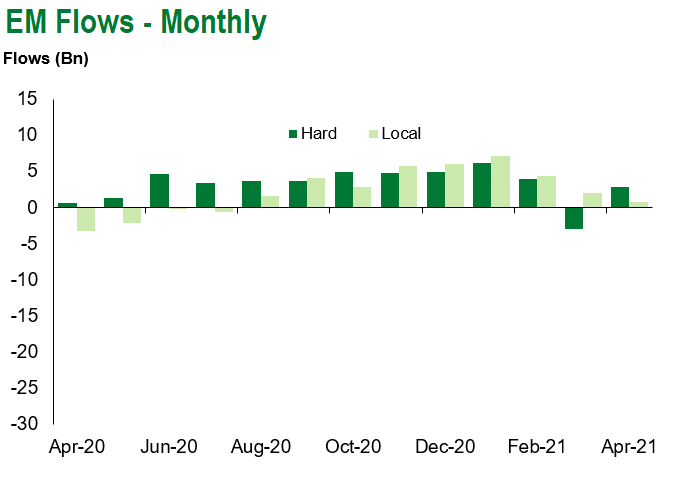

Emerging Markets Technicals

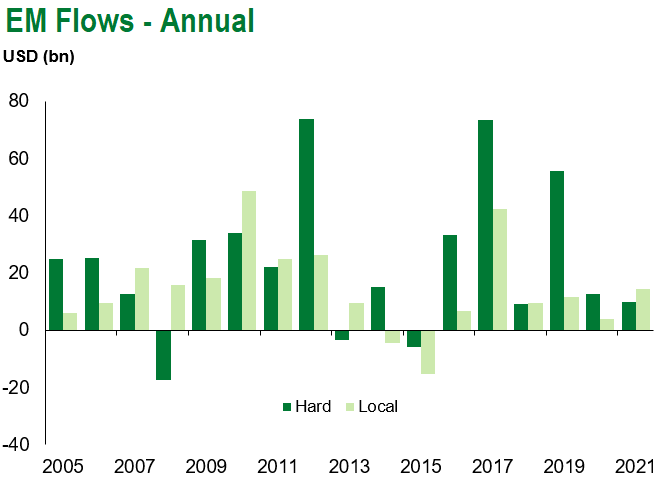

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of April 23, 2021.

COVID Resources

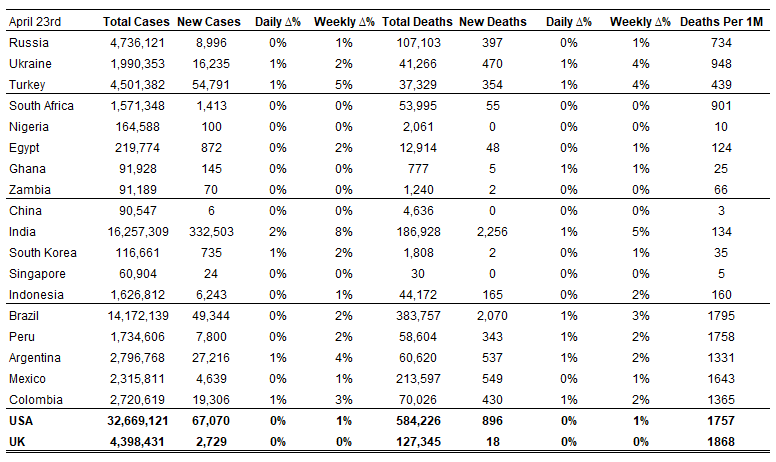

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of April 23, 2021.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, CFA, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.