Contents

Market Overview

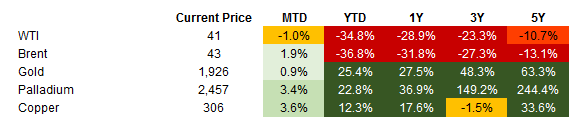

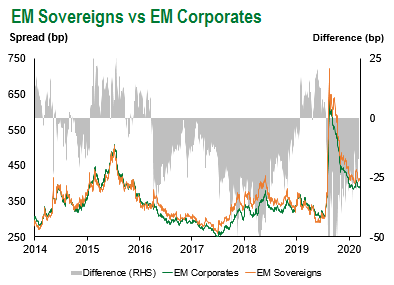

Stimulus hopes dominated the week and ultimately overshadowed a benign presidential debate. Markets are at least buying the fact that the Senate can overcome the three major obstacles: (1) state & government aid; (2) school funding; and (3) liability shields for employers. While a significant gulf remains, Pelosi announced that they were “just about there” which led to Treasury yields spiking. The move saw the 10yr U.S. Treasury hit 86bp with the 30yr touching 1.68%, as 10s30s steepened beyond 80bp. In turn, 5y5y inflation is almost back to 2.20% as 10yr breakevens reached 1.76%. This puts the idea of negative real yields back on the radar. Meanwhile, the Fed’s balance sheet reached a new all-time high of $7.2 trillion. On top of that, the European Union issued SURE 10yr and 20yr bonds that garnered interest in €233 billion for the €17 billion issuance, meaning it is the largest EUR-denominated book after the Italian 10yr bond issue in June (book was €108 billion). With OPEC+ not committing to additional 2021 production cuts, crude markets were kept largely in check through the week, but the real headline maker was with copper as it traded above $7000/t. China’s investment-led approach aimed at gearing up production is one explanation given higher industrial production (even if 3Q GDP slipped to 4.9%) as supply shortages in Chile weighed on the commodity. EM Sovereigns ended the week 3bp wider while EM Corporates were 4bp tighter. Overall, Cameroon, South Africa & Kenya outperformed, while Lebanon, Zambia & Sri Lanka underperformed. Into next week, South Africa’s inflation print will be watched after the impressive ZAR run with some focus on whether core inflation at 3.3% will slowdown. However, the Medium Term Budget Policy Statement on October 28th is likely to overshadow macro developments and act as a reality check. Third quarter growth figures can also be expected out of Czech Republic, Hong Kong, Mexico and South Korea, followed by PMIs out of China. As far as central bank rate decisions go, we can expect a quieter week with announcements from only Brazil and Colombia.

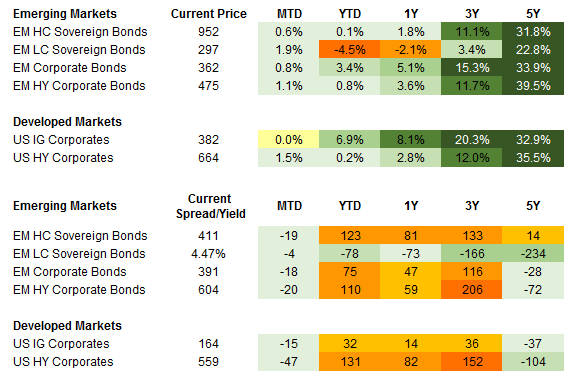

Fixed Income

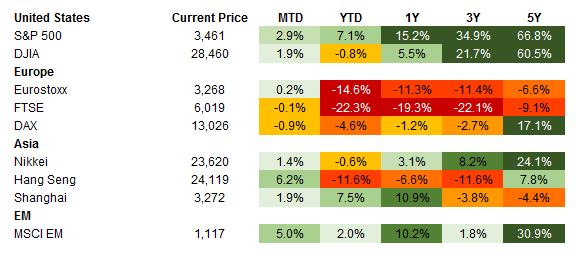

Equities

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of October 23, 2020 (Mid Afternoon).

Emerging Markets Weekly Highlights

Turkey’s Central Bank (CBRT) misses an opportunity to boost monetary policy credibility and send a constructive signal to markets, Bolivia’s presidential election outcome points to potential challenges for macroeconomic stability, Peruvian President Vizcarra to face second impeachment bid in 5 weeks, and Street protests in Nigeria over police brutality highlight simmering social and economic tensions, may complicate policymaking by the Buhari Administration .

Turkey’s Central Bank (CBRT) misses an opportunity to boost monetary policy credibility and send a constructive signal to markets

Event: CBRT left the one-week repo rate, its main policy rate, unchanged at 10.25%, contrary to market expectations of 150-200 bps of tightening. Instead, the Central Bank opted for widening its interest rate corridor by increasing the late liquidity window rate (LLW) by 150bps to 14.75%, which sets the upper limit for the cost of domestic liquidity.

Gramercy commentary: With CBRT’s effective funding rate (EFR) (i.e. the weighted average cost of funding provided by the central bank) standing at around 12.75% this week, the asymmetrically wider upper bound of the interest rate corridor means that the authorities could deliver approximately 200bps of additional “hidden tightening” of monetary policy by managing the liquidity mix they provide to the local banking system. Assuming inflation stabilizes at current levels, this strategy will help restore domestic real interest rates closer to levels (2-3%) that historically have helped reduce local deposit dollarization, a key downside pressure point on the currency (TRY). This being said, the most important take-away for investors in Turkey from CBRTs’ decision not to hike its main policy rate is the missed opportunity to reverse policy credibility erosion and send a strong signal that the Central Bank is willing and able to shift toward a more transparent and predictable monetary policy stance. As a reminder, September’s 200bps policy rate hike came as a positive surprise to markets and was perceived as a step in the right direction, but not bold enough given how loose monetary and financial conditions in Turkey have been. This week investors were looking for a confirmation of a constructive policy U-turn by the CBRT, but were left disappointed. Against this backdrop, although gradual “hidden tightening” of monetary policy via the EFR is set to continue, pressures on the already thin FX reserves buffer are likely to remain elevated. This will leave Turkish local and hard currency assets more vulnerable to fluctuations in global risk appetite and geopolitical risks stemming from the upcoming U.S. election as well as Turkey’s ongoing tensions with the U.S. and EU over a variety of simmering diplomatic issues. Given the missed opportunity to deliver a decisive pivot to a more market-friendly economic policy mix and the heightened external risks, we remain cautious on Turkey’s near-term credit story.

Bolivia’s presidential election outcome points to potential challenges for macroeconomic stability

Event: Luis Arce of the Movement for Socialism (MAS), the preferred candidate of ousted President Evo Morales and his former Finance and Economy Minister, secured a first-round win in the presidential vote held on Sunday, October 18th. With roughly 90% of votes counted, Arce obtained 55% of votes compared to the right-wing runner-up Carlos Mesa who garnered 29% of the vote. The large margin of victory limited social unrest and contested election allegations, with Mesa conceding on Monday.

Gramercy commentary: While Arce is viewed as more technocratic and moderate than Morales, his policy agenda which envisages demand fueled growth supported by public spending is unlikely to resolve the country’s growing macroeconomic challenges in the near-term. Fiscal and current accounts shifted into deficit following the 2014/15 collapse in oil prices and have continued to widen and erode FX reserves to just $3.5 billion from just over $13 billion in 2014. This compares to the country’s total outstanding Eurobond debt of $2 billion with debt service of around $1.3 billion through 2023. Bolivia was not in scope for initial DSSI relief but Arce has indicated in the past that he would request relief from foreign creditors albeit details remain unclear. The majority of Bolivia’s external debt stock is multilateral and bilateral in nature with a comparatively low interest burden relative to revenue, but the pressure on FX reserves suggests measures will need to be taken absent an adjustment to the currency peg or more material financial support from the IMF or other IFIs.

Peruvian President Vizcarra to face second impeachment bid in 5 weeks

Event: Barely a month after attempted efforts to impeach Peruvian President Martin Vizcarra for graft, Peruvian Congress is trying to impeach him again over different bribery allegations. A motion to impeach was presented to the Peruvian Congress on Thursday and a vote on whether to accept the motion and start impeachment proceedings could be held as early as Friday, October 23rd. The motion requires support of 52 out of 130 members to be admitted for a vote and 87 out of 130 votes to pass after the hearing.

Gramercy commentary: This new impeachment effort adds to the political noise that has surrounded Peru since the initial constitutional crisis unraveled in 2019. While President Vizcarra has maintained relatively high approval ratings while in office of just under 60%, he has faced constant opposition from a hostile and much less popular Congress (support of around 25%). We do not expect the attempt to be successful given the proximity of the next general election in April 2021 and the debatable legal basis for the motion. If President Vizcarra is removed from office, the President of Congress, Manuel Merino, would take over until the election. While the near-term political noise complicates policymaking amid a challenging macroeconomic backdrop, the more significant issue for markets is the growing potential for broader populist electoral and policy implications. In the near-term, Congress is set to vote on another pension reform that could result in additional withdrawals from the system and narrow local market depth. Over the medium-term, the focus will be on the presidential election with high prospects for emergence of populist and anti-establishment candidates. The new administration’s approach to macroeconomic policy in the aftermath of COVID-19 will be key for Peruvian assets over the long-term. While the balance sheet of the sovereign remains comparatively robust, further erosion of fiscal space overtime combined with structural populist measures would begin to weigh on currently very tight spreads.

Street protests in Nigeria over police brutality highlight simmering social and economic tensions, may complicate policymaking by the Buhari Administration

Event: Nigerian security forces opened fire on protestors in Lagos who defied a government curfew. Protests that started in early October over alleged brutality by a special police unit have morphed into a broader movement drawing on additional social grievances such as rising food prices, corruption, and COVID-induced unemployment. President Buhari has largely remained silent during the unrest and have thus far failed to address the demands for reforms.

Gramercy commentary: The domestic tensions and shootings of unarmed protestors will complicate the Nigerian government’s policymaking efforts in the near-term. For example, the 2021 budget is now likely to be delayed as the speaker of the House of Representatives has promised not to support a budget that doesn’t include compensation for victims of police brutality. The 2021 budget was set to be approved before the beginning of the fiscal year for only the second time in a decade. Both the finance bill, aimed at improving tax enforcement, and the petroleum industry bill will also likely be delayed into next year. Additionally, President Buhari’s credibility has taken a significant hit as many believe the shootings were done with his knowledge. This being said, violent street protests appear unlikely to be sustained for a prolonged period of time due to the lack of support among middle and upper-class Nigerians, in our view. However, this also highlights the wide socio-economic and generational divides that will remain a critical medium-term credit concern among investors in Africa’s most populous country and one of the fastest growing populations globally.

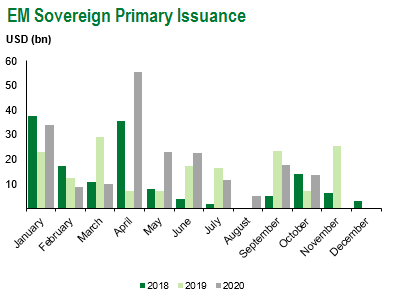

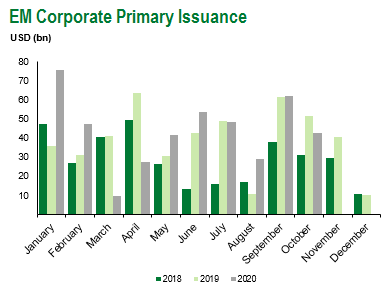

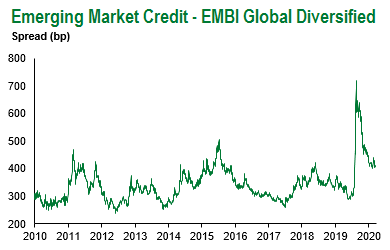

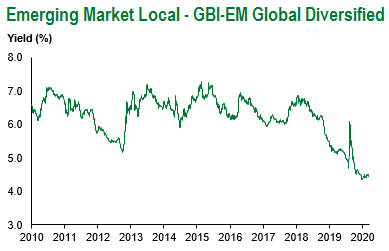

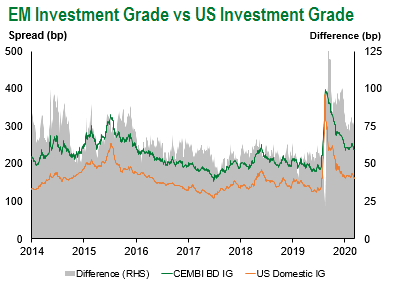

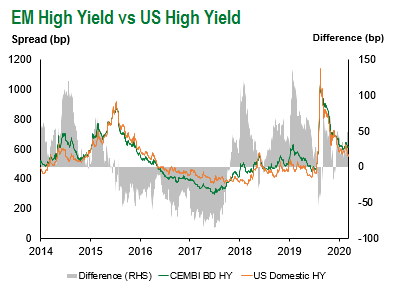

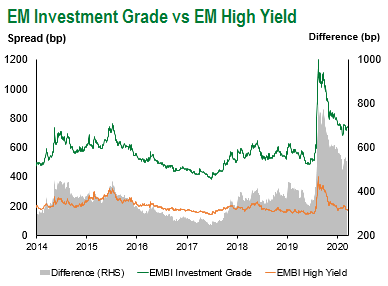

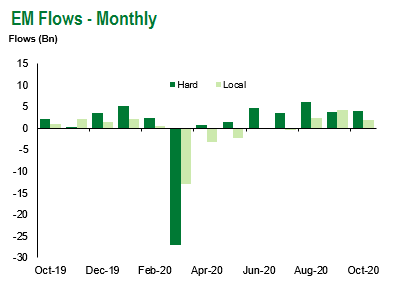

Emerging Markets Technicals

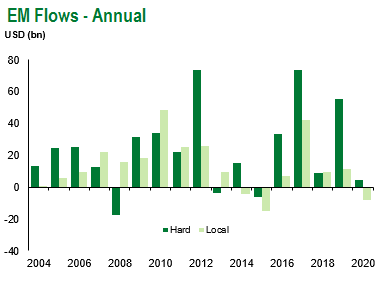

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of October 23, 2020.

COVID Resources

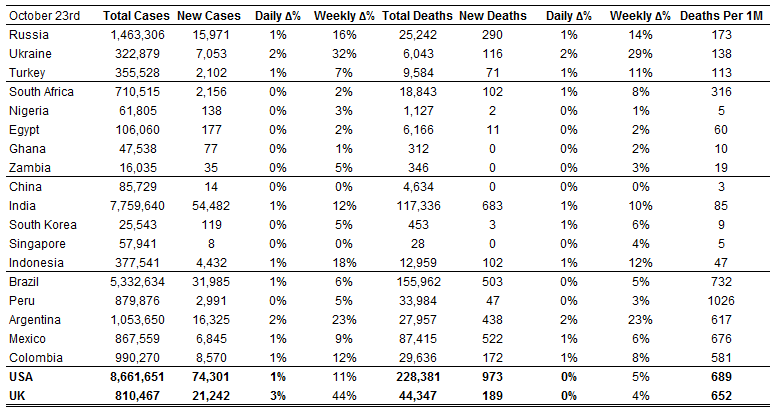

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of October 23, 2020.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.