Our Mission is to positively impact the well-being of our clients, portfolio investments and team members.

CIO Robert Koenigsberger Profile "Exploring Inspirational Leadership in a Changing World" ›

CIO Robert Koenigsberger Profile "Exploring Inspirational Leadership in a Changing World" › FT | Global volatility is a reason to lean into emerging markets, not to flee them ›

FT | Global volatility is a reason to lean into emerging markets, not to flee them › Potential Impact of U.S. Tariffs on Emerging Markets ›

Potential Impact of U.S. Tariffs on Emerging Markets › The State of Investing and The Economy ›

The State of Investing and The Economy › Robert Koenigsberger and Mohamed A. El-Erian Appear on Bloomberg Surveillance ›

Robert Koenigsberger and Mohamed A. El-Erian Appear on Bloomberg Surveillance › GAM and Gramercy enter into Strategic Partnership for Emerging Market Debt Strategies ›

GAM and Gramercy enter into Strategic Partnership for Emerging Market Debt Strategies › Gramercy Funds Management LLC Has Deployed Over $700 Million in Private Debt in Peru ›

Gramercy Funds Management LLC Has Deployed Over $700 Million in Private Debt in Peru › P&I | Why not try a better approach to emerging markets debt? ›

P&I | Why not try a better approach to emerging markets debt? ›

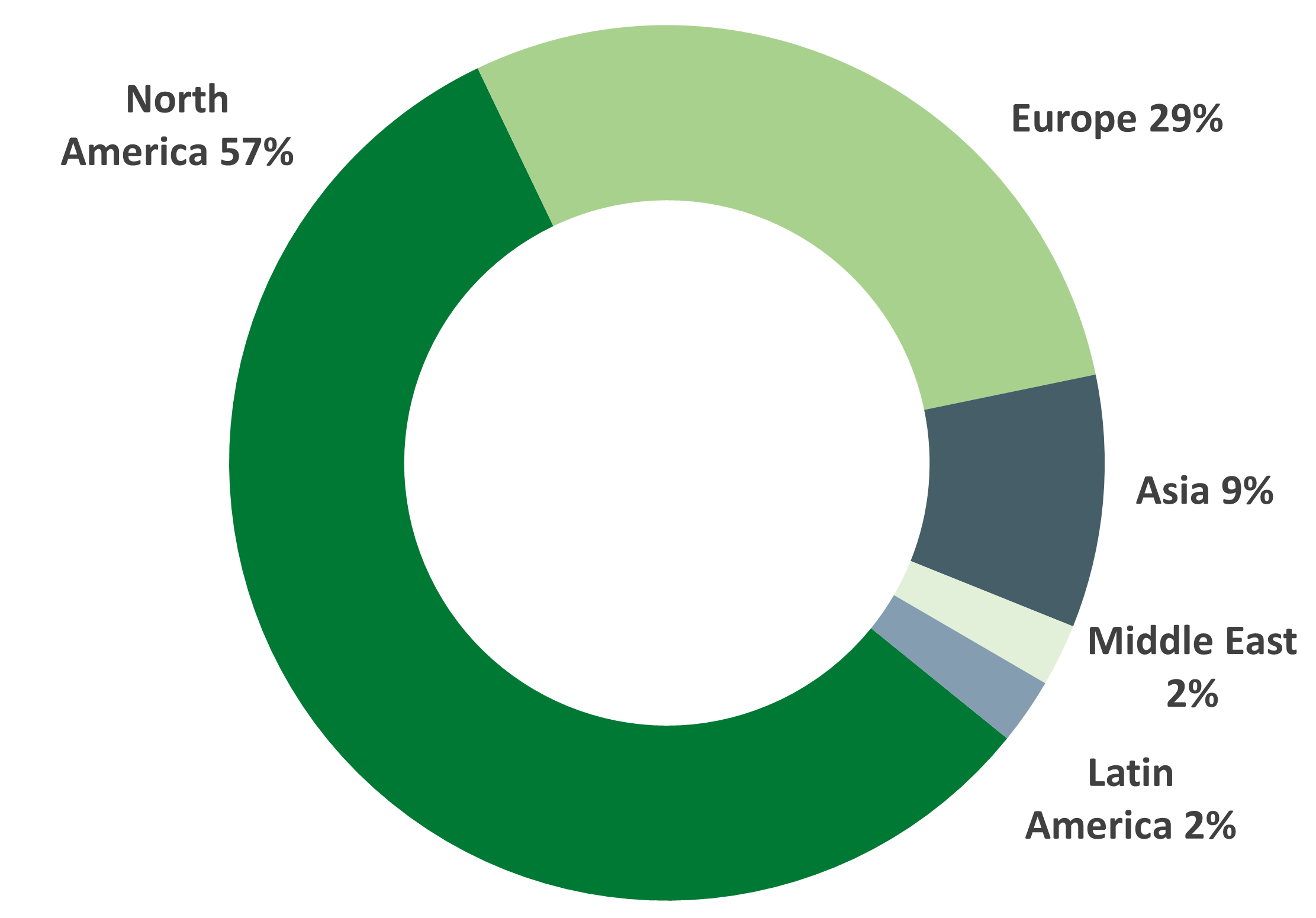

Gramercy is a global emerging markets alternatives investment manager with offices in West Palm Beach, Greenwich, London, Buenos Aires, Miami, and Mexico City and dedicated lending platforms in Mexico, Türkiye, Peru, Pan-Africa, Brazil, and Colombia. The $6 billion firm, founded in 1998, seeks to provide investors with a better approach to emerging markets, delivering attractive risk-adjusted returns supported by a transparent and robust institutional platform. Gramercy offers alternative and long-only strategies across emerging markets asset classes, including multi-asset, direct lending, EM debt and special situations. Gramercy’s mission is to positively impact the well-being of our clients, portfolio investments, and team members. Gramercy is a Registered Investment Adviser with the US Securities and Exchange Commission (SEC) and a Signatory of the Principles for Responsible Investment (PRI). Gramercy Ltd, an affiliate, is registered with the UK Financial Conduct Authority (FCA).

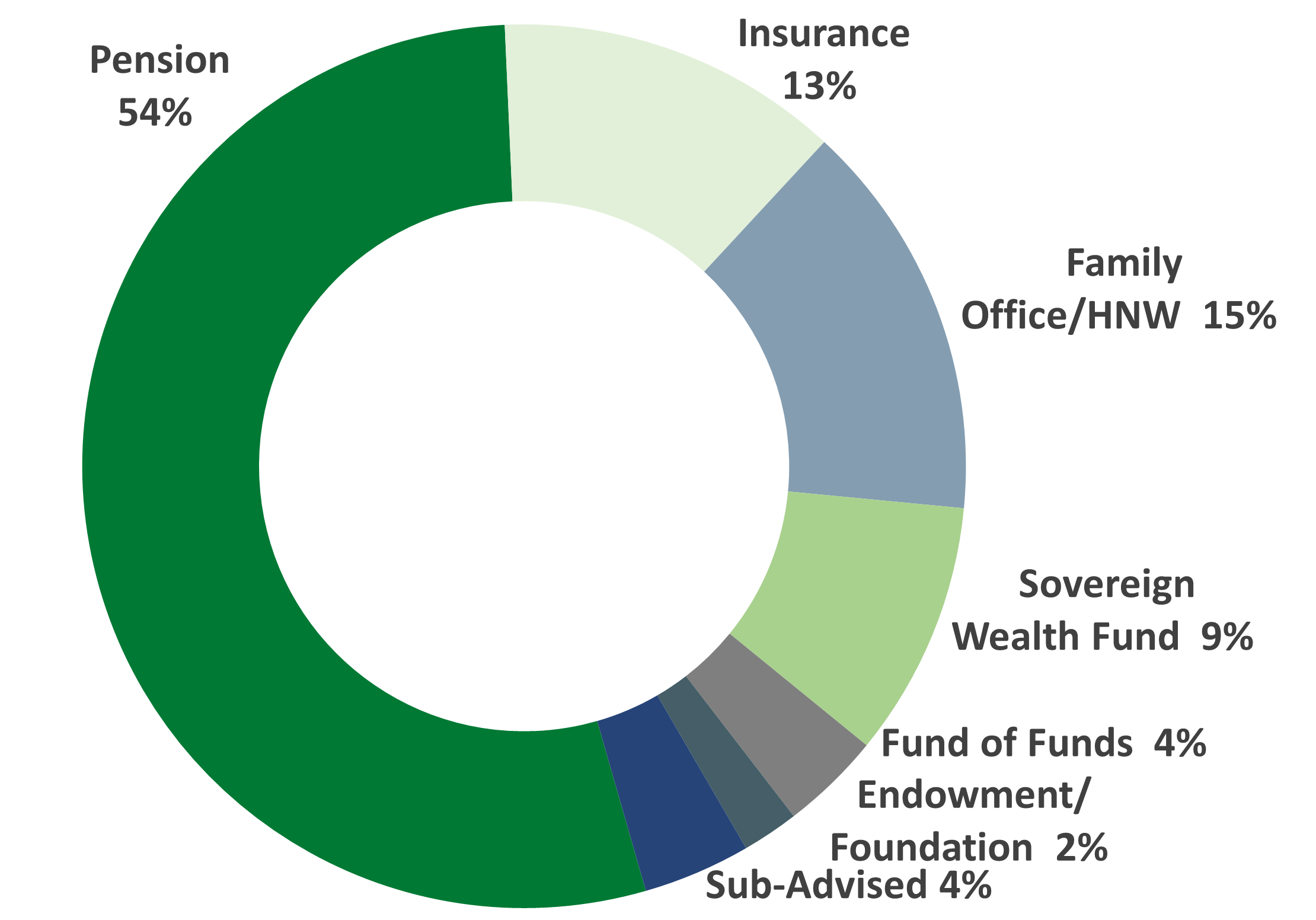

Gramercy is proud that for over 25 years, we have managed assets on behalf of a diverse and sophisticated global client base that includes pension plans, sovereign wealth funds, endowments & foundations, fund of funds, family offices and ultra-high net worth individuals. We pride ourselves on our ability to meet their objectives by delivering tailored investment solutions and world-class client service.

As of March 31, 2025

Gramercy was founded in 1998 by Robert Koenigsberger, Managing Partner and CIO, to invest in distressed credit opportunities in emerging markets where value could be realized through active involvement and hands on restructurings.

In 2001, Gramercy became registered with the SEC, a pioneering step taken before this became a requirement post Global Financial Crisis.

Our investment team has been dedicated to emerging markets for nearly three decades. We have cultivated deep-rooted, unique, local relationships across the globe that are difficult to replicate, which give Gramercy a distinct advantage.

Gramercy offers a wide range of investment solutions across emerging markets, aligning the risk/reward profile of our strategies with the return and liquidity needs of our investors. We endeavor to provide clients with superior risk-adjusted returns through a comprehensive approach to emerging markets using transparent investment processes, supported by a robust operational and business platform.

Gramercy’s roots are in emerging market debt; however, as the asset class has evolved, so too has our firm. In the infancy of the asset class, emerging markets consisted almost entirely of defaulted debt. Today, the range of investment instruments in emerging markets has expanded to mirror that of developed markets. Gramercy has thoughtfully and deliberately expanded our investment capabilities, keeping pace with the evolution of the asset class and the needs of our investors.

The integrity of the investment process is first and foremost.

Transparency and responsiveness are the foundations of client service.

In order to partner with our investors, we endeavor to find solutions that fit their needs and solve their problems.

Gramercy strives to embody corporate responsibility in all aspects of our business: our portfolio investments, our clients, our employees and the communities in which we live and operate. Gramercy is a Signatory to the Principles for Responsible Investment (formerly United Nations Principles for Responsible Investment) and a member of the Emerging Markets Investors Alliance.

Gramercy professionals are based in the U.S., Europe and Latin America. Our Portfolio Managers and Research Analysts come together as one team to discuss and debate top-down perspectives and fundamental bottom-up research. They are backed by a diverse team of individuals dedicated to running a transparent business platform complemented by world-class independent institutional service providers.

Chair of gramercy funds management

Dr. El-Erian is a global economist and leader in emerging markets investment and research, having previously held senior roles in investment management and international policymaking. He was on Foreign Policy’s list of Top 100 Global Thinkers for four years in a row and writes regularly for Bloomberg and the Financial Times.

As Chair of Gramercy Funds Management, Dr. El-Erian actively contributes in the following areas: (i) providing the investment team with global, regional and country perspectives on economic, market and geopolitical developments; (ii) offering insights on a range of investment-related matters (in particular, global investment trends and their immediate and longer-term impacts on emerging markets asset classes); (iii) helping to decode economic and policy developments, focusing on their potential emerging markets effects; (iv) macro themes that inform and influence individual trades and; and (v) advising on specific investment issues, including multi-asset allocations.

Managing Partner, Chief Investment Officer

Mr. Koenigsberger is Founder, Chief Investment Officer and the Managing Partner of Gramercy. He founded Gramercy in 1998 with a vision for the firm to become a global, institutional investment management firm focused on emerging markets. Mr. Koenigsberger has 38 years of investment experience dedicated to emerging markets with a specialization in distressed opportunistic credit strategies. He is a member of Gramercy’s Management Team and is Co-Chair of the Risk Management Committee.

Senior Partner, Co-Chief Operating Officer

Mr. Seaman has 41 years of business management experience. He has executive oversight of the firm’s business areas including accounting, operations, legal, risk management and compliance, technology, cybersecurity, human resources and administration. Mr. Seaman is a member of Gramercy’s Management Team and Co-Chair of Gramercy’s Risk Management Committee. Further, he is a member of Gramercy’s Valuation Committee and Compliance Committee.

Senior Partner, President

Mr. Humphrey has over 30 years of financial markets experience spanning sales, trading, research, capital markets, and investment management. He is responsible for Gramercy’s commercial and capital formation strategy including origination, sourcing and structuring of differentiated investment opportunities, further developing relationships with key sell-side counterparties, enhancing the firm’s existing high quality global investor relationships and accelerating new client acquisitions, and implementation of strategic initiatives to solidify Gramercy’s position as an industry leading global investment manager. Additionally, Mr. Humphrey is a Senior Partner and serves as a member of Gramercy’s Management Team.

Partner, Head of Capital Solutions

Mr. Ferraro has 38 years of Latin America-focused investment banking and capital markets investment experience. As a Partner at Gramercy Funds Management LLC and Head of the firm’s Capital Solutions business, Mr. Ferraro is responsible for managing a portfolio of more than $2bn and a team that has deployed more than $6bn of private credit transactions. He is a member of the Capital Solutions Investment Committee and reports directly to Robert Koenigsberger, Chief Investment Officer. He is Chairman of Gramercy’s Diversity Committee and is also a member of Gramercy’s Management Team. Additionally, Mr. Ferraro chairs the Private Credit Council of the Global Private Capital Association (GPCA).

Partner, Head of Special Situations

Mr. Taylor has over 23 years of legal, transactional and investment experience. Mr. Taylor is responsible for the management and investment decisions of Gramercy’s Special Situations Group. During his tenure at Gramercy, Mr. Taylor has overseen the management of sovereign and corporate restructurings, financings, acquisitions of private assets, and Gramercy’s participation in positions as a private equity investor. Mr. Taylor has also served as Gramercy’s Chief Legal Officer from 2010 -2019 and was responsible for managing the full spectrum of Gramercy’s legal affairs. Further, he is a member of Gramercy’s Management Team and Global Investment Committee. He has also served as a guest lecturer at University of Pennsylvania Law School, Wharton Business School, Yale Law School, and Columbia Law School.

Partner, Deputy Chief Investment officer

Mr. Meier brings more than 18 years of investment experience to Gramercy. He is Deputy Chief Investment Officer responsible for Public Markets and Multi-Asset Strategies. Based out of the London office, Mr. Meier is also an integral part of expanding the firm’s coverage of CEEMEA and Asia and serves as a member of Gramercy’s Management Team, Global Investment Committee, Public Credit Investment Committee, Global Research Committee and Top-Down View Committee.

PARTNER, Co-CHIEF Operating OFFICER

Mr. Joannou has 23 years of financial management and control experience. As part of Gramercy’s succession plan, Mr. Joannou will lead the oversight of the firm’s business areas as Co-Chief Operating Officer alongside Scott Seaman. Mr. Joannou’s oversight will include business areas such as accounting, operations, legal, risk management and compliance, technology, cybersecurity, human resources, and administration.

Mr. Joannou also served as Gramercy’s Chief Financial Officer from 2014 through 2023 and was responsible for managing Gramercy’s financial reporting and the SSAE 18 Soc 1 Type II compliance team. Further, he is a member of Gramercy’s Management Team.

Lastly, Mr. Joannou is a Certified Public Accountant in the State of New York.

partner, head of investor relations

Ms. Smith has over 17 years of industry experience. At Gramercy, she is a primary contact person for current and prospective investors. Ms. Smith manages new investor onboarding and is responsible for marketing collateral. Additionally, Ms. Smith works on strategic projects aimed at organizing and optimizing client materials and interfaces with service providers such as legal counsels and administrators to ensure regulatory compliance and client-facing process efficiencies.

Partner, Chief Legal Officer

Mr. O’Melia has 20 years of legal experience. At Gramercy, he is responsible for managing all aspects of Gramercy’s legal affairs, including new business development initiatives related to fund formation and client on-boarding, legal aspects of public and private portfolio transactions, and risk management. In addition, Mr. O’Melia advises on regulatory and compliance matters, third-party relationship management and documentation, and various strategic initiatives. Further, he is a member of Gramercy’s Management Team.

Copyright © 2025 Gramercy.

All Rights Reserved

Our affiliate, Gramercy Ltd., is a limited company organized under the laws of the United Kingdom and registered with U.K. Financial Conduct Authority which has been delegated certain portfolio management services, including but not limited to investment advice and execution of trades. The activities of Gramercy Ltd. provide for the benefit of additional trade coverage and risk management functions.

Visit our LinkedIn page:

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |