Contents

Market Overview

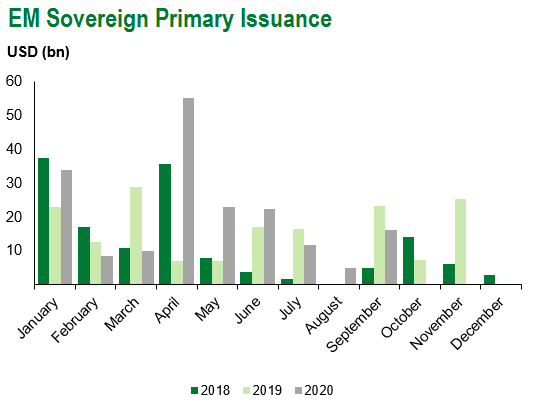

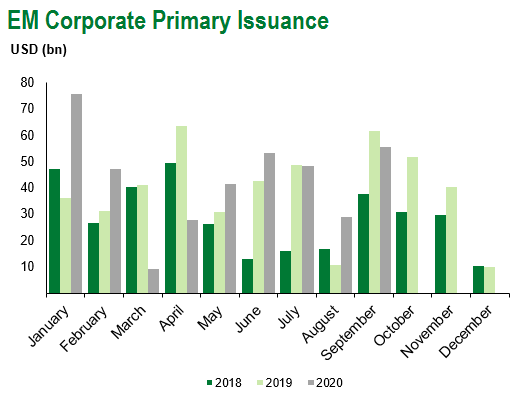

Is this the dip that keeps on dipping? Corrections are often healthy, although bulls will continue to expect further stimulus amid an uptick in global coronavirus cases. Sentiment was partially lifted as Treasury Secretary Mnuchin sought to break the deadlock further, even if McConnell had to re-clarify that a peaceful political transition will take place should the White House change hands. Nevertheless, a risk blip in markets saw the S&P end -2.2% on the week, with crude -3.2%, gold -4.7% as U.S. rates tightened 2-4.5 bps and 5y5y inflation almost broke the symbolic 2% level. The VIX may have edged down to 29.2, but risk dynamics are becoming more volatile as we enter the final fifth week to the election. The EM Sovereign Index ended down 2.2%, with Poland, Lithuania, and Vietnam outperforming, while Lebanon, Zambia and Sri Lanka lagged. However, the constructive tone in EM can be measured by the fact that primary issuance continues to accelerate and is now set to post two consecutive months of record supply. The counter-argument is often supply indigestion, however this has not yet developed into a theme. As we turn to next week, central bank decisions in India, Philippines, Ghana and Kenya will be in focus. Turkey’s trade deficit release will be watched after the surprise 200 bps hike, taking the one-week repo to 10.25%. This will be followed by manufacturing PMIs from China, Poland and Czech, where surprise prints akin to European data will provide further indication of the two-speed recovery. In Latin America, we can expect unemployment data out of Mexico, Brazil and Columbia, along with Peruvian inflation.

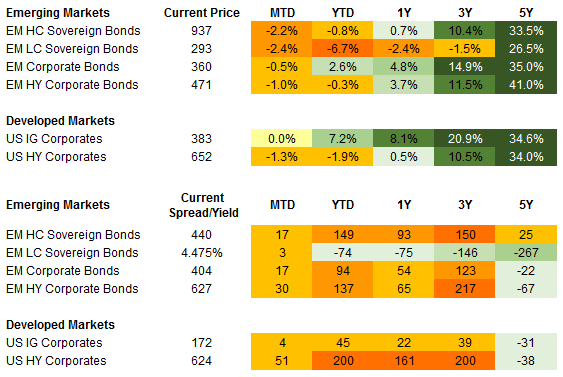

Fixed Income

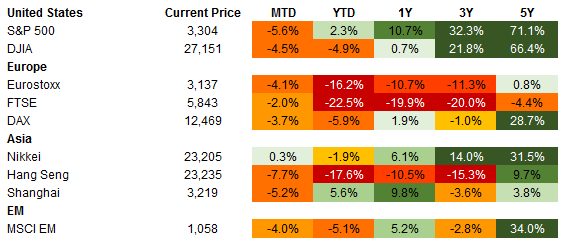

Equities

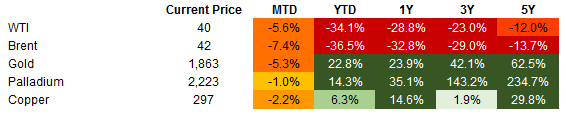

Commodities

Source for data tables: Bloomberg, JPMorgan, Gramercy. EM Fixed Income is represented by the following JPMorgan Indicies: EMBI Global, GBI-EM Global Diversified, CEMBI Broad Diversified and CEMBI Broad High Yield. DM Fixed Income is represented by the JPMorgan JULI Total Return Index and Domestic High Yield Index. Fixed Income, Equity and Commodity data is as of September 25, 2020 (Mid Afternoon).

Emerging Markets Weekly Highlights

Turkey’s central bank tightens monetary policy sending a constructive signal to markets, but needs to do more to restore severely eroded policy credibility and investor confidence; Zambia’s government requests a six-month delay on Eurobond interest payments preempting default; Potential second-wave lockdowns in the UK and Israel, softer Eurozone August PMIs send caution signals for EM.

Turkey’s Central Bank tightens monetary policy, sending a constructive signal to markets, but needs to do more to restore severely eroded policy credibility and investor confidence

Event: Against market consensus, the Turkish Central Bank (CBRT) delivered a hawkish surprise, hiking its main policy rate (one-week repo) this week by 200 bps to 10.25%. We note that this marks the first monetary policy tightening action by a major EM central bank since the start of the COVID-19 crisis.

Gramercy commentary: The hike comes amid strong pressures on the Turkish lira (TRY) that, despite an environment of general USD weakness until recently, has depreciated in nominal terms against the dollar by around 12.5% since late July and more than 30% year-to-date. In that context, CBRT’s action was fully in line with what investors thought the bank should do (albeit probably less aggressive), but did not believe it has the willingness to do, given the political toxicity of higher interest rates in Turkey. As such, the CBRT showed that although is not in the habit to act pre-emptively to alleviate market concerns, when push comes to shove, it tends to make pragmatic policy shifts. This being said, given the large macroeconomic distortions and vulnerabilities in the Turkish economy, further tightening of monetary policy will be required by the CBRT to restore market confidence. The cost of onshore liquidity will need to continue increasing to provide sustainable relief for the TRY, but higher borrowing costs domestically remain at odds with the government’s agenda to support growth in the face of the COVID-19 crisis. We will follow closely the impact of monetary policy tightening on two key metrics: i) CBRT’s FX reserves and dollarization of deposits in the banking system, both of which are important for the TRY’s outlook and ii) the Turkish credit story in general. Given the depletion of FX reserves (~45% down YTD) and the pandemic’s severe impact on the tourism sector (materially lower FX revenues and weaker current account), aggressive policy action by the CBRT is required to reassure the market. This week’s CBRT action was an important first step and a positive surprise, but further tightening will be necessary to slow down (and potentially reverse) the bleeding of FX reserves, tame inflation expectations and incentivize local economic agents to switch back to TRY denominated assets on a more material scale.

Zambia’s government requests a six-month delay on Eurobond interest payments preempting default

Event: Earlier this week, the government issued a consent solicitation to holders of their global bonds asking for suspension of upcoming debt service payments on October 14th, January 30th, and March 20th. The Ministry of Finance presented its budget on Friday and announced that an investor call will be held on September 29th.

Gramercy commentary: While the timing of the authorities’ request was somewhat of a surprise, the credit has been under distress and headed for a restructuring for some time. We expect bondholders to reject the current proposal as the government has failed to make credible commitments on the policy front, mend IMF relations, provide adequate transparency on debt, or progress with renegotiation of Chinese debt. The latter is a key component for debt sustainability as it accounts for roughly 30% of total external debt. Political infighting among the ruling Patriotic Front (PF) party and divisions over whether the incumbent President, Edgar Lungu, can run for another term complicate reform progress and debt resolution. The 2021 budget, which outlined modest fiscal consolidation of 2.4% of GDP and growth recovery to 1.8% next year, did not offer much insight into the government’s broader debt management plan with no reference to the IMF or the restructuring. The focus will turn to the investor presentation on the 29th. At this juncture, we see it as unlikely that a restructuring with bondholders is agreed upon before the August 2021 presidential election and expect further downward pressure on prices. Thereafter, possible improvement in IMF relations and policy, combined with Chinese debt relief, could result in attractive recovery values but will be a function of the extent of macroeconomic deterioration endured in the meantime.

Potential second-wave lockdowns in the UK and Israel, softer Eurozone August PMIs send caution signals for EM

Event: As the COVID-19 outbreak intensifies in London, health policy officials do not think Boris Johnson’s light restrictions (closing bars and restaurants by 10 pm) will be enough to curb the outbreak, citing need for second round of lockdowns. Meanwhile, August Eurozone manufacturing PMI beat expectations at 53.7 (vs. 54.0 consensus) while services meaningfully underperformed, falling back into contractionary territory at 47.6 (vs. 50.6 consensus).

Gramercy commentary: Our concerns surrounding second wave lockdowns have materialized, first in Asia, and now in Europe. Every additional shutdown lowers the probability of a v-shaped economic recovery and increases the chances for slower growth going forward, further delaying a return to pre-COVID-19 GDP levels. Given the fact that European countries are a few weeks ahead of the Americas in terms of the virus lifecycle, we anticipate countries in North and South America could face similar challenges to economic recovery, even as the market reflects a more optimistic view. While restrictions and lockdowns may be lighter and less aggressive in the second wave than the first, the psychological and behavioral impact on consumers of the second wave itself will still likely impede improvement in growth as reflected in the contrasting trend of Eurozone PMIs last month. Government officials’ responses to the second wave could also become increasingly polarizing and political, particularly in the context of an already challenged macroeconomic context.

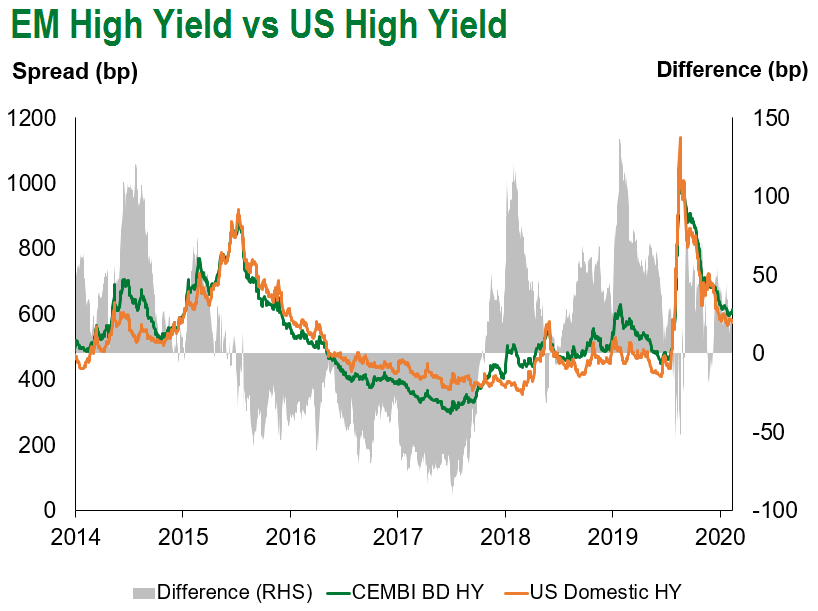

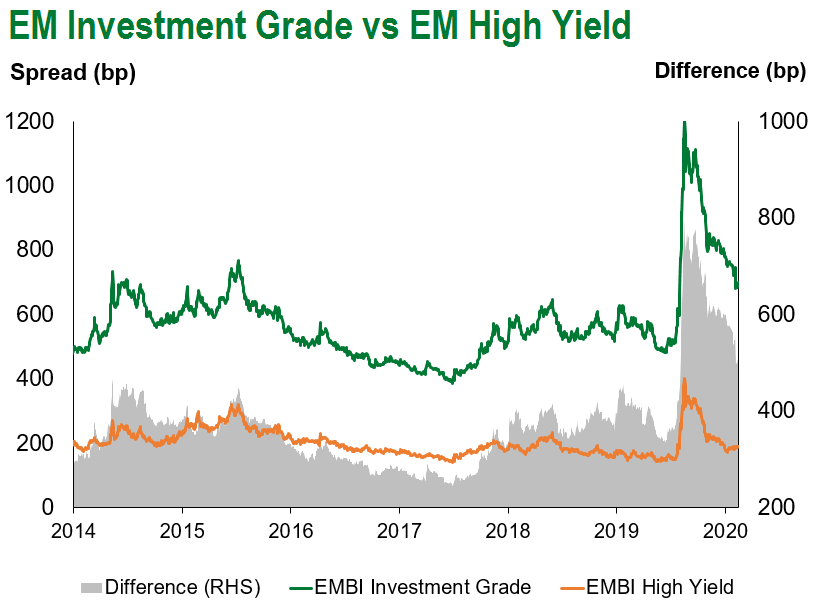

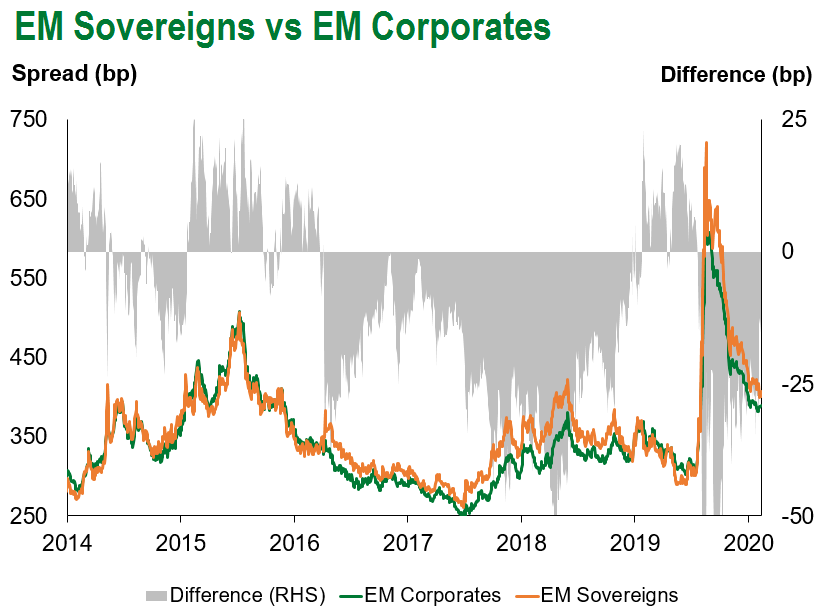

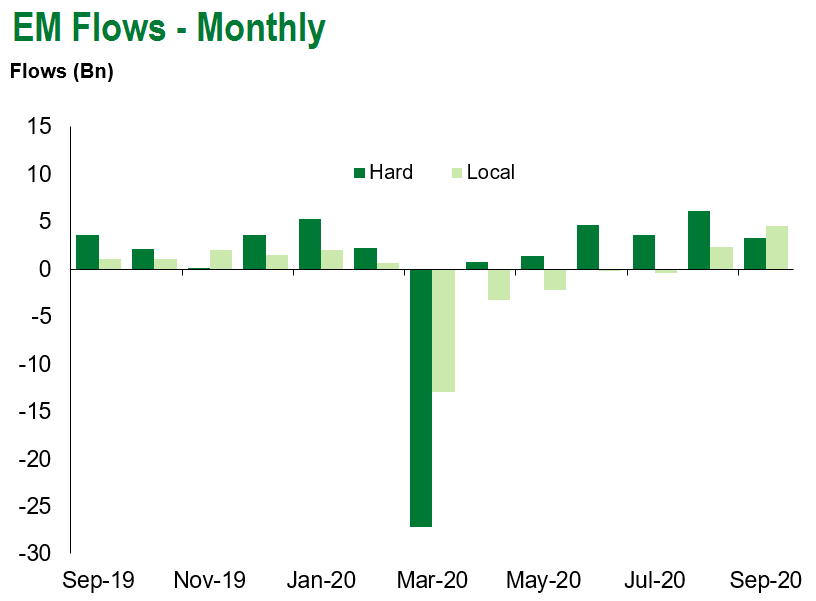

Emerging Markets Technicals

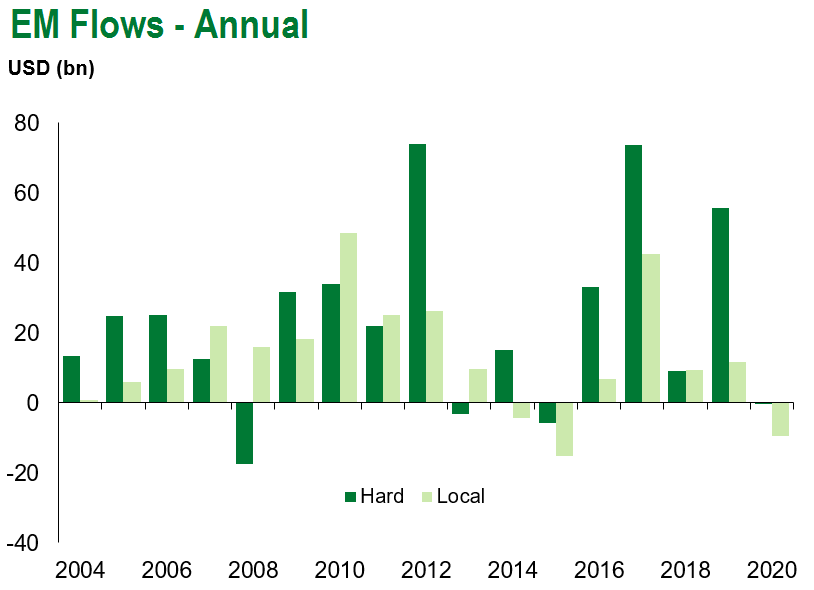

Emerging Markets Flows

Source for graphs: Bloomberg, JPMorgan, Gramercy. As of September 25, 2020.

COVID Resources

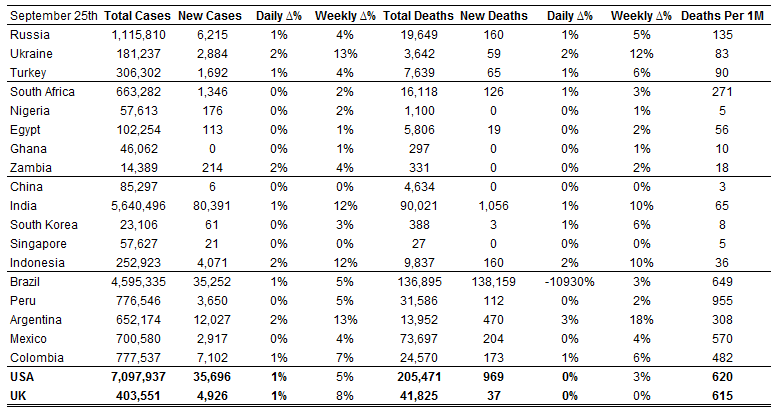

Emerging Markets COVID-19 Case Summary

Source: Worldometer as of September 25, 2020.

Additional Crisis Resources:

Johns Hopkins COVID-19 Case Tracker

For questions, please contact:

Kathryn Exum, Senior Vice President, Sovereign Research Analyst, [email protected]

Petar Atanasov, Senior Vice President, Sovereign Research Analyst, [email protected]

Tolu Alamutu, Senior Vice President, Corporate Research Analyst, [email protected]

James Barry, Vice President, Corporate Research Analyst, [email protected]

This document is for informational purposes only. The information presented is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Gramercy may have current investment positions in the securities or sovereigns mentioned above. The information and opinions contained in this paper are as of the date of initial publication, derived from proprietary and nonproprietary sources deemed by Gramercy to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. This paper may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this paper is at the sole discretion of the reader. You should not rely on this presentation as the basis upon which to make an investment decision. Investment involves risk. There can be no assurance that investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks are often heightened for investments in emerging/developing markets or smaller capital markets. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. The information provided herein is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation.